Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Week that giveth back – Big Buyers done?

Two weeks ago, MS QDS (via Market Ear) argued for a “15% to 20% counter-trend rally over March month-end”. We got it. Then last week we learned from this duo that

- “What stands out has been the “lack of follow through from active accounts” – making you wonder “where the next source of significant demand comes from once Pensions have rebalanced. ”

Once again, they proved correct at least for last week.

Monday, the day before quarter end, was a big up day. Almost everything we like to see the markets showed on Monday. Stocks up big, Treasury yields down, credit up, leveraged bond CEFs (closed end funds) outperformed unleveraged funds. Tuesday gave back some of this.

But Wednesday was brutal. During the last 11 years, the first day of a month was always up as people added to their 401Ks & reallocated to stocks. This Wednesday seemed just the reverse. Dow fell by 973 points, S&P fell by 114 handles, NDX fell by 327; Treasury yields went down hard & Treasury ETFs were up 2% while high yield ETFs & Munis fell by 2.5%. And yes, leveraged CEFs fell far worse than their bond ETF counterparts. A “very decisive 90% down day“, as Lawrence McMillan of Option Strategist called it.

Frankly, Wednesday April 1 was the signature day of the past week. And the week ended the same way. Dow down 584 points (2.7%), S&P down 2% & notably IWM, small cap ETF, down by 7%. Treasury yields fell a few bps on the week but High yield funds fell by 4.5% & Munis fell by 3%.

Look what Lawrence McMillan wrote in his Friday summary:

- “For the record, both breadth oscillators are still on sell signals after a terrible day on Wednesday, which was a very decisive “90% down day.” … It’s not only breadth and volatility that are displaying characteristics that haven’t been seen since 2011 or 2008. This does mark the end of the “buy the dips” and “TINA” era that had dominated market thinking, really since 2009 and certainly since 2011. This is a true bear market, plain and simple. Hence, a “core” bearish position is warranted — certainly as long as $SPX remains below 2730. Hence, while buy signals can be traded, we are continuing to be cautious. “

2. The Big Risk Factor – Fed’s failure?

So was last week just a counter-trend move in the Dollar?

The semi-parabolic move in the Dollar is such a sign of fear-based liquidation. The reversal of 50% of this March move in the last week of March seemed such a good sign, especially when combined with Fed establishing swap lines with just about every foreign central bank.

But the Dollar rallied by 2.5% this past week. This is just poison for the global economy, as Larry McDonald of Bear Traps Report pointed out on Friday afternoon:

- “There’s $13T of dollar-denominated debt in the emerging market space. A 10% move higher in the US dollar adds $1.3T to that debt load.”

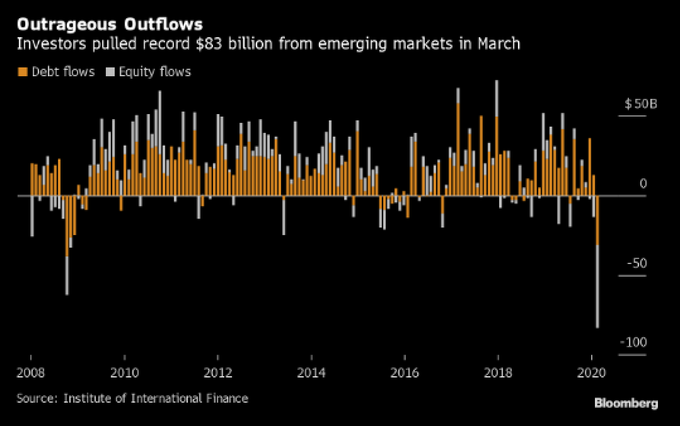

How bad was the damage in March?

On the other hand,

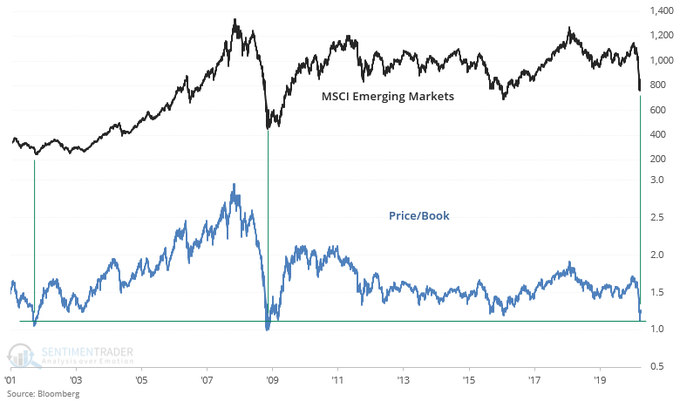

- SentimenTrader@sentimentrader – – Emerging Markets price-to-book ratio is extremely low. The only 2 other times it was this low was near the MSCI Emerging Markets Index’s bottom in 2002 and 2008

This is not just for non-domestic investor. The last thing the Fed needs is a EM Debt crisis given what they are dealing with near disasters in two different parts of the US Fixed Income market.

3. Oil

As we all know, the market plunge in America was amplified by the Saudi Roulette action of MBS of Saudi Arabia. It was clear to most geopolitical observers that Saudi Arabia was playing a losing hand. It became obvious to all this week. Look at the chart produced by Larry McDonald of Bear Traps Report:

Remember last week’s exhortation of Scott Sheffield of Pioneer Natural Resources – “we need Trump to do something”. Look what happened on Thursday, April 2:

- Lisa Abramowicz@lisaabramowicz1 – –Trump tweets, & the oil market listens.

What could be going on might actually be described as the structure of a new UROPEC, meaning the addition of US energy industry to Russia & Traditional OPEC with US, Russia & Saudi becoming the big voices. Look what Geopolitical Futures wrote this week:

- Private companies have begun to take matters into their own hands. A representative from the oil industry in Texas met with Russia’s energy minister to discuss cutting production by 10 million barrels per day. U.S. shale producers have also started to lobby for sanctions that would lower production in Russia and Saudi Arabia. Industry experts have also raised the possibility of protectionist measures being put in place on behalf of U.S. producers.

The drive to impose protectionist measures has gained momentum after tapping Rick Perry, (recently departed energy secretary & ex-Gov of Texas) to lead the effort. According to a detailed FT article – “Perry’s starting to turn the tide — he has an understanding of what’s going on and deep ties to the Midland crowd,”

Who would have thunk a decade ago that some one like Gov. Perry would actually say what he did on Fox, that

- “he would advise the president to tell US refineries to process only American-produced crude for the next 60 to 90 days and send a “clear message that we’re just not going to let foreign oil flow in here”“

According to the FT,

- “Among the shale industry proposals are preventing Saudi crude from reaching the kingdom’s large Motiva refinery in Port Arthur, Texas; tariffs on foreign oil; or suspending the Jones Act, which helps make crude shipped by domestic suppliers more expensive than oil delivered on foreign tankers. “The idea that is gaining the most traction is to target Motiva,” the largest refinery in North America, said an executive at a shale producer.”

Remember what Scott Sheffield said last week that the real war within US is being waged by Oil majors against the independent shale producers. Look what the FT wrote:

- “The shale push comes despite resistance from the oil industry’s most powerful lobbying organization, the American Petroleum Institute, which represents the largest energy groups and opposes any controls on supply.”

Looking a bit into the future, we can’t help thinking that better days might be here for Russia & a more mutually beneficial US-Russia relationship might be a possibility. Look Rosneft just left Venezuela.

Bringing an upward stability to oil & to US shale industry would be welcomed by a large segment of the US high yield market.

4. Mortgage Services – Havoc from Best Intentions

The Fed action to reduce the federal funds rate from 1.75% to 0.25% was widely praised & it was done with the best of intentions.In addition, the Fed & the Treasury have spoken for forbearance for homeowners from making their monthly mortgage payments. In addition, Fed’s announced QE includes buying mortgage backed securities, same securities used by mortgage lenders & servicers to hedge their risk.

Unfortunately these Fed actions have backfired on a very big area of fixed income, an area that affects 20% of US GDP. Just look at the chart of Annaly Mortgage, (a stock that has been mentioned in the past by both Jeff Gundlach & Jim Cramer), vs. IEF, the 7-10 year Treasury ETF.

Remember the plight we described of 65 independent shale oil producers last week. In contrast, there are over 500 MBS services that might be in colossal trouble. Remember the banks get paid to originate mortgages but not to CARRY them.

So are the banks trying to do the same to independent nonbank servicing companies that Oil majors are trying to do to independent shale companies? Both these independent groups survive on razor thin margins on their revenues. Margin calls on their capital is not something either group can handle.

Ex-Secretary & Ex-Governor Perry is leading the effort to help independent shale companies. Is there any ex-secretary or ex-Fed governor doing anything to help mortgage servicing sector? Isn’t housing a bigger nationwide sector than oil production?

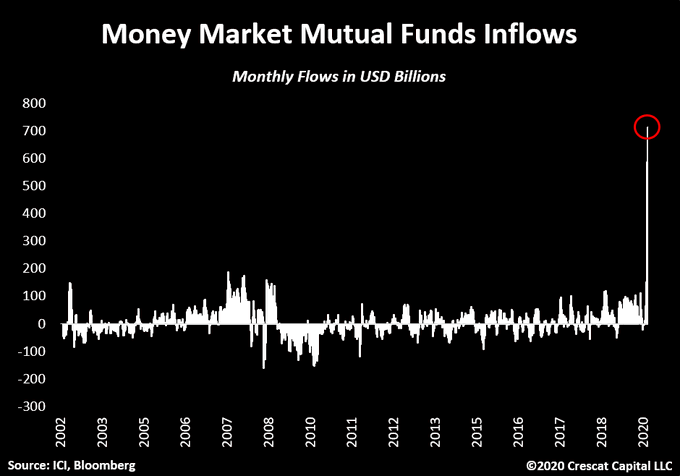

Given all this, shouldn’t we be praying for Treasury yields to rise? Above we described the rally in the Dollar as parabolic? What is worse than parabolic? Something with an infinite slope:

Finally, how many people are juggling with something like this depiction by Nishant Choksi in WSJ or worse doing a conference call like this?

There is only one aspect missing in the above from our Gender Equality viewpoint – a woman doing the same in an adjoining room. Life for a single parent with a job was always difficult. Now it must be incredibly difficult.

There is only one aspect missing in the above from our Gender Equality viewpoint – a woman doing the same in an adjoining room. Life for a single parent with a job was always difficult. Now it must be incredibly difficult.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter