Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. Deja Vu in 4 weeks – speed & turmoil

It was like Gamestop all over again, wasn’t it? Wasn’t it whirlwind fast & furious? They were able to do it then because every one was on one side of that boat. It was an attack on large entrenched positions deemed safe. The stampede out of those safe shorts is what caused that entire 6 standard deviation (borrowing a term from Larry McDonald) move.

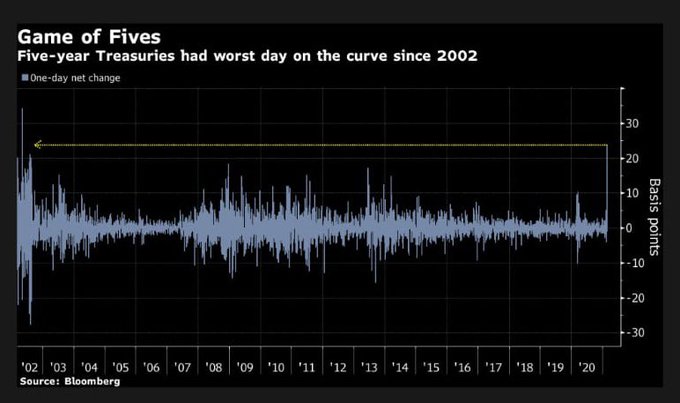

This week’s 6 standard deviation move resulted from the same condition of everyone being on one side of the boat, the 5-year side of the Treasury curve or, more broadly the 3-7 year part of the curve. Remember how FinTV kept crowing about the steepening yield curve. A favorite stock guest of CNBC actually expressed satisfaction on Thursday’s Closing Bell, yes on Thursday afternoon, that rates were going up for the right reasons. What an idiot? The 5-7 year yield rising 18 bps in one day because of “right reasons”?

But there is more here than meets the superficial eye. Look what you see when you compare & contrast the net moves in Treasury yields on Thursday & Friday:

30-year yield up 5.5 bps on Thursday & down 19.8 bps on Friday – Net move = minus 14.3 bps;

20-year yield up 16.8 bps on Thursday & down 17.6 bps on Friday – Net move = minus 0.8 bps

10-year yield up 14.5 bps on Thursday & down 11.9 on Friday – Net move = + 2.6 bps

7-year yield up 18.4 bps on Thursday & down 9.5 bps on Friday – Net move = + 8.9 bps

5-year yield up 18.3 bps on Thursday & down 9.6 bps on Friday – Net move = + 8.7 bps

3-year yield up 9.8 bps on Thursday & down 6.9 bps on Friday – Net move = + 2.9 bps

The 30-year yield, most sensitive to inflation expectations. rose the least on Thursday and fell the most on Friday with a net minus 14 bps down move in those 2-days. So this Treasury flash crash had nothing to do with inflation expectations at least not so far.

In contrast, yields in 5-7 year sector rose the most on Thursday & fell the least on Friday. And the 5-year is the most sensitive yield to near-term Fed moves. Last week, we quoted Bob Michele of JPM Fixed Income saying on Bloomberg Real Yield that “Powell/Clarida/Brainard will try to stop this rise in long duration Treasury rates“. Not only did the Fed Brain Trust failed to stop long duration rates from rising but they created a massive stampede out of the belly of the curve – 5-7 year sector.

And, just like Gamestop shorts, the positioning was massive in the 5-year Treasury. It was deemed as the safest with 40 bps+ yield. Instead of reassuring them this week, Fed Chairman Powell scared them in his “cavalier” manner. That created a stampede out of that corral and it broke the deepest & largest bond market in the world. Just like the Treasury storm launched by Chairman Powell in December 2018? Guess no one can scare them like good old Jay!

- Lawrence McDonald@Convertbond – Worst single day for 5s since 2002… What lending instruments are tied to US 5 year bond yields? FCIs are key. #FinancialConditions

BlackRock’s Rick Rieder was pretty sanguine about the destruction in Treasuries. He said he had sold most of his Treasury & Agency positions. He also wrote an article on Friday that keeping loads of cash & refusing to invest in short duration Treasuries that pay zlich was like using the “Queen’s Gambit Declined” move in Chess. True that!

We wish CNBC’s Scott Wapner had reminded Mr. Rieder about his oft-repeated view that being able to finance at 40-50 bps (raised in about 5-year maturity) was like injecting enterprise value in to companies. But how can companies finance at 40-50 bps now when the 5-year Treasury rate is 75-80 bps? So by his own argument, this 2-day move has already exposed companies to higher financing rates and that is assuming credit markets don’t get infected by this Treasury contagion.

This storm is entirely due to Fed’s appallingly “tone-deaf” (term borrowed from BTV’s Lexington Jon) remarks this week. This 5-year Treasury stampede happened because the Treasury market couldn’t figure out how the Fed can manage or, scarily, whether the Fed will even be able to manage the relentless move in real yields ( from minus 100 bps to minus 60 bps in last 2 weeks).

The Gamestop attack was stopped by the SEC & Robinhood by banning new long positions in Gamestop. As Priya Misra said on Bloomberg Real Yield on Friday – “the Fed needs to step in or its going to get worse” especially with the 10-year auction coming in just over a week.

Forget “in over a week”. Look what ISI was quoted as saying on Friday:

- Thomas Thornton@TommyThornton – ISI out saying the Fed needs to change its tone in 24 hours as yields are getting disorderly. Powell and company should have not been so cavalier about rising yields in my opinion.

Mark Cabana of BAML said on Bloomberg Real Yield at about 1:20 pm that

- “Fed is very concerned primarily with the illiquidity we are seeing in the rates market; they know that is unhealthy; they know it can have knock-on impacts on other markets … they care a lot about credit creation mechanism … but they care most about illiquidity ”

Now look what happened to TLT, the Treasury ETF, during the last hour of trading on Friday:

Was that furious short-covering ahead of the weekend or did some get a signal about a Fed comment on Monday, or even Sunday before Asia opens?

Now look at the above maturity-wise breakdown of yield action on Thursday & Friday and notice that the 30-5 year curve FLATTENED by 23 bps in the last 2 days. Yes, flattened, not steepened. So any surprise that the reflation trades in equities closed down horribly on Friday?

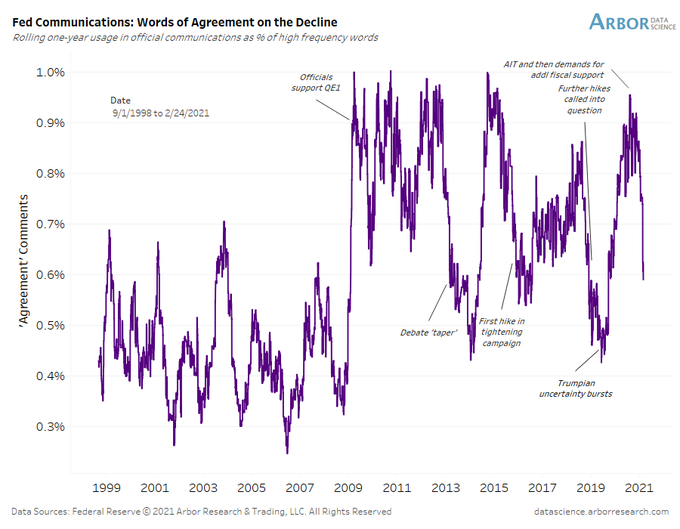

- Ben Breitholtz@benbreitholtz – Well looks like falling agreement among Fed officials did indeed lead a burst in UST volatility. LOTS of speeches to come, curious if ambiguity / uncertainty begins to rise. If so, this ‘great rebalancing of risks’ between stocks and bonds will likely continue. We’ll see!

Now ask yourselves what if Fed-heads Williams, Meister & Bostic say something on Monday that confirms this intra-FOMC disagreement?

2. Oversold?

We know the Fed can’t do much for the long-end of the Treasury curve. But they may not have to given what you see below:

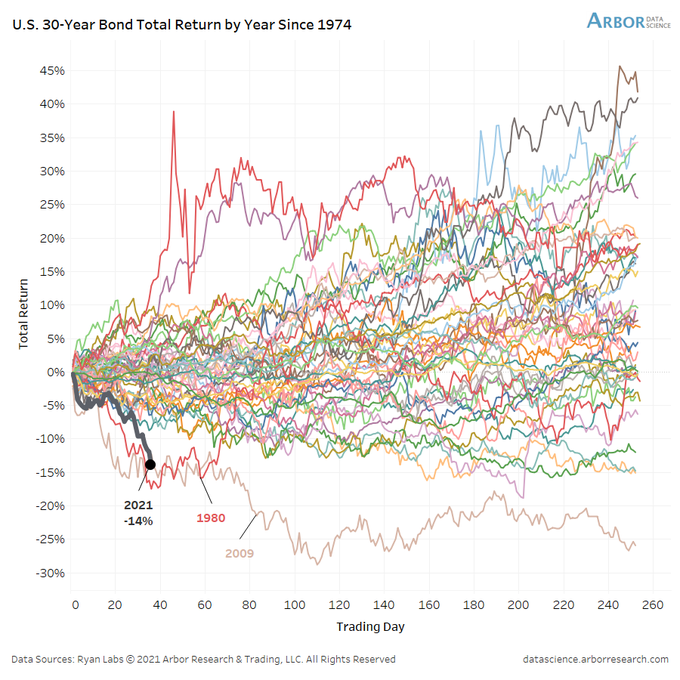

- Ben Breitholtz@benbreitholtz – Feb 24 – Here’s the U.S. 30-year bond’s total return by year since 1974. Only 1980 and 2009 are close comparisons at the moment! These years led to wildly different reactions throughout the remainder of the year.

What about global bonds in general?

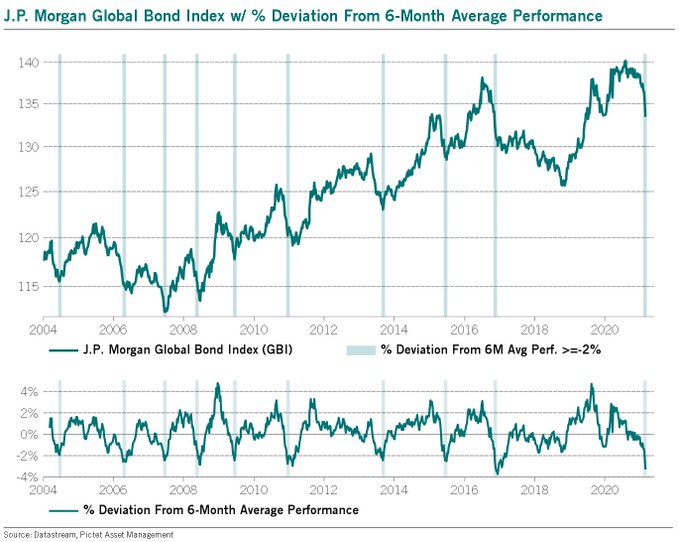

- Julien Bittel, CFA@BittelJulien – Only 10X in the last 17 years have global bonds traded more than 2% below their 6M moving average. This is deeply oversold territory. One to watch.

What about Relative Strength or lack thereof?

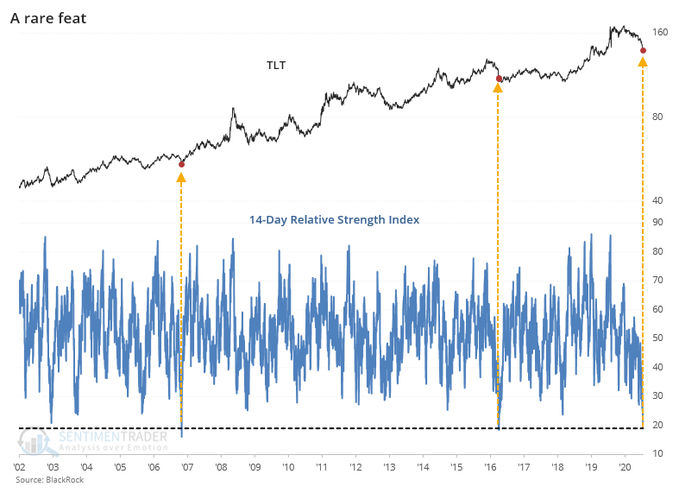

- SentimenTrader@sentimentrader – Feb 25 – Nearing a record low in the RSI on TLT.

What is TLT rallies from here? What stock sectors might benefit the most?

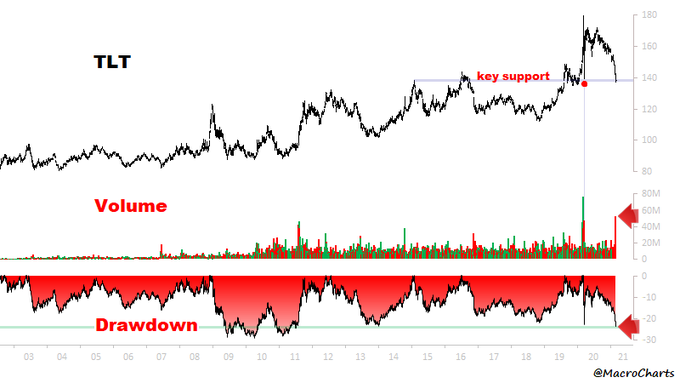

- Macro Charts@MacroCharts – Bonds – time to watch closely: *TLT 2nd largest Volume spike of all time*Record Volume for a DOWN day – prior was 3/18/20 (bottom) *Drawdown near the worst in history, worse than 2013 Tantrum *Price at key support *ANY stabilization could trigger a sharp rally in growth Stocks

That brings us to stocks.

3. Stocks

US Stocks have behaved relatively well in this breakdown in the Treasury market. The VIX did rally 35% on Thursday but only to 28.9. In contrast, VIX exploded up 61.6% to 37.21 on the first Gamestop de-grossing day on Wednesday January 27. But that was a 1-day peak which led to McMillan’s VIX spike buy signal. What if Thursday 35% VIX move to 28.29 also proves to be a peak?

Did Lawrence McMillan say anything about that on Friday?

- “Volatility finally took notice of the market’s decline, and $VIX rose over 7 points and closed near the high of the day on Feb 26th. If it forms a peak there, that will be a new buy signal, but as long as $VIX is rising, that is a problem for the stock market.”

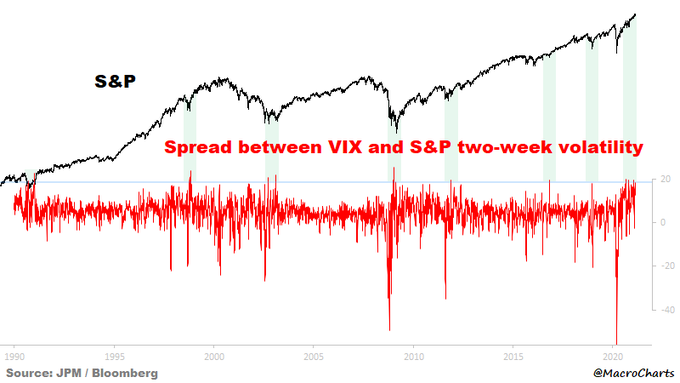

JPM’s Marko Kolanovic said early this week that VIX is in a bubble and if it falls, we would see a rally. He is not the only one who argues the VIX trades way above where it should:

- Macro Charts@MacroCharts– Feb 25 – Fear is too high: The spread between VIX and S&P Realized Volatility is at the Top 1% in data history (source JPM/BBG). 1) Similar to when the global economy was recovering from past Major downturns. 2) If history repeats, the Cyclical recovery may just be getting started.

The primary focus early next week will be on the Treasury market & especially on the belly of the curve. But next week’s data will be also be important. If the data is less strong than expected, then the Treasury complex may cool down & the VIX may follow. Extreme events like the 6-sigma stampede from the belly of the Treasury curve usually do settle down in the next few days and that process might begin next week.

International stocks, especially EM stocks, fell much harder than US Stocks this week. EEM was down 6.7% vs. S&P down 2.5%. Brazil was down over 9%. Indian ETFs fell 3-4% & South Korea fell over 5%. Hong Kong ETF, FXI, fell 8.5% and so did ASHR, the Chinese A-shares ETF.

- Holger Zschaepitz@Schuldensuehner – Fed has lost control of bond mkts – & Europe is victim. Wild moves in $21tn US Treasury mkt have become disorderly. Shockwaves pulsating through fin system. Spillover smashed even into vast Japanese bond mkt, where 10y ylds blew through yld control regime.telegraph.co.uk/business/2021/

Is there one word for this?

- Holger Zschaepitz@Schuldensuehner – It’s the liquidity, stupid! S&P 500 dropped 2.5% this week as global liquidity shrank by $417bn mainly driven by the stronger Dollar.

The US Dollar went up because of fear in the Treasury market. Nothing causes illiquidity & risk aversion like fear. And who is the only player that can reduce this fear? You can call him Jay! How will you see if he is being successful? Treasury selloff reverses & VIX falls. Now that is a consummation devoutly to be wished!

Send your feedback to [email protected] Or @MacroViewpoints on Twitter