Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TACs is our acronym for Tweets, Articles, & Clips –our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Fed up.

Frankly, we can’t take it anymore. We felt sure that Friday’s Non-farm payroll number will finally point to a clear choice for the Fed. It did not. The number of 173K jobs was lukewarm but the unemployment level of 5.1% was a big number. The reaction is best described in:

- Holger Zschaepitz @Schuldensuehner – This chart shows that mkts have no clue: US Aug NFP +173k vs 220k exp BUT jobless rate drops to 5.1% lowest since 08

Jeffrey Lacker said almost immediately after the release that the report was “good, pretty much right down the fairway“. Bill Gross said to Bloomberg Radio “I still think it’s 50:50 and China and global conditions are the dominant factor. Otherwise, I would have said, yes, I think Fischer and Yellen and maybe even Dudley their fingers are itching“. The consensus of the talking heads is that September hike is a done deal but are they credible?

- Richard Bernstein @RBAdvisors – Irony: Those screaming loudest that the economy stunk are now those screaming loudest for Fed to raise rates.

Indeed, the markets continue to price it as about a 30% probability. And the decision is only two weeks away. How will markets react if the Fed does tighten on September 17th meeting? What if the Fed suggests what Bill Gross opined “I think they are one and done for six months“? Will that matter to markets?

Jim Bianco was explicit in his conversation with Rick Santelli on Thursday:

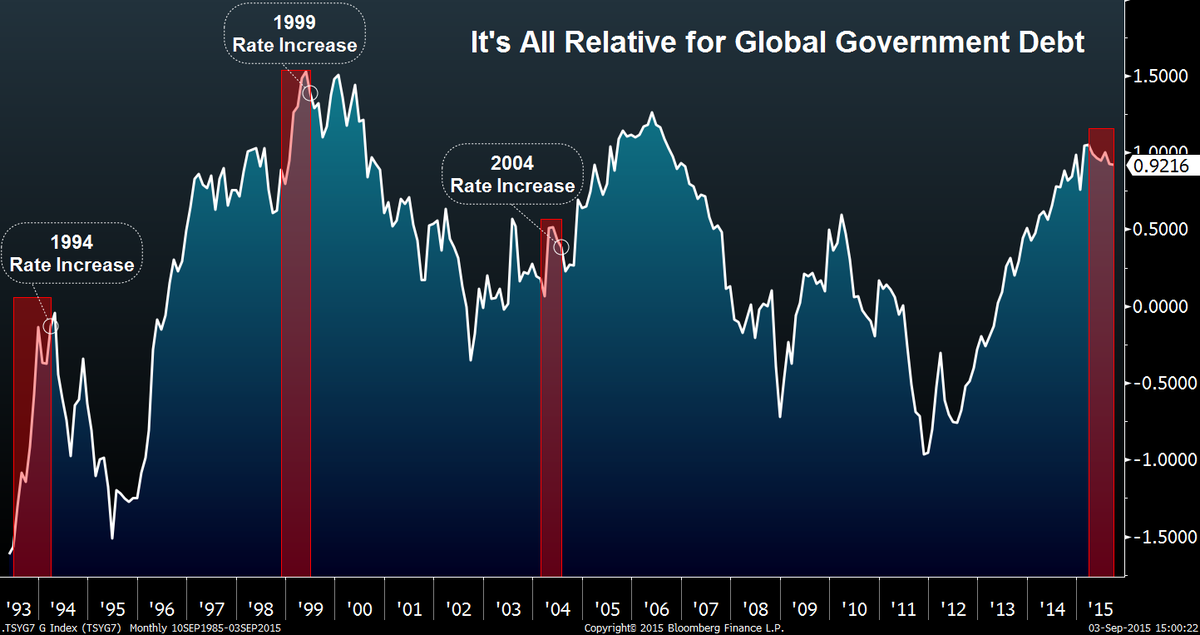

- the market does not have a Fed hike priced in; if the Fed were to hike in two weeks, it can have a very profound effect on the market; yes, even if they promise they won’t hike again;

- the market expects the funds rate to be at the end of 2017 to be 1.5%; the Fed says it is going to be closer to 3%; if the Fed raises rates in two weeks; they are saying we don’t care about financial stability; we don’t care about China, the economy is so strong we have to move now, the market starts thinking may be they will move the funds rate to 3%; if the market does that, the 2-yr, 3-yr, 5-yr notes will have to re-price to a new higher forward curve;

- the front end of the curve goes up a lot; yield curve flattens quite a bit because the market is priced into a reality and the Fed in two weeks might tell us that reality is something different & much higher; they will try to tell they will not move for 6 months but they can’t make that statement; they are meeting to meeting, they are data dependent & they don’t know what the data is going to be; ,

This, as Rick Santelli pointed out, is called “Lehman Dynamic” on the trading floor. This is why Art Cashin said on Friday afternoon that Chair Yellen has to send a signal of some sort before the meeting. You don’t want to stun the fixed income markets.

Why are markets so unwilling to price in a Fed hike for September 17th?

- Thursday – Charlie Bilello, CMT @MktOutperform – Volatility spikes in ’87, ’97, ’98, ’01, ’02, ’08-09, ’10, & ’11 => More Fed Easing. NEW POST. http://stks.co/q2nMq

Why this link to volatility? His partner Michael Gayed said that Fed’s “3rd implicit mandate is stability of asset prices“. Which is another way of reiterating Bernanck-Yellen mantra of wealth effect driving the economy. How is that linked to easing?

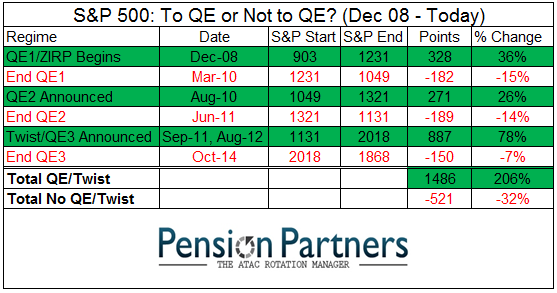

- Charlie Bilello, CMT @MktOutperform – @howardlindzon Can you blame them?

The above seems clear except what about the economy? Hedgeye’s Bottom Line is:

- “Like an old broken record, we’re here to remind you again that it’s late cycle and it’s time to start preparing for the inevitable cyclical downturn“

and,

- Holger Zschaepitz @Schuldensuehner – When the world were looking to #ECB, US inflation expectations, measured by 5y5y swap, collapse to lowest since 2008

The above argues that the Fed should, as in March 2015, get more dovish, talk the U.S. Dollar down and take the pressure off of commodities & emerging markets. This, with Draghi’s QE now & probably QE2 sooner than later, will settle the financial markets down and preserve the wealth effect.

On the other hand, James Paulsen of Wells Capital argues:

- “we are headed to full employment; we are going to be at 4-handle on unemployment within months & that totally changes the premise & fundamentals of this stock market upto now“

But don’t get us wrong. Paulsen doesn’t argue for hiking rates. Instead he warns:

- “if you have to raise interest rates, you challenge the entire valuation profile of both the stock & bond markets & of course the liquidity friend is going to go bye bye; I think thats what this is about; it is about the financial markets finding a valuation level which can sustain a very different environment going forward than what we have had upto now; I think that’s the chaos last two weeks; thats what is underlying all this; people think if we fix China, if we bottom commodity prices, we are good to go; I dont think that’s the case”

In other words, it is all about the US economy and what the Fed does about it. It is about the significant divergence between a strong US economy and a weakening European & Asian economies. This divergence is one big problem but if the Fed adds to a widening liquidity divergence between US & Europe-Asia to the current mess, they could create a financial accident. This is why Art Cashin said on Friday afternoon “I think they would be crazy to go“.

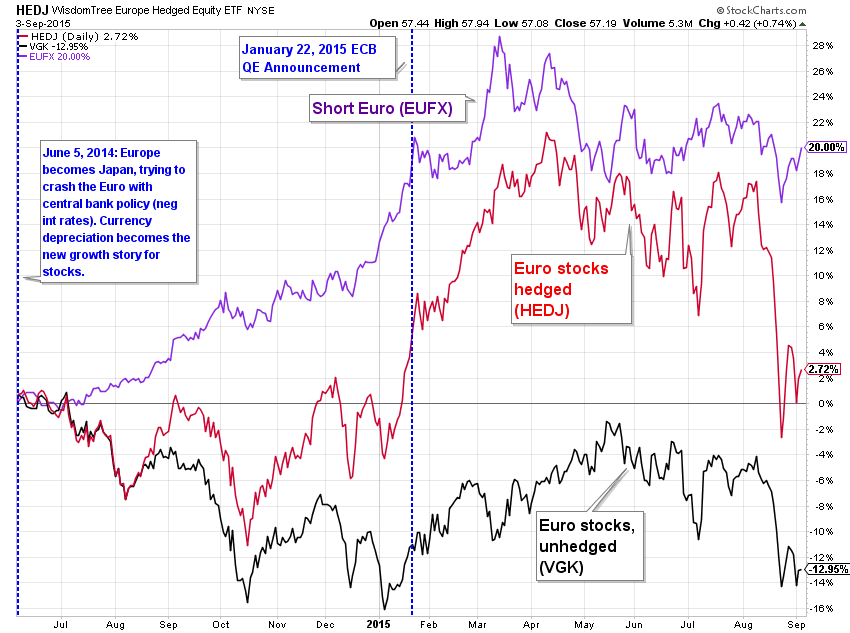

- Thursday – Charlie Bilello, CMT @MktOutperform – European stocks have done nothing under neg rates/QE thus far. Response: dovish Draghi hints at more QE

Draghi was so powerful in 2013. Why is that magic ineffective now? Because his QE is being rapidly overshadowed by the looming specter of liquidity divergence between US & rest of the World. This is why Thursday morning’s celebration of Draghi’s QE promises proved so short-lived.

That is why it may be not be sufficient to postpone the rate hike to October or perhaps even December. They need, as Steve Liesman demanded on Friday, to hint at or suggest a sort of moratorium against raising rates for the next six months.

Or the Fed could raise rates in two weeks to prove, in Larry Kudlow’s words, “Fed’s manhood or womanhood.” Then they can either celebrate their “hood” or wait in fear of a financial accident. When they get one, they can then do QE4 without any hesitation.

We are so fed up of the Fed that we are almost tempted to demand this “hood”-based action. Lehman did clear the markets, didn’t it? So did Russia in 1998, right? The only accident that petrifies us is the 1914-kind. Something happened on Friday morning that we had never witnessed before – Alan Greenspan spoke about China’s military might displayed in the Chinese WWI I parade and spoke about how the Sequester is damaging the capability of the US military. Any one recall the maestro ever discussing the preparedness of the US military before?

2. Treasuries

Finally on Friday, Treasuries behaved like Treasuries of old. Old meaning pre-Chinese selling and pre-RiskParity selling. Is the latter as simple as the below?

- CNBC Now @CNBCnow – Bridgewater Associates’ $80B risk-parity fund down 4.2% in August – Reuters, citing sources

But what about China & rest of EM selling their reserves of Treasuries? The curve bull-steepened for the week with 30-year yield falling by 2 bps while the 10-year yield fell by 6 bps and the 5-year yield fell by 5 bps. But that was for the week. The 30-5 & 30-10 yr curves bull-flattened on Friday:

- Friday – Mark Newton @MarkNewtonCMT – Greater than 2% Flattening today in most parts of the Yield curve, here seen in 5s/30s

Some say Treasuries are back to their old role:

- Bloomberg Business @business – Treasuries are cementing their status as the world’s market oasis of choice http://bloom.bg/1VAc7j1

Next week should tell the story whether the forced selling is done. If it indeed is done, then Treasuries could see a powerful rally. TLT is between its 100-day & 200-day having just bounced off the 100-day with RSI/MACD/Stochastics all turning up.

3. Stocks

Everyone knows that stocks are in a downturn. So we begin with short term bullish factors & opinions.

- Jason Goepfert @sentimentrader Small speculators went net short index futures by $2 billion this week, 2nd largest short position in 20 years.

- Northy @NorthmanTrader – I give it a perfect “10“

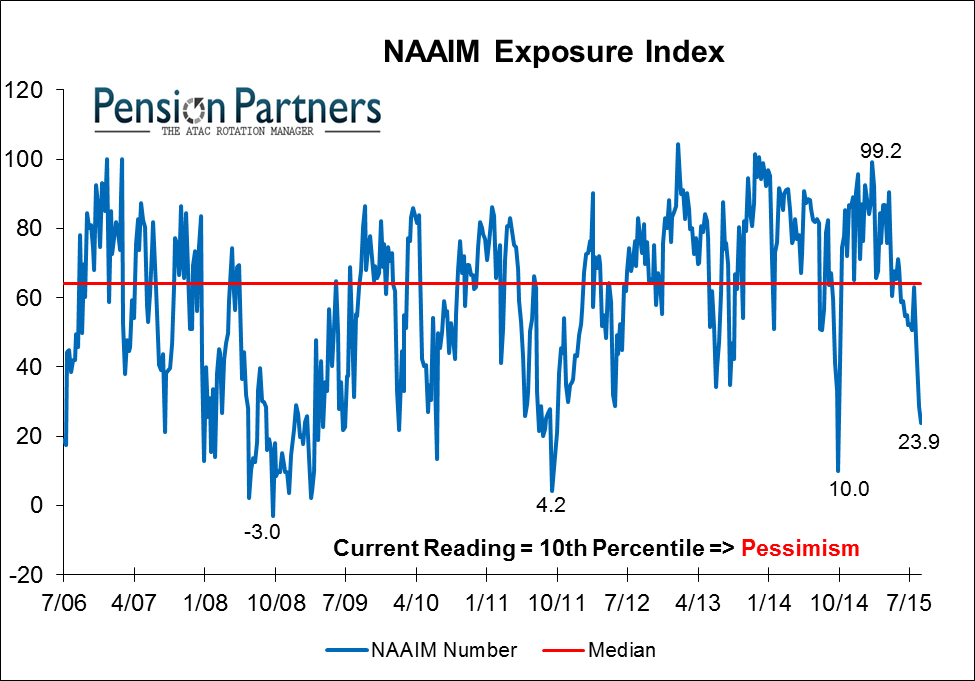

- Charlie Bilello, CMT @MktOutperform – Active Managers (NAAIM) reported 99% U.S. equity exposure back in February with S&P at 2113. Down to 23% today

Now for the intermediate term bearish opinions:

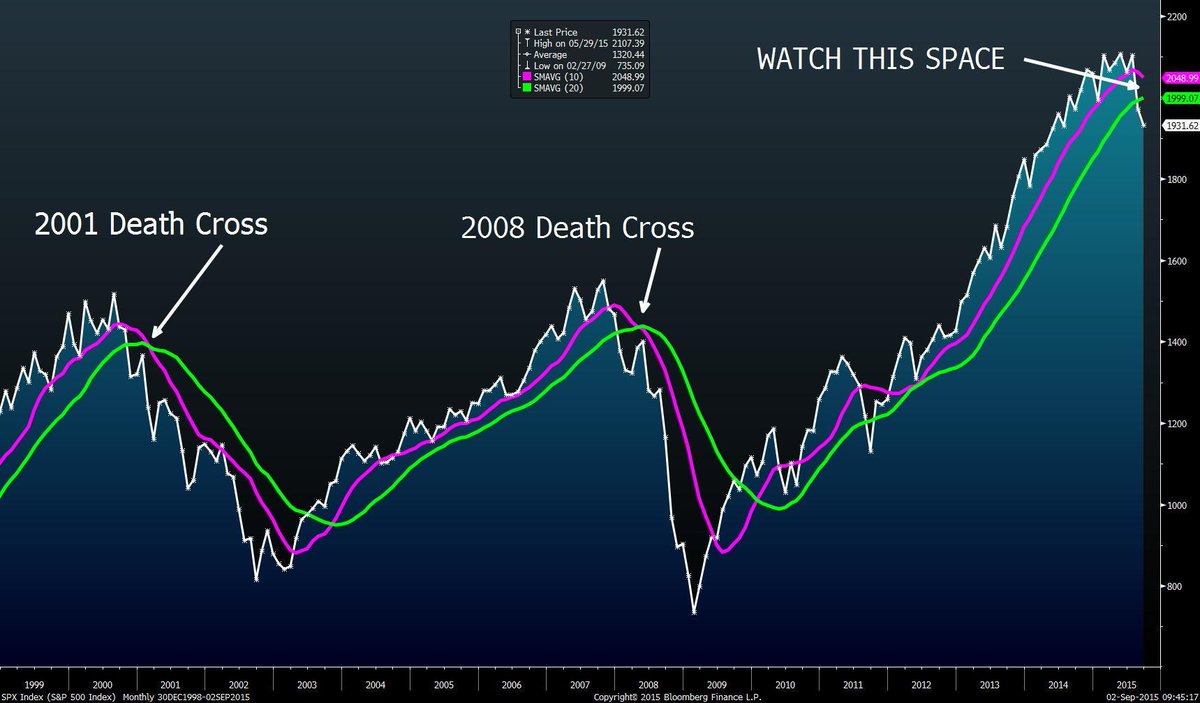

Louise Yamada said the bull market was over on CNBC Futures Now on Tuesday and said:

- “momentum has been declining for four months, which by her work, is a “classic” sell signal. “This is suggesting to me that we are looking at a bear market,”

- “the last two times the market saw a similar shift in momentum were in January 2008 and June 2000.”

- “If the 1,800 level were to be breached, I think we could go all the way back toward 1,600 which is the breakout point through which the market moved in 2013″

- “the market could see bounces and the overall decline will happen over the course of a number of weeks to months”

A more detailed coverage of Yamada’s charts can be found via:

- Bloomberg TV @BloombergTV – These are a few of the stock charts that spook Louise Yamada http://bloom.bg/1O904oy

Mark Newton on CNBC on Thursday:

- [this market is] a lot different than what we saw in 2011 or October of last year; My target is 1820 & below that we could get to 1680 & give up almost 1/3rd of upside from 2011; this year is similar to 1946 & 1974 – those 2 years market was down over 6% in August & was down greater than 2% on first day in September; market this year is similar in this regard

What about fundamentals? Jim Paulsen on CNBC Squawk Box on Friday:

- it is about the financial markets finding a valuation level which can sustain a very different environment going forward than what we have had up to now; I think that’s the chaos last two weeks; that’s what is underlying all this; people think if we fix China, if we bottom commodity prices, we are good to go; I don’t think that’s the case; I think we have to find a valuation level & investment sentiment level that can support growth with negative consequences; I think we have got another down leg; might break 1800 & scare people a bit more; that’s my guess;

Back to the bullish camp:

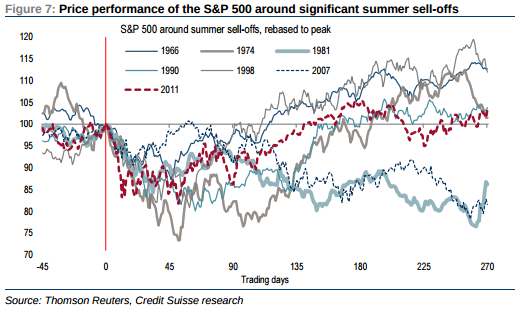

- ValueWalk @valuewalk – The S&P 500 Is Going Back To 2,100 This Year: Credit Suisse http://bit.ly/1LWSShY

4. Leadership change in the offing? – Commodities & Commodity Countries

Last week, we wrote:

- “Every major correction leads to a change in leadership. Since 2008-2009, S&P has blown away Emerging Markets in performance and natural resource stocks have viciously underperformed. With China about to enter the QE business & with the rest of the non-US developed world already knee deep in QE, is it possible that a cycle of EM outperformance is possible in the next bull run?”

Jim Paulsen of Wells Capital made similar comments on Friday on CNBC Squawk Box:

- “I don’t recall another recovery where the US has been such a different position relative to almost everyone else in the world;while we are heading over the crossroads of employment, no one else is; so right now I think commodity prices may be bottoming, we may get a global bounce & if we do, its all good for foreign markets; but it is going to be conflicted here; & I think we could see a big delinking in performance between US & overseas“

The chart below is from an article by Prof Carmen Reinhart:

So “it is too early to conclude that inflation is a problem of the past“, she writes.

Mohamed El-Erian described Brazil & Oil markets as “completely unhinged“. But unhinged to one can be most interesting to another. ACG Analytics recommended buying a 1/3rd position in EWZ, the Brazil ETF. Dana Lyons called the Brazilian Bovespa The Most Interesting Chart in the World:

- “All we can say is the Brazilian Bovespa is primed to move BIG – we just don’t know which way yet — given that the recovery would mean another “hold” of the 61.8% Fibonacci Retracement level of the 2008-2010 rally, an eventual new up-leg to the post-2002 secular bull market could conceivably unfold…i.e., new all-time highs“

- “Well, based just on the breakdown of the head-&-shoulders pattern, a measured move would suggest a drop all the way down to near the 2008 lows“

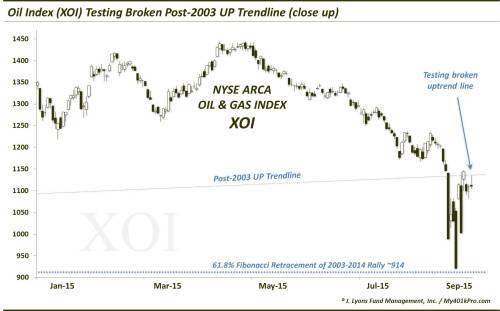

If Brazil is the ultimate commodity market, what is the ultimate commodity? And isn’t a failed breakdown a major bullish signal? Dana Lyons discussed both in his article Oil Stocks Testing Breakdown Level of Long-Term Uptrend:

- The reaction here will be key, for the near-term and possibly for the long-term. If the XOI fails here, it would appear to have little support down to a retest of the 61.8% line. And the longer it stays below the broken trendline, the more significant the break becomes. That is, the more negative the connotations are for the longer-term prospects of the sector.

- If the XOI is able to regain and hold the old trendline in short order, it could arguably be considered a false breakdown. This could imply that the long-term prospects of the secular post-2003 uptrend remain intact, though bloodied a bit. In the short-term, it could also spur a massive short squeeze/mean-reversion rally in a sector that, from an intermediate-term perspective became about as washed out as you will ever see.

- If you’re watching this sector, and the index, the key is simple, in our view. Above the trendline, near 1130-1140, prospects are bullish for the XOI, with immediate upside to the low 1220′s breakdown level (~7%) – and longer-term prospects, much higher. Below that line, prospects are bearish, with immediate downside to the 914 level.

And,

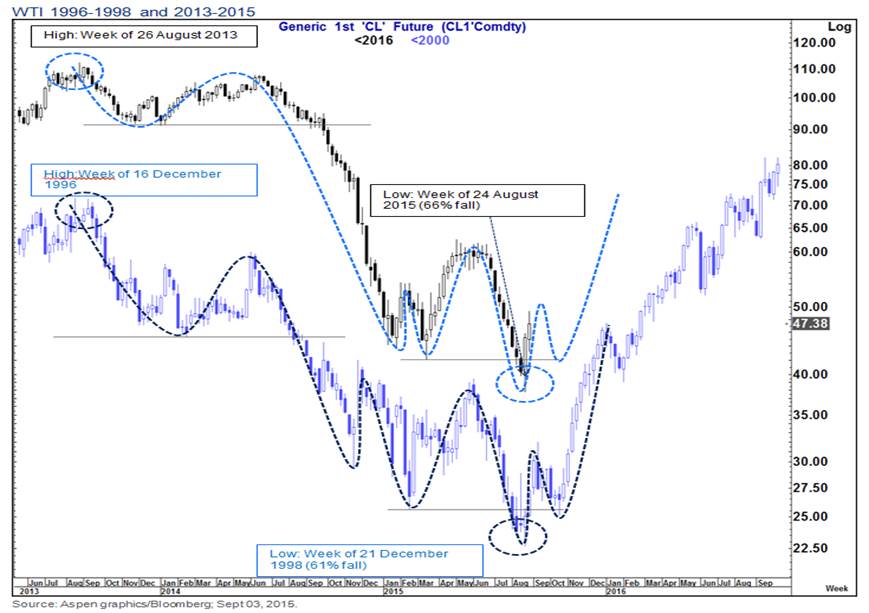

- Steve Collins – @TradeDesk_Steve OIL deja vu – Citi

5. Gold

It is hard for Gold to rally in Dollar terms as long as the specter of Fed raising rates looms. This is explained in more detail in the article Gold Prices Held in Check as Fed Rate Hikes Linger. In the meantime, the long positions keep increasing:

Finally,

- Mark Newton @MarkNewtonCMT – Weekly Copper requires move over 244 to expect larger rally, but would catch many shorts offguard given extent of O/S

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter