Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Are you not coming, Santa?

We do have 2 more days for the Santa Claus rally to materialize. But if it doesn’t materialize, will Ryan Detrick’s warning of last week come true?

- ” .. in the rare instance that the market gets a lump of coal instead of a Santa Claus Rally, that usually means there could be weakness in January. You can call it a potential indicator that something could be wrong. In fact, over the past 20 years, 5 have seen coal and sure enough, January was lower every single time.“

On the other hand, as bulls keeping saying on Fin TV, usual seasonality patterns have not worked all year. So why should they work now?

On the first hand again, Ryan Detrick used the dreaded “07” number this week:

- Ryan Detrick, CMT @RyanDetrick The S&P 500 on the last trading day of the year has closed down the past 3 years. Since ’28, has been down 4 yrs in a row only once … with the fourth being the last day of ’07.

Frankly, we will just wait for next week and let them fall where they may. In the meantime, below are 3 charts we found interesting:

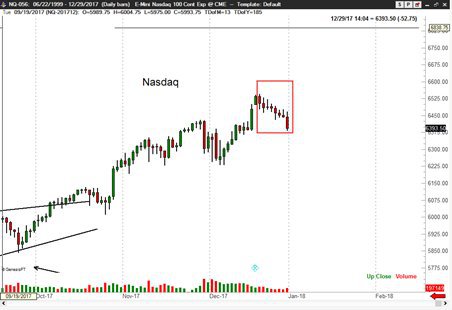

- Peter Brandt @PeterLBrandt Eight days of lower closes in NASDAQ. Not a good sign.

$NQ_F$QQQ

- Peter Brandt @PeterLBrandt

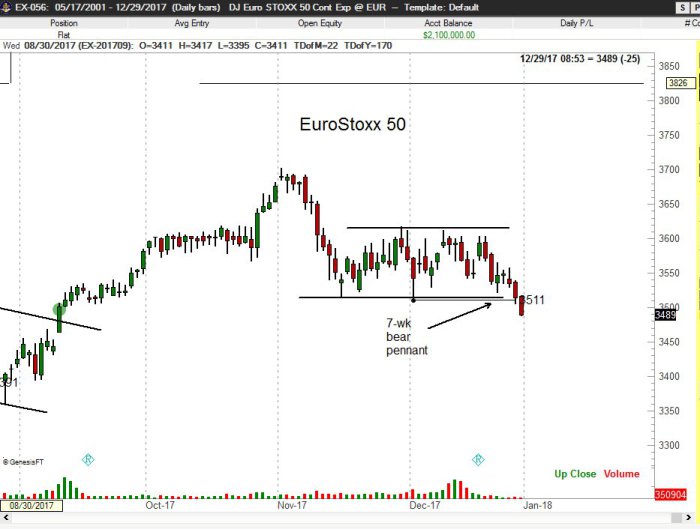

#FACTORMEMBERS EuroStoxx 50 breaking down. See Factor Update dated Dec 24.$EX_F$VH_F

- Peter Brandt @PeterLBrandt –

#FACTORMEMBERS See recent Factor updates.$FTSE$FQT UK should be one of world’s strongest stock markets in 2018

2. Back to the Past or Future?

After the tantalizing jump in interest rates & steepening of the Treasury Yield Curve last week, it was back to the recent past this week. Yields along the entire Treasury curve fell this week and all segments of the curve flattened. The 30-5 curve re-flattened to 53 bps, its level of two weeks ago.

Remember Jeffrey Gundlach’s warning about the 3-year yield?

- Jeffrey GundlachVerified account @TruthGundlach – Dec 21 – Here it is! Three year UST yield banging on the door of 2%, a major pivot point from June of ‘09. Big deal if it doesn’t hold.

Last week, the 3-year yield closed at 2.01%, a bit above the dreaded 2% level. This level it disappointed again by falling to 1.97%. Where does it go in 2018? No one knows but one prophecy seems tantalizing in the reverse:

- Christopher Whalen @rcwhalen – Dec 27 – My year-end call is a rally in the 10-yr taking 2s to 10s negative by end of Q1….

Holy whatever! To get that in 3 months, you are going to need an immediately stupid Fed and a major global event that raises fears of an imminent recession. That’s why these articles are called “Interesting TACs”. Can any deny that this is a interesting tweet from Signor Whalen?

3. Gold & Copper

Remember the Gundlach rule about the correlation between the 10-year yield and the Copper-Gold ratio? So what are the smart ones saying about Gold and Copper?

- Douglas Kass @DougKass – I have consistently been adding to

$GLD all month. Gold is my favorite asset class for 2018.

Does “favorite” imply a big run?

But does “big run in 2018” preclude a short term pull back?

- Jeff York, PPT @Pivotal_Pivots – Gold

$GC_F$GLD today, is filling an open gap from 10/16 at the YHC4 Pivot. Good spot here to reduce risk.#TradethePivots@PivotalPivots.

But what about Copper? Below is an excerpt from an article titled A Deep Dive into Copper from Dragonfly Capital:

- “Then there is the price action since the 2014 break of that triangle. It has traced out an Inverse Head and Shoulders pattern. The pattern triggered in July this year as the price rose through the neckline. This pattern gives a price objective to at least 3.80 above. Momentum is quite supportive of a move higher with the RSI rising in the bullish zone and the MACD moving up and positive. Finally, look at the volume pattern since the 2009 low. It has been constantly rising and accelerated as it started this latest leg higher. Copper looks set to continue higher for some time.”

But what about the Copper/Gold ratio? With both Copper & Gold projected higher, which one will go up more? We couldn’t find anyone willing to predict that.

4. Oil

Carter Worth of CNBC Options Action recommended going & staying long energy stocks. On the other hand, DeMarkian signals say wait:

- Thomas Thornton @TommyThornton – WTI Crude Futures upside DeMark daily exhaustion signal today. Didn’t quite make it into today’s Hedge Fund Telemetry Daily Note but we’ve been expecting this.

5. Unity & Corps over Unit this weekend

It has been a long long time for the good guys to triumph during this weekend. But what a triumph have we enjoyed so far! So we adopt the code of the Marine from a Few Good Men this weekend. His code was Unit, Corps, Country. Ours has always been Michigan, Big 10, College Football.

As we write this, Big Ten is 5-0 in this Bowl season. And everyone can see that the Big Ten is now more physical and faster than the Pac-12. We found it hard to believe how Michigan State just ran over Washington State. Then came the amazing win in the Rose Bowl. Yes, it is the U with a blood feud with Michigan. But in keeping with the Corps=Big 10 code, we confess we thoroughly enjoyed the trouncing of USC in the Rose Bowl.

That’s why chose Roses in our wish to you all for a Happy New Year.

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter