Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Come September

What a month was August! Actually the way it ended was so awesome. We mean the last 30 minutes of August 31 which featured a sharp rally from about 3:30 pm into after hours – a rally of more than 10 S&P handles first on news that Canada-US will continue talks into next week and then Chrystia Freeland’s soothing press party at 4:30 pm.

Not only did the S&P rallied after hours but so did small caps & QQQ. Speaking of QQQ, didn’t August give us the most madcap affair we have seen in 18 years, a kind of coming of September at the Riviera?

Unfortunately, that romance was not real because reportedly Rock Hudson did not prefer the Gina Lollobrigida gender in real life. That makes us wonder whether Chrystia Freeland & Bob Lightheizer don’t get along all that well or, more importantly, their principals have mutually conflicting imperatives.

No. The imperatives are not the sun, the sand or the sea that the Riviera offers. The imperative is milk powder. 13,000 farmers in Canada prefer their dairy subsidies and don’t want American milk powder to take away their prosperity while 78,000 farmers in Wisconsin want to sell milk powder to Canadians & so demand removal of huge Canadian tariffs on American milk powder. It is not the size of the powder but the political impact of the powder as Kevin O’Leary explained on Friday afternoon:

Hopefully he is proven wrong & the markets will end up dancing the way Rock Hudson danced with Gina Lollobrigida in Come September.

Unfortunately, there could be a bigger hurdle that was discussed by Paul Richards of Medley Global Advisors two weeks ago. That hurdle is the implementation of tariffs on $200 billion Chinese exports:

- “that day could be the start of something hell of a lot worse or significantly better; but the outcome, in my opinion, is going to be binary“. He added “market is saying we have had enough” about trade stuff and “market is going to have very serious trouble” if some kind of arrangement is not struck.

Look at the Thursday afternoon section of the SPY chart above. The S&P fell hard at around 2:20 pm when news broke about President Trump’s intention to implement the tariffs on China early next week. We will find out if Richards is right. That is assuming President Trump doesn’t postpone the tariffs in favor of more negotiations.

As Kevin O’Leary explained on Friday afternoon, most investors are not willing to sell this strong rally because the risk of missing out on the big upside they expect once US-China come to some deal. That makes perfect sense assuming both China & US want a deal. We are increasingly concerned that China believes the trade dispute is just a part of the drive by US to stop China from being a strategic competitor. And that makes China less interested in making concessions at this stage.

So we have moved from Canada in North America to China in Asia. How about making a turn and jumping to Europe by skipping over the Middle East for a minute? We are not speaking about little issues like EU-US disagreement about tariffs on automobiles. There is something bigger at stake, like the Future of EU.

- Lawrence McDonald @Convertbond – Italy vs. German 10-year bond yield spread is NOW through the Memorial day weekend wides, what a way to end the summer.

#Eurozone#CreditRisk https://www.thebeartrapsreport.com/blog/2018/08/31/summer-of-2018-in-italy/ …

Yes, but what is the potential trigger? Italy will present its budget in September. And EU’s fear is that Italy could spend the way Greece did a few years ago. As Geopolitical Futures wrote this week:

Yes, but what is the potential trigger? Italy will present its budget in September. And EU’s fear is that Italy could spend the way Greece did a few years ago. As Geopolitical Futures wrote this week:

- “The EU’s biggest fear of late has been that if Italy goes the way of Greece, it won’t be too big to fail – it’ll be too big to save. … As of June 2018, Italy had a negative balance of 481 billion euros, 21 percent more than the next largest negative balance (which belongs to Spain). Germany, on the other hand, sports a positive balance of 976 billion euros, almost 30 percent of Germany’s GDP. No other country is even close to Germany in this regard. That is why even the threat of an Italian default sends the coldest shivers down Germany’s spine.”

So how does Geopolitical Futures see the options?

- It is not a stretch to say, then, that the next chapter in the EU’s history has begun. … If Italy takes a hard line and its government can survive the resulting faceoff with the EU, it will put Brussels in a difficult position, one that could undermine the very fabric of the EU itself. … In the meantime, Brussels must decide just how tough it means to get with Italy. If the EU gives in, its authority may be weakened. But if it tries to treat Italy the way it did Greece, there might not be much of an EU left to govern. It is those impending negotiations – not Brexit, or any others – that will shape the EU’s immediate future.

What might happen to EU’s banks if the Italy situation blows up?

- Raoul PalVerified account @RaoulGMI – Maybe I’m biased from being in Spain over the EU crisis, but I still fear that most of the banks are destined for zero. This is BBVA, I could have chosen Santander, Bankia, Sabadell, etc. All look bad on long-term charts…

Finally, let us go back to the area we skipped – the Middle East. Specifically we mean Idlib province of Syria & the planned offensive that may involve Syria, Russia, Turkey, USA, all of whom want to eliminate Hayat Tahrir al-Sham (HTS), the Al-Qaida affiliated group that controls much of Idlib. All of these players are working on a deal to achieve the removal of HTS.

But what happens after HTS is eradicated? Therein lies the problem for the deal. Syria & Turkey have opposite views but could possibly come to terms. Russia & US could possibly agree on an outcome as well but the relations between Russia & USA are at their most unpleasant stage. NSC adviser John Bolton has already warned about severe retaliation against Assad if chemical weapons are used and Russia has already warned that any chemical attack is likely to be the work of HTS which wants the various countries to quarrel with each other instead of fighting HTS.

This is sort of like the milk powder issue between Canada & USA. Idlib like milk powder is of very little strategic importance at this stage but the broader conflicts between Turkey & Syria or Russia & America could collide in Idlib which has over 2.5 million civilians. But, despite all this, the markets may not care much about what happens in Idlib unless things get out of hand.

And right smack in the middle of September is the FOMC meeting on September 26 with a rate hike of 25 basis points baked in. Any change in that or any unanticipated language from Chairman Powell could be another issue.

Of course, all these issues could come and go without any market impact as issues have since February. In that case, we could see 3,000 on the S&P in September. And if Chairman Powell once again surprises on the dovish side, then 3100 could be within reach before they start scaring us about the perils of October.

2. Treasuries & Credit

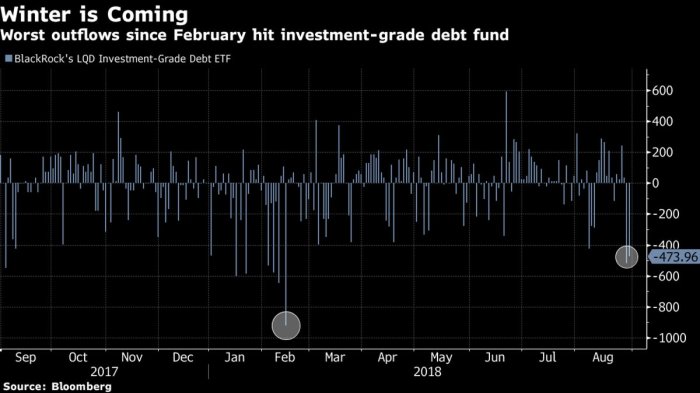

Ford was downgraded this week to a grade just above junk. Perhaps because of it or perhaps because of the stress in the investment grade credit space, the 3rd biggest bond ETF in the world took a big hit:

- Jesse Felder @jessefelder – BlackRock’s Investment Grade Corporate Bond ETF has lost $994 million over the last two days, the most since February’s vol-pocalypse. https://www.bloomberg.com/news/articles/2018-08-31/nearly-1-billion-flees-third-largest-debt-etf-as-caution-rules … ht

@trevornoren

Since the yield curve is now topic du jour, why not listen to two smart bond guys discussing it?

Well, the yield curve actually steepened a bit this week as it usually does when the Fed seems dovish in its commentary as Powell did a week ago Friday. The 30-5 spread steepened by 3 bps & the 10-2 spread steepened by 4 bps. The 30-year yield rose by 5 bps on the week past 3% and the 10-year yield rose by 5 bps despite the German 10-year yield falling by 1.5 bps.

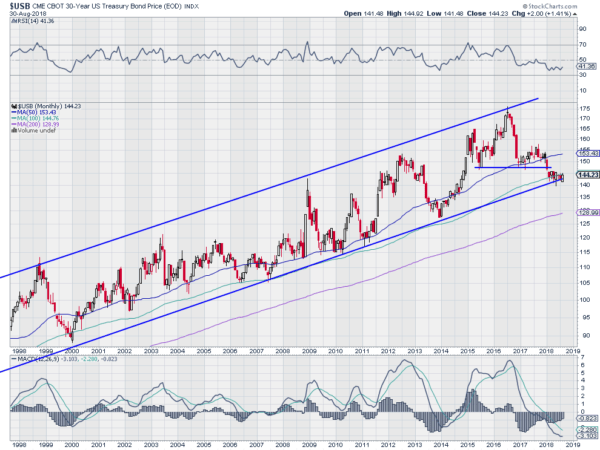

Remember Greg Harmon of DragonFly Capital warning a few weeks ago that TLT was hitting resistance from below. He proved right and TLT fell from that resistance. This Friday, he raised another picture:

- Greg Harmon, CMTVerified account @harmongreg – Dragonfly Capital – Bonds Hanging on by the Fingertips https://tmblr.co/Zjsg5q2bOt6U7

$TLT

He wrote:

- The price action shows that they have been consolidating at support for 7 months. This is happening at the bottom of a 30 year long rising channel and the 100 month SMA. Both have been key spots where reversals in price have occurred.

- Momentum remains weak with the RSI cruising along sideways in the bearish zone and the MACD falling and negative. The RSI is not gonna give you a reason to watch. But the MACD is getting to extreme low levels and is starting to flatten. Too early to buy Bonds but it does suggest you start watching. Of course Bonds could just keep moving sideways befuddling everyone. A move back over 147 would suggest a reversal. A break under 140 that continuation to the downside has begun.

3. US Stocks

- J.C. Parets @allstarcharts – I’m exhausted from seeing all of those demark upside exhaustions the past few months ?

That’s the kind of week it was until Thursday afternoon when President Trump’s intention to implement tariffs on $200B Chinese exports hit the tape. We ourselves have scoffed at DeMark indicators during QE days. Our point was simple – when Fed adding liquidity is the big force in markets, even proven technical indicators don’t work on the downside. We started following downside DeMark indicators when Fed switched from QE to QT. We think this past week was pushed both by Chairman Powell’s dovish speech on Friday, August 24 and positive trade events. Both of these tend to overwhelm indicators that often work during normal markets.

Having said that, is there an update?

- Thomas Thornton @TommyThornton – The potential for a risk off trade with US equities into US 10 year is quite strong right now. Besides the upside DeMark exhaustion signals on equity indexes there is a downside Countdown on 10 year yields

Last week, we discussed the possibility of 2018 being another 1994. To our surprise, Tom McClellan wrote about his own comparison between 2018 & 1994 in his article Deja Voodoo 1994 Edition:

- the stock market’s response in each period is greatly similar. … In August 1994, the SP500 did not make a higher high than its Feb. 2, 1994 price high, but the resemblance of the price pattern to the current pattern is unmistakable. There was an initial down move in February 1994, followed by a minicrash to a bottom April 4, 1994. In the current rerun, the final bottom was on April 2, 2018. Close enough for government work.

- August 1994 was a strong month for the SP500. It was not strong enough to produce a higher closing high than Feb. 1994, but it was still a robust swoop upward that pulled in a lot of investors.

- August 2018 has been a strong month for the SP500, seeing it eke out a slightly higher closing high for that index, but not for the DJIA nor the NYSE Composite. We are now at the equivalent point to the Aug. 30, 1994 peak which led to a 3-wave decline to a December 1994 low.

- Nothing says that the stock market in 2018 has to continue following this pattern. But then nothing had said it would do such a good job following that pattern up until now. If the pattern resemblance continues, then we are in for a rough and choppy 3 months, and then a really robust rally into 2019. If…

4. Dollar & EM

After a decline of 1% the week before, the U.S. Dollar was unchanged this past week.

- Raoul PalVerified account @RaoulGMI I do think the spread between

$EM vs DXY interesting. Last time we saw a gap like this, the DXY rallied very sharply. (Chat shows JPM EM FX Index inverted, for clarity).

That should be terrible for EM FX. Could it be the final capitulation? Yes, if the FOMC is generally done or close to being done. And then?

- Deepesh Parwal @maverickgold7 – Interesting observation on Emerging market equities in last rate hike cycle. As fed near or was done with its hike cycle, MSCI emerging markets almost doubled. @agurevich23

5. Weird EM market

The debacle in EM currencies has hit the Indian Rupee as hard as or even harder than other Asian currencies. On Friday, the Rupee hit a new low of 71. Most markets with currency declines are showing negative impact on their economies.

That makes India weird. Because on Friday, India’s Q2 GDP came in at 8.2% growth year/year vs. consensus expectations of 7.6-7.7% growth. How can a falling currency coexist with record GDP growth? First, the Rupee had become overvalued compared to other Asian currencies. So this decline is kinda par for the EM Asia course. Secondly the Rupee is affected by the rise in current account deficit which is principally driven by the price of oil, India’s greatest import. Third, the Rupee is also being affected by expectations of higher fiscal stimulus by the Modi Government ahead of the May 2019 elections.

Unlike in many other countries, fiscal stimulus in India, especially in pre-election months, consists of direct & indirect monies delivered to poor & very low middle class, the most reliable voting bloc in India. Since Indians of all income levels are dedicated spenders, the fiscal stimulus tends to increase consumption & GDP.

Add to that the proven tenet that stock market in local currency rises to balance the fall in the currency value. So the fall in the Rupee combined with rising consumption & increasing GDP is potentially creating a virtuous circle for the Indian stock market. No wonder the Reserve Bank of India is willing to let the Rupee fall to 80 before launching major initiatives to support the Rupee.

But not everything is rosy. The biggest problem is a potential rupture in the US-India strategic defense partnership. India is about to conclude purchase of the S-400 missile defense system from Russia. President Trump has threatened sanctions on India if India goes ahead with the purchase. India & Indians unanimously believe this is stupid and an intolerable diktat.

This is similar to draconian sanctions imposed by President Clinton in 1998 after India conducted nuclear tests. Since then, India has not purchased US fighter planes or any system wide technology from US. The 2018 sanctions from President Trump will have far worse and longer term effect on US-India arms relationship. That is why Secretary of Defense Mattis is campaigning hard to provide a sanctions waiver to India. Both he & Secretary of State Pompeo are scheduled to fly to India for a planned meeting with their Indian counterparts on September 6.

The other negative is urban voter discontent. Faced with massive rural plans, day to day urban infrastructure needs are being ignored as the tweet below points out:

- Uday Tharar @udaytharar – Tax payers money being used to create records like these! All the talk about increasing tax collections and this is what the tax payer gets. Shameful

Having said all this, we do think the Indian economy is about to enter a virtuous circle of higher bank credit growth, increased consumer incomes, rising consumption & a higher GDP growth rate. If we could a decent correction in the Indian market, it would be swell.

Finally getting back to the Come September theme, look at the very short clip below. Is there a reverse Rock Hudson angle in this adaptation of the Come September theme?

https://www.youtube.com/watch?v=RuDaSgCwlmo

6. Sad or Funny?

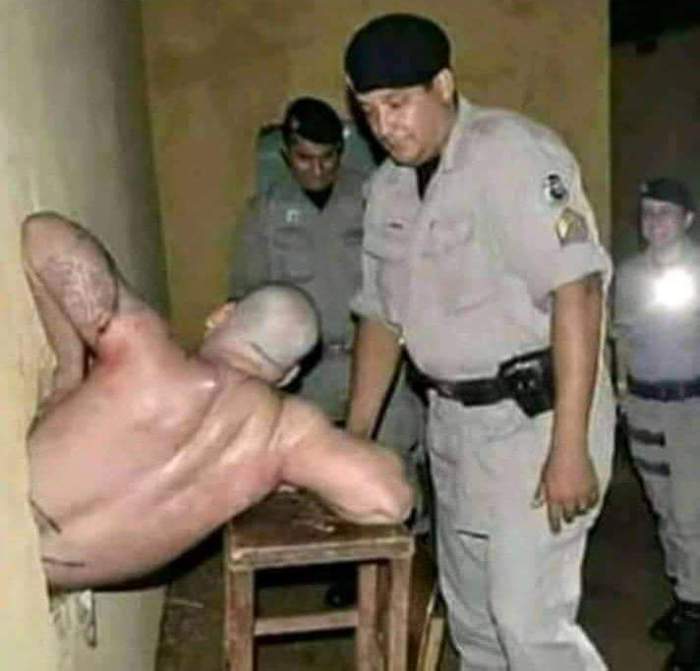

- Omaram_ @Omaram41333816 – Aug 27 – Anytime you feel life isn’t nice, remember this Brazilian prisoner who dug an escape tunnel for 5 years only to burst out in a Guard Room.

Thanks to Igor Schatz (@Copernicus2013) for retweeting this.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter