Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.God or Lights Out?

Napoleon is supposed to have said “God is the on the side of the biggest battalion”. In contrast, Turkey’s boss invoked his God against the strongest & biggest battalion in today’s world – the U.S. Dollar.

In what seemed to be a quasi-maniacal speech to a big live audience, Erdogan accused the US of trying to destroy Turkey’s economy. But that speech may have worked at least for now because, reportedly, the Turkish majority does think Turkey’s problems are due to America. However, that doesn’t last very long especially if bad economic conditions bite them.

In what seemed to be a quasi-maniacal speech to a big live audience, Erdogan accused the US of trying to destroy Turkey’s economy. But that speech may have worked at least for now because, reportedly, the Turkish majority does think Turkey’s problems are due to America. However, that doesn’t last very long especially if bad economic conditions bite them.

As Larry McDonald of ACG Analytics argues in the clip below that Turkey’s huge 250 billion Dollar-Euro debt creates additional 5 billion lira of interest coverage for each 1% fall in the Lira. So he says “its lights out; there is no way the country can come out of it“. Larry also adds that IMF is unlikely to bail Turkey out and the only choices are China & Middle East.

China is already committed to bail out its “all weather” friend NonPakistan and China is helping Iran in stabilizing Iranian Rial. And, yes, China is adding a large stimulus to the Chinese economy to fight off the tariffs’ impact on China. So does China really have the financial balance sheet to bail out Erdogan from his self-inflicted disaster? And the Middle East? Aren’t the Saudis already strained? Do they want serious unrest at home like what Iran is facing from a population fed up of seeing their monies given away to Syria & Palestinians?

So who is left? How about Europe? Of course Europeans hate Erdogan, especially Merkel because of Erdogan’s threats & political campaigning within Germany. On the other hand,

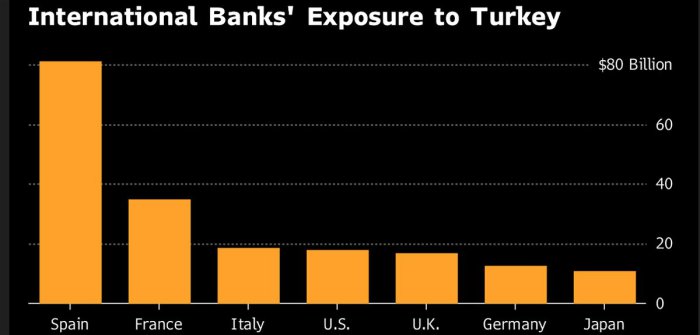

- Holger Zschaepitz @Schuldensuehner –

#Turkey matters: Lira crisis is becoming more & more of a problem for Europe. European banks drop on concern they may suffer heavy losses from Turkish exposure. Most at risk for#Spain‘s banks, but#Italy or#France have reasons to be concerned. https://www.welt.de/wirtschaft/article180930064/Krise-der-Tuerkei-wird-zum-Problem-fuer-Europa.html?wtmc=socialmedia.twitter.shared.web … via@welt

So do the markets confine themselves to Turkey or do they test Italy next as Tim Seymour of CNBC FM said? May be that is why,

- Charlie BilelloVerified account @charliebilello – Italian equities down over 3% today, hitting a 52-week low.

$EWI

One silver lining is that Erdogan is not stupid. At least he has not been stupid so far. So after his fiery appeal to his domestic audience, perhaps he will privately come to some deal to postpone the end. And Europe has done this already with Greece. So it is possible that the final washout might be delayed.

Even before that, it is likely that Erdogan comes to a deal with the Trump Administration about Pastor Brunson. If that happens soon, then we could see a rebound next week from Lira’s & Turkey’s debacle on Friday.

But if that crisis continues unabated & actually worsens, then Rick Santelli’s term “immediacy” might be relevant to this crisis. How could the Turkey crisis worsen? Quite easily, as Jim Rickards pointed out in the Daily Reckoning:

- “President Erdoğan is strong-willed but also defiant and stubborn in the face of what he regards as the infringement on Turkey’s sovereignty by the U.S. and Europe.”

- “Far from negotiating with the IMF in the event of distress, Erdoğan could easily impose capital controls, which would effectively be a default on all external debt and lock all equity investments in place with no ability to cash out for dollars. Turkish stock and bond markets would plunge at best or cease to function at worst.”

- “The situation in Turkey is uncomfortably close to the situations that arose in Thailand in 1997 and Russia in 1998 in which both countries closed their capital accounts after attracting billions of dollars in foreign loans and investment. Those Thai and Russian defaults precipitated one of the most acute and dangerous liquidity crises in world history.”

Even in the first & benign case, as Rick Santelli said in the above clip, capital deployment away from Turkey & EM in general would make the US market a beneficiary. He meant the US stock market but we wonder whether another US market might be a bigger beneficiary.

And that other market may also benefit from the decisive movement of Friday:

- Peter BrandtVerified account @PeterLBrandt –

#Eurocurrency$EURUSD has broken down against Greenback. Target is 1.1166. Long live Kind Dollar.

2. Treasury Yields

The Fed obstacle itself might be less of one thanks to Turkey & its contagion:

- Holger Zschaepitz @Schuldensuehner –

#Turkey rout knocks down odds of 2 more Fed rate hikes, BBG reports. The probability of 2 hikes (in Sep and October) drops to 54%.

No wonder the 5-year Treasury yield showed the biggest fall of 6.7 bps on Friday. In contrast, the 30-year yield only fell by 5.4 bps, a steepening of that crucial spread by 2.3 bps. This decline in yields was actually smaller than the 9 bps decline in the 10-year German Bund which is threatening to break below the 30 bps level again.

No wonder the 5-year Treasury yield showed the biggest fall of 6.7 bps on Friday. In contrast, the 30-year yield only fell by 5.4 bps, a steepening of that crucial spread by 2.3 bps. This decline in yields was actually smaller than the 9 bps decline in the 10-year German Bund which is threatening to break below the 30 bps level again.

The fall in the 10-year Treasury yield also broke a key technical level:

- Mark Newton @MarkNewtonCMT – Today’s most important development technically had less to do with US equities and more about Treasuries, the Dollar and the ongoing carnage in EM-

$TNX undercutting 2.92 is a big deal near-term– Should allow for test of this larger neckline support near 2.81-2%-

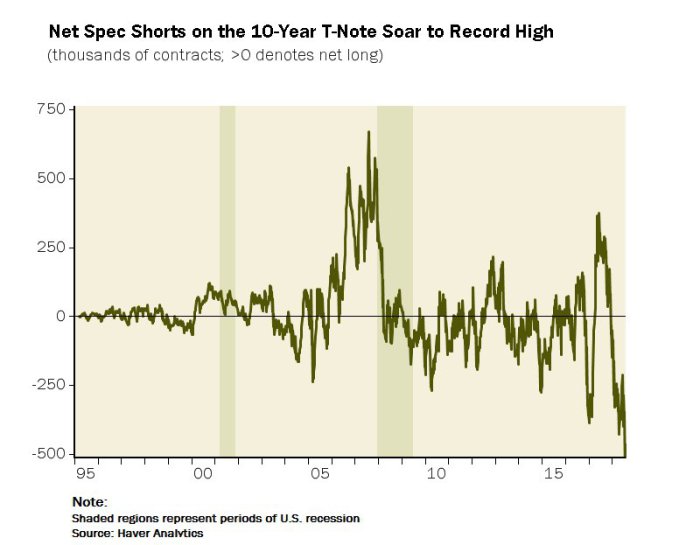

So we may get a deployment into Treasuries thanks to Turkey fright, strong Dollar & a technical breakout. But is the positioning ripe to benefit from such deployment?

- David Rosenberg @EconguyRosie – Here’s why the 10-year T-note yield can’t seem to manage to break above 3%. The sellers have already exhausted themselves! The net spec short position on CBOT futures & options have soared to a record high 572,986 contracts – doubling since the end of June.

But is a trade case really well argued without a Head & Shoulders reference?

But is a trade case really well argued without a Head & Shoulders reference?

- Raoul PalVerified account @RaoulGMI – Now the dollar is moving higher again, the next big macro theme should be this head and shoulders top in 10 year yields breaking lower, moving in the opposite direction to all time biggest short position in bonds (longs in yield). There will be blood…

The real test of this bullish case will come during a rebound rally in the S&P.

The real test of this bullish case will come during a rebound rally in the S&P.

Ever notice how Fin TV anchors often derisively ask stock managers “would you lend money to the Federal Government for 30 years (or 10 years) at 3.1% (2.9%)?“, suggesting that only stupid people would do so. The same Fin TV anchors hear professionals from BlackRock & other smart asset managers talk about the strong demand from Pension plans for long maturity Treasuries without even paying attention.

They should read this week’s article titled Why the Yield Curve is Flat & Why It May Steepen by David Kotok of Cumberland Advisors. We include a couple of excerpts below:

- By using Treasury strips … you can lock up the funding of your long-term pension liabilities. When you do, your creditworthiness according to rating agencies goes up, and your funding ratio is more secure.

- Put this all together and there are huge incentives for certain companies to buy US Treasury strips, and those companies have been doing so in increasing amounts.

- Barclays reports that US Treasury stripping activity has accelerated. Here are numbers from the US Treasury. (We present them in first-half-of-year increments so there is no seasonality distortion.) H1 2015 stripping was $1 billion; H1 2016 was $6 billion; H1 2017 was $14 billion; and H1 2018 was $26 billion. Note that the US Treasury auctions about $14 billion of 30-year bonds each month. So in the first half of this 2018 year the equivalent of about 1/3 of the newly created long bonds were stripped. For the corresponding period in the previous year that was about 1/6.

The incentives to buy Strips from the Tax Code expire on September 15. So what happens to the Yield Curve after that?

3. US Stocks

When in doubt, look at the breadth or so we have heard. So what did breadth look like during Friday’s decline?

- Joe Kunkle @OptionsHawk – Indices may be lower, but there is a roaring growth rally beneath the surface today

But is “roaring growth’ in breadth too much of a good thing?

- Thomas Thornton @TommyThornton – My view on

$SPX cumulative breadth. Previous DeMark signals were ahead of Jan-Feb -10% correction and June 3.5% pullback.

- “The S&P closed at 2840, just a big day or two from getting to a new closing high.”

Monday & Tuesday counted as one big enough day with the S&P closing at 2858 on Tuesday. But we did not get the second rightfully big day to cross into new high territory. Carter Worth described the S&P top as an “intermediate top” and said you often see a sideways or down action before the previous top is broken.

We hope he is right because no one, except the shorts, want to see a failed breakout & a confirmed double top, at least not in the August-September period.

4. Good EM

During the last several weeks, we had softly characterized countries within EM as “value” EM & “growth” EM. None of the big-name gurus who came on Fin TV & predicted EM rally to catch up with the S&P gave specific country or sector recommendations & none of the TV Anchors pressed them for such clear recommendations.

This week “value” EM crashed back to earth both in currency & stock market terms. Brazil, the anointed “value” market fell by 9.5% this week. There was serious selling in both commodity-based EM markets and in trade-affected EM markets like South Korea.

But what about EM markets that are domestic growth markets & relatively impervious to trade conflicts? One of them went to new highs this week, something the S&P has not been able to do. Just look at the year-to-date chart of this EM market index:

This is a smoother uptrend that even that of the Nasdaq 100, the star index of the US market.

This is a smoother uptrend that even that of the Nasdaq 100, the star index of the US market.

But is this breakout above 38,000 a buy? Frankly, we would love a correction to buy. But some like the Indian market right now as a play on growth picking up, banks recovering & credit growth improving. All these enable Jack Lowenstein of Morphic Asset Management to expect real sustainable growth of 8%-10% as opposed to the nominal 8-10% growth India saw over the past few years.

His call is that Non-performing loans in Indian Banks are peaking out and that, he thinks, will create a very virtuous cycle going forward. Banks ought to do very well in that environment as they start growing their asset base.

Jack Lowenstein may not like China very much but Jeff Weniger of WisdomTree sure does:

- A more realistic take on matters is that China finds itself isolated, unable to pair with Moscow in a two-country geostrategic counterbalance to the West. This forces Beijing to backtrack on intellectual property theft, inordinately high tariff levels, state subsidies and dumping, due to its weak bargaining hand.

- The pain must be offset, so Beijing gives the market that which it aches for: trillions of dollars in tax cuts at the business, product and personal income tax levels.

- Chinese equities are the play here.

- We calculate that many Chinese will see their personal income tax liability fall by half or more, effective January 1, 2019. Add to this our estimate of nearly $500 billion in value-added tax (VAT) cuts over the next decade, with still-in-the-works business tax relief on top, which would be another $132 billion to $138 billion if activity grows at a 6% to 7% pace. For perspective, Beijing’s Lehman-era $586 billion spending package, hypothesized by some to be the reason the global financial crisis ended, is smaller than 2018’s total announced tax cuts, if we calculate them over several years. This is this year’s big story.

- With many Chinese equity markets hammered this year, the S&P China 500 Index’s forward P/E multiple has fallen to 12.3, a sharp discount to the U.S. S&P 500 (P/E of 17.7). It trades for such a low multiple even though it has 16.6% of its weight in Tencent and Alibaba5, part of the FAANGs + BATs octet of market darlings.

With India at new all time highs & potentially China rallying ahead, the EM story isn’t quite dead, is it? But a nice correction is devoutly wished, at least by those who want to buy.

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter