Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Two Economies or Three?

Remember Wednesday? The day Salesforce.com reported a quarter than even stunned their chairman Mark Benioff. The Salesforce stock exploded up 25%+ and led to a buying panic in cloud or mo-mo stocks. Adobe was up 9%. Netflix was up 11.6% & Facebook was up 8%. In contrast, banks were down & so were airlines. NDX was up over 2% but Russell 2000 was down 70 bps. Was below the message from Wednesday’s market?

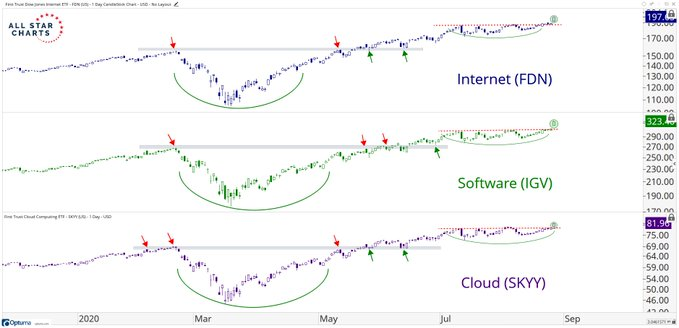

- Steven Strazza@sstrazza – After consolidating in continuation patterns for two months, Tech’s strongest subsectors are resolving higher.. $FDN $IGV $SKYY $XLK

But Rich Bernstein saw a different message in Wednesday’s market action. He said to CNBC’s Kelly Evans on Wednesday afternoon – “anytime you see NDX up like this & Russell 2000 down, you have to be pessimistic about the economy“. He wondered “whether the liquidity will make it into the real economy” and added that “the transmission process from monetary policy to the real economy has broken down“.

To him, the NDX & tech stocks were different from what he termed as the “real economy”, presumably the one reflected in the Russell 2000. If he meant that the real economy is the small business economy, then his inference is indeed correct. We all know that 80% of jobs are in the small business sector, a sector that is being hurt very very badly for lack of adequate fiscal stimulus.

But what about the 3rd economy – the industrial economy who strength is reflected in industrial material prices? Guess what Lakshman Achuthan of ECRI told CNBC’s Rahel Soloman* on Wednesday:

- “… the industrial sector of the economy, it has high cyclical volatility, is really firing on all cylinders… very strong upturn in sensitive industrial price inflation …”

- “The readings that we’re showing in this chart here are the strongest we’ve seen since the spring of 2018 …. So, we have a recovery that is going to continue.”

Go back to March-April 2020 when dire warnings about a long depressionary recession were heard from most corners. Recall that Lakshman Achuthan stood firm & made the then stunning call that the 2020 recession would be one of the shortest U.S. economic recessions on record. He hit a bulls-eye on that prediction. So we are inclined to go with his prediction of a strong cyclical industrial recovery.

Listen to him explain his case & how non-exchange material (benzene, tallow) pricing is also very strong.

Thursday’s stock market seemed to listen to Lakshman’s message. Airlines & Banks flew while the cloud & mo-mo stocks gave back about half of their Wednesday’s gains. This market action had a lot to do with the optimism generated by the $5 test announced by Abbott. With a very quick & inexpensive test, the inclination to travel, the urge to go out will be back fast & strong was the expectation.

But that still leaves a lukewarm small business economy, the one that might surprise negatively next week with a worse than expected Payrolls report.

*Ms. Rahel Soloman is a relative newcomer to CNBC and we happily note that other CNBC anchor/reporters take extra care in pronouncing “Rahel”. Sadly, Ms. Rahel Soloman does not exercise similar care in pronouncing Mr. Achuthan’s name correctly. She pronounced his first name as “Laakshman” instead of “Lakshman”, in the above clip. Is this lack of care in pronouncing Indian names, especially the historically important ones, a necessary step in CNBC’s orientation program for new on-air talent or just a part of the CNBC culture?

2. Powell’s Words – “big change” shelved?

Last week, we highlighted the views of Larry Williams (via Jim Cramer) and others to term the upcoming rally in the U.S. Dollar as “the big change”. Based on the reaction to what Fed Chairman Powell said, we may actually get a reverse big move.

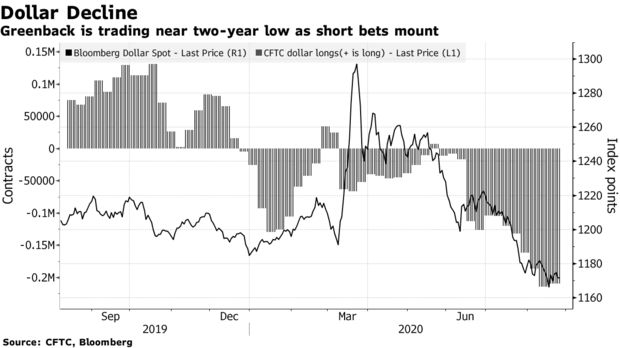

- Lisa Abramowicz@lisaabramowicz1 – The Bloomberg dollar spot index falls to the lowest since May 2018.

They get what they wish?

- Lawrence McDonald@Convertbond – New lows for the US Dollar – Euro, Yen, Mex Peso, Sterling, all leading the change today. When the Fed and Treasury want this beast lower, they usually get their way…

Perhaps, we are in the later innings?

- Lisa Abramowicz@lisaabramowicz1 – Pimco sees the dollar continuing to weaken, particularly versus Asian currencies. “We are still in the early innings of dollar depreciation.”

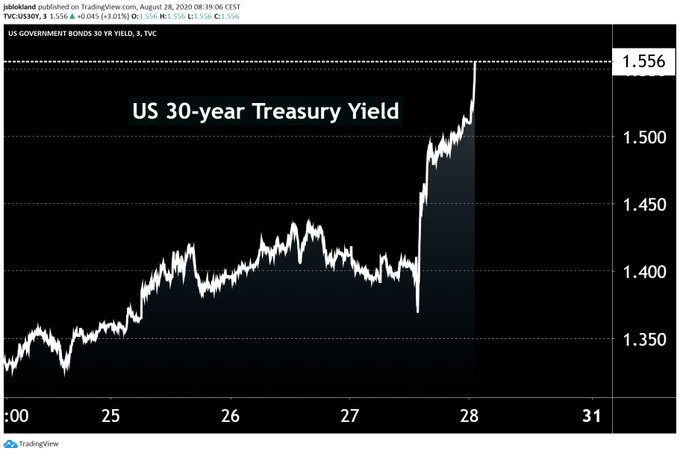

Treasury rates exploded to the upside in a big steepening on Thursday after Powell’s speech. The 30-year yield jumped up 10 bps to close above 1.5%; 20-yr yield jumped up 9 bps; the 10-year rose 6 bps to close just below 75 bps. In contrast, the 3-1 year curve was almost unchanged. Highly natural because Powell committed the Fed to not raise rates even if inflation crossed above 2%.

- Jeroen blokland@jsblokland – The spike in US bond yields continues, with the US 30-year Treasury #yield now above 1.55%, up more than 20 basis points in the last couple of trading days.

Remember the term “convexity of low rates“? We all saw that in action on Thursday & Friday:

- Lawrence McDonald@Convertbond – US 30 Year Bond in August Yield: 1.18% to 1.57% ETFs TLT $172 to $160 ZROZ: $186 to $167 **$70m loss on $1B. *Convexity escalating at lower bond yields, the slightest uptick leads to profound capital destruction. This helps explain the colossal commodity bid.

But the rates were going up since Monday ahead of Powell’s speech. And on Friday, rates actually gave up their morning highs to closer lower. Yes, the 30-year yield closed up 1.4 bps to 1.514% & the 20-year yield closed almost unchanged. But the 10-year yield closed lower by 1.7 bps and so did the 7-1 year curve. Next week should be interesting with the Non-Farm payrolls report.

3. Powell’s actions

Frankly what Powell said was not that surprising. He simply said that he would let inflation rise above 2%, something they have been hinting for some time. Actually, they keep praying for inflation that hasn’t shown any sign of coming. What about ECRI’s ‘industrial economy firing on all cylinders”? Shouldn’t that lead to higher inflation soon? Actually not, said Lakshman Achuthan in the clip above. He explained:

- “inflation is not a clear & present danger… we will get an upturn in headline inflation but look at core inflation – it is pretty much near its recessionary lows; … look at what the Central Banks are doing – the end result is longer term low-flation or dis-inflation. … there is capacity that shouldn’t be there ….

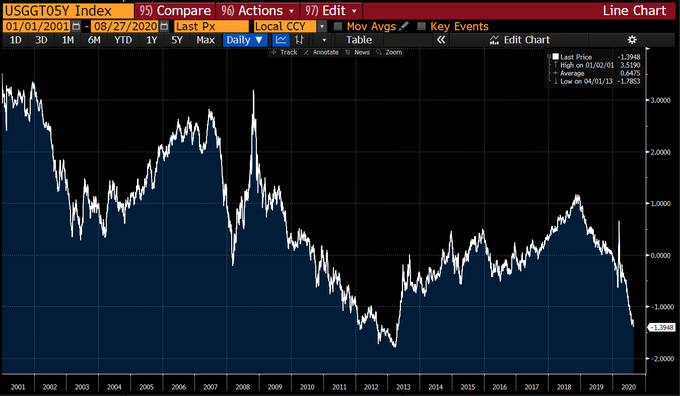

Look where the yields are in maturities the Fed can control, real yields:

- Lisa Abramowicz@lisaabramowicz1 – Aug 27 – U.S. 5-year real yields are the most negative since April 2013, right before the taper tantrum.

All week we kept noticing that leveraged DPG & UTG were underperforming the unleveraged ETFs, HYG & JNK. That is a sign, at least to us, of liquidity getting constrained. Then on Friday, we saw:

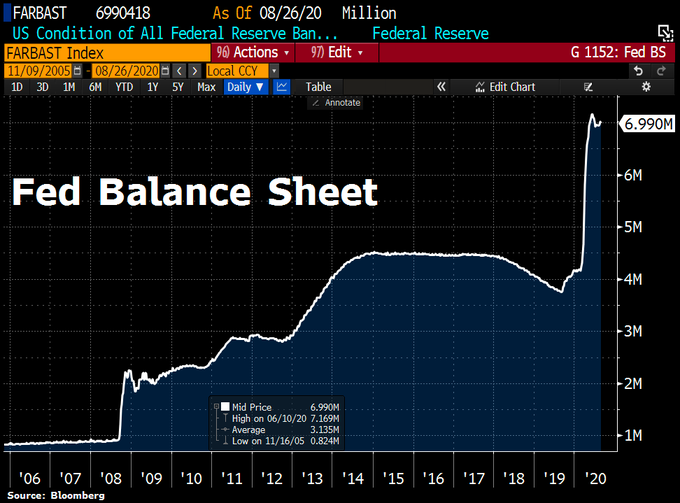

- Holger Zschaepitz@Schuldensuehner – Fed’s total assets fall again: Balance sheet has shrunk by $20bn to <$7tn as Fed dollar liquidity-swaps dropped by $4bn and MBS fell by $29bn, while Treasury securities rose by $13bn. Fed’s balance sheet now equal to 35.9% of US’s GDP vs #BoJ‘s 132% and #ECB‘s 61%.

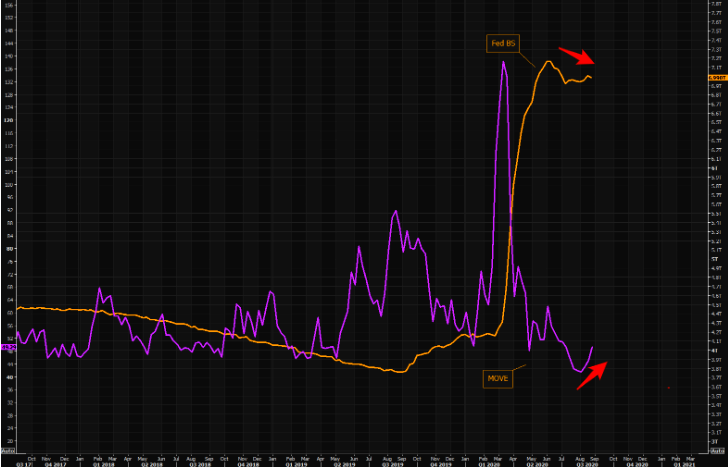

Apart from being a liquidity constraining force, the Fed’s Balance Sheet is also linked to volatility:

- Market Ear – Bond vol is addicted to Fed’s BS…

So while Powell tells us that he will let inflation go up, his Fed keeps reducing liquidity, a clearly dis-inflationary action. So which Powell do we believe – the talking one or the walking one?

Of course, Gold & Silver and their miners love both Powells – on the week, Gold was up 1.5%. GDX up 2.7%; Silver up 3.7%, Copper up 3.4%, Freeport up 8.2% and Cleveland Cliff up 5.7%.

4. Stocks

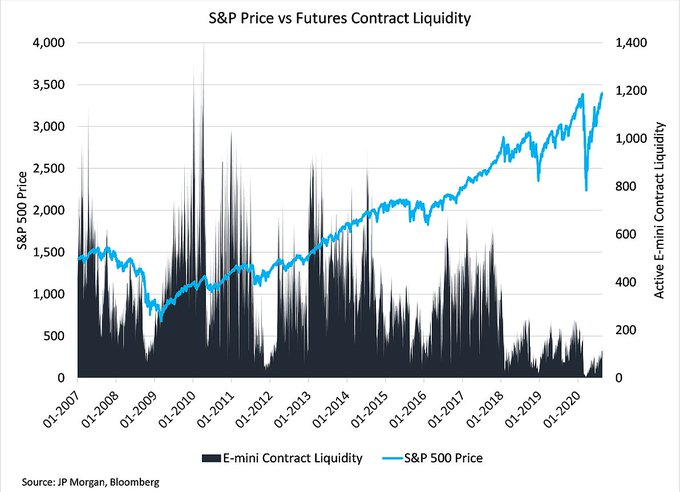

Liquidity reduction is also being noticed in the S&P 500 e-mini futures:

- Jesse Felder@jessefelder – ‘While markets are making all-time highs, the lack of liquidity rather than a wall of Liquidity (capital “L” from the Fed) is the driver. Markets are increasingly fragile in both directions.’ logicafunds.com/lets-talk-abou by @profplum99

But just like Gold et al, non-US stocks love Powell’s impact on the Dollar or as Steven Strazza of All Star Charts put it “The World Is Breaking Out“:

They write:

- “We like ACWI long above 81.75 with an objective just below 100, and about a 4-month timeframe into year-end.”

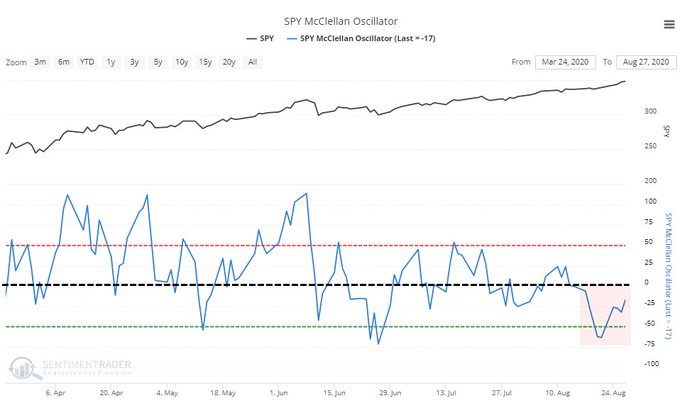

Is “this has never happened before” another way of saying “this time it is different“?

- SentimenTrader@sentimentrader – The S&P 500 set a 52-week high for a week straight. Every one of the sessions had a negative McClellan Oscillator. This has never happened before, using S&P stock data to 1998 or all NYSE securities back to 1962.

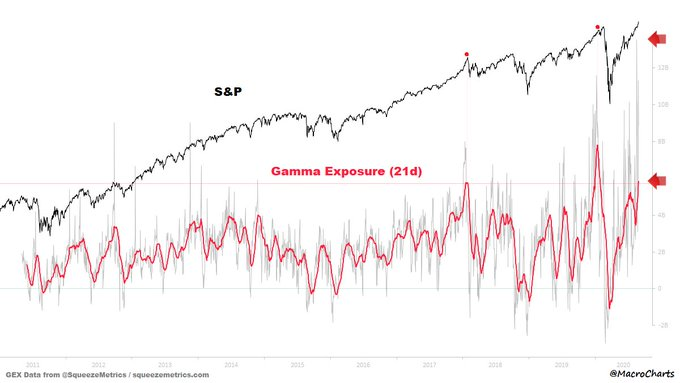

What about Gamma? Is it ever going down or will it only do so after it also hits a new all-time high?

- Macro Charts@MacroCharts – $SPX Gamma Exposure (updated). 21DMA in the Top 20 days in data history (0.85%), just passed the JAN 2018 peak value – still climbing, with JAN 2020 now in sight. Watching closely how this develops and IF/when it turns down. Will revisit in the coming weeks – stay tuned.

How about simple advice simply stated?

- Lawrence McMillan of Option Strategist – The trend of $VIX is still downward, so that is still bullish for stocks. That will be the case as long as both $VIX and its 20-day moving average are trading below the 200-day moving average. In summary, we remain bullish because there are no confirmed sell signals, and the $SPX chart is strongly in an uptrend. However, given the number of overbought conditions and potential negative divergences, we are staying alert to take bearish positions if and when confirmed sell signals appear.

5. Ratios or Numerators

Which do you prefer – ratios or just numerators? That seemingly dumb-ish question may actually bigly relevant to the state of today’s stock market.

- Sara Eisen@SaraEisen – “Most pronounced liquidity bubble of all time” @EconguyRosie

Ms. Eisen was kinda misquoting Rosie, if our memory serves us correctly. We do recall David Rosenberg stop short of calling the stock market a bubble but Ms. Eisen did get his tone right in her summary quote. There is no doubt that factually the amount of liquidity added is highly highly pronounced & could easily be described as “most pronounced liquidity bubble of all time“, at least from a numerator-only view.

But there is a purpose to the liquidity added by the Fed. Yes, this liquidity is not being transmitted to the “real economy” as Rich Bernstein, David Rosenberg’s old colleague, told Kelly Evans, Ms. Eisen’s CNBC colleague. But that is not the fault of Powell, the liquidity creator. Blaming Powell would be like blaming a car engine for the fault of the car’s transmission.

Going back to basic arithmetic & focusing on what the Fed is trying to do, we would rather look the ratio of liquidity added to jobless claims, a figure that both Rich Bernstein & David Rosenberg watch. The jobless claims in March 2000 (the last “pronounced” liquidity bubble) were 266,000. In contrast, the jobless claims this past week were in excess of 1,000,000 or 3.5 times the March 2000 number. So wouldn’t current liquidity added have to be 3.5 times the March 2000 liquidity to make today the “most pronounced liquidity bubble of all time“, as Sara Eisen quoted David Rosenberg?

We leave our simplistic question with Ms. Eisen & Mr. Rosenberg and hope to be educated by them.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter