Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. Now, Now, Now!

In the Hunt for Red October, the instruction to launch a torpedo was given by the American officer with the words – “Now, Now, Now”. How we wish some one at the Fed had the authority to tell Chair Yellen to raise rates at 8:30 am on Monday with words like those. Because the absolute best opportunity for the Fed to raise rates is Monday morning.

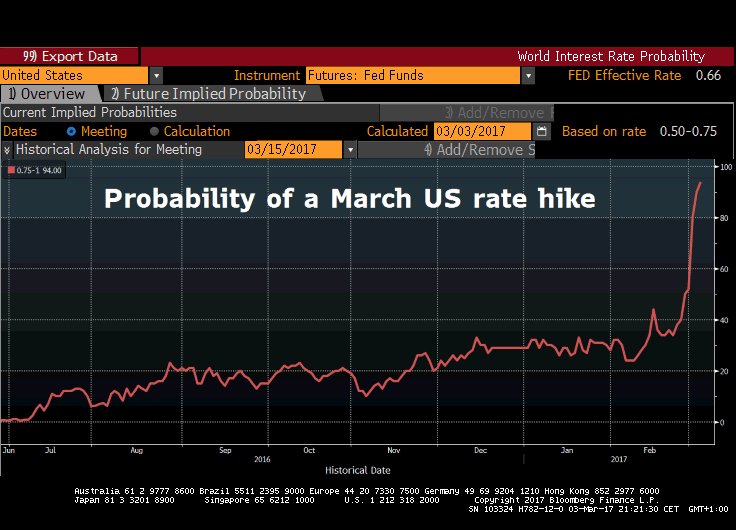

We cannot remember a week like this. The Fed simply told the market that they planned to raise rates during the FOMC meeting on March 14. Not just once but via four Fedheads including Vice Chair Fisher, NY Fed President Dudley and uber-dove Lael Brainard & Chair Yellen herself on Friday.The message has been clearly and forcefully communicated and received with total clarity.

- Holger Zschaepitz

@Schuldensuehner – Probability for a US March rate hike jumps to 94% as Yellen gives March a green light.

So why wait for another 8 trading days, days that are full of data releases? Nothing in the data can add any more certainty to the rate hike on March 14. But the data can certainly add a level of uncertainty to that rate hike. For example, a weak Nonfarm payroll number can raise doubts and so can a hard correction in the stock market next week. Why take the chance? Just pull the trigger on Monday morning, Chair Yellen.

So why wait for another 8 trading days, days that are full of data releases? Nothing in the data can add any more certainty to the rate hike on March 14. But the data can certainly add a level of uncertainty to that rate hike. For example, a weak Nonfarm payroll number can raise doubts and so can a hard correction in the stock market next week. Why take the chance? Just pull the trigger on Monday morning, Chair Yellen.

2. Reaction to the Yellen speech

Once again, the reaction of markets was totally contrary to Yellen’s message. Look at Friday’s intra-day action in TLT & GLD:

Both TLT and GLD rallied as a result of Yellen’s speech. JUNG, the triple-leveraged junior gold miner ETF, rallied by almost 10% post Yellen’s comments. Yes, a 10% move from 1:30 pm to 2:30 pm.

Another proof that this Fed does all its damage during its endeavor to prepare the markets. That talk flattened the 30-5 year curve by about 8 bps on the week.

Another proof that this Fed does all its damage during its endeavor to prepare the markets. That talk flattened the 30-5 year curve by about 8 bps on the week.

How much more yield do you get by going out an extra 25 years from 5 years to 30 years? Just about 1%, scoffed Larry McDonald of Bear Traps Report. This is even flatter than the State of Illinois which boasts of the I-74 clover leaf as its highest peak. The long end of the Treasury curve is mocking the Fed and dissing the inflation component of the Fed’s argument.

How much more yield do you get by going out an extra 25 years from 5 years to 30 years? Just about 1%, scoffed Larry McDonald of Bear Traps Report. This is even flatter than the State of Illinois which boasts of the I-74 clover leaf as its highest peak. The long end of the Treasury curve is mocking the Fed and dissing the inflation component of the Fed’s argument.

But the short end is listening intently and reacting.

- Charlie BilelloVerified account

@charliebilello – US 1-Year Treasury Yield ends the day at a 8-year high: 0.98%.

- Charlie BilelloVerified account

@charliebilello – US 2-Year Treasury Yield ends the day at a 7-year high: 1.32%

This is why we don’t understand why this Fed would choose to wait for another 8 trading days before raising rates, assuming they actually do raise rates on March 14. The real risk, of course, is that they actually raise rates 3 times in 2017 in a 2-handle GDP economy and causes a recession in 2018 just as Greenspan caused a recession in 2000-2001.

3. Still all about the Fed

Look at the damage wrought by Fed’s cajoling last week – Gold Miners were nearly liquidated, falling 8%-11% and yields in the short end of the curve exploded higher. So what happens next week depends on how the Dollar, Treasury market & Gold behave under the near certainty of a rate rise the following week.

One market doesn’t seem to give a hoot to the Fed. We mean the major US stock indices. As we expected the Trump speech led to a 300 Dow point on Wednesday. The remaining four days did nothing and meant nothing expect, of course, the determination of the major indices to not go down.

Look at the last two weeks – when rates are falling, utilities & staples do well and when rates are rising, banks & reflation trades do well. But this is all within steadily rising stock indices. What a sweet & fast rally has it been?

- Ryan Detrick, CMT

@RyanDetrick#Dow took 24 days to move from 20k to 21k, tying fastest 1k interval since ’99. Yes, the % move is much less though. http://lpl-research.com/hoc/Charts/Blog/030117_MMM_Figure1.jpg …

This rally has been a function of confidence in higher earnings to come.

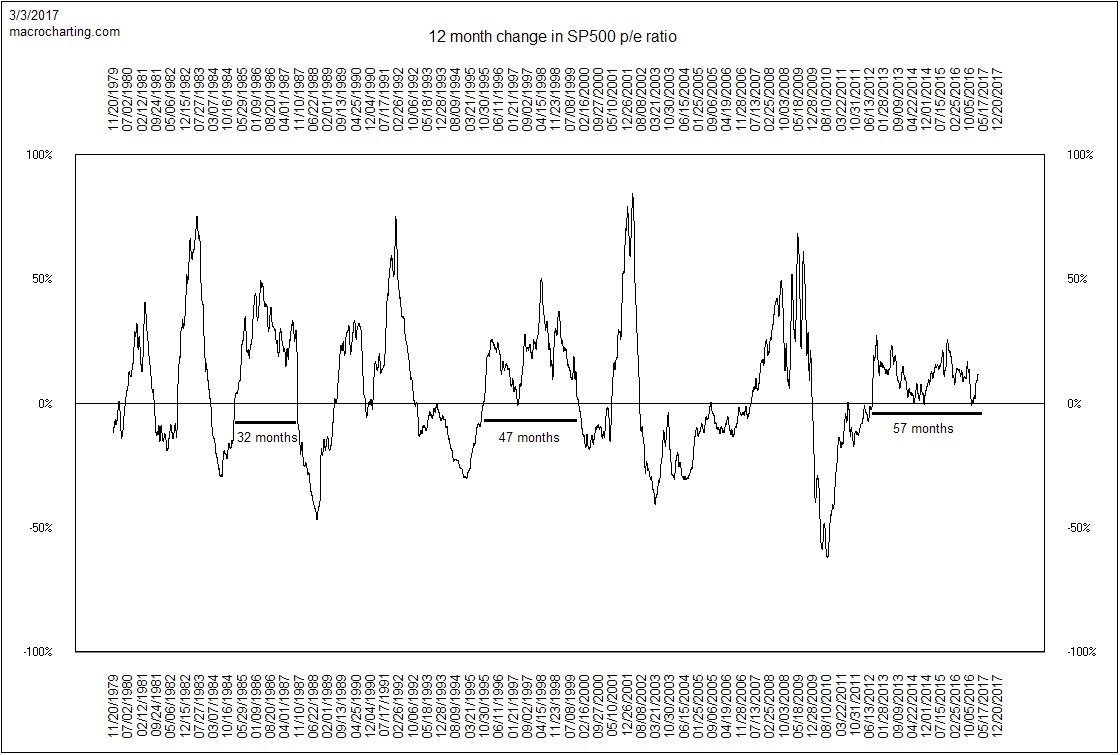

- John Alexander @MacroCharting – At 57 months, we have eclipsed the pre-1987 and pre-2000 markets for longest streak of non-stop p/e expansion. #fundamentalsareforlosers

What’s another name for conviction? Doesn’t strength lead to conviction, intense conviction that persuades investor to shun hedging?

What’s another name for conviction? Doesn’t strength lead to conviction, intense conviction that persuades investor to shun hedging?

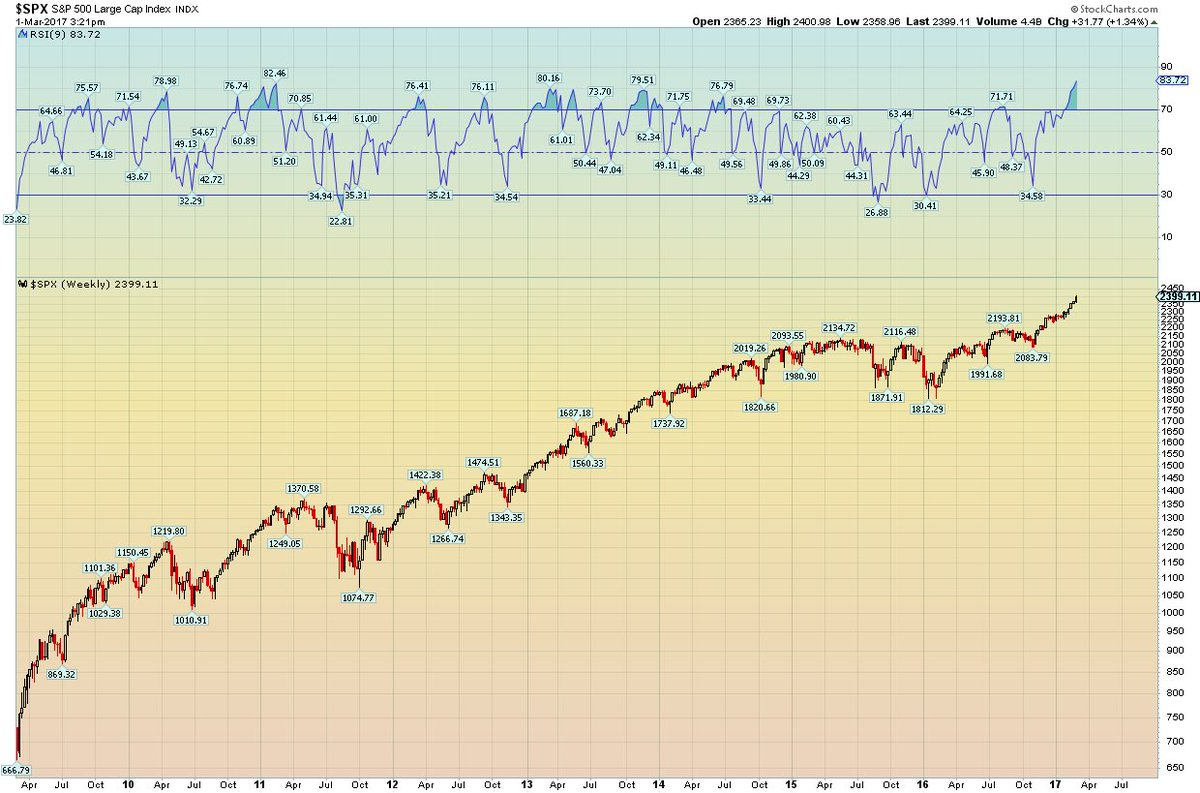

- Ivan Beljan CMT @BellTimeTrading – Mar 1 – Record high for weekly RSI. Very stretched. $SPX $SPY

All this is fine but what would folks from Missouri say? What Lawrence McMillan said on Friday:

All this is fine but what would folks from Missouri say? What Lawrence McMillan said on Friday:

- “In summary, the overbought conditions that have been in existence for a few weeks now are beginning to mature into sell signals, but it would take an $SPX close below 2300 and a $VIX close above 15 to change the intermediate-term outlook to bearish”

But the erosion is becoming more visible:

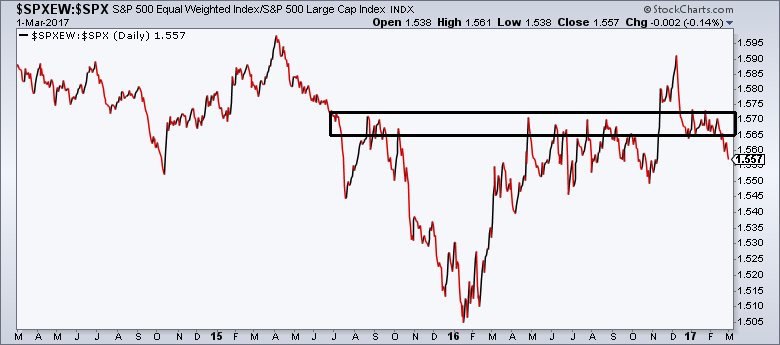

- See It Market @seeitmarket – Mar 2 – The S&P 500 equal weight index relative to the S&P 500 is breaking down this week. Larger companies leading $SPX. $SPXEW

And Emerging markets badly underperformed the S&P this week. Not a surprise when rates explode up and Dollar rallies some.

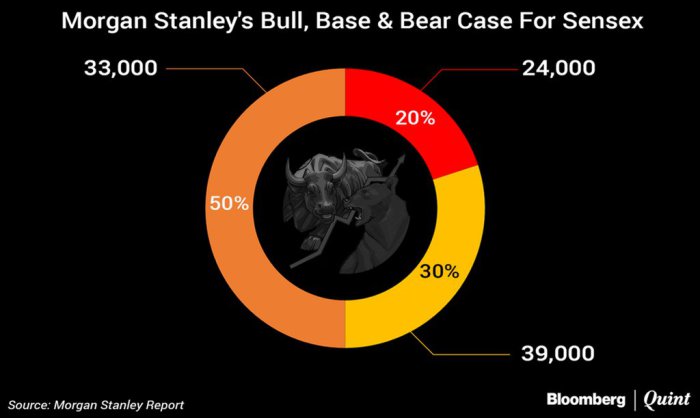

The Indian market could see some action because the results of the election in the mammoth UP state will be out next week. Expectations are that PM Modi’s party will win a majority of seats. Winning UP will add to his party’s strength in the Upper House of Parliament where his reforms are still stuck. And, oh yes, India’s GDP confounded skeptics who had warned of a slowdown from the demonetisation turmoil of November-December 2016. What is then the year-end base case for the Sensex? 33,000 or 14% higher than today, per Morgan Stanley:

- BloombergQuintVerified account @BloombergQuint – Morgan Stanley’s Ridham Desai sees a Rs 6 lakh cr M&A boom sending the Sensex to 33,000 by December. @rndx1 https://goo.gl/H0ZWF8

A team from Alliance Bernstein visited large & small cities across India to interview people of all ages. Their findings are in the article Indian Consumers Embrace Disruption in Era of Change.

- Government-led initiatives are shaking up the economic landscape in India. Despite the challenges, we discovered that consumers are embracing change and feeling confident about the future in ways that could open new opportunities for investors.

- We recently traveled to large and small cities across India to interview people of all ages. Our research revealed that consumers are in high spirits and generally supportive of recent government initiatives to modernize their economy.

- Take, for example, the accommodative response to the Modi administration’s demonetization last November, which deemed 86% of the value of banknotes in circulation invalid. Despite the action’s initial upheaval, most people we spoke to believed that it would ultimately improve the fairness of the system.

- With a growing number of retail outlets accepting e-wallets, the younger generations don’t see the need to go back to cash. And, in a trend we call “reverse nurturing,” younger generations are slowly convincing their reluctant older friends and family members to accept newer technologies. We see demonetization creating a distinct opportunity for mobile-payment services providers to serve India’s large, unbanked population..

4. Gold

What a difference the Fed makes? Last week, the talk was of a breakout in Gold. This week, the talk is about a washout in gold miners. Gold was hit hard (down 1.8%), miners were literally discarded (GDX down 8%; GDXJ down 11%) and Silver was gored (down 2.2%). The action persuaded Carter Worth of CNBC Options Action to go negative on gold.

But what do the CEOs of gold companies say? At least one is clear:

- ‘I don’t think, in my 20 years, I’ve ever seen the stars so aligned for a better gold price, – Randgold CEO Mark Bristow at the annual BMO Metals & Mining conference in Florida.

But that better price may take 1-3 months to achieve, Bristow added.

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter