Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Is this what it’s all about?

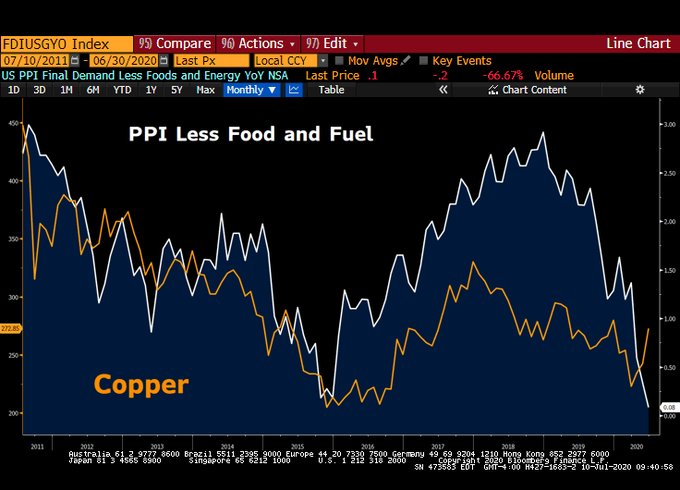

Stock futures were down on Friday morning and the 10-year yield was at 58 bps, 2 bps below the magical level of 60 bps. The PPI numbers (minus 0.2 vs. +0.4 est & core minus 0.3 vs. +0.1 est) showed, in the words of Rick Santelli, “a deflationary wind blowing through the inflation data“.

Then came the news that Gilead’s Remdesivir has been shown to cut mortality of CoronaVirus patients by 62%. Presto! The 10-year yield moved up and the S&P futures rallied about 30 handles. That carried through during the day to make Friday not merely a rally day but a re-opening type rally day with Money Center Banks up big & Airlines up even bigger. Yes the same money center banks that were almost thrown by the wayside on Thursday on CNBC Fast Money (with lonely dissent by the sensible KFine).

This shows what the sole risk in this market seems to be.

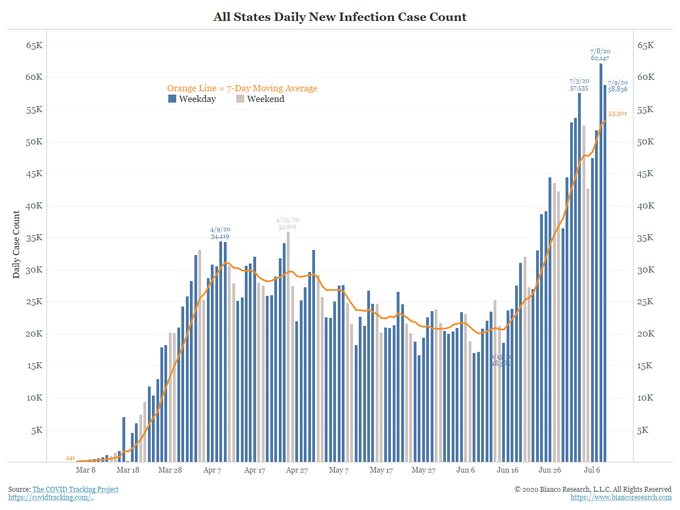

- Jim Bianco@biancoresearch – What also happened in mid-June? The case count turned higher. Conclusion It does not matter whether we have an official shutdown or not, if the case count does not peak soon, we are going to have an effective shutdown by everyone’s voluntary

We have never been “privileged” in any way that we can recall. But, frankly, we as NYC residents do enjoy a kind of “markets” privilege. If NYC were having the ICU shortages & rapidly rising CoronaVirus cases that Houston is, then financial markets would have been more negatively affected, we think. Even then,

- Jim Bianco@biancoresearch – I’ll save many from asking: The infection data is bad and getting worse and no matter how long you stand on your head and rationalize, it cannot be dismissed. The good news is the Fed’s infinite printing press is burying markets in money and driving them higher.

To us the best action of the day was in the Treasury markets with the 10-year yield closing at almost 64 bps and the 7-year yield closing at 49 bps, a full 3 bps higher than its all-time low on Thursday. Doesn’t it sound pathetic the 64 bps level as up? Again, we wonder, isn’t that a case of the hound not barking? The foremost Ice Age proponent says so:

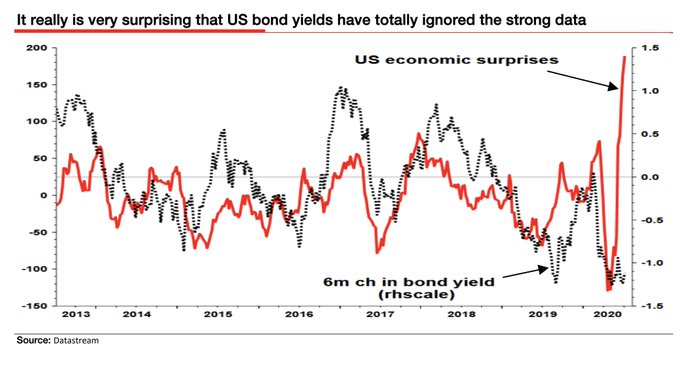

- Holger Zschaepitz@Schuldensuehner – – What rat does Mr. Market smell? US econ surprises surging to record & yet US 10y yield showing no inclination to rise, as one would normally expect, SG’s Edwards highlights. Expects that US bond yields will soon be negative when econ surprise indicator begins to turn down again.

Just look at this week. With the S&P up 1.8%, the Nasdaq up 4%, Transports up, Emerging markets up 4.5%, Europe up, Money Center Banks up 4% with even Citi up 4%, the 30-year yield FELL by 10 bps this week. And this fall in yield was BEFORE the release of the PPI on Friday. German 30-year yield fell 7 bps and the Japanese 30-year yield fell by 10 bps on the week.

What’s going on? Doesn’t history rhyme any more?

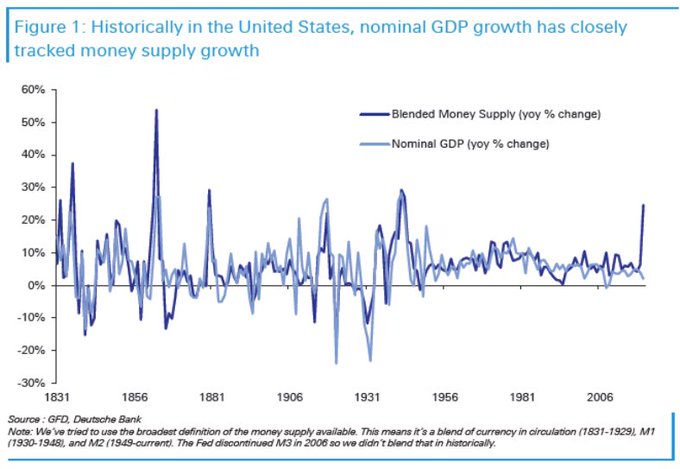

- Jeroen blokland@jsblokland – Current US Money Supply growth is among the fastest on record. And history shows that some of that money ended up not only in the stocks market, but also in nominal GDP growth. Will this time be different? (ht Schuldensuehner) #inflation

Another way to ask what is going on?

- Lawrence McDonald@Convertbond – Copper v PPI: Someone is wrong here, wow… thebeartrapsreport.com/blog/2020/07/0

Or is it simply Biden? Without being in the least bit political, Biden’s speech convinced us that we will see a steep recession if he actually does what he said in his speech. A commitment to raise taxes in a depressionary recession? The only way to survive that would be to have been born rich.

With all of the above, who can we turn to? Who else but a Quant? Not just any Quant but Charlie McElligott of Nomura. Those who are tired of listening to CNBC’s Andrew Ross Sorkin* attempting to speak with him, we recommend listening to or at least reading the transcript of a detailed discussion by Charlie McElligott with Erik Townsend of Macro Voices. What did he say about the long bond positioning?

- “what you see here in the bonds space, it still is reflecting – and that’s almost consensual long across the boards. …. you’re getting a lot of max-long signal across the bond complex, which is capturing, certainly, the environment of this last three months of shock-down.”

- “in light of some of this positioning dynamic – you can see on Page 8 there, just

looking at CTA exposures – with the equities positioned just kind of at 18 percentile going back to 2011 or bonds at 98 percentile – This is where you start getting some of those extremes that can sharply reverse.” - “talking about that bond long and the impact that it’s had on equity behavior and equity cymatic behavior on the volatility complex, I do feel like there is a potential for this very large bond position to just reprice, even on incrementally better interpretation of the virus data.”

- “some of this premium that’s been built into long in the bond space (as you see in Slide 1 with the CTA positioning giving that 100% long signal and most of the major G10 developed market bonds and then short-term money markets, eurodollar futures for instance) – some of that could bleed out into a less bad scenario. … if you get this less bad behavior in the fixed-income market, this less bad interpretation of the virus, the less bad interpretation of pricing in a potential re-shutdown, you’re going to get a yields-up trade. You’re going to get probably a bear-steepening trade.”

- Investors are realizing they were probably too far set up into too long of a bond position. They’ve got to start taking down some of that bond exposure. And occasionally, with a core CPI beat or a big jobs beat when nobody knows how to estimate the jobs numbers that make growth look like it’s a little bit better than maybe we expected, you can get these positioning shock-downs. And I think that’s probably where we are right now.

Let us be clear. Mr. McElligott is speaking tactically above. He made it clear in his discussion on Macro Voices that

- “long term I believe in the three Ds – the long-term disinflationary implications of debt, of demographics, of tech disruption. Those are major headwinds. … “

- “Jerome Powell got the joke back then. October 12 Fed minutes have him on the record as speaking and knowing that the Fed is running a massive (quote) short-volatility position. And that the market will continue wanting more and continue pressing more. I think that that, in and of itself, will never allow for a true end to the bond bull market.”

So the man who presciently said “Buy Bonds, Wear Diamonds” in 2019 could still prove correct:

- Raoul Pal@RaoulGMI – Just to remind you of The Chart of Truth – 10 year yields still heading for sub-zero.

*This should not be construed as a negative about Signor Sorkin. We can be guilty of lese majeste in case of physical majesty but never of intellectual majesty. Mr. Sorkin is certainly of the latter kind, a classic “BrIndian” as we have called him – the epitome to us of intellectual privilege, both born & bred, that every Brit-following Indian “intellectual” tries to project. We simply suggested above that an elite thinker like Mr. Sorkin should not get his mind soiled with practical ramifications of positioning & tactical reversals. That is not his forte. Better to leave that to Rick Santelli or, his fellow Sant, Mike Santoli.

2. U.S. Stocks – A summer rally based on fundamentals

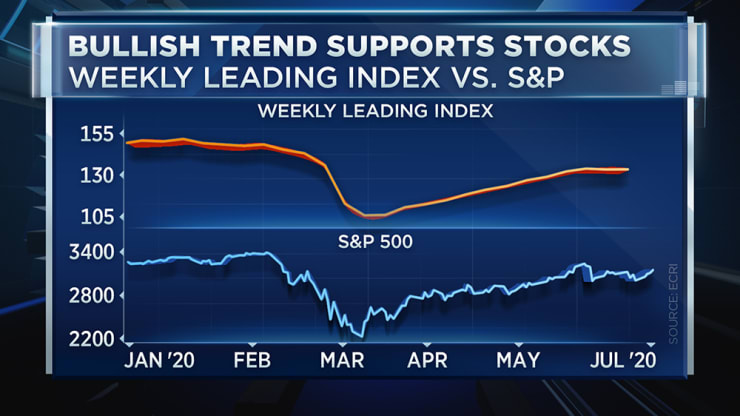

No we are not joking. That comes from the man, the business cycles guru, who said weeks ago that this recession would be among short despite being so severe, the guru who wrote about the 3-Ds of recessions & focused on Diffusion. This week he said on CNBC’s Trading Nation that ECRI’s Weekly Leading Index says the “upturn, the directional upturn, was warranted by the cyclical economic fundamentals“. He described the chart below as,

- “This is a fundamentally optimistic chart,…. It’s showing us that the cyclical fundamentals are to the upside.“

To quote CNBC’s summary,

- “Right now, Achuthan finds it’s revealing economic fundamentals are firmly supporting the market bounce. He doesn’t see runaway speculation driving stocks and expects the rally to least another six weeks.”

But this is a short term indicator & requires the Weekly Index to keep going up. Listen to him explain it below:

Now to the most important non-fundamental.

3. U.S. Stocks – What counts the most now?

Last week, three different gurus spoke of VIX as the key to the short term direction of the U.S. Stock market. Lawrence McMillan of Option Strategist got more bullish this Friday because of his VIX spike indicator:

- Volatility remains relatively high. $VIX has bounced off its rising 200-day moving average three times in the last month, including twice in the last week. As long as it is above its 200-day MA, that is a potential bearish sign for stocks.

- The short-term interpretation of the $VIX chart is more bullish in that the $VIX “spike peak” buy signal remains in effect.

- In summary, the bulls are still in charge because the $SPX chart has not broken support. It’s as simple as that. We would expect a strong $SPX move once it does eventually break out of this trading range.

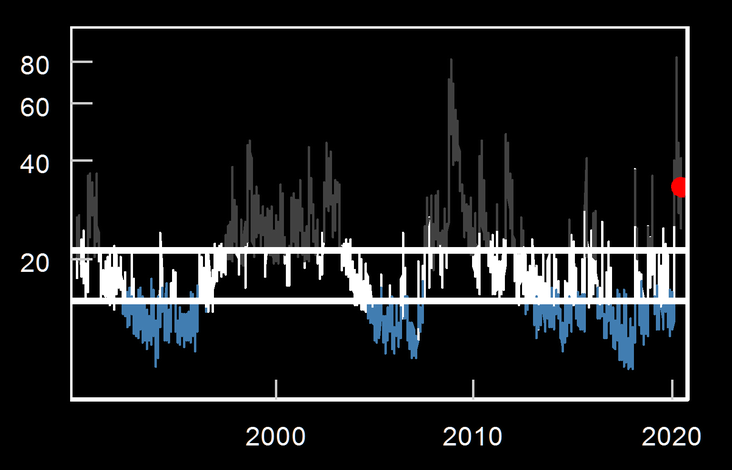

That takes us to Charlie McElligott of Nomura & his detailed discussion with Erik Townsend of Macro Voices. We urge all to listen to the podcast & read the extensive transcript. His critical point is:

- “I mean, at the end of the day, anything vol-control, vol-target, the trend, purely speaking systematically, is going to size each position set to be inversely proportional to the instrument’s volatility. So as volatility goes lower, that position sizing can then reverse and go higher.”

This leads to not only counter-intuitive but even unprofitable behavior. In plain words, sensible investors should buy into crashes. But what happens to the systematic vol-based models?

- “Instead, what ends up happening is you are forced to delever and gross down into the crashes and then you lever up into the rallies to match your exposure to volatility targets.”

He himself describes this as “quite perverse” but points out that he doesn’t “see that changing as long as, frankly, central banks continue to backstop the market with their unspoken financial conditions mandate“. What is the result of this behavior?

- “All of their vol models, all of their risk management tools are still, frankly, at the end of the day, operating on that same framework. …. And so you end up having this amplification effect where everybody is a momentum trader. Everybody is a trend trader.”

So what might all this mean for the near term?

- “the velocity of that repricing lower of volatility really, really matters. Especially, then, as it

pertains to a trend or a vol-control model which uses volatility as the exposure toggle. - And that is also another sling shot for this whole space of the universe – vol-control funds, CTA

funds – that have taken down their exposure so low. And that’s why I still think there is ample room to see the systematic universe as vol rebases to continue adding exposure … So there is still ample fuel to burn on a melt-up, … That develops unto itself and can start to snowball.

Is a turn about to happen?

- “Cross-asset momentum was down kind of 6% last quarter. Multi-asset trend was down 4.5%. And just equities momentum, as you see here, was down almost 23% on the quarter. So that, to me, is a signal that we are in the midst of a turn. … As we just went over in the CTA, look at the 13 equities futures that we track in the model, 11 of which remain shorts, and what you’re seeing is price and vol signals are beginning to turn.“

What would be an “unprivileged” way to describe a high velocity downward move in VIX?

- Market Ear – VIX puke next? VIX 2/8 months futs spread remains elevated, but is coming down. We would not be surprised to see “smart quants” start pitching “vol yield” trade ideas soon. Our take on vol remains intact, equity vol has more downside as the “summer box” logic plays out.

Where could VIX go? Marko Kolanovic thinks that the boundaries for the volatility regimes are 15 & 21, per Market Ear.

Remember the clip of Jim Cramer explaining the charts & views of Caroline Boroden from last week? Her next target for the S&P is 3720 provided the S&P holds the 3,150 level & the 5-13 day ema gets bullish. That level was held every day this week except on Tuesday when the S&P closed at 3145. So 3720 next?

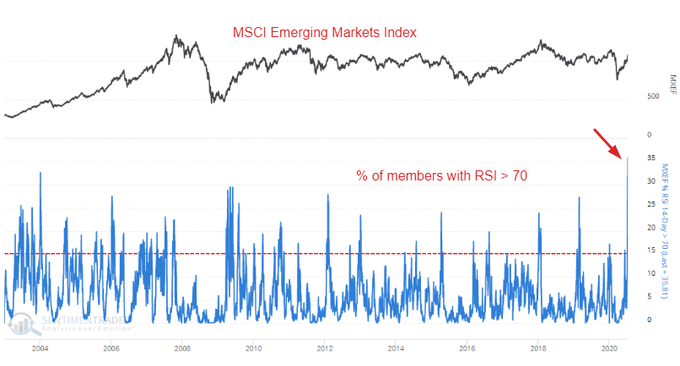

For all the talk about the S&P, EM markets led by China were the stars of the week. But that led Mohammed El-Erian to be negative on EM on BTV. Also,

- SentimenTrader@sentimentrader – Extreme breadth readings in emerging markets: Speculators rushed headlong into emerging markets, pushing a RECORD percent of emerging market stocks to overbought levels (RSI > 70)

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter