Summary – A top-down review of interesting calls and comments made last week about monetary policy, economics, stocks, bonds & commodities. This week, we review the Jackson Hole meeting, Yellen-Draghi speeches & the stock market rally. Also did Fibonacci discover the numbers or were they discovered & used 100 years before him? TACs is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance

1. Yellen & Draghi

For once, the stock market did not do much after the combined vocal stimulus from Fed Chair Yellen & ECB chief Draghi. Simply because it was all factored in the prior 4 days of the week, 4 days that featured a 2% move in the Dow and a new high in the NYSE advance-decline line. This changed a one well-known mind. Back on July 31st, Tom McClellan had described a composite indicator (Shiller’s CAPE divided by Moody’s BAA yield) that suggested a major top forming in the US stock market. This Thursday, McClellan said on CNBC Closing Bell:

- “It no longer looks like it is a major storm … what has changed is what we have seen in this bounce in August with 8 of the last 10 days closing higher for the S&P 500, we have seen strong breadth numbers – so the NYSE Advance-Decline line today is at a new all time high; you don’t get 2008 or 1987 within the weeks, months after a new high in the A-D line.”

This is another example of how the old indicators & intermediate term technician stuff keeps getting run over by the stock market that only recognizes Fed-provided liquidity. The only technical work that has worked is the short term stuff. That is why we began focusing on such ideas & predictions for the past several weeks.

Chair Yellen may not have moved the stock market but she had a big impact on the Treasury curve. The 30-5 year yield curve steepened by 7 basis points on Friday alone with 30-year yield falling by 3.6 bps while the 5-year yield rose by 3.3 bps. The 30-5 yr curve closed at 150 bps, a level last seen in early 2009, before the big stock rally began in March 2009. This is the strongest message of slowing growth ahead in our empirical view. Others seem to agree on Friday:

- Douglas Kass @DougKass – … the action in the US bond market (yields down further this afternoon) is sending a – econ message

- Tom Graff @tdgraff – @DougKass @KDaimler I think when you see long bond yields fall while short yields rise, mkt is saying Fed hikes lead to eventual recession

- FxMacro @fxmacro – look at 5s 30s … looks like 2 hikes and than a recession in 16‘ pic.twitter.com/SEYRFbKKsY

We know that David Rosenberg has described the possibility of a slowdown arising from a tightening by the Fed as “lunacy”. But the treasury market seems to differ as it differed by sharply steepening on Friday and by steepening all year.

The economic data released on Thursday also told this story based on a classic indicator – behavior of Leading Indicators vs. Coincident Indicators:

- Thursday – Retweeted by Ed Bradford – Will Slaughter @NWPCapital – Ratio of LEI Index to COI Index a good predictor of curve flattening; currently screaming more 5s30s flattening ahead pic.twitter.com/cgMWYnCENe

But what about the direction of the 10-year Treasury yield?

- Thursday – Guggenheim Partners @GuggenheimPtnrs – @ScottMinerd anticipates a near-term #bond rally in the latest Market Perspectives http://bit.ly/XD0Sy1

Minerd says in this article:

- “My original forecast of 2.0 to 2.25 percent still seems reasonable. Nevertheless, markets do not move in straight lines, so yields could retrace to 2.5 percent in the near term. Ultimately, as rates head back toward 2 percent portfolio managers should use the rally to reduce interest rate risk.”

Rick Santelli said on Wednesday that yields of long maturity treasuries tend to be highest on the days Fed statements or minutes are released. He called it this week because the peak on yields this week came on Wednesday afternoon & the 30-yr yield fell by 6 bps from Wednesday to Friday.

2. Draghi

We are not sure what some expected from Draghi. But they were disappointed a bit by it:

- Holger Zschaepitz @Schuldensuehner – #Euro pushes higher against Dollar as #ECB’s Draghi brings no dovish suprises. Now at $1.3252. http://www.ecb.europa.eu/press/key/date/2014/html/sp140822.en.htm … pic.twitter.com/1zKkKandKG.

This is what “smart money” wanted according to:

- Jason Goepfert @sentimentrader – Large change in latest futures report shows “smart money” adding to Euro long positions, nears record. pic.twitter.com/LjWl1eRfRK..

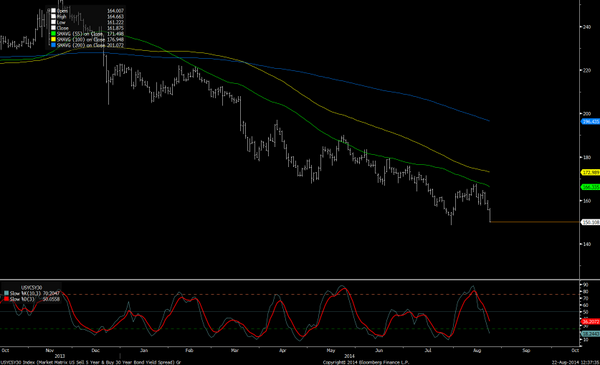

- Mella @Mella_TA – The long term trend line held like a champ – u watch this closely next time $SPX pic.twitter.com/s832vl2ehX.

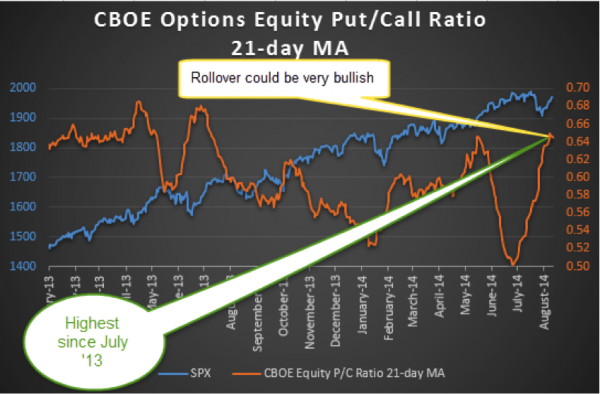

- Ryan Detrick, CMT @RyanDetrick – My latest for @SeeItMarket. Look at one of my favorite indicators and why it is now bullish. http://stks.co/g0y3i $SPY $STUDY

- “To me, should this continue to roll-over it has a long ways to potentially fall. In other words, there are some significant buyers still out there“

- Jeremy Siegel who has been calling for the Dow Jones industrial average to hit 18,000 by year-end, and said on CNBC Closing Bell on Tuesday that he now thinks it could possibly hit 19,000.

- David Rosenberg on CNBC Futures Now on Tuesday – “If you’re going to turn bearish on equities outright, you’ve got to have a view that the Fed is going to drain liquidity outright, flatten the yield curve and that recession is around the corner… Because outside of that—you might get corrections along the way … but as long as the Fed is keeping the system flush with liquidity and we don’t slip into recession, the path of least resistance is going to be up for the markets.” He said he prefers stocks to treasuries.

- Barry Bannister on CNBC FM 1/2 on Friday – raised his year-end target for the S&P 500 by 20 percent, from 1,800 to 2,300.

Lawrence McMillan also changed his intermediate-term bearish stance on Friday:

- “In summary, all of the indicators have swiftly swung back to “bullish” except for the put-call ratios. A consecutive close at new highs will make the intermediate-term outlook bullish once again“

- GaveKal on Thursday in MSCI North America is Overbought … Again – It sure didn’t take long for stocks in North America to snap back into overbought territory once again. The number of stocks that are trading above their 200-day moving average hit a six month low on August 7th at at relatively still elevated level of 59%. In just two short weeks, the number of stocks trading above their 200-day moving average has rocketed back up to 77%. We are now three years out from the last reading of a truly oversold market according to this metric. In contrast, even with a slight bounce, MSCI Europe is approaching oversold status for the first time since 2012.

- Gavekal on Tuesday in Not A Single Developed Sector Is Trading Below 22x P/E – On an equal-weighted basis, the average P/E in the MSCI World Index stands at a lofty 25.2x. As the title of this blog post states, not a single sector is trading below a 22.5x P/E level. In the Emerging Markets, valuations are not too far behind. The equal-weighted average P/E in the MSCI Emerging Markets Index stands at 21.9x. Two sectors in the Emerging Markets are trading below 20x P/E level (Utilities and Financials).

- Friday – See It Market @seeitmarket – New Post: “Emerging Markets At Key Technical Resistance” http://stks.co/r0hgc by @ChrisBurbaCMT $SPY $EEM $STUDY

- “What interests me the most, though, is that fast downtrends in EEM from October 2013 to February 2014, and the first half of 2013, coincided with SPY marching higher. That makes a short EEM trade an attractive way to diversify a portfolio. There’s a chance it will fall even if SPY continues higher from here. And if SPY rolls over (and some of your holdings take a hit), there wouldn’t be any reason to expect EEM to go up. Keep in mind, every time SPY has dipped even mildly since the 2011 low, EEM has also gone down.”

- John Kicklighter @JohnKicklighter – Gold dropped for five straight days (matching longest slump in 9mths) and held the line at support: http://stks.co/q0hMA

- ETF Godfather @ETFGodfather – Interesting look at the $GDXJ $GDX ratio from @KimbleCharting http://www.etftrends.com/2014/08/comparing-two-gold-miners-etfs-yields-big-results/ ….

- “The end of August/early September has historically been an important turning point in the popular indices, especially when it comes to runaway moves and tests of highs. … The current pattern in Gold (GLD) echoes the notion of an upcoming turning point, as shown in this chart. … Consequently, I think we need to watch for a false move in either direction before we see the genuine move.”

- Tuesday – J.C. Parets @allstarcharts – NEW POST: The Problem That I See With Silver $SI_F $SLV http://allstarcharts.com/problem-see-silver/ …

Parets writes in his article:

- “First, here is a weekly line chart showing these lows just below 19 tested successfully 3 times. Where I come from triple bottoms and triple tops are very very rare, if they even exist at all. In all likelihood, as I mentioned on Fox Business in late May, we’ll see a 4th or 5th test that eventually cracks the support. Well as we can see in this chart, we’re seeing just that: a 4th test of support in a commodity that is still in a 3+ year downtrend”

- “The next chart shows the daily bars with a downward sloping 200 day moving average. I find it hard to believe, from where we sit here today, that this is a bottom and not a continuation pattern. Everything in my experience tells me to lean short“

- “But I want to see a break first. I think there will be plenty of downside to take advantage of upon a break of support. … Patiently waiting for a break“

But can Silver break without Gold breaking as well? We don’t know and Parets doesn’t say.

6. Hemchandra and/or Fibonacci numbers

Manjul Bhargava (pronounced Bhargav with silent “a” suffix), a Princeton professor of Mathematics, was awarded the Fields Medal (with three others) on August 12 at the International Congress of Mathematics held in Seoul. Unlike the annual Nobel Prize, the Fields medal is awarded once in 4 years and is only awarded to Mathematicians who are less than 40 year old. This makes it much harder to win a Fields Medal than a Nobel Prize, statistically speaking.

Any one who discusses investing has heard of of Fibonacci numbers. But hardly anyone, us included, knew that Fibonacci was not the first to discover these series of numbers. Read what Professor Bhargava said in his interview with India Today:

- “This sequence of numbers is now ubiquitous in mathematics, as well as in a number of other arts and sciences! The numbers are known as the Hemachandra numbers, after the 11th century linguist who first documented and proved their method of generation — called a “recurrence relation” in modern mathematics. The numbers are also known as the Fibonacci numbers in the West, after the famous Italian mathematician who wrote about them in the 12th century.”

- “These numbers play an important role now in so many areas of mathematics (there is even an entire mathematical journal, the Fibonacci Quarterly, devoted to them!). They also arise in botany and biology. For example, the number of petals on a daisy tends to be one of these Hemachandra numbers, and similarly for the number of spirals on a pine cone (for mathematical reasons that are now essentially understood).”

We don’t expect any one in the US to acknowledge Hemachandra (again short “a”) for his discovery of numbers that are credited to Fibonacci. Professor Bhargava knows this only because he is fluent in Sanskrut which very very few Indians are. But we are indebted to Prof. Bhargava for teaching us what Hemachandra did and we shall, from now on, refer to these as Hemachandra (Fibonacci) numbers.

Will Tom Keene of BTV invite Professor Bhargava for a discussion on Mathematics? He did a terrific job in discussing Mathematics in his interview with Vivek Ranadive of Tibco. Or will CNBC’s Seema Mody invite Prof. Bhargava for a discussion with Guy Adami of CNBC Fast Money?

Perhaps, Prof. Bhargav may not be aware of the importance of these numbers in investing or, perhaps, he may be using these numbers to trade stocks himself. This would be an interesting discussion either with Tom Keene or with Adami-Modi.

By the way, as more research is done about old Sanskrut texts, the world is discovering what Indians knew in the first CE millenium. For example, the discoveries that earth rotates around itself and revolves around the sun in an elliptic orbit had been made by Indian astronomers some 1,000 years before Copernicus & Galileo.

And this old knowledge was not restricted to India. It is now documented that the Piston, the mainstay of the Industrial Revolution, was used in the Roman era.

PS: The name Bhargava, phonetically written as Bhaargav, means descendant of Bhrugu, one of the seven most ancient sages of Indian Philosophy. So Prof. Manjul has lived up to his illustrious last name. Kudos to him.

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter