Summary – A top-down review of interesting calls and comments made last week about monetary policy, economics, stocks, bonds & commodities – Ukraine-Russia, Global Yields plummet. TACs is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance

1. Again, who can doubt

that Ukraine-Russia rules the roost in financial markets? The Dow was up 70 odd points on Friday morning en route to a great week when news hit the tape that Ukrainian forces had destroyed a Russian convoy. The Algos went hyper & the Dow fell 80 points or so in a couple of minutes and went down triple digits later in the morning, VIX shot up to 15 and the 10-year treasury yield collapsed to 2.31%. Later in the afternoon, the stock market rallied with Nasdaq going positive and VIX fell back to a 12-handle. Perhaps, it was an unwind of the hysteria of the morning or the news that foreign ministers of Ukraine & Russia were going to meet in Berlin on Sunday evening.

Anything is possible in the hall of mirrors called foreign policy. In that vein, the most interesting comment came from CNBC Fast Money trader Tim Seymour on Friday afternoon:

- “I talked to a bunch of people in Moscow … this is, believe it or not, a de-escalation approach, giving [Ukrainian President] Poroshenko some victory”

His CNBC FM colleague Brian Kelly pooh-poohed the “de-escalation” notion and pointed out:

- “Today what happened is very similar to what happened in Crimea – we had a sell off on Friday, we had a rally back in the afternoon and on Sunday night, we had the futures down 10-20 handles”

It is clear that the markets are deeply concerned about an overt invasion into Ukraine from Russia. So how likely is it and under what conditions might it happen?

- Ian Bremmer of Eurasia on CNBC FM 1/2 on Friday – “Russians have to play along in that they don’t want to invade formallly, precisely because they think they can win the economic long game, … understand Russians are not bluffing – they are really prepared to go to war if they need to and by the way that is absolutely my view”

- General Barry McCaffrey on CNBC Street Signs on Friday – I also think, without question, if the Ukrainian military tries to capture these rebel urban areas, Donestk etc.with artillery and aircraft, Russians will without question intervene – so its a tricky situation,the US has no vital security interest at stake, no military power to influence it, the Russians do…they will make an overt military intervention if the Ukrainians start killing masses of people in these built up areas – they are right on the verge of doing that

What happened on Friday morning is weird if Stratfor is indeed correct in their assessment on Friday:

- “Kiev’s attempts to cut off supply lines running into the city of Donetsk are showing signs of a potential breakdown. … As Ukrainian government forces stretch themselves thin, their ability to interdict support for separatists moving through their positions is eroding. … These separatist movements east of Donetsk and the continued arrival of military support into the city signal a potential turnaround for the government offensive in this part of the battlefield … the recent continuous, small separatist counterattacks could evolve into a larger, more significant setback for Kiev’s offensive”

If Russia is able to deliver military support to Donetsk and if the separatists could deliver a setback for Ukrainian military, then the notion that Russia meekly allowed its convoy to be destroyed by Ukraine doesn’t make sense. Unless, as Tim Seymour’s sources said, the big news of Friday was indeed a show of giving Ukrainian President a public victory. The markets will tell us what’s what on Sunday night.

2. Global Economy

Despite the above, the stock market action was really a side show on Friday. The big story was the vertical fall in Treasury yields. Was it Ukraine, was it the global economy or was it just love?

- Friday late morning – J.C. Parets @allstarcharts – I love that they’re blaming lower rates and higher bonds on Ukraine. You know how hilarious that is to me? Best part of my friday so far

- Friday afternoon – John Kicklighter @JohnKicklighter – An appetite for bonds rather than true aversion to risk. Treasuries and EM Sovs rising in tandem: http://stks.co/i0wuG

The 10-year yield seemed to argue for a bit of both – 3 basis & plunge to 2.31% was Ukraine-related and the 5.5 bps drop to 2.34% was the global economy which seemed to have stunned both Bill Gross and David Rosenberg:

- Gross on CNBC Street Signs on Friday – “we are surprised by the magnitude of the decline in global growth; 1/2 of the global economy is in recession, Euroland is in recession, obviously Russia is; all of South America is in recession, Japan ; basically US and North America is the only decent 2-2.5% growth area in the world; so yields are coming down not only because of growth but inflation is very very low; one giant global bond market in which low growth & low inflation is being exacerbated by geopolitical reason”

- Rosenberg in his Friday bullet points – “A sudden sputter – In just a 24 hour span, the whole macro outlook has shifted for the worse … It is not looking good for the residential real estate market “.

Is Rosenberg’s “24-hour span” is related to Ian Bremmer’s “24-hour” comment?

- “I would make a bet that Europe is forced back into recession at the back of this Ukraine crisis. we do see Europeans fragmenting off; The Hungarian prime minister, the Slovak prime minister whose economies are taking a hit coming out in the last 24 hours saying in no uncertain terms this is unacceptable, all sanctions are doing is hurting Europe, as this starts to really bite, not just the Russians – they know where they are going, but the Europeans, I think you are going to start seeing very very public fragmentation among the dozens of leaders that comprise the EU”

Add to this comments by Fed-head Kocherlakota on Friday morning:

- “Inflation won’t reach Fed’s 2-pct goal until 2018 ; sees unemployment rate falling to 5.7% this year; drop in jobless rate masks continued weakness in labor markets; fraction of prime-age potential workers with a job is disturbingly low …”

So what about the Fed raising interest rates any time soon? Jeff Gundlach answered that on CNBC FM 1/2 on Friday:

- “Yellen doesn’t want to raise interest rates … Fed follows long end of the bond market; Fed doesn’t tighten while long rates are falling”

This takes us back to Tuesday, May 20, 2013, the day before Bernanke stunned the investing world on May 21, 2013 by suggesting he might taper in August 2013. Compare the treasury yields on Tuesday, May 20, 2013 and on this Friday, August 15, 2014:

- TLT at $117.79 on 5/20/13 & $117.73 this Friday; 30-yr yield – 3.13% on 5/20/13 & 3.13% on this Friday; 10-yr yield – 1.93% on 5/20/13 & 2.34% on this Friday; 5-yr yield – 82 bps on 5/20/13 & 1.54% on this Friday.

So the long end of the treasury curve has taken back the entire taper tantrum of Bernanke. This demonstrates the enormous flattening of the treasury curve in 2014, a negative sign for growth. It also makes us wonder whether the 10-year yield will be next to take out the taper tantrum either on way to October’s taper-end or after that. And the spread between the 5-year yield on May 20, 2013 & on this Friday shows the rate rise expectations still embedded in the short end of the treasury curve.

3. 10-year yield did close under 2.35%.

Jeff Gundlach talked about the importance of 2.35% on CNBC FM 1/2:

- When the 10-year yield broke above 2.35% in April 2013, it shot up fast to 2.75%. If we close today below 2.35%, we go to 2.20%.

Rick Santelli disputed the importance of 2.35% and said:

- “The big yield [level] was the May 28 low of 2.44%; once that was violated, now probability of 2.25% is 75-80% and of 2% is 50%”

Guy Adami of CNBC FM has said for months that TLT, the long treasury ETF, would go to $115. This week, he raised his target to $125. Mike Harris of Campbell & Co. made a similar prediction on CNBC FM on Thursday:

- “we just keep taking out support, 2.48% gone, 2.40% gone as well, now we are really looking at 2.30% its gonna be the next big level” .. if 2.30% breaks we could see 2% (this last line deleted from the videoclip by CNBC webmasters)

Gundlach also said that the fall in yields is a momentum trade now driven by relative value over corresponding yields in Europe and added that 10-year at 2% has no investment value. Bill Gross essentially concurred when he said he did not expect the 10-year trade to fall below 2% with a US economy growing at 2% with 2.5% inflation.

What has the bond market done this year in the face of such expert opinion? Trashed it with its action. So will the 10-year yield break through 2% and laugh at Gross-Gundlach?

- Friday Mark Newton @MarkNewtonCMT – Definitely can’t rule out move down to 2% in 10-yr ylds or even brief undercut down to 1.85 before bottoming #AndAtTHATtimeBundYldsWILLBE?

Thursday 1:00 pm feels like ancient history after the action on Friday. But we need to point out that the move in long treasuries was triggered by the strong 30-year treasury auction on Thursday. As they say, a chart is worth a thousand words:

- Thursday – Charlie Bilello, CMT @MktOutperform – 30-year auction. $TLTpic.twitter.com/YMDtpICVl3

4. Equities

Remember the last week of July 2014? We could not find any bullish guru on Friday, August 1 except:

- Rachel @Sassy_SPY – Stocks at 20-day lows – get ready to buy $SPX SPY pic.twitter.com/lrc12H3ytR.

Kudos to @Sassy-SPY. In our simplistic way, we had written then:

- “Empirically speaking, when we find it hard to find/include a bullish stance, the stock market rallies the following week.”

Both our simple-minded line & the prediction of @Sassy-SPY came true both last week and this week. This shows that the buy the dip tactic still works in this market. What does that suggest?

- Thursday – Bespoke @bespokeinvest – Investors buying the dip. Is complacency setting in? http://bspke.com/5m7n3leu pic.twitter.com/Su7wLTtliB

This brings us to a set of tweets from Friday, August 8, that we featured last week:

- Chad Gassaway, CMT @WildcatTrader – We are nearing a period of seasonal strength in the SPX. Historically rallies from the 8th session through the 17th

- Chad Gassaway, CMT @WildcatTrader – 9 of 12 times we have had two consecutive weeks lower since 2012 a new low has been put in over the next two weeks

The first of the above two tweets proved right. Will the 2nd tweet above prove correct next week? We will find out. Now what about the intermediate or absolute direction?

- Mike Harris of Campbell & Co. on CNBC FM on Thursday – “If we look at the technicals, it becomes very clear…we focus on the last 30-days; that’s where our systematic models have taken off about 70% of our long equity exposure. … the models are looking at a weaker trend and that’s why risk is being taken off. … we are still long, we are long S&P and Asian Indices, we have gone net short the European markets and that’s part of what is driving our global stock exposure lower…”

- MacNeil Curry of BAC-Merrill Lynch on CNBC Futures Now on Thursday – “we are in a corrective environment, that correction isn’t done yet, … we are looking at a top right about now or in the course of next week or two, & from there you get a move down to 1860, a move from now say 1950 to 1860, frankly, by the time we get to that, it is likely to be finished, … we expect a very strong Q4″

Then you have the financials:

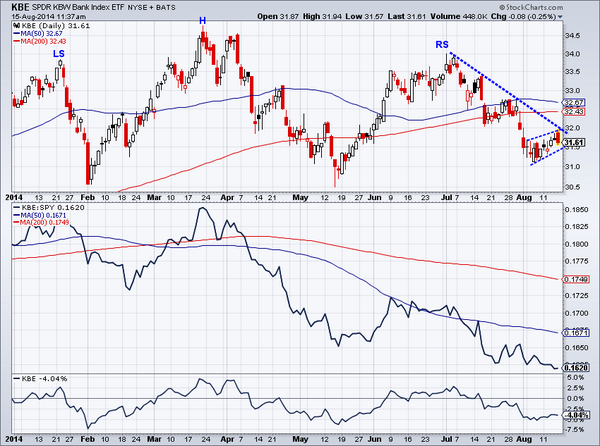

- Charlie Bilello, CMT @MktOutperform – Watch for a breakdown in this bear flag in the banks, likely coincide with second leg down in broader equities. $KBE pic.twitter.com/N8ytLiZR3A

On a more positive note, Friday August 15 was Independence Day for India, one of the best stock markets of 2014. Keith McCullough of Hedgeye may or may not know that. But he celebrated it just the same on Thursday in his clip:

- “India just acts fantastic; no matter what is happening in Europe, no matter what is happening in US, you buy Asia, buy China, buy India – they are really testing ytd highs this morning, up 25.1% ytd. India’s reported wholesale price inflation was lower again sequentially, month/month. … What Dr. Rajan is doing – stronger interest rates, stronger purchasing power for people, stronger India. That’s why we like India.”

5. Gold, Silver & Commodities.

We admit once again that we have no clue how gold trades & why it trades the way it does. This frustration was expressed by a technician this week:

- Jeff Cooper @JeffCooperLive – every time gold is flirting with a breakout someone lowers the boom. #papercartel

Some others took Friday morning’s slam in stride:

- Friday pre-Ukraine – Mark Newton @MarkNewtonCMT – Gold’s break this am of prior weeks lows a temp negative.. but don’t see too much more damage technically, ie #BTFD pic.twitter.com/xZCyyt1u3v

If Gold acts badly, Silver acts just ugly. But what about Corn?

- J.C. Parets @allstarcharts – Tuesday Video: Video: Here’s Why Today’s Action in Corn Is Bullish http://tmblr.co/ZRUaZx1O3TzFA

- Tuesday – J.C. Parets @allstarcharts – NEW POST: Here’s Why There Is A Trade In Corn http://stks.co/g0w7s $ZC_F $CORN $JJG

His case is made in his article Here’s Why There Is A Trade In Corn. The trade recommendation worked this week & Parets took a bow on Friday

- J.C. Parets @allstarcharts – solid close to the week for Corn. Can’t really ask for more after Tuesday’s reversal. This is the type of follow thru we like $ZC_F $CORN

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter