Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Even Steven

That Seinfeld clip seems the best way to describe stocks & bonds this week. At the end of an eventful week, the S&P is up a flattish 14 bps, TLT is merely up 60 bps and the US Dollar & Yen were flat. Every action was balanced out quickly by an opposite action, whether that be the first debate or the Deutsche Bank fear. The VIX is up 8% on the week but closed with 13-handle. That’s not what you call volatility as Crocodile Dundee would say.

So what’s up with the Deutsche Bank stuff? On a macro level, nothing that hasn’t been going on since 2014. But on an immediate here & now level, it is all about political survival & legacy. After the refugees disaster & two straight election losses, it would political suicide for Merkel to do anything for DB. So she took a page out of the old Musharaaf-NonPakistani book. What page? The page that taught Musharaaf to say to the US – if you don’t help me, I will shoot myself. She said that & all hell broke loose on Thursday afternoon.

So what did you hear Friday morning? Rumors that the DOJ was going to reduce the yuuge $14 billion dollar fine by about 60% to a manageable $5.4 billion. So DB exploded up 14% on Friday and stocks rallied hard as much as they had fallen on Thursday. Even Steven?

President Obama is totally vested in defeating Donald Trump and he simply cannot afford a market crisis in the next 6 weeks & ideally until the end of the year. So our expectation is this DB fine/crisis will be either resolved satisfactorily or talked away till Obama exits in 2017.

Is that why?

- J.C. Parets

@allstarcharts – European banks have exploded off July lows. Momentum is suggesting after some consolidation, we should see higher highs$EUFN$DB$CS$UBS

But is that true of the S&P?

- Urban Carmel @ukarlewitz – $SPY – $DB could not produce a lower low. FOMC last week couldn’t make a higher high. So, we have wedge. See which side breaks first

Some reversals were noticed on Friday.

2. Friday Reversals or Weekly?

Last week we pointed out the hard reversal in gold & gold miners on Friday, September 23. That was a signal for what happened this week – Gold down 1.5%, Silver down 2.5% & miners down 2.5%. Last week’s bond divergence was the 7 bps rise in the 30-year Treasury-Bund spread. This week, Rick Santelli drew attention to the rise in the 10-year Treasury-Bund spread saying this “is getting close to a spread we haven’t seen since the 80s“.

This could simply be a quarter-end phenomenon just like the one below could be:

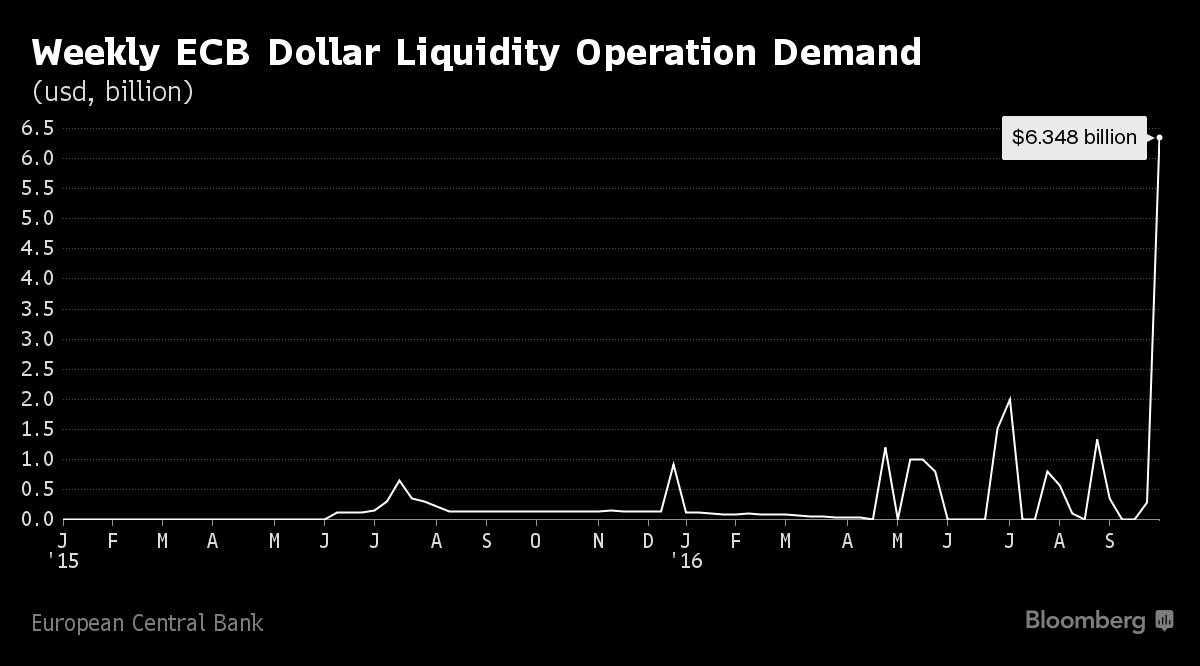

- Holger Zschaepitz

@Schuldensuehner – Oops! European Banks are asking the#ECB for a lot more Dollar funding .http://bloom.bg/2dbIjuY

The interesting point is that German banks were not among those bidding for Dollar liquidity on Friday. So another quarter-end phenomenon?

3. Stocks

A simple succinct description of reality came from Lawrence McMillan of Option Strategist:

- “In summary, until $SPX breaks out of the 2120-2195 area, expect mixed signals from the indicators and a directionless market. But a breakout from that range can and should be traded.”

The week & the month have been lackluster but the third quarter was up. Does that mean anything?

- Ryan Detrick, CMT

@RyanDetrick – The S&P 500 is up 3.3% this quarter. Going back to ’90, when up >3% during the historically weak 3Q – the 4Q is up 8 of 10 w/ avg of 4.7%.

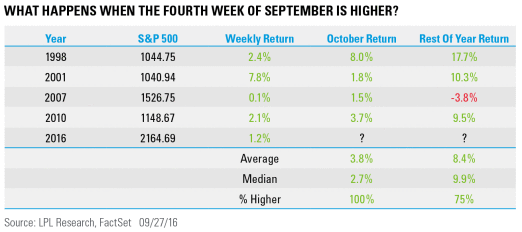

Also the fourth week of September was higher, something that has happened “going back to 1990“, only “4 times out of the past 26“. So what does LPL Research make out of this rarity?

On the other hand, Tom McClellan writes in his article VIX Well Below Its Futures Contracts:

- “It is pretty rare to see the spread get up as high as it has recently, and when it does happen, there tends to be a meaningful selloff in stock prices in order to restore a healthy level of worry into the hearts of overly bullish speculators. I expect to see the same outcome this time“.

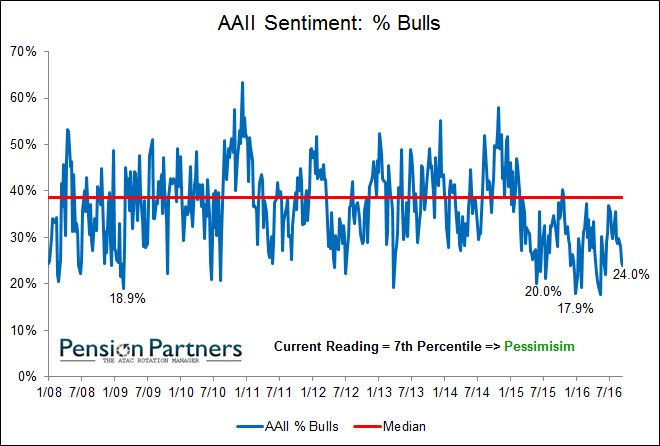

But bullish sentiment is low despite an incredible run over nearly 4 years:

- Charlie Bilello, CMT

@MktOutperform – S&P 500 will be up 14 out of the last 15 quarters. Meanwhile: 24% bulls vs. 37% bears in AAII’s latest poll.$SPX

4. Gold, Treasuries and S&P 500

First gold in isolation:

- Tom McClellan

@McClellanOsc – Spot gold in $ is breaking uptrend line. Same line on € price plot still holding. Watch for recognition wave of sell orders if that breaks.

Now Gold relative to Treasuries from J.C.Parets:

- Here is Gold relative to US Treasury Bonds. To me it looks like a nice bottom and poised for a breakout, which suggests owning gold and selling bonds

Is Parets turning into Bill Miller?

- “Here is the S&P500 vs US Treasury Bonds. The way I see it, we’re above the March 2000 highs and above a downtrend line from last year’s highs. With momentum in a bullish range I think the benefit of the doubt here still has to go to the bulls, which suggests buying stocks and selling bonds.”

5. The truly big indicator

J.C.Parets said true in the conclusion of his article:

- “There is a lot going on here with Bonds and US Interest Rates. I think the next move could impact a lot of assets around the world.”

And what could determine that? Next week’s Non-farm payroll report.

6. Oil

While we have no clue how oil trades or what whims drive the words of Saudis, the action this week was real & spectacular with USO & BNO up 7+% and OIH up 9.6%. For those interested in tracking an interesting correlation, we suggest the article by J.C. Parets in which he describes the correlation of ratio of ILF (iShares Latin American ETF) & EEM (iShares Emerging Markets ETF) to Crude Oil.

Finally for those who don’t know Seinfeld:

[embedyt] http://www.youtube.com/watch?v=y08LUrcp1OI[/embedyt]

Send your feedback to [email protected] Or @MacroViewpoints on Twitter