Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.“No one can scare them like …”

As we said last week, “Guess no one can scare them like good old Jay!“. You think he would have learned from the week before.

- Jim Bianco@biancoresearch – Mar 4 – Jay is done talking … His job was to calm the bond market. So he babbled dovish and here is the reaction … Jay … the market is worried about inflation and promises of MOAR is not what it needs.

That might be par for the course for Jay:

- Lawrence McDonald@Convertbond – Mar 4 – Pivots, Policy Reversals – Q2 2013 Q1 2016 Q4 2018 Q1 2020

The trouble is that Jay doesn’t fold in just a week or two, as the above cases show. Recall he began his scare- the-markets campaign in October 2018 & kept going until he finally set the proverbial house on fire in the December 2018 FOMC meeting. Then he capitulated & sealed his capitulation in the first week of 2019.

But reversing that stubborn stupidity was both easy & healthy. It was the right thing to do. In contrast, he has a bigger problem now. He really cannot go to Yield Curve Control (YCC) until the 10-year Treasury rate gets much higher. Else he will torch the Dollar and create a bigger problem. What he needed on Thursday was to channel his inner Greenspan and speak in a lingo that no one could decipher clearly.

On the positive side, Friday showed that there is a limit to puking, even puking Treasuries & Nasdaq stocks. That is why, despite a 379K jobs report (vs. 200K expected), the 30-yr rate settled down in the afternoon to close down on the day & TLT closed up a bit on Friday.

Is there a “Tums” available to prevent puking next week? The most effective one might be silence from Chairman Powell & his merry band of talkers until the FOMC meeting the following week. There is another hurdle though – 10-yr Treasury auction on Wednesday & the 30-yr Treasury auction on Thursday. If those go through without too much damage, then rates might stabilize next week.

What might that mean for TLT? Carter Worth of CNBC Options Action, in response to a viewer question on Friday, said TLT could bounce to 150. His rationale?

- “If you look at the history of TLT going back some 15 years, there are 2 other instances when it has been this far below its 15-day moving average – 2009 & 2016. “

Perhaps the best news for both rates & stocks was the action in VIX on Friday after the Thursday. From its peak around 32 at 1:00 pm on Thursday, it felt off its Friday cliff from 30 to 24.67:

What did Lawrence McMillan write about this action in VIX?

- “Volatility has generally remained in the bullish camp for stocks. There is a new $VIX “spike peak” buy signal in place. Meanwhile, $VIX rose above its 200-day moving average, but that is tolerable as long as the 20-day moving average doesn’t follow suit.”

2. Nasdaq 100

The Nasdaq 100 (QQQ) chart below from CNBC’s Mike Santoli is so perfect:

Larry McDonald (@convertbond) put numbers on the otherwise perfect symmetry above – $12 trillion market value lost & dead money for 6 Months. But another chart may suggest some life:

- Macro Charts@MacroCharts – NDX

The Market Ear posted another QQQ chart with the heading – “NASDAQ, the biggest casualty post the rates panic, is down to some big “must hold” levels. … Futures are below the 100 day moving average, which is not great, but we have seen the index trade below it and snap back before.”

The Market Ear added:

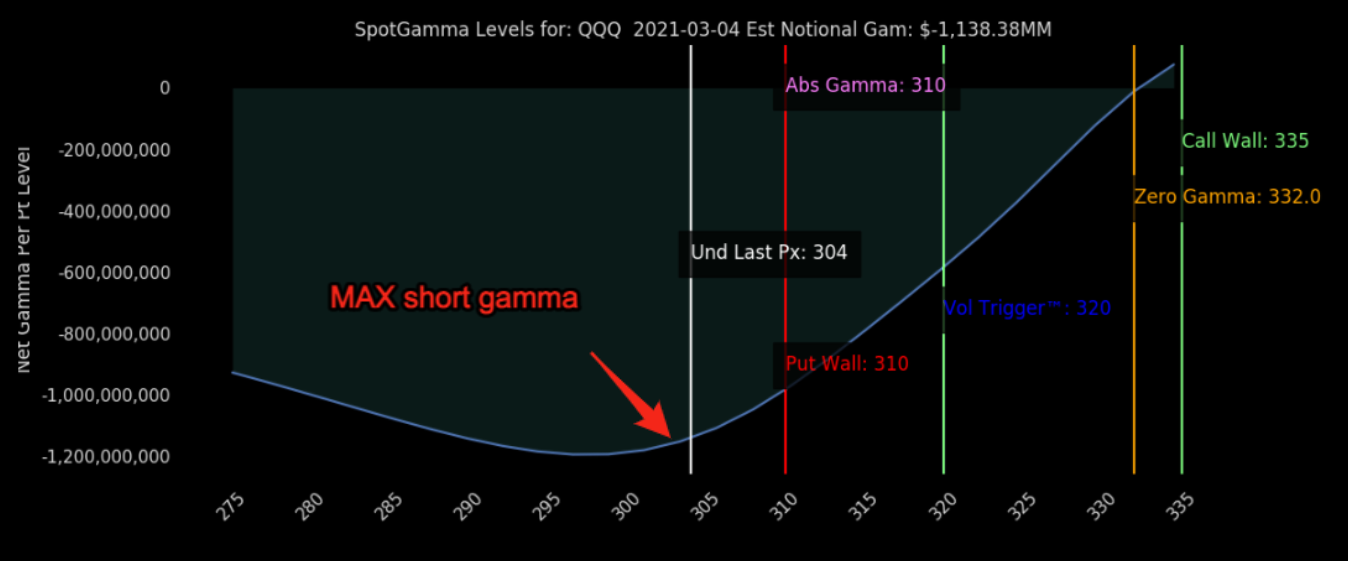

- “Given the fact QQQ is basically trading with a max short gamma here, a possible bounce would be the most frustrating trade for many punters here as the bear narrative suddenly got strong and everybody is now scared for the downside. Should this bounce, short gamma dealers will need to start chasing stuff higher again. If there is one thing this market does well, it surely loves to create max frustration.”

The above were posted after the fact on Friday. Did any one have the courage to tweet positively about momentum stocks on Thursday evening?

- Bob Lang@aztecs99 – Thu March 4 -370 on namot, -186 on nyse…now we’re talking oversold! monster rally will be coming within days.

Tom McClellan had flipped from short to long on Thursday of the week before as he said on this past Tuesday, March 2:

- ” … we flipped from short to long on Thursday [Feb 25] …. there is a little more seasonal softness this week in the first week of March, but then we should see a nice rise in the next week, week & half; there is going to be another stumble later in March but we will deal with that when it gets closer; right now there is more upside to go for the stock market; … the VIX is very important for the flip from short to long last week; … on Thursday, we saw the VIX spike up 35% in one day; generally speaking if you get the VIX to go up 10% on one day, that’s a pretty good sign for a bottom … “

Veteran Tech investor Dan Niles came on after the close on Thursday, March 4, and said that they “covered 70% of their tech shorts on Thursday” and pointed out GOOGL & Facebook are reasonably priced growth stocks with “a lot of runway ahead of them“. He added they will start deploying “cash over the next day or two“.

If rates have stabilized enough to spark a serious NDX rally, then perhaps some over-done trends might be on the verge of reversing?

- The Market Ear – Teutonic shift: Mega Cap Tech vs Unprofitable Tech – The most notable shift this week is in Mega Cap Tech relative to Non-Profitable Tech. This has been one-way traffic for a year, and has started to turn. That is new.

In this vein, Carter Worth pointed out on Thursday evening that the top 5 stocks (Apple, Amazon, Facebook, Google, Microsoft) as a basket were only down 0.17%, meaning “they held up very will in a tech rout“. He also pointed out that the relative performance of NDX to the Nasdaq composite had bounced off the long term trend line which was bullish.

In the above vein, is another broader turn also taking place?

- Macro Charts@MacroCharts – Mar 4 – Why the big picture is critical – especially now: Growth/Value is extremely oversold – RSI hit bottom 0.75% in 26 years. *From 2009-19, led to big rallies. *From 2000-06, led to dead cat bounces to 200dma. IF Growth/Value made a Major top, the next bounce will be KEY to watch.

Meaning if the growth over value bounce is only a dead cat bounce that stops at the 200-day moving average, then this is a period like 2000-2006, a period in which rates went up, commodity stocks went up etc. That is the view Dan Niles expressed on Thursday saying the tech rally he expects will be a “one more surge higher” and then rates will move higher with the “10-year going to at least 2% by late this year“. He added that the “reflation trade … like energy, like banks they have a long way to run“.

3. 2% 10-year yield

The reflation trade & the resultant 2% on the 10-year yield are now accepted consensus because of the stimulus-driven 6%-7% print in US GDP later this year. Priya Misra of TD Securities raised her 10-year rate forecast to 2% on Friday morning, mainly because of Chairman Powell’s speech on Thursday as she said on BTV.

But some smart fixed income managers are openly saying that the impact of the stimulus will be short-lived and then the old factors of demographics, high debt load etc. will again reassert their impact. Scott Minerd of Guggenheim came forward with an extreme forecast of negative yields based on his model. A more prosaic & perhaps more realistic forecast came from Robert Tipp, head of global bonds at PGIM, in a Bloomberg article.

- “His basic view is that the economy will end up in a more sluggish state than at the end of 2019 and that the market returns to 1% after an “absolute peak in optimism about the strength of the recovery“.

In the mean time, Treasury rates shot up this week with 30-yr rate up 17 bps; 20-yr rate up 15 bps; 10-yr rate up 16 bps; 7-yr up 11 bps & 5-yr rate up 8 bps with TLT down 2.6% on the week.

4. Dollar & Energy

We know how shorts have piled on the Dollar:

- Julien Bittel, CFA@BittelJulien – Net speculative positioning remains near record short: -33.5% of OI.

Notice that the Dollar was up 1% this week and the Dollar was the one entity that did not reverse from Thursday to Friday as VIX, Rates & Stocks did:

Is that setting up the following?

- The Market Ear – Mighty dollar pushing higher – Meanwhile everybody hates the dollar and loves the soggy euro. DXY is now “well” above the 100 day moving average, approaching the 92 level. The real big level is at 92.5. This was the support for months last year before the DXY finally broke lower. Who would have thought we would write about the 200 day moving average in the DXY. It is still higher, but not unreachable. Meanwhile, people remain very short the greenback…

Oil was simply great again this week – up 7.5% with the ETFs, OIH & XLE, up 10% + on the week. But would a Dollar renaissance mean a cooling off?

- Macro Charts@MacroCharts – Energy is the most important sector to watch in 2021. This could be the start of a Major recovery – but remember what I said in December: Past cycles had lots of Trend *and* Trading opportunity. The Trend has been nearly perfect. Be prepared IF things change – especially now.

Now compare the above chart to the answer by Carter Worth in Section 1 above. Both this energy chart & the answer by Carter Worth answer refer back to 2009 & 2016 for the last two times the trend in Energy & TLT changed. May be, everything does go back to Interest Rates after all.

In contrast, Tom McClellan said this week, based on the signals from the action in Gold, that “there are many many more months of rise for oil to come, for grain prices & for interest rates for that matter”.

5. A momentous turn

Speaking of big turns & trend reversals, Saturday March 6 2021 is the 50-year anniversary of a momentous turn. Indians have not been winners since they became termed as “Hindus”, a trait that continued even after the British left India. India has produced scintillating cricket players but the Indian team was never a winner in our early childhood. Then a 21-year old young man was selected to the Indian Team in their foray into the mighty, mighty West Indies.

- Amit Paranjape@aparanjape – March 6 – 50 years ago this day…a dawn of a new era in Indian sports…an era of self-belief, attitude, determination and excellence. Mar 6, 1971 – A 21 year old Sunil Gavaskar debut for India in the West Indies. End of the series…he had already amassed 774 runs including a 200.

See! While Amit Paranjape praises Gavaskar’s positives, he missed the most important of Gavaskar’s attributes, the attribute that was far greater and far more unique than others. That attribute was lauded by the all-time iconic Gary Sobers, the captain of the 1971 West Indies team. Sobers called Gavaskar the GOAT of all cricket players & said Gavaskar was so special because “he just hated to lose“. Gavaskar was a winner, in contrast to Hindus who still prefer to be gracious losers just as the British taught them to be.

Sobers knows because his team handled the rest of the Indian batting easily but just could not get Gavaskar out. The result was the first ever series win by India over the great West Indies in their home ground. In fact, the West Indies produced a calypso in Gavaskar’s honor with the theme:

- “It was Gavaskar, the real master, like a wall; we couldn’t out Gavaskar at all, not at all; you know the West Indies couldn’t out Gavaskar at all“

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter