Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Two MICs of 2020

As 2020 ends, it is important to recall and salute the Most Important Calls of 2020, calls if followed led to huge success in 2020. The first without question is the call by Bill Ackman on Monday, March 23, 2020 that he had gone long. To us that was a clarion call, perhaps because we had already noticed a turn in our own leveraged-unleveraged outperformance indicators on Thursday, March 19. Listen to that Ackman clip now to see what a fantastic call that was:

Remember how horrific the US economy seemed at that time? How could we see a sustained rally without the economy co-operating? Then, two weeks after Ackman’s call to go long, came the following tweet from the Cycle-gurus of ECRI:

- Lakshman Achuthan@businesscycle – This recession will be extremely deep, very broad, but relatively brief. Here’s why: bit.ly/348t7bf

This seemed laughable at that time. A couple of weeks later, Achuthan elaborated on his model of the 2020 recession and suggested that, in terms of duration, “this recession could be among the shortest on record”.

He wrote then about the 3rd D or duration of the 2020 recession:

- “With economic activity plunging so deeply, even a slow, partial opening up of the economy would lift activity off those extreme lows. If that happens, …. the recessionary vicious cycle will flip to a virtuous cycle of a self-feeding recovery. In that case, the recession could end by summertime. If so, this would be among the shortest recessions on record, closer to half a year, compared with a year and a half for the Great Recession“.

Kudos and sincere thanks to the two AAs – Ackman & Achuthan. Without these calls, simple folks like us would have been mired in gloom in March-April.

2. Now What?

2020 ended well. All major stock indices closed at all-time highs, except a small dip in the Russell 2000 and the microcap IWC. Treasury rates closed lower for the past two weeks. US High yield & EM Debt closed 2020 without any hiccups. And Dollar co-operated fully in this Panglossian calm.

Our friends at CNBC kept reminding us how they see smart players getting negative on the S&P 500 both physically & mentally. The action does seem to be factually true. But could CNBC folks prove wrong again true to their record? One smart observer pointed out that the only signal he saw from Volatility was a “Spike Peak” buy signal on December 21. As he, Lawrence McMillan of Option Strategist, wrote on December 31:

- “Volatility is interesting in that $VIX remains at relatively high levels — between 21 and 23 — even though realized volatility is down to 8. Obviously, traders are stocking up on $SPX puts expiring next year, but that doesn’t mean they’re correct in doing so. The only signal we have from $VIX right now is the “spike peak” buy signal that took place on December 21st.”

- “In summary, at this moment, the major indices have strong bullish momentum and are at or near all-time highs. Moreover, we do not have any confirmed sell signals at this time, except for the possible “reversion to the mean” move by the equity-only put-call ratios. So, what could possibly go wrong? Well, there are plenty of sell signals that could be setting up. So, it is necessary to remain bullish but vigilant.”

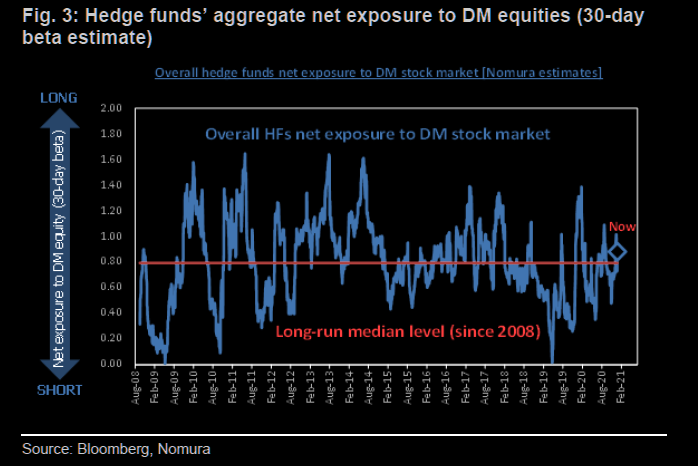

Going back to those smart investors going net short the S&P, we saw the below on December 30 from Nomura via The Market Ear with their accompanying chart:

- “According to Nomura overall hedge funds in DM have brought back their net exposure to above the long run median level since 2008, but positioning is far from extreme according to their model. …. They believe hedgies will need to shift up their risk taking and add more leverage, “next move may look like forceful buying“.

Then we saw the following semi-prognostication from Ryan Detrick:

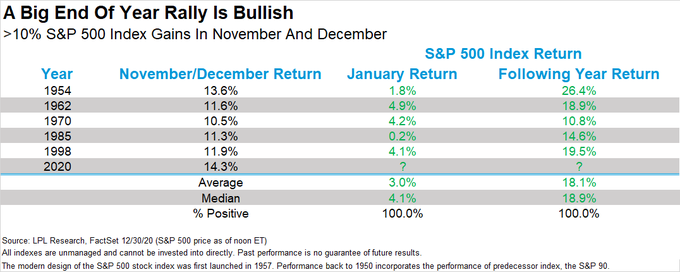

- Ryan Detrick, CMT@RyanDetrick – The S&P 500 is up 14.3% in November and December, the largest end of year rally since at least WWII. What does it mean? Previous times it gained >10% saw the following January and year higher every single time. “An object in motion tends to remain in motion.” Isaac Newton

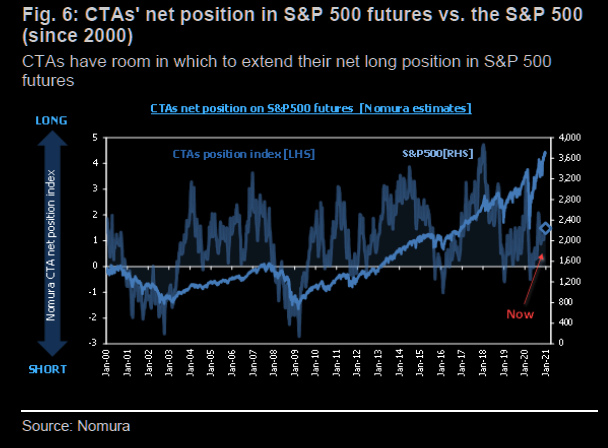

Recall that Tom Lee expects a 10% correction in the February-April period. Could the wonderful chasers, or CTAs as they are called by many, lead a rally in January to create conditions for Tom Lee’s selloff in February? Once again, we point to what we saw from Market Ear on December 30:

- “…but there is much more room to continue buying this market. Why not the January effect, people that missed 2020 need to show they can deploy risk, things start breaking up again, CTAs chase even more momentum, people puke vols post Georgia, vol targeting funds get back in the game and then a great set up for a correction so many have been waiting for.”

January apart, what about the comment by Ryan Detrick about “Previous times it … saw … the year higher every single time“?

- Joe Kunkle@OptionsHawk – Dec 31, 2020 – S&P $SPY buyer 6000 January 2023 $450 OTM calls midday $10 to $10.75 Around same exact time as $QQQ Jan 2023 $400 calls bought 3500X to open as well

3. Treasuries

No one should be surprised to hear that Fin TV is uniformly bearish on Treasuries & expects rates to shoot up in 2021. That makes sense except that Treasury rates have now fallen for two consecutive weeks from 1.696% on 30-yrs to 1.646% on Dec 31. The 10-year yield has also fallen from 94.6 to 91.6 bps. Not major declines but still suggestive of more to come at least to some:

- Albert Edwards@albertedwards99 – Dec 30 – Agree with @LanceRoberts . Defiantly worth keeping a close eye on $TLT. A downside breakout in yields could be the first big surprise of 2021 (T-Bond yield in chart). Weekly Macd has been unwinding excess overboughtness (is that a word?!) since March yield low.

Remember Albert Edwards has been warning about Core CPI falling to zero mainly because of the rent & shelter component. Well, this week we saw the following:

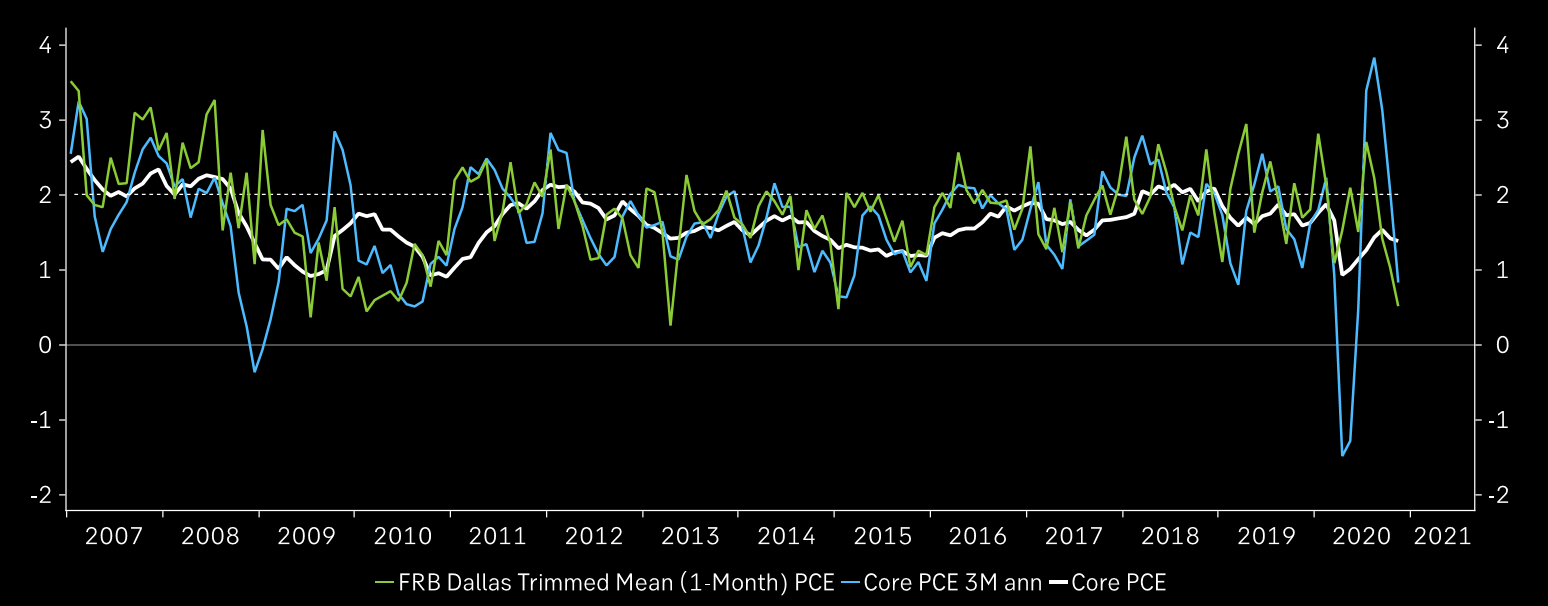

- Market Ear – If the Fed needed another reason: core PCE inflation is now reversing sharply

And guess what?

- Joe Kunkle@OptionsHawk – Dec 31, 2020 – Treasury $TLT notable buying flow for 14,000 March $160 calls $3.30 to $3.40, emerging out of a long base to end 2020

If TLT rallies & Treasury rates fall, could Real-Estate entities be far behind? Interestingly, as CNBC’s Jon Najarian reported on Thursday, unusual buying activity was seen in Vornado (VNO) Jan 40 calls.

4. Divergent Inflation; A Megatrend Change?

What have we seen since China entered the WTO in 2002? While Service sector inflation has waxed & waned, good inflation has fallen consistently & inexorably.

We are glad that DC has finally passed the mini-stimulus that delivers $600 to needy individuals. Those $900 billion should do something to prevent a collapse in consumer spending. But it is not the $2,000 payment stimulus that President Trump was seeking. It seems clear that the Senate Republicans are back into the Fiscal Deficits concerns mode both from their core beliefs & from the need to show clear contrast with free-spending Democrats.

Regardless of what happens later this week in Georgia, the outlook for job-creation seems dim. That means we may be entering a phase of service sector disinflation or something worse if David Rosenberg proves correct. As he points out,

- “If commodities, fiscal deficits, a weaker dollar, and a bloated Fed balance sheet were all that mattered, we would have seen the inflation by now.”

Worse, he says,

- “From a basic supply-demand perspective, we still have a huge deflationary output gap on our hands. Even with the recovery phase, the gap is 5.4% of GDP right now, as of the latest CBO estimate (keep in mind that the unemployment rate is 6.7%,which is at least 2.7 percentage points above full capacity and the industry capacity utilization rate of 73% is still far below the 78% threshold for producer inflation).That is every big a resource gap as we had on our hands in the first quarter of 2009. Core inflation then was 1.8%, everyone was talking about how the Democrats were going to ignite inflation, and instead what we got was the YoY core rate easing to 0.6% by the end of 2010. Yes, yes, with tremendous effort, core inflation finally did get to 2.0% —a little higher even. But it was a good two years into the recovery phase and not before a whole lot of lifting by the Bernanke Fed.”

All this is true but we are already seeing a major change in the US economy? The tremendous surge in the shift to online has meant a multi-year surge in online commerce in America and in US companies.

But there is a flip side of that, as Steen Jakobsen of Saxo Bank, pointed out on BTV:

- “…. the physical infrastructure can no longer follow the success of that ; we have been too successful in digitization and online sales to the extent that UPS-FedEx can’t get vans to do the last mile; shipping rates are already at all-time high levels … infrastructure is no longer able to deal with the success of the online story; … that is inflation itself & on top we have had under-investment in the mining sector for years & years … absolutely inflation is coming back and for the record growth will be much higher than the outlook we have right now …. Fed is one of the worst predictors of growth in the US … ”

So Jakobsen says 10-year Treasury rates will go to 1.50%-2%.

The real scary scenario is where both Rosenberg & Jakobsen prove right. We could get a real problem in the US economy in the next few months with core PCE going towards zero while aggressive efforts to kill the CoronaVirus end up decapacitating service-sector employment in restaurants & local merchants while focus on climate change prevents infrastructure spending in mining, agriculture & energy.

In such a scenario, we could see the Fed increasing their balance sheet to even higher levels & adding stimulus to both credit & stock markets that does nothing for industrial & commodity sector workers. We could see the Fed stimulus, because of its negative consequences on the working class, itself become a political football between AOC-regressive & core-Biden factions of the Democrat party. And Ex-President Trump himself could be a powerful voice against the McConnell Senate Republicans & closer to screw the Climate Change wings of both parties.

With all this, we could simultaneously get reduced consumer spending and high commodity & goods inflation. And what is food inflation also spikes up at that time? That might finally force Treasury rates higher, even above 2%. Wouldn’t that finally force the Fed to start raising rates at the perfectly wrong time in 2022?

On that note, our best recommendation to all is to not get arrogant into 2021 or even too sure what you know. Else you might end up feeling like what Dabo Swinney is feeling today.

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter