Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”Up…Up & Down…Down”

The title above is a short version of the succinct statement Rick Santelli made to James Grant this week. He said simply – “Fed’s Balance Sheet goes Up, Stocks go Up; Balance Sheet goes down, Stocks go Down“.

But Santelli is a trader & used to speaking bluntly. That’s not true of economists who love to switch from hand to hand. Then there is David Rosenberg who can be as candid as Santelli & produce numbers at the same time:

- “It’s all about the Fed; $3 trillion in market cap added since March exactly matches the $3T increase in the Fed’s balance sheet over that period. There is a 90% correlation between the Fed’s balance sheet & the S&P.”

What about economic data? Rosenberg said to CNBC’s Sara Eisen,

- “correlation between SPX & GDP is almost Zero; the stock market is giving you zero economic information.”

Calling it a L-shaped market recovery with “L” meaning liquidity, Rosenberg added:

- “You have to take a look at liquidity.. I am blown away by these numbers; M2 growth is running at 80% annual rate over the past 3 months … pretty much everything is rallying with all this liquidity … the Fed’s primary influence is in asset values … “

The stock market may not give us “economic” information as Rosenberg said but terrible economic data can give investors good results said Tom McClellan in his article “Unemployment Is Not “Good”, But It Is Bullish“. He wrote:

- “…. perhaps the more important point, is that instances of high unemployment rates tend to be followed by several months of rising stock prices. … high unemployment also tends to bring a much more accommodative Federal reserve.”

So,

- “This has been tremendously stimulative to the stock market’s rebound, and the Fed is not likely to back away from this stimulus until it is clear to the decision makers that the economy and unemployment have turned a corner. In the meantime, those stimulative efforts will continue to help boost stock prices higher.”

We have argued that the biggest beneficiary of the Fed’s balance sheet increase has been & should be the sector that is best positioned to benefit from both the liquidity & the lockdown – the internet social media & cloud sector. Look what happened this week. After a couple of days of fast & steep rotation into beaten down sectors, common sense prevailed at the end of the week:

- Market Ear – “Sentimentors” – THE 2 most important drivers of sentiment closed at ATHs today, Fed’s balance sheet ($7.097 T) and internet ETF, FDN. Keep it simple. (their chart below is from Thomson Reuters)

2. Wednesday around 11:00 am

What happened at that time? Why do we ask? Just look at how the week turned around 11:00 am on Wednesday:

FDN QQQ

MSFT AMZN

The above wasn’t true ONLY for this stock sector:

GLD RPAR – Risk Parity ETF

We have no clue why the turn happened around 11:00 am on Wednesday. But we have been told by both experience & gurus that “why” is a very expensive question & a useless one. It is much better to notice a turn & act while leaving the “why” to smart people. The big question is whether the turn continues next week.

We had described last week as a “perfecter” week. This week was in some respects even more perfect than the previous week but not in other respects. By “other respects’ , we principally mean non-US stocks.

- EEM was up 3.9%; EWZ was up 4.9%; EWY was up 4.7%; INDY was up 6.8%; even basic Europe outperformed big time with EWG up 6.4%.

The big move came from European banks, mainly because the of the German-French plan to issue 750 Euro-currency bonds from the EU. Those who like it should thank the German Constitutional Court whose decision forced the EU to get to financial closeness this way. No wonder the Italian market flew & so did the European Banks. Was that an additional trigger for the big move in US banks?

Our favorite spread indicator of Fed liquidity did very well. Leveraged credit funds like DPG & UTG were up 9% whereas unleveraged HYG, JNK were only up 1.6%.

Remember what Carolyn Boroden from Cramer’s RealMoney said last week:

- “The picture for NDX, Nasdaq 100, looks better given that NDX has broken above its 50-day & 200-day moving averages. So it only has to remain above last week’s low of 8860. Then the first upside target would be 9,660.”

NDX closed the week at 9556, up 142 on the week. So 9660 is only 104 away. Ms. Boroden’s SPX target is a bit farther away:

- If the S&P breaks out above the 200-day moving average, then the first target would be 3,720. But if the S&P 500 is unable to break out above its 200-day, then 2,766 would be the first downside target.

The SPX did close at 3044, decisively above the 200-day (at 3002 at Friday’s close). When did this move begin in earnest? On Wednesday around 11:00 am. That’s what our eyes tell us.

Now let us see if Ms. Boroden proves correct with her targets & about closing above the 200-day being such a big deal. Will she get a big assist from positioning?

- Joe Kunkle@OptionsHawk – Thu May 28 – BAML good piece this morning on the amount of overwhelming contrarian bullish signals; Asset Managers, Speculators etc all non believers the whole way up and remain that way .We could definitely see a chasing blowoff type move soon

Any negative signals in that report?

- Joe Kunkle@OptionsHawk – The only minor complacency shown are Put/Call 5 and 25 day, but positioning remains ultra-bearish in futures Cool study on margin debt divergences and recoveries from low levels too

3. Dollar, Gold & Oil

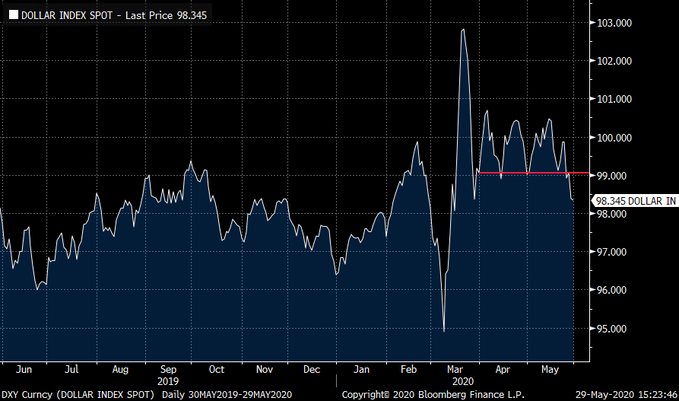

- Richard Bernstein@RBAdvisors – Look out below! #Dollar losing its bid. Could be good for #gold and commodities and bad for financing US #deficits.

What about Silver, up 3.5% this week?

OK, but what about Gold?

- Greg Harmon@harmongreg – Reasons to own $GLD : rising from 6½ year base, uptrend. Reasons to be cautious slightly overbought (?) or is that strong momentum. #longtheyellowrock

- Greg Harmon@harmongreg – Morning Star reversal confirmation in Crude Oil monthly chart $CL_F

4. GS

A different career & years ago we were at a conference in Atlanta. At lunch, we heard a mid-level executive at our table speak in anger & pain about all the foreigners who were moving to Atlanta & destroying it. Then he added, “they come from everywhere, Boston, New York, Chicago“. We also heard from a few close colleagues who said their grandmothers had told them about what Sherman did to Atlanta in his march through Georgia in the Civil War.

We thought about this when we saw “Grant“, a terrific 3-night series this week on the History channel. And yes, we meant Grant & Sherman, when we wrote GS in the title.

Everyone should watch this series in our humble opinion. The coverage is balanced, sensible & poignant. The coverage of how Grant got his chance & how he conquered Chattanooga, Corinth & Vicksburg is superbly detailed.

Specifically, the series points out that Sherman’s march through Georgia was a calculated decision of Grant. It was clear to both him & Sherman that the war would not be over until the people of the South suffer so much that they would not choose war again. This is an unpalatable truth that no one likes to hear but one that every successful victory, at least the final victory in an existential war, demands.

The sheer will & determination of Lincoln, Grant & the people of the North remind us of another decision, a catastrophic decision, that doomed over 1.7 billion people to a perpetual state of war amid poverty & misery. As Rafiq Zakaria, an associate of Mahatma Gandhi, wrote in 2001:

- “In the civil war, millions of Americans on either side died. Lincoln was killed by an assassin’s bullet. But the Union was preserved, with the result that America is today the mightiest superpower in the world. “

Then Zakaria compared Indian leaders to Lincoln:

- “Unfortunately at a critical juncture in India’s history there was no Lincoln with the vision, foresight and determination, who could have staved off the dismemberment. Nehru and Patel lost nerve; they could not muster courage to face the possibility of a civil war between the Hindus and the Muslims.”

Look at the result. The breakaway state of Na-Pakistan remains a failed state in every way except its arsenal of nuclear weapons. Instead of the real & united India proceeding on the route of economic development, the two states remain in near-war like status.

Nehru, as Zakaria tells us, had a bust of Lincoln on his desk. But he never learned from Lincoln & when time came to exercise will, he chose surrender to the breakaway faction.

Finally, as the series shows us, Lincoln was not enough. He needed Grant to win the war decisively & before his re-election. Grant did, Lincoln won & no entity has ever tried to leave the Union again.

*PS – The book we refer to is The Man who Divided India by Dr. Rafiq Zakaria, a distinguished son of India. Those who read this article might know him better as the father of CNN’s Fareed Zakaria.

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter