Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Powellosi?

After two terrible post-Powell days from 9/16 to 9/18, we did expect Chairman Powell to promise to do all they can in his congressional testimony. He did not. Instead, he simply reiterated his view that this was time for a fiscal stimulus & not for balance sheet expansion.

How did the markets react to that on Wednesday after a minor rally attempt on Tuesday?

- Dow down 525 points; S&P down 78 handles or down 2.38%; NDX down 353 or 3.2%; Russell 2000 down 3%; Gold down 2.4%; Silver down 7%; Copper down 3.6%;

It felt worse than Monday. The best reaction came from Jim Cramer who said something like “unless we get stimulus, economy is going back to full Covid mode“.

Cramer’s comment instantly brought to mind the classic frustration of Hamilton Berger* who said to the Judge “The District Attorney has already been thrown out on one of these squeeze plays by Mason to Gilmore to Banks“. In this case, Mason & Gilmore are Pelosi & Powell; Banks is the stimulus and the District Attorney is macro markets. We don’t have the gift of gab like Erle Stanley Gardner and so we simply say “Powellosi”.

We understand that the Fed is the master of the world & they decide what the state of the economy should be. They are absolutely correct in demanding fiscal support from Congress. We can also understand somewhat their threat to hold the economy hostage. But it is unthinkably unbelievable that Powell would that 6 weeks before the most intensely emotional Presidential election in modern history.

Nancy Pelosi is a politician. Her first & foremost inclination is to win the upcoming election. That is why she has steadfastly refused to act on the fiscal stimulus bill betting a bad economy will help Democrats & Biden. But Fed Chairman Powell has the mandate to win for the economy. In this situation, it was incumbent on Powell to act to reduce the damage of Pelosi intransigence and increase the Fed’s Balance Sheet. But he did not. Instead he acted as if he was in cahoots with Pelosi. Hence our nickname “Powellosi”.

But the Fed is supposed to “independent” of politics, right? Honestly, we don’t know anyone who is not intensely fervent about the existential need for victory of their candidate. And the Fed being “independent” – ask someone who has served as an advisor to the Fed:

- Jim Bianco@biancoresearch – Sep 24 – Same with Hillary. Proving yet again she is the partisan that risks the Fed”s independence, not Judy Shelton. Fed’s Brainard Seen at Top of Biden’s Treasury Secretary List

And what risk can there be in fading the economy down just for 8 weeks or so? After all, the Fed can build up their BS fast & furious right after the election. They are the masters of the world, aren’t they?

Are we going too far or does the Fed really rule the monetary world?

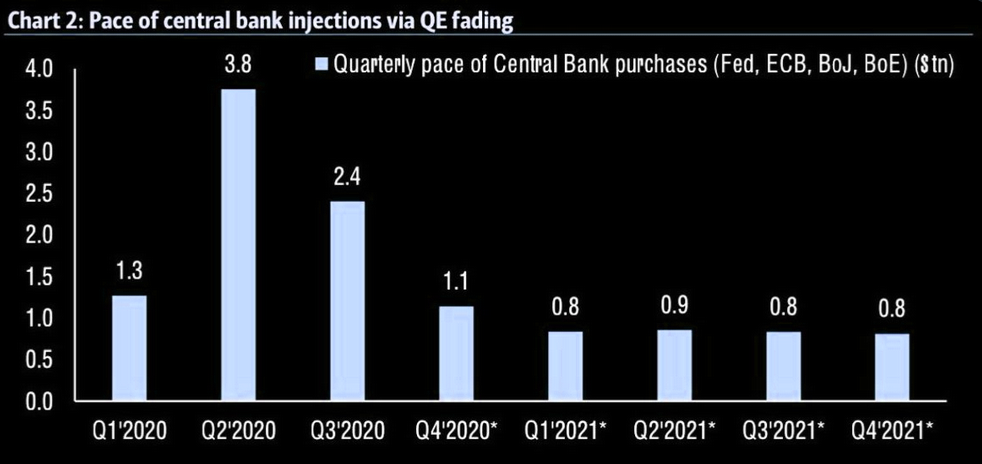

- Market Ear– The scariest chart of them all: The QE fade…. For so many reasons – the absolute size – and that we should worry about the fade when the numbers are still so big… A heroine user would not like this trajectory….

*The Case of the Ice-Cold Hands

2. Post-Wednesday

Was the carnage so bad & did the fear of being punished by voters become so palpable that we saw signs of a U-turn by Powellosi?

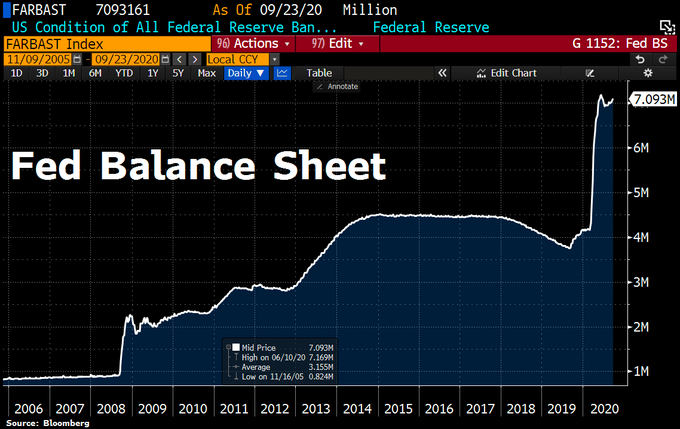

- Holger Zschaepitz@Schuldensuehner – #Fedput in action: US CenBank expanded its balance sheet by 0.4% to $7.09tn in the past week. Total assets rose by $27bn on Treasury and MBS buying. Fed balance sheet now equal to 36.4% of US’s GDP.

And House Democrats are drafting legislation for a $2.4 trillion stimulus proposal that could be voted on next week. Yes, next week. Wowser! Is this why the stock market exploded on Friday with NDX up 2.34%? Forget the boring slow-poke NDX & its old horses like Amazon & Microsoft that only rise by two-handle percentages. Look how the young studs ran:

- DOCU up 8.51 or up 4.17% to 211.00; PENN up 5.87 or up 9.17% to 69.52;. SHOP up 52.31 or up 5.76% to 958.25; SQ up 5.41 or up 3.55% to 157.06; TDOC up 15.05 or up 7.38% to 217.00; TSLA up 19.55 or up 5.04% to 405.15; ZM up 31.52 or up 6.78% to 493.25;

Now that’s what we are talking about. Are Happy Days are going to be here soon with both BS increase & Stimulus checks? Is there a message from our trusted indicator for Fed’s realized liquidity?

Not only is the absolute spread at about 35% is close to the March low spread of about 40%, but the RSI of DPG is almost touching the March low. And Friday was the first day in awhile to see outperformance of DPG over HYG. So are we close? We will see next week.

3. Starving Kids!

Let’s not forget the primary responsibility of the masters. After all they have “bank” in their names. So what’s up with the kids of Lagarde-Powell?

- Alessio Urban@AlessioUrban – European banks One tick before falling into the abyss

How about a longer view?

- Gin Lane Securities@GinSecurities – The Stoxx 600 Bank Index ( cap weighted index of European banks ) was created in 1987 it is at its alltime lows over last 33 years worse than 2008-2009 crisis or March 2020 crash

EUFN, the iShares ETF of European Financials, was down 8% on the week. Lest we laugh at them, Citi & Bank of America were down 6.5% on the week. This is looks far worse than ugly. The only non-dark lining we can try & locate is that the RSI of both EUFN & C is touching 20.

But what about the Fed’s drive to “Make America Inflationary Again”? No, that is not ours.

- Richard Bernstein@RBAdvisors – Sep 23 – The #Fed‘s quest to “Make America Inflationary Again” (oh come on, laugh a bit) might not be working. #Inflationexpectations might be topping out.

May be this is finally beginning to scare Powell or at least we hope it is. If not, the steady drip drip down of Treasury rates should. 30-year & 10-year rates were down 5 bps on the week and the 10-year down 4 bps to just over 65 bps. What did that suggest to Jim Bianco, the man who told BTV’s Lexington Jo Nathan* that the 39-year old Treasury bull market ended on March 9 when the 10-year yield touched 33 bps intra-day?

- ” we can go to low 50s or high 40s [for the 10-year yield] one more time”

If that doesn’t spell fiscal stimulus to you, then nothing can. At least fiscal stimulus is easier to do in Q4 than distribute a vaccine that works.

As an aside, where can you find quality banks that have loan growth & high interest rates? To the country that deservedly gets bad press for high levels of non-performing loans. No we are not kidding. India’s private banks, especially HDFC & ICICI, are deemed to be long term growth stocks. Just look at HDFC vs. JPM and the higher beta pair ICICI vs. BAC over the last 6 months, a period in which Indian economy has been semi-shut because of CoronaVirus:

Do note that we specify private banks in India not the public-sector banks that are loaded with problem loans.

*BTV’s Jonathan Ferro is no Broadway Joe Namath but he may be called Lexington Jo Nathan. After all, BTV offices are on Lexington Avenue AND Ferro is the only British Fin TV anchor who has ever spoken about football on US TV. And he knew that Jack Kemp was AFL’s MVP in 1965. Does Larry Kudlow know he said that on TV? If he does, then NEC Director Kudlow might give interviews to Ferro exclusively.

4. Stocks

A terrific Friday could not overcome terrible Monday & Wednesday. But damage to the broad indices was not terrible with Dow down 1.7% on the week and S&P down 60 bps. In contrast, Russell 2000 was down 4% and EM was down 3.5%. Germany was down 5% on the week, perhaps due to the disaster that are European Banks.

In stark contrast, NDX was up 2% on the week, yes Up. Kudos to those who believed in last Friday’s tweet below & did not puke on Monday or on Wednesday.

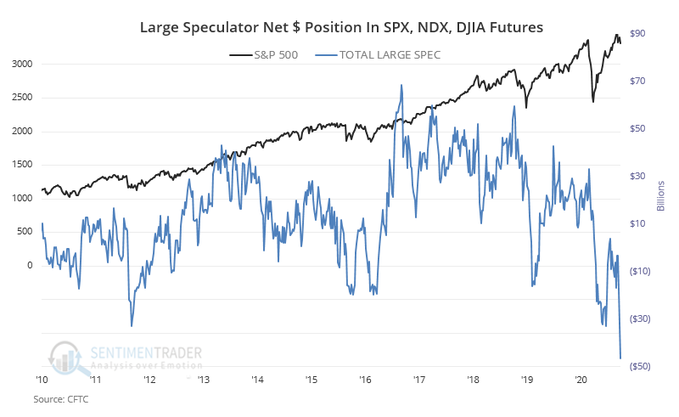

- SentimenTrader@sentimentrader– Sep 18 – Well, here’s one for the bulls. As retail options traders were suffering catastrophic losses, who (of course) was buying?Smart money hedgers in the futures. They’ve moved to a decade-high long position in the Nasdaq 100.

OK, but what does he say now? Does he see another decade-high?

- SentimenTrader@sentimentrader – Large speculators* haven’t had this much short exposure to major equity index futures in over a decade. They’re short about $47 billion worth. * Hedge funds, trend-following CTAs, etc.

Not so fast, says another:

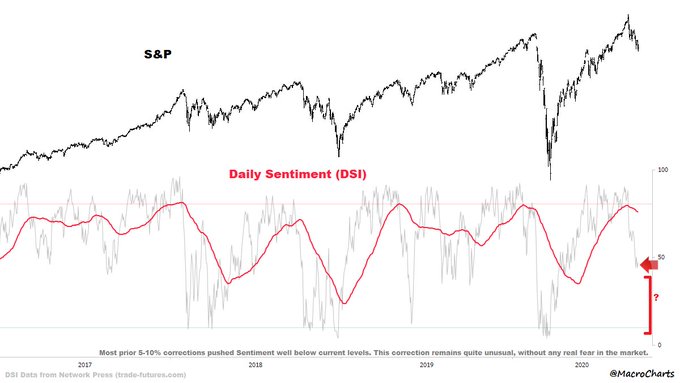

- Macro Charts@MacroCharts – $SPXDaily Sentiment finally cracked below 50% but is still nowhere near capitulation. This looks far from finished… particularly after the 3M average hit Top 2% most overbought in history (34 years) and just turned down. Will revisit this in time – Stay nimble. HAGW!

Consistent with this “not yet” is tweet is the message of the legendary Larry Williams communicated by Jim Cramer:

- ” …. important low coming on or around October 20; that is the signal from both the 70-week oil cycle and the 110-week rate cycle; both major cycle lows coming around October 20 … the bottom is not here but is in sight …”

Remember the other occasion when an important low was made on October 20? That was the mid-morning on Tuesday October 20, 1987, the day after the 87 crash on Monday October 19, 1987 the day after the options expiration on Friday October 16, 1987.

Fast forward to October 2020 to find that October 20 is a Tuesday that follows Monday, October 19 that follows the Options expiration on Friday, October 16. Just weird or scary? Hopefully this history does not rhyme or repeat!!

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter