Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Non-event itself an event

Last week, we ended with,

- After all of the above, wouldn’t it be ironic if China doesn’t retaliate and we see a rally come Monday morning that lasts into Options Expiration next Friday? After all, events not resulting in a risk is also a type of Event Risk, right?

The US stock market did open & trade up 123 points on Monday. But the rally did not hold until first China said they were going to WTO (meaning not retaliating) and then news about Secretary Mnuchin hinting at new talks hit the tape. Then on Friday, the market dropped a quick 100 points on a vague statement that President Trump wants his staff to go ahead with tariffs on $200B of Chinese goods. But the drop was made up quickly and the S&P closed up 1.1% on the week with NDX up 1.6%.

None of the other events discussed last week progressed. So it was a fairly uneventful week in summary. Hence bullish.

The FOMC event is another week & half away. Idlib is still a real possibility but neither side seems to be in a hurry to begin something. EM risk actually dropped a bit. So it came down to the China tariffs. That brings us to David Tepper & his trademarked “don’t overthink” message.

- Tepper said the tariff issue is tricky; the stock market is fairly valued assuming no tariffs. If tariffs are imposed, then you could see a correction, the Dollar would rise and earnings would get hurt. If the markets hears a no tariffs message then there could be a 5% or so rally. Given the binary tricky nature, he is about 25% exposed to S&P but could ratchet it up fast as needed.

So what is the probability that the market hears a definitive no tariffs message? Not very high, in our opinion. That would be kinda waving a tiny white flag at least for now and we don’t think that is in President Trump’s nature, certainly not into the midterms. But if talks resume with China, then the markets could heave a sigh of temporary & tentative relief and rally some.

If David Tepper doesn’t have anything to add to this, then we certainly don’t. That brings us to Jeffrey Gundlach and the Dollar. But before that, a quick tweet:

- Urban Carmel @ukarlewitz – Equity only put/call = 0.5 today. Last 2 times in mid-May and mid-June. Consolidation or gains given back. Chart in this thread

$SPX

2. Jeffrey Gundlach & Dollar

In his conference call on Tuesday, Gundlach reportedly said – “global economic growth was slowing and the next big move in the dollar will be down“. The Dollar long trade is crowded and may remain so until we see some daylight on tariffs. On the other hand, a Dollar bull sounded doubtful this week:

- Raoul PalVerified account @RaoulGMI – Sep 12 – The DXY is either a Head and Shoulders top, signally a deeper pullback, or its a wedge… we will know pretty soon. Dollar does feel a bit tired here…

A down move in the Dollar will benefit commodities. Mat be that is why one observer sees the possibility a bullish move in Copper:

- Ryan Detrick, CMT @RyanDetrick Potential bullish engulfing pattern on copper taking place near support?

The pressures on EM did begin with reduced liquidity created by the strong up move in the Dollar. So even a small respite could create a tail wind for Emerging Markets.

But Rob Citrone of Discovery Capital Management doesn’t agree, as he told CNBC’s Scott Wapner on Thursday (see section 3 below).

3. Emerging Markets – Re-Emerging or Re-Submerging?

LpL Research took a bold stand this week:

- HORANCapitalAdvisors @HORANCapitalAdv “EM could be an intriguing contrarian idea given that the bearish sentiment appears to be approaching extreme levels….we believe most of the fears surrounding EM will pass fairly soon.” https://lpl-research.com/~rss/LPL_RSS_Feeds_Publications/WMC/Weekly_Market_Commentary_09102018.pdf … h/t:

@RyanDetrick

But some chartists say not yet:

- Jeff York, PPT @Pivotal_Pivots

$EEM so far this week, fell to the Ws2 pivot point. When that happens, price comes back to the WP 80% of the time. This is not a long term bottom! I have NEVER seen a long term bottom on a weekly pivot, Long term bottoms happen on the Yearly Pivot Points@PivotalPivots.

What about a fundamental macro view? Rob Citrone of Discovery Capital was very direct in his conversation with Scott Wapner of CNBC:

- “We think tariffs are coming and the Dollar will see a rally.” He added he doesn’t believe in this EM rally. He says we will get contagion of Europe has problems. He is net short and short the rest of the world against his two longs – USA & India. He sees a “bull market in India for a long long time.”

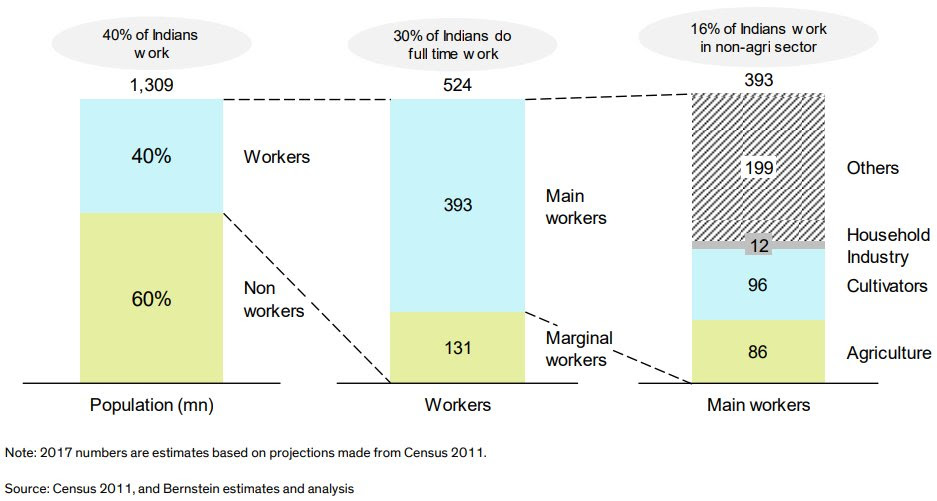

He added that Indian investors are very overweight real estate & gold and underweight stocks. He expects capital to flow from overweights in real estate & gold into stocks. He is right. Our own opinion is that India is like America was in 1982 with a young generation coming into employment at a time when banks are recovering from their NPL problems & GDP growth is accelerating. The scale of labor slack is huge:

- Uday Tharar @udaytharar – Did you know? Only 40% of Indians work Only 30% of Indians do full time work Only 16% of Indians work in non-agri sector

This is, of course, a double-edged sword. Hence the fiscal stimulus focus of Prime Minister Modi and that too in the rural sector.

This is, of course, a double-edged sword. Hence the fiscal stimulus focus of Prime Minister Modi and that too in the rural sector.

Being long the US market vs. the rest of the world is one thing. The US stock market is somewhat protected by King Dollar. But being also long India vs. the rest of the world requires conviction & courage. Because a further or final fall in the Rupee can hurt the Indian stock market as it did this week.

Unfortunately, CNBC’s Wapner did not seem focused or even seriously interested in what Citrone was saying. He didn’t ask any real questions. Instead, Wapner merely used Citrone as a filler for the time remaining after David Tepper had left. Furthermore, Wapner did not even care to put Citrone’s interview in a videoclip on CNBC website. We don’t really understand why. Wonder if Scott Wapner cares to elaborate?

4. Treasury Rates & Corporate Credit

What began on NonFarm Payroll Friday September 7, continued this week with yields rising along the Treasury curve. One aspect actually accelerated this week – flattening of the yield curve. Partly because of lower inflation data & partly because of investor demand, the 30-year yield only rose by 2.7 bps while the 2-year yield rose up by 7.5 bps & the 5-year yield by 8.3 bps, thereby flattening the 30-5 curve by 6 bps on the week. The 10-2 year curve flattened to 21 bps. Those who are waiting to see an inversion takes place, should look at a cousin of Treasuries – TIPs:

- (((The Daily Shot))) @SoberLook – Chart: The TIPS curve (inflation-adjusted Treasury curve) has inverted –

So while the 10-5 year Treasury curve is still + ve at 9 bps, its TIPs equivalent has already inverted. So what will Chairman Powell do on September 26? A big decision we think. That is why it ranks foremost as an event risk for all markets.

So while the 10-5 year Treasury curve is still + ve at 9 bps, its TIPs equivalent has already inverted. So what will Chairman Powell do on September 26? A big decision we think. That is why it ranks foremost as an event risk for all markets.

Inversion in yield curves don’t spell happiness for corporate credit. In fact, they seem to signal the opposite. That is why liquidity is deemed so important. But how do you get liquidity when bonds don’t even trade. FT Alphaville quotes Anindya (what a name?) Basu from Citi:

- “we find that on average, only 18% of the entire corporate bond universe (by CUSIP) traded on any given day. For issues that traded 5 times or more on a given day, the percentage was in the single digits at about 8% … Furthermore, most of these CUSIPs trade in small size – more than 75% of the total volume traded during this period can be attributed to only 15% of the CUSIPs.”

This raises the age old question from principal market makers – Sell? To Whom? That may be why the Citi piece suggests that:

- “investors wishing to prepare for a sustained sell-off in corporate credit act sooner rather than later”. Options include reducing core bond holdings, or using derivatives to reduce exposure to swings in credit markets. However, Basu does conclude with a warning: “sustained outflows remain a big risk, and no amount of hedging can compensate for that.”

Remember Basu’s name is A-Nindya or one who is NOT nindya or insultable/defamable. And an uninsultable analyst cannot really be dismissed, right?

To us, an accident that creates a sell off in corporate credit is the scariest event risk because that will immediately bring to mind contagion either of the 2007-2008 kind or the 1998 kind. We would not wish either even on our worst enemy, presuming we can find one.

Something like that or even something smaller can bring about what Jeff Gundlach warned this week:

- “If something happens that is a catalyst for starting to get a rally going in bond prices and a decline in the 10-year (Treasury) yield, you could just imagine what kind of a stampede there would have to be to cover the shorts, … That might be the way you get to 2.25 percent, if it ever happens. Of course, that would be at the long end. My suspicion is that the short end would be higher at that point … we would get an inverted curve.”

Well, if the TIPS are already there, can nominal Treasuries be far behind? About 9 basis points right now.

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter