Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Back to Normal?

Needless to say we don’t mean what used to be normal. No, we mean what has been normal since 3rd week of March, 2020.

After a hiatus, the Fed’s balanced sheet grew again this week to go past the $7 trillion mark. And long-duration Treasury yields began correcting their previous week’s rapid rise by falling on 4 of 5 days this week. So what happened is what has been happening since late March 2020 – QQQ blew away the S&P & Dow while Russell 2000 actually fell. Cloud stocks once again claimed leadership with Amazon up 4.2%.

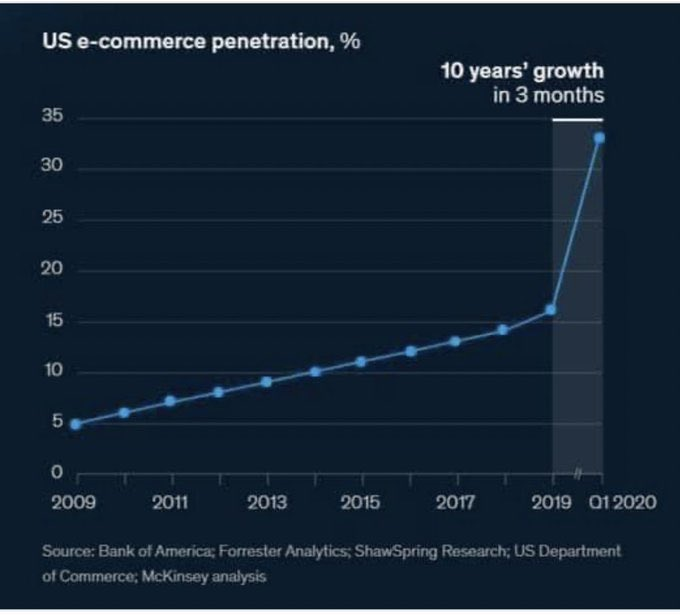

Once again, the fundamentals of their growth outshone the potential of the earnings turnaround at “value” stocks:

- David Schawel@DavidSchawel – This chart on e-commerce continues to amaze me.

Contrast this with the utter indifference among Democrats to getting much needed financial stimulus to the lower-income or unemployed Americans. Their spending power is being reduced on a weekly basis. So why one earth would people crowd into stocks that depend on this non-cloud, non-internet spending? No wonder long duration rates have found a new vigor in going down especially given what the Fed minutes said.

- David Rosenberg@EconguyRosie – Reading the somber tone and all the downside macro risks in those FOMC minutes, one can legitimately wonder why the Fed sat on its hands the day of the last meeting. Something tells me Mr. Market thought the exact same thing based on when things went south.

Rosie spoke too soon and mistook this as One Mr. Market. There are at least two, Mr. Rosenberg – QQQ/FAANG & rest. The first Mr. Market realized all that “downside macro risks” stuff was great for his “peeps”. Witness how his “peeps” galloped on Thursday – Facebook up 2.55%, Apple up 2.22%, AMZN up 1.13%, Adobe up 3.56%, Netflix up 2.76% & Google up 2.05%. And their cohort led by DOCU/SHOP/SQ were all up 3%+ on Thursday while the S&P was only up 32 bps, Russell 2000 was down 49 bps and even the new-idol DJT was only up 10 bps.

This continued on Friday and actually got stronger in one sense:

- Joe Kunkle@OptionsHawk – Today they stopped with the spreads and just buying mammoth calls for November in large cap Tech, and $NFLX joined the fun Along with $CRM $ADBE

It got so bad that CNBC’s Scott Wapner actually got angry on his show & began berating his “investment committee” about the death of the “rotation to value/cyclicals” they had been pushing for a couple of weeks. Wapner should have gone back & watched old clips of David Tepper say again & again “don’t overthink it“.

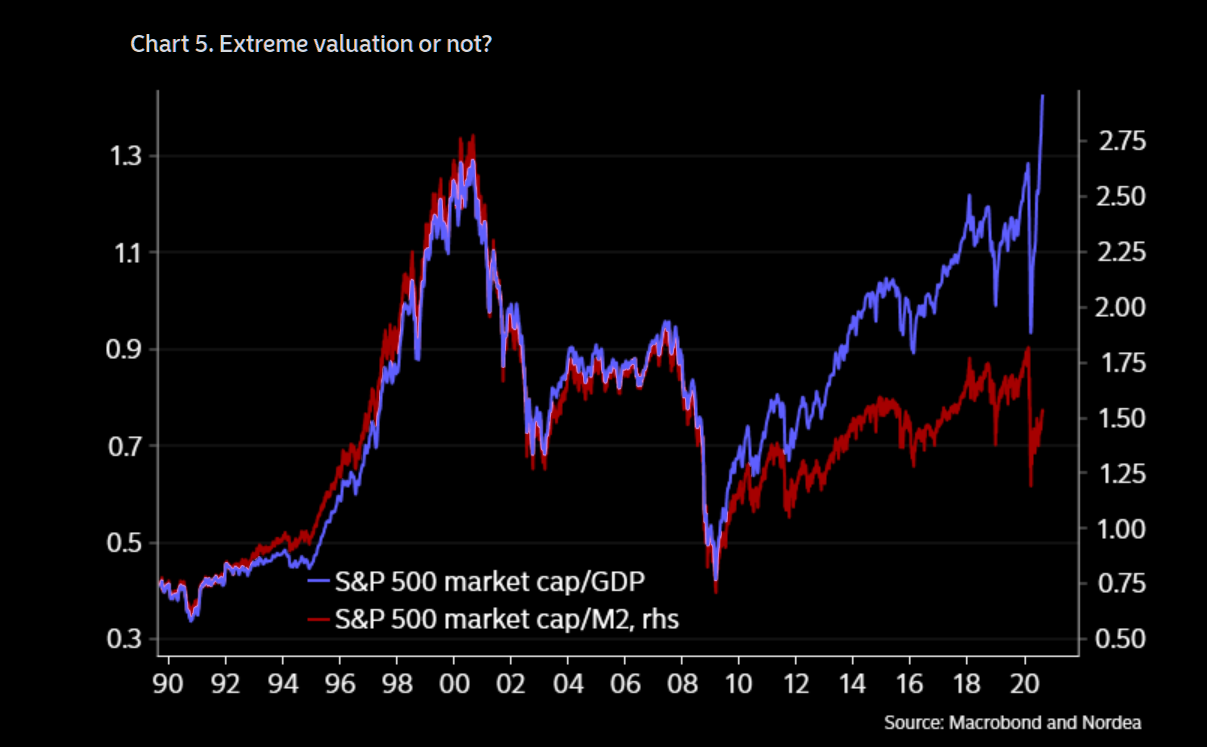

All these “investment advisors” talk about the stock market not being the economy. They don’t get that the Fed remains the ONLY force behind this stock market. And what does the Fed control or at least seek to control? Money Supply & NOT the GDP. Since a picture is worth lots of words, they should see the following chart from Nordea (via Market Ear):

Now re-read David Rosenberg’s tweet above and ask what can the Fed do except increase its balance sheet. If they do, the same cloud-type stocks in the NDX will go up & the rest will meander. If they do nothing, then they will reduce liquidity or simply maintain and the “rest” of the stocks will get killed while the cloud-type stocks merely fall. This is why Chairman Powell was begging for fiscal stimulus at the last FOMC meeting.

But Pelosi & company don’t care & perhaps rightly so. If they surrender & get cash into the hands of the vast majority, then the benefit might actually accrue to President Trump. So they may have made a calculated decision to inflict economic pain on the income-poor, small business groups hoping they will blame President Trump.

Now Chairman Powell is on deck at Jackson Hole next Thursday.

2. Calling for a big change

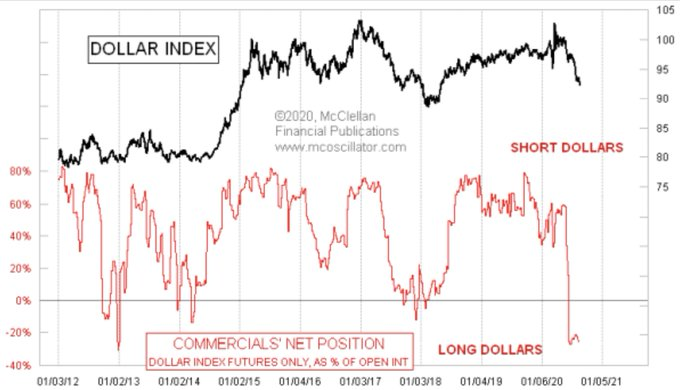

The U.S. dollar rallied by 80 bps after the Fed minutes were released this past Wednesday. Tom McClellan doesn’t think the Feds like that & so he thinks they are going to get upset soon & it will give them “additional justification for keeping short term interest rates lower“. We have news for Mr. McClellan – they don’t need any justification whatsoever.

- Jesse Felder@jessefelder – ‘The big money commercial traders are holding a rare net long position as a group. It is an unusual and interesting statement, indicating that the Dollar Index should be bottoming.’mcoscillator.com/learning_cente by

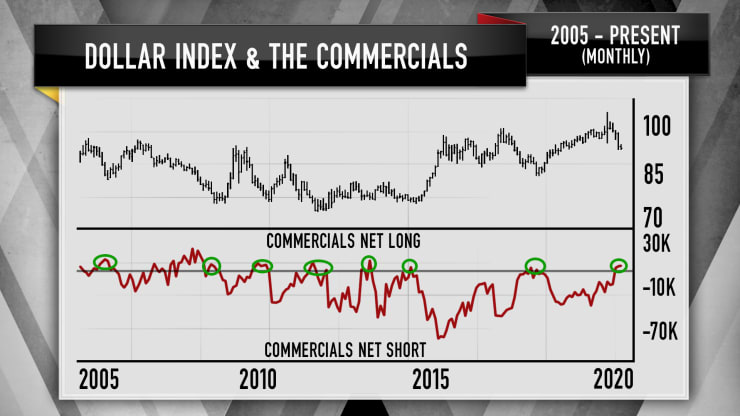

This week Larry Williams, a legendary trader, told Jim Cramer that the Dollar is headed higher.

- Citing Williams, Cramer pointed out multiple indicators that suggest the U.S. dollar index may be poised to reverse course. They include correlations in the crude market, a greenback nearing seasonal lows and the TD Sequential — a momentum indicator — suggesting the decline in the dollar is coming to an end.

- Looking at the monthly chart of the dollar index, which measures the American dollar against foreign currencies, Cramer noted a bullish sign in buying and selling activity of commercial hedgers.

“Whenever these commercial hedgers build a big net long position, above the black horizontal line, Williams points out that the dollar index actually tends to rally pretty consistently, … We’ve just gotten to a point where the commercial hedgers are net long, [which is] an unusually bullish position that says buy the greenback.”

3. Rates

A rise in the Dollar is usually indicative of decreased liquidity. So would the calls above, if realized, create a downward pressure on Treasury yields? And that too after a fall in yields this week that reversed about 45% of the big rise in yields the week before?

Two weeks ago, the 30-year yield closed at 1.23%; then it rallied by 21 bps to close at 1.446% on August 14. This past week it fell by 10 bps to close at 1.35%. Similarly TLT fell from about $170 on August 7 to $163.25 on August 14 & rallied this past week to close at $166.25. The rest of the long duration curve also fell in yield despite a bad 20-year Treasury auction. Both the 20-year & 10-year yields fell by 9.5 bps this week. And this is despite the better than expected PMI data this week.

And,

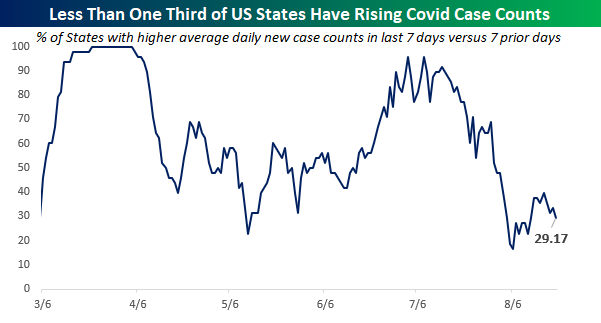

- Bespoke@bespokeinvest – Less than a third of US states have rising Covid case counts in last seven days.

So why did rates fall this week? Are they smelling what is coming next? Jobless Claims rose this week after falling for several consecutive weeks. Is that a sign that the next Non Farm Payroll report will disappoint? Or was the steep 21 bps rise from August 7 to August 14 just a correction of a big overbought condition in Treasury bonds?

But before the next NFP comes Jackson Hole next Thursday. What Chairman Powell says or doesn’t say might have some impact, won’t it?

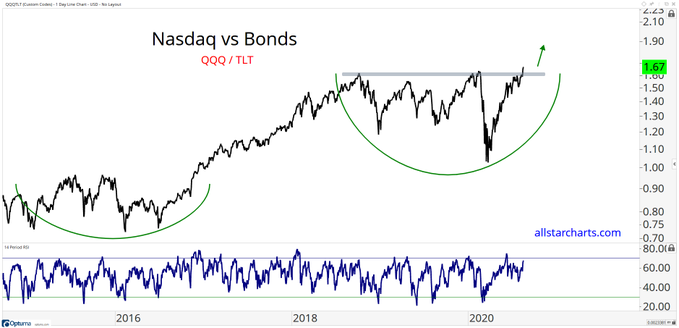

We all know that Nasdaq is on fire but we also recollect that charts that glorify cross-asset moves like the one below are sometimes subject to a tactical reversal.

- J.C. Parets@allstarcharts – they tell me it’s a bubble, and then I remind them of the multiple years of no progress. To me, this looks a lot more like a beginning than an end $QQQ $TLT

4. Stocks

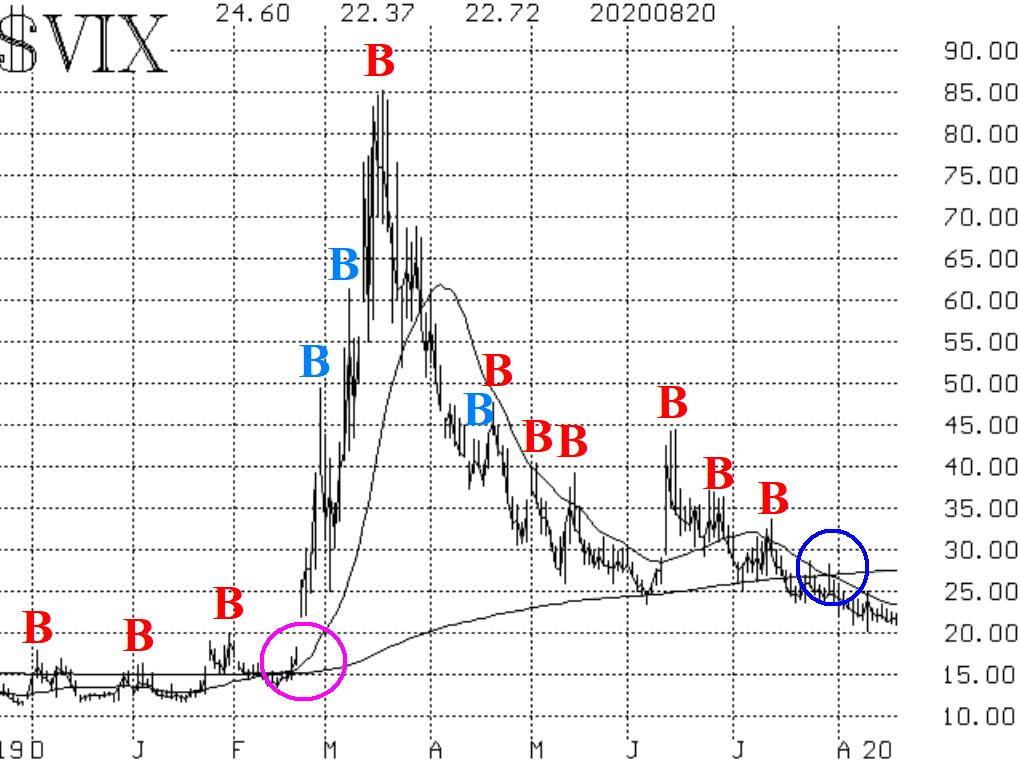

So many tell us that now is just like Feb 2020 and their points seem to make sense. But one guru points out a difference in the volatility charts then & now.

Lawrence McMillan on volatility in his Friday summary:

- Volatility remains bullish for now. The trend of VIX is an intermediate-term bullish mode as long as $VIX and its 20-day moving average are both below the 200-day MA. The blue circle on the chart in Figure 4 shows where this bullish crossover was initiated, and it remains in place. The opposite occurred back in February (pink circle on the chart).

His closing summary:

- “In summary, there are some potential sell signals setting up, and we will be trading them if they are confirmed. However, one must remember that the $SPX chart is still positive, and that is the most important indicator. Sell signals from other indicators can come and go, but if the $SPX chart does not break support (3200, in this case), then the price trend will remain higher. So, there are some cracks appearing in the dam, and while it’s not time for panic, you better have Hans Brinker on speed dial.”

The S&P made a new all-time closing high on Tuesday at 3389.78. The next day came the sharp fall after the release of the Fed minutes. That raises the specter of a double top. That makes the following tweet relevant:

- Lawrence G. McMillan@optstrategist – – “There is a possibility of a double top being formed in $SPX, which would be a rather formidable obstacle. However, it is my observation that the bears are quite gleeful about this modest selling, and they might be premature in their celebration…” optionstrategist.com/products/daily

- Joe Kunkle@OptionsHawk – Cumulative TICK at -14,500, pretty weak under the surface today

And as you must have guessed,

- Thomas Thornton@TommyThornton – – Nasdaq futures and $QQQ with a cluster of upside DeMark Sell Countdown 13’s. 20 day mov avg has been support. Pause or fall?

5. China getting restless or the entire world?

This week Jim Cramer alluded twice to the “Xi is in trouble” sentiment. In this context, read how Phillip Orchard of Geopolitical Futures opened in his article on Friday titled “China’s War on Taiwan Won’t Start in Taiwan“:

- “China is beginning to feel more restless about Taiwan – and a convergence of internal pressures in China, along with the belief in Beijing that Washington is too concerned with its own issues to stomach the costs of coming to Taipei’s defense, gives China reason to consider moving on Taiwan sooner rather than later.”

What might be Washington’s main issue? Whether Trump or Biden wins the election. Whether Mike Pompeo or Susan Rice will lead the effort to manage China.

This may be the most momentous election of recent decades in America. The World gets it & the World will pivot as needed. For a more detailed discussion about the restless world, see our adjacent article A Restless World – – Middle East, China & Kublai Khan & Far East.

Another sign of a restless world & their deep apprehension about Biden is the report below about the Biden & the Democratic Convention by India’s Palki Sharma & WION .

Move over, Laura Ingraham. Here comes Palki Sharma.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter