Editor’s Note: This is an journalism article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

The mood in the Indian Stock Market is pretty dour these days. Gone is the party atmosphere of earlier this year. But is that a good thing? The Bhagvat Geeta teaches that “In what is night to all, the wise remain wide awake; When people are wide awake, the wise realize it is time to sleep*“. Besides being a Divine Text, the Geeta is an enormously wise book for material practice on earth. In particular, the wisdom in the above Shlok has proven correct again and again in the Indian Stock Market.

Remember the gloom of June 2012 when the S&P downgraded India. The negativity about India was global and pervasive. The majority of Indians were wide awake in fright. But that was the time for the wise to relax about India. We wrote so in our June 2012 Knowledge@Wharton article Can India be the First Fallen Angel to Fly again?

Remember the crash of the Indian Rupee in August 2013? How deep was the gloom about India & the Indian Rupee? Indians were wide awake in fear once again. And that again was the time for the wise to relax about India. The all-time low for the Indian Rupee was reached on August 28, 2013. And that day in New York, the India ETFs demonstrated a DeMark Trend Exhaustion Signal and reversed. This was highlighted in the mid-morning tweet below:

- Wednesday, August 28, 2013 – Michael Gayed @pensionpartners – India ETF $INP intraday kinda having a massive reversal

Yes, that morning’s reversal marked a bottom for Indian Stocks and Indian Rupee. The Indian Stock market began a glorious rally from 17,996 on August 28, 2013 to about 30,000 in early March 2015. That was the period for most Indians to relax & sleep. Standard & Poors raised their growth forecast for India from 6.2% to 7.9% and an Investment Management company issued a report titled “Three’s is a Party in India“. We described this report in our own article on February 28, 2015.

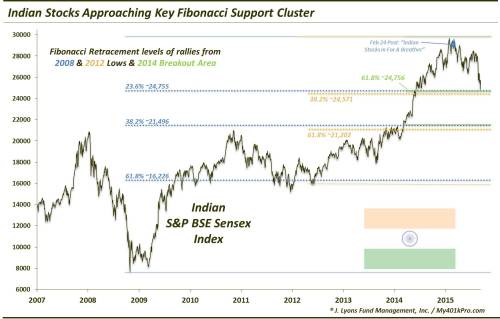

It was certainly a night of complacency for most. But was that, as the Bhagvat Geeta taught us, a period for the wise to be wide awake? Yes, indeed. One wise technical analyst put out a report titled Indian Stocks May Be In For Breather After Banner Year. We featured this report in our article on February 28, 2015. His graph from that article is reproduced below:

(Chart date – February 24, 2015)

How wise was this analyst, Dana Lyons of J. Lyons Fund Management? The Indian Sensex is down 17% from his report. No wonder the mood in the Indian market is so dour? No wonder investors are so wide awake in fear?

But is this a time for the wise to relax? Dana Lyons is leaning that way based on his report of this week titled Indian Stocks Ready To Resume Bull Market?

Before we go further, we must point out that what follows is merely one man’s opinion. The fact that Mr. Lyons was correct in February 2015 does not necessarily mean he will be correct now or going forward. This is an uncertain period in world markets with China slowing down, Brazil downgraded this week and the US Fed expected by some to raise US interest rates next week. So remember past performance is NO indication of future results and risks abound at this time. And, in fact, Dana Lyons himself ( @JLyonsFundMgmt) writes in his article of this week that he himself does not know what will follow or whether his own indicators will work or not.

So with the above provisos & disclosures, below are excerpts from the article of Mr. Lyons. Interested readers should read the entire article of Mr. Lyons (@JLyonsFundMgmt ) for specific levels:

- The good news is that the Sensex is now approaching a potential level of support, based on an assortment of analyses. … First off, we have another one of those [Hemachandra-]*** Fibonacci clusters …. Here is the chart showing the Sensex approaching this confluence of [Hemachandra-] Fibonacci levels:

- “The 2nd piece of potential major support comes from the long UP trendline from the kickoff of the Indian secular bull market in 2003. Using a logarithmic scale, this trendline precisely connects the 2003, 2009 and 2013 lows. And it is fast approaching current price levels now.”

How reliable are these levels? You will only know that in retrospect. Technical Analysis is a discipline based on pattern recognition and, as we all know, patterns can change without any notice. So to what extent is Dana Lyons willing to stick out his proverbial neck?

- “the Sensex should hold the Fibonacci levels mentioned above if the market is to resume its bull market in the near future …. Failing to hold, or quickly regain, these key levels would open up the breakout level around 21,500 to a potential test. And while that will likely be in the cards eventually, the Sensex does stand a good chance of bouncing from the nearby area first.” [emphasis ours]

If the Sensex does indeed bounce from these levels, that might provide a good luck send-off** to Prime Minister Modi for his visit to America in late September.

Footnotes:

* या निशा सर्व भूतानाम् तस्याम् जागर्ति सय्यमि यस्याम् जाग्रति भूतानि सा निशा पश्यतो मुनै (Yaa Nishaa Sarv Bhutanaam Tasyaam Jagarti Sayyami; Yasyaam Jagrati Bhutaani Saa Nishaa Pashyato Munayee) – Bhagvat Geeta II.69

** शुभास्ते पन्थानः सन्तु (Shubhaaste Panthaanah Santu) – traditional Sanskrut sendoff – May your travel be good & fruitful

*** Indian Mathematician Hemachandra was the first to discover these series of numbers and their properties. His work was translated into Arabic by Arab Scholars. Fibonacci learned of these numbers from Arab translations of Indian texts. So we now to call these Hemachandra-Fibonacci numbers for both rigor & historical accuracy.

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter