Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”we lost the moon“

That was Steve Liesman’s reaction to the stunning 20,000 jobs added number in Friday’s Non-Farm Payroll Report. Perhaps he meant to sing “I’ve lost the moon While trying to count the dots“, dots meaning predictions of rate tightening by FOMC members. (forgive our liberties of replacing stars by dots). Why?

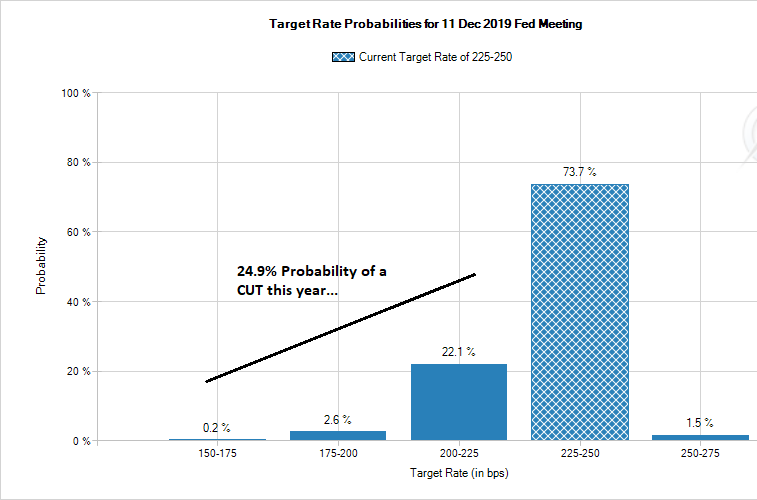

- Charlie BilelloVerified account@charliebilello – After weak payroll report, market now pricing in a 25% probability of a Fed Rate CUT this year…

If you think this is crazy, read the following:

If you think this is crazy, read the following:

- Bob Lang @aztecs99 – don’t look now…but there is tiny tiny bet on THREE rate cuts by Jan 2020!

Was this all merely the impact of one component of one NFP number or was it the cumulative effect of a series of shocks? First could be the worst from a US consumer point of view:

- Babak @TN – US Household wealth fell by $3.73T to $104.3T, the largest nominal dollar drop since Q4 2008 – decline was caused by stock market decline wiping out -$4.57T of wealth (which has been mostly recovered as quickly as it was lost) https://www.federalreserve.

gov/releases/z1/dataviz/z1/ changes_in_net_worth/chart/ …

It might have been recovered in the year to date rally but is the mindset as sanguine as it was in September 2018? We doubt it. Very few consumers have forgotten the precipitous fall in the stock market from October to December 2018. They have no real idea why that fall happened. So when they see a massive rally, do they feel reassured or do they feel another fall could happen any time? Does this fear explain the below?

It might have been recovered in the year to date rally but is the mindset as sanguine as it was in September 2018? We doubt it. Very few consumers have forgotten the precipitous fall in the stock market from October to December 2018. They have no real idea why that fall happened. So when they see a massive rally, do they feel reassured or do they feel another fall could happen any time? Does this fear explain the below?

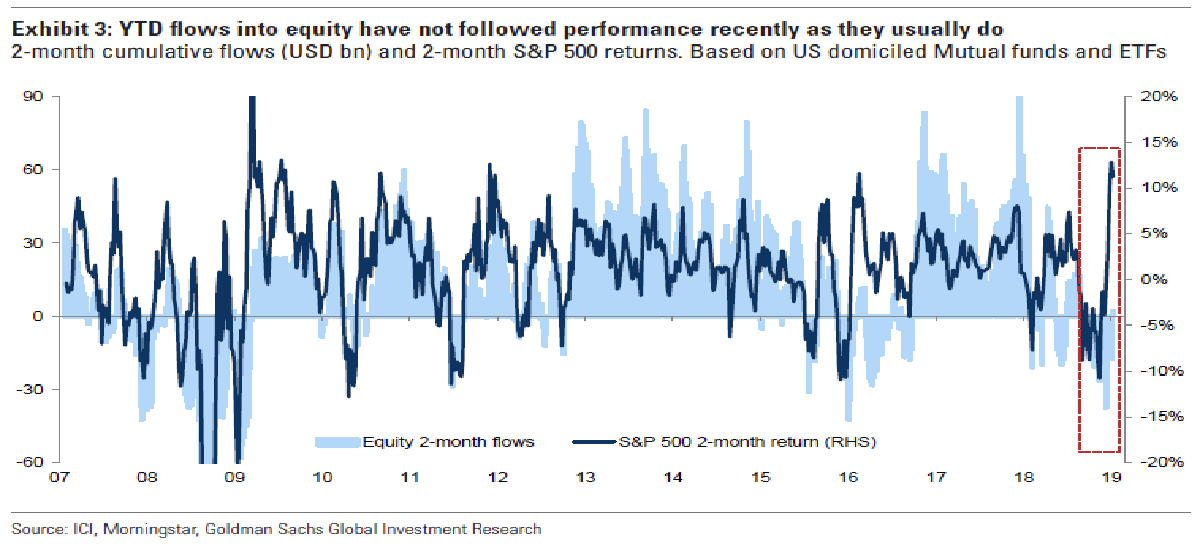

- Babak @TN Latest installment in the continuing saga of “Who the hell is buying?”: we’re seeing the widest gap, since 2009, between equity performance and equity fund flows https://www.bloomberg.com/

news/articles/2019-03-05/ goldman-sees-crisis-echo-in- big-stock-rally-bereft-of- buyers …

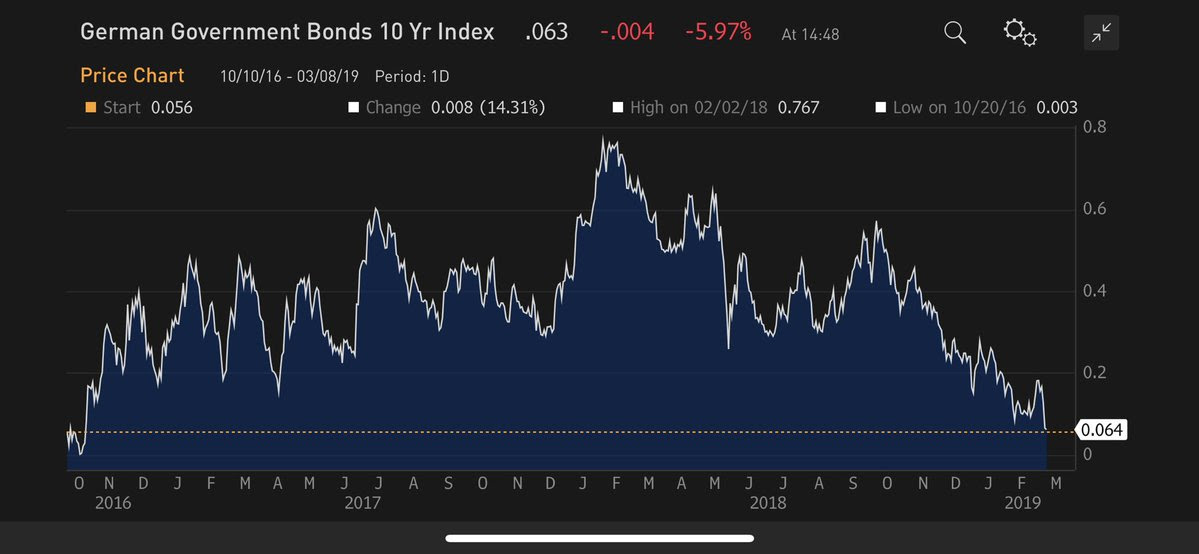

Then the data from China that showed a big drop in both imports by China of U.S. goods and a big fall in Chinese exports to the U.S. If that wasn’t enough, Draghi stunned the world by getting awfully negative on European growth prospects on Thursday leading to a 1-day fall of 1% in the Euro vs. the Dollar. Guess what that did to the 10-year German Bund rate:

- jeroen bloklandVerified account @jsblokland – German 10-year bond #yield down to 0.06%, lowest level since October 2016!

What did David Rosenberg have to say about the NFP report?

- David Rosenberg @EconguyRosie – The Household survey did show a 255k pop but that only offset the 251k plunge in January. So netting out the government shutdown effect, Household employment growth is flat so far this year.

How does it relate to the action in the stock market?

- David Rosenberg @EconguyRosie – For the first time in seven months, the pace of job creation in the cyclically-sensitive US transportation services industry stalled out. At least we know that the steep correction in this part of the stock market isn’t exactly devoid of deteriorating macro conditions.

But all this is based on today’s data. What if tomorrow’s unemployment numbers turn for the worse? Isn’t that pure supposition? Or is there any one suggesting that?

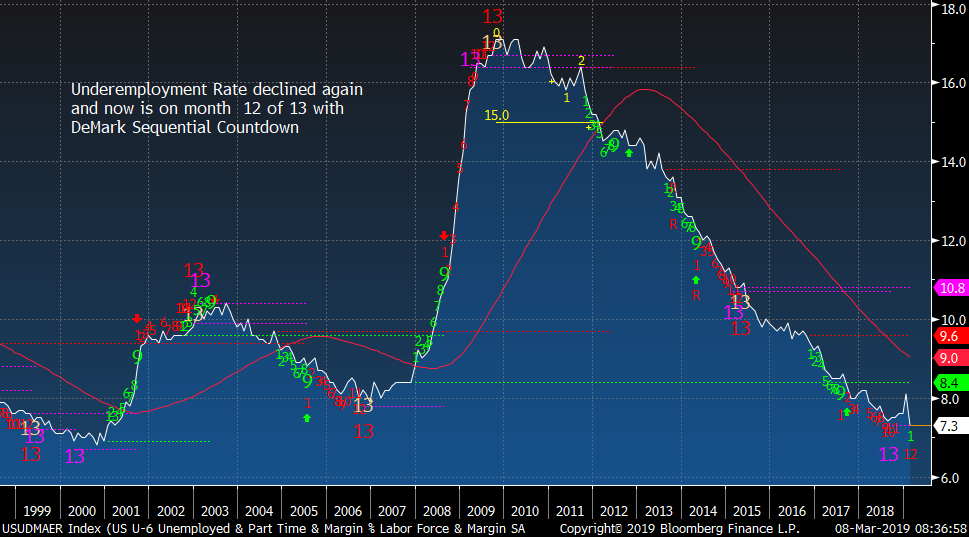

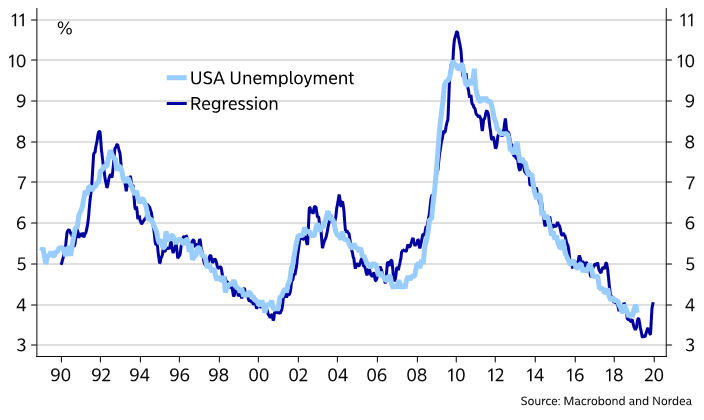

- Thomas Thornton @TommyThornton – US Unemployment Rate and Underemployment Rate monthly DeMark downside Sequential Countdown issues. Guess what happens next?

He is not alone.

- Mikael Sarwe @MikaelSarwe –

For the first time in many many years, my leading unemployment indicator has started to point north. Times they are a-changin’

For the first time in many many years, my leading unemployment indicator has started to point north. Times they are a-changin’

With “Southeast Asia is headed for a recession in 2019. Europe is headed for a recession in 2019” what happens to US interest rates? Kyle Bass, the noted hedge fund manager told Brian Sullivan of CNBC:

With “Southeast Asia is headed for a recession in 2019. Europe is headed for a recession in 2019” what happens to US interest rates? Kyle Bass, the noted hedge fund manager told Brian Sullivan of CNBC:

- “U.S. rates head back to Zero by 2020; we own a lot of Bonds“.

If you think zero% rates are nuts, read what Fed’s Williams said on Wednesday:

- Jennifer AblanVerified account @jennablan – FED’S WILLIAMS SAYS IN A DOWNTURN WE COULD CONSIDER QUANTITATIVE EASING, NEGATIVE RATES

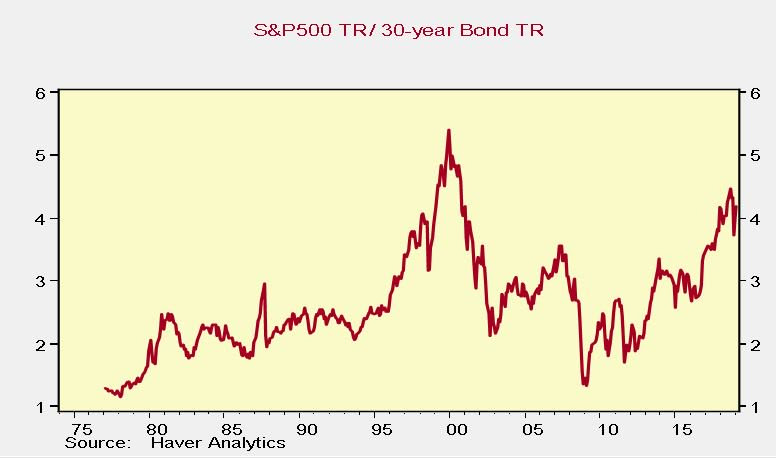

What might all that do to the 40 year stock-bond relative return?

- Sri Thiruvadanthai @teasri – Take a look at the total return on S&P vs 30 year bond. In the next recession, would it be a surprise to see this ratio come back below 2? So, after 40 years, stocks would have gone nowhere relative. So much for long run.

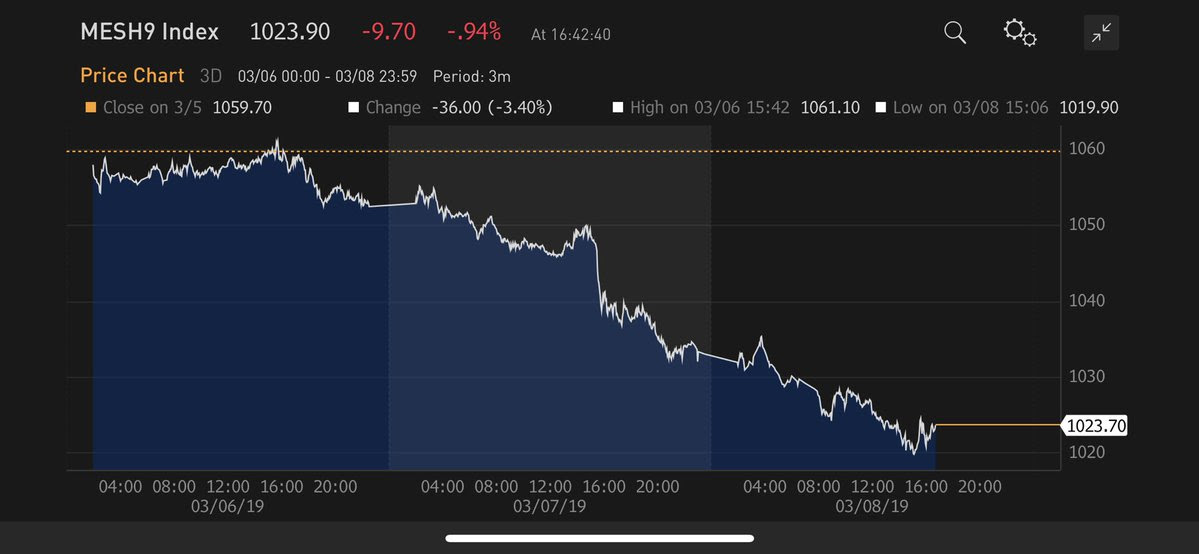

No wonder Treasury rates fell hard this week:

- 30-year rate fell by 12 bps; 10-yr rate fell by 14 bps; 7-year fell by 15 bps; 5-year by 14 bps; 3-year by 10 bps & 2-year by 9 bps.

The entire 1-5 yr curve is now inverted and the 7-year fell to the same rate as 1-yr at 2.52%.

But haven’t we seen a big drop in rates on a Friday get reversed the following week? And note that the 10-year yield only fell marginally on Friday & bounced off of the critical support level of 2.60%. So is Anne Mathias, global rates & FX strategist at Vanguard, correct when she says “Fed should feel good about this jobs report” and Subadra Rajappa, head of US rates at SocGen, right when she says “bonds are overbought here” and that she is short Bonds? Listen to them yourselves:

Now listen to David Rosenberg arguing the recession ahead case and a topping process for stocks:

2. Stocks

It was a bad week with Dow, S&P 500 & the Nasdaq down 2%-2.5% and the Russell 2000 down 4.3%. The Dow Transports were down another 3% making it the 11th consecutive down day. But is all this suggesting an oversold market?

- Igor Schatz @Copernicus2013 – Thu Mar 7 – We probably seen the highs in $VIX short term.. it got to 8 above 30day realized with a relatively tame sell off in $ES.. stocks will probably stage a bounce here given oversold $NYMO and test of 200dma

Carter Worth of CNBC Options Action says the S&P will at least touch 2600 and possibly retest the 2300 level. In fact, he said going to 2300 is “the best bet we can make“.

What about emerging markets? The Shanghai ETFs were down 4%-5% and FXI, the Hong Kong ETF, was down 3% on the week, both worse than S&P 500 & Dow.

- jeroen bloklandVerified account @jsblokland – Pretty rough ride for emerging market equities the last few days. Down 3.5% during the last 3 trading days.

One Emerging Market was an exception to the above carnage, a market that has been among the worst performers within EM. Look at the year-to-date chart below of INDY, India’s Nifty index, relative to the S&P 500.

This week proved different. INDY was up 2.8% vs. S&P down 2.2%.

Was it because of the euphoria about finally taking down a Jaish-e-Mohammed terrorist camp or was it because the bold air force strike made PM Modi’s election chances much brighter? We will find out soon.

3. Dollar & Gold

Given what Draghi did to the Euro, how can the U.S. Dollar go anywhere but up? And $DXY broke above the big 97 level. On the other hand,

- Jeff York, PPT @Pivotal_Pivots $DXY $USD is testing resistance at the Fibonacci Yearly R1 Pivot Point. Computer algorithms are programmed to buy & sell @ Pivot Points.

The Dollar was up 90 bps this week. Despite that, Gold closed up 64 bps to $1,300 & Silver closed up 1.25. The miners, GDX & GDXJ were up 2.5%. Is this Gold rally for real or will it fade next week?

The Dollar was up 90 bps this week. Despite that, Gold closed up 64 bps to $1,300 & Silver closed up 1.25. The miners, GDX & GDXJ were up 2.5%. Is this Gold rally for real or will it fade next week?

Next week should be quite interesting.

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter