Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.What happened on Thursday?

We know what happened from Monday to Wednesday. Treasury rates were up all three days; VIX was up double digit percentages all three days; and stock indices were down all three days (despite a big rally in NDX on Tuesday afternoon).

The biggest news of the week hit on Wednesday with the CPI number blowing away even the high expectations. So rates exploded up in the morning and in early afternoon and VIX shot up 26% to close at 27.59 after crossing above 28 in the late afternoon. A 2-handle on the 10-year yield was deemed to be just a couple of CPI numbers away.

While the relentless selling of Nasdaq 100 (QQQ) stocks drew all the attention, the Russell 2000 was sold off worse. It was down 3.26% vs. QQQ down 2.62% and, as Tom Lee informed all of us on Friday, it ” actually had a sequential 9 count on Wednesday [DeMarkian lingo]“. He also said on Wednesday after the close on CNBC Fast Money that ““today has the feel of a panic day“. He pointed out that “we have the VIX soaring 30% today after a up move of 40% in 2 days; .. that’s not what happens when the markets peak ; … usually happens at the end of a sell off“. JPM’s Marko Kolanovic had also made similar remarks on Wednesday’s CNBC Half Time Report.

They both turned out to be right on Thursday morning. Stocks were up & Treasury rates were down on Thursday morning. Then a couple of things happened around 1 pm. CDC boss Walensky announced in a televised address that CDC was lifting restrictions for fully vaccinated Americans. While that was clearly positive for reopening stocks & for the economy, it should have been negative for Treasury Bonds. Meaning Treasury rates should have gone up on this joyous reopening news.

There was another negative news for Treasury bonds at the same time. The results of Thursday’s 30-year Treasury auction came out just around 1 pm and they were bad. Rick Santelli gave that auction a D- rating. Treasury rates rose immediately and TLT, the Treasury ETF, fell vertically as you can see in the 5-day TLT chart below.

But then TLT began rallying and, after a couple of gyrations, TLT closed above the post-auction low. And interest rates along the entire Treasury curve closed down on Thursday with the 10-year rate down 4.6 bps.

And strangely, the rally in the TLT and the fall in interest rates continued on Friday with the 30-year rate falling 4.1 bps & the 10-year falling 3.6 bps by Friday’s close. Why? Did Friday morning’s data show a fall in inflation expectations? Just the opposite said Bloomberg’s Brian Chappatta:

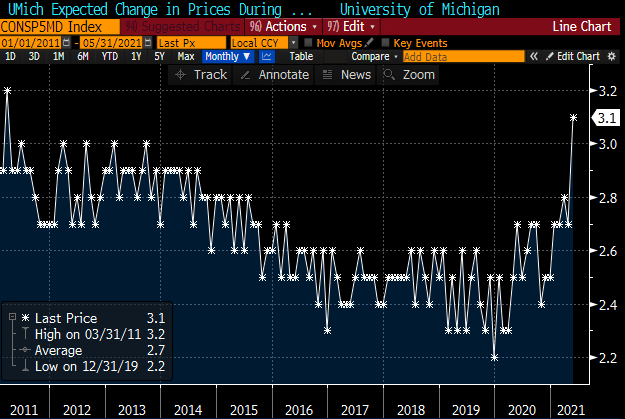

- Brian Chappatta@BChappatta – oh wow UMich 5-10 year inflation expectations surge to 3.1%, the highest since 2011. The 40 basis point increase from April to May is the biggest I see since at least 2001.

So Wednesday’s CPI data was the hottest in awhile; Thursday’s PPI data was also strong; CDC lifted mask restrictions enabling cruises & other re-openings; Thursday’s 30-year Treasury auction was D-rated bad and Friday morning’s inflation expectations were hottest since 2001. Yet in the face of all this, Treasury rates fell hard on Thursday & Friday? This is not just the “dog didn’t bark” Sherlock Holmes tale; here the dog actually turned into a rabbit.

We have no idea why the above happened on Thursday. But is it somehow possible that Wednesday’s explosive rise in Treasury rates becomes a short term top? If it does, wouldn’t that be a risk-on signal besides the CDC’s risk-on signal? If so, wouldn’t Russell 2000 (IWM) & Nasdaq 100 (QQQ) outperform the S&P?

They actually did on Thursday & Friday. Look the SPY-RUT 2-day chart above & notice that Russell 2000 began outperforming the S&P 500 around 1:30 pm after both the CDC announcement & the Treasury auction results.

But what about Wednesday’s DeMark Sequential 9 count of the Russell 2000? Well, as Tom Lee pointed out on Friday’s CNBC Fast Money, the Russell 2000 “on Thursday it did exactly what we needed & on a relative basis to the S&P registered a 13 Buy signal on the combo“.

So what does this highly complicated mumbo-jumbo mean to simple folks? Tom Lee charitably elaborated:

- “… so this happened to energy stocks on April 23rd; what happened 10 days later, nearly a 20% rally; So I think there is a huge rally underway for small caps …” ;

Unlike our own pictorial & simplistic stuff above, Tom Lee gave 4 reasons for his claim that “bottom is in for epicenter stocks” before he gave us the above “huge rally underway for small caps” call:

- “Four important things happened this week –

- first & most important, the CDC lifted essentially all restrictions for fully vaccinated Americans; …. that’s huge for epicenter;

- India cases are rolling over that really takes down the tail risk of a global shut down;

- market had a failed attempt at a crash; VIX didn’t even manage to break 30 after rising 80% in 3 days and now has fallen just about 50%; a big risk-on sign ;

- and then as an extra credit for those who follow DeMark, small caps which we think is a important proxy for epicenter stocks because it is full of epicenter stocks, actually had a sequential 9 count on Wednesday but on Thursday it did exactly what we needed & on a relative basis to the S&P registered a 13 Buy signal on the combo; “

There is quite a bit more in the full clip below including a discussion with the FM team.

The above is fine but what if Treasury Bonds keep rallying? What message might the markets be sending?

2. Commodities

When a confirmed bull begins to wonder about being bullish, you have to ask if it is a sign.

- J.C. Parets@allstarcharts – are the lumber/gold and copper/gold ratios ready to completely fall apart? I think the setup is certainly there. the trade in that scenario would be to own treasury bonds right? something to think about this weekend…

A day before the above tweet. Jim Cramer put in an extra off-the-charts clip on his Mad Money show about similar views of his colleague Carley Garner. True to form, CNBC seems to have hidden this clip from sight of simple folks like us. It’s not even displayed as behind their firewall. Perhaps they were spooked by the “13” number in the May 13 date.

So below is what Cramer said about Garner’s views from our hastily scribbled notes & a weak memory. Those who desire more details should tweet Jim Cramer or CNBC.

- “The basic message was that Lumber prices fell limit down for three straight days and that might be the beginning of a broad commodities correction. Garner feels that the inflation narrative is flawed & the response to Wednesday’s CPI was overdone. She pointed out that most commodities are highly correlated at this time and so the steep fall in Lumber may be repeated in other commodities; She said copper rally has stalled and copper price could fall 10% or we could even see a total breakdown … “

Some are already acting this way:

- Thomas Thornton@TommyThornton – May 13 – Corn futures a recent new short idea

Note that Garner, Thornton are talking about absolute prices of copper, corn, while Parets tweet above talks about commodity ratios. For example, copper-gold ratio.

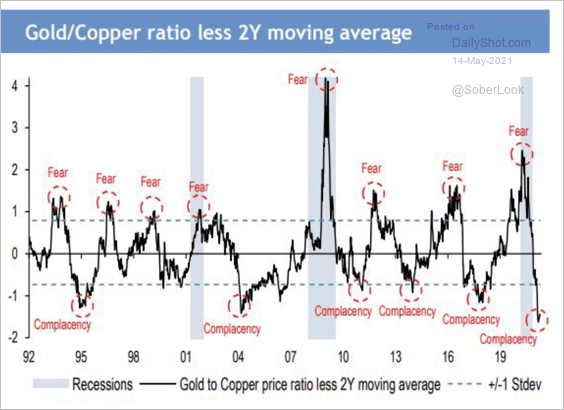

- Jesse Felder@jessefelder – ‘The gold/copper ratio is at an extreme low, which suggests investor complacency.’ thedailyshot.com/2021/05/14/loo via @SoberLook

Hmm, remember the Gundlach dictum – that Treasury yields are inversely correlated to Gold-Copper ratio. So if the gold-copper ratio begins to get off the mat, then Treasury rates could fall. Would that suggest that the fall we saw in Treasury rates after Wednesday’s blazing hot CPI might suggest more than most think?

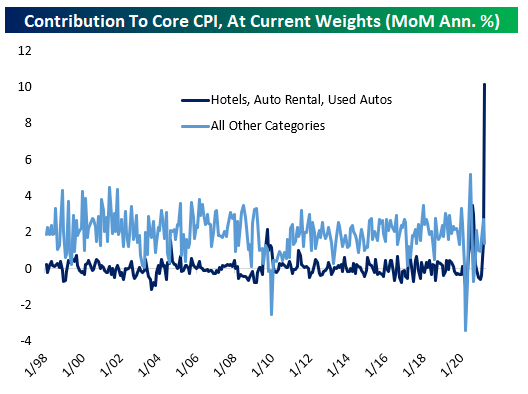

Then you have the following that gives a different look at the blazing hot CPI:

- George Pearkes@pearkes – May 12 – Lol

Now that we are in “economist” area, the two hands custom requires us to mention the following:

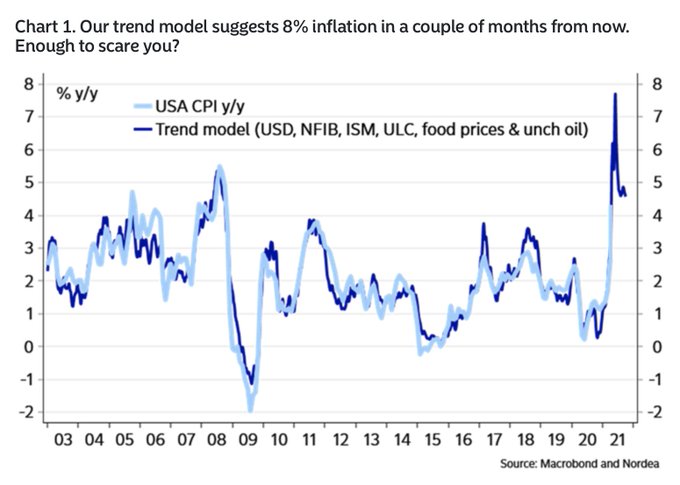

- Jesse Felder@jessefelder – ‘Everybody knows that inflation is coming this spring, and even a baby with a calculator can predict a further rise in the coming months. Our trend-model suggests that we can reach 8% inflation this summer.’ corporate.nordea.com/article/65484/

3. Stocks

Don’t know if you noticed it but all the gurus who came on FinTV this past week said that the valuations of FAAMG stocks were reasonable. Even Stanley Druckenmiller called them “earnings machines” as he said he would be out of the US stock market by year-end. If Treasury rates are going to take a pause, then might FAAMG stocks see better days ahead?

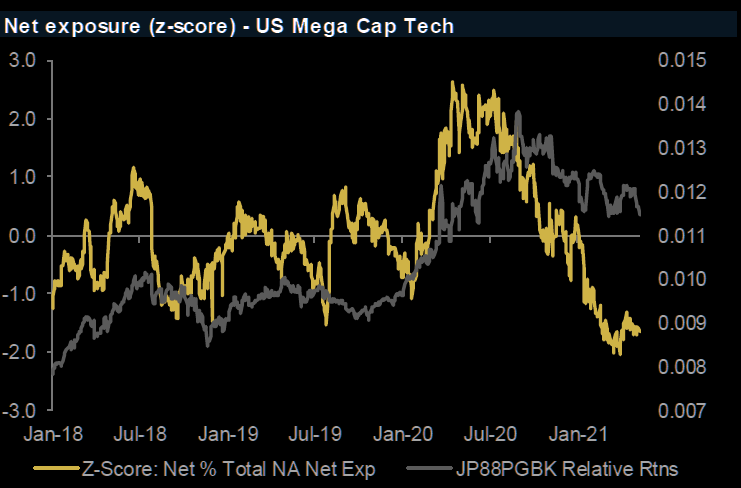

A couple of brave money managers like Victoria Fernandez & Sylvia Jablonski told CNBC’s Beck Quick early this week that they were buying mega tech stocks and Ms. Jablonski reiterated that on Friday to CNBC’s Joe Kernen. We call them brave because the Hedge Funds seem to be positioned against them:

- The Market Ear – Hedge fund exposure to US Mega-cap TECH at 2-year lows – In the US given the focus on Mega Cap Tech stocks as a key pillar of the US equity market and driver of outsized gains in past years, it’s notable that flows have been relatively quiet among these stocks lately. If anything, it seems HFs are looking to use the recent weakness to add some longs as net exposures remain quite low vs. the rest of the book

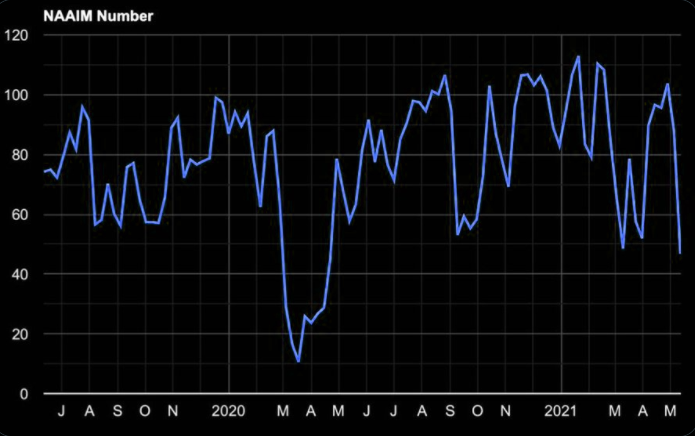

Not just tech but broad equity sentiment hit a low this week.

- NAAIM via The Market Ear – NAAIM Sentiment hitting 12 month low. Expect many other sentiment & positioning indicators to follow this trend lower over the weekend (GS “stretch”, Hartnetts Fear&Greed, MS Risk etc”). Perplexing. Is there any other way to read this than “be hmmmm when others are fearful…”?

Finally, how is a smart trader looking at this week’s fall?

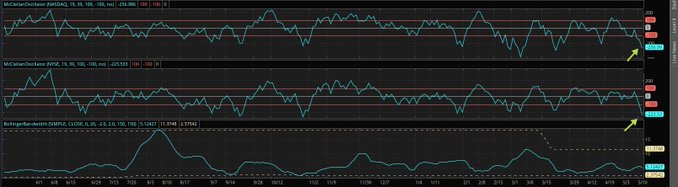

- Bob Lang@aztecs99 – chart of the MCO, nyse and nasdaq. we’ll have a whopper of a rally within a week or so. over 4000 to get oscillator to zero is hella oversold.

4. Indian Market & CoronaVirus

Again this week, the Indian ETFs outperformed the US indices but on a minor scale. SPY was down 1.4% this week while INDY, INDA & EPI were down 69 bps, 70 bps & 37 bps resp. The small-cap iShares Indian ETF SMIN was down 1.1% whereas the US iShares Small-Cap ETF was down 2.1%. Look what the outperformance over the last 3 weeks has done to the year-to-date comparison:

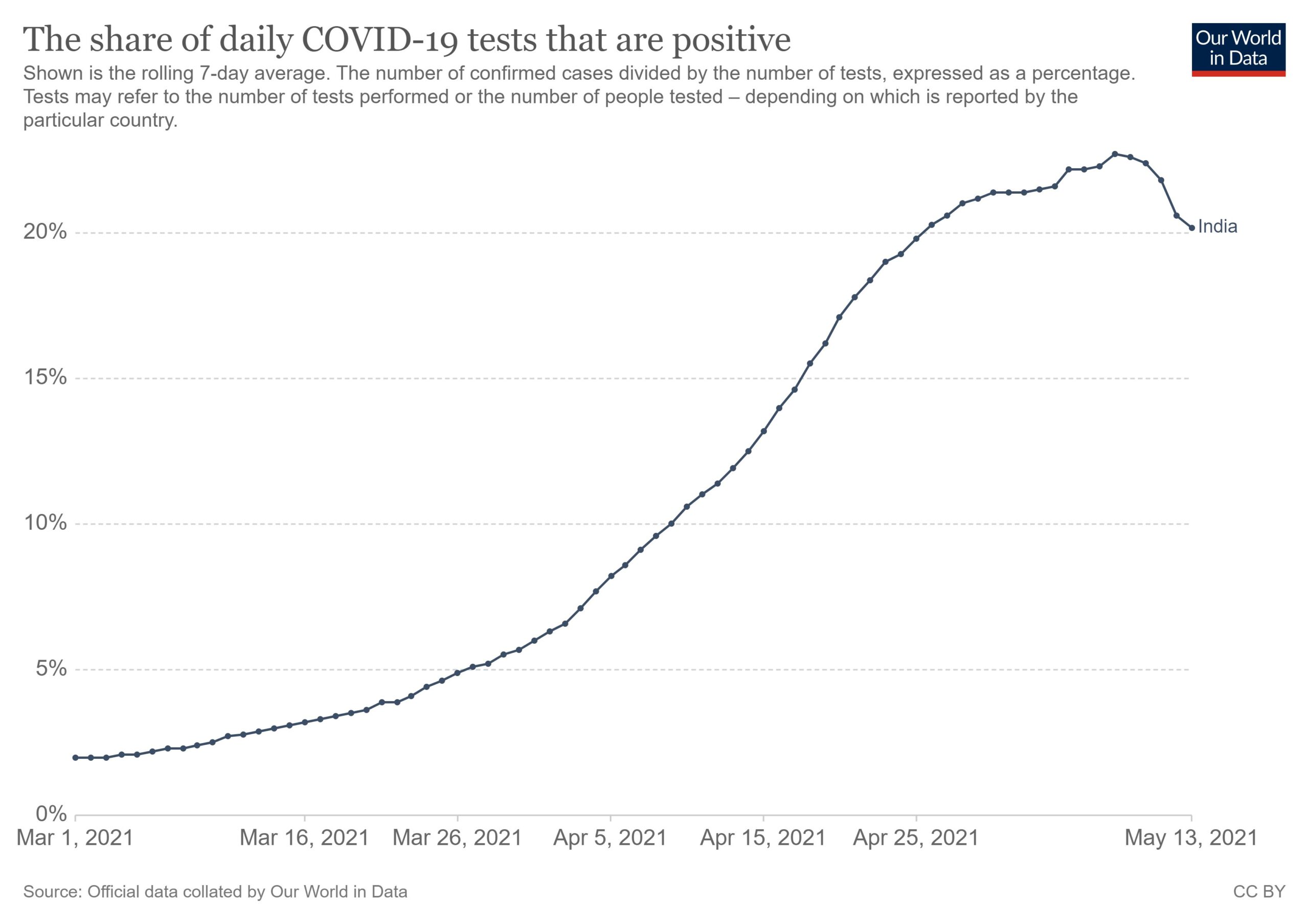

What about the CoronaVirus situation in India? Thanks to @ConvertBond Larry McDonald for retweeting the below:

- Lucio Martelli@LucioMM1 – If you were wondering why you don’t hear as much about India and covid as you did 2 weeks- 1month ago, well this is why.

Last week, we had written that “the Oxygen crisis faced by urban hospitals will be almost over by May-end or early June“. Guess we were wrong in being so pessimistic. We had also written that “all of India is now on a war footing against this second wave“. The mammoth Indian Railway system began transporting Liquid Medical Oxygen (LMO) from industrial towns and ports to India’s mega cities where the demand for LMO is the highest. The first “Oxygen Express” train was on April 19.

And,

- “as of May 12, Indian Railways has delivered nearly 6260 MT of LMO in more than 396 tankers to various states across the country – 407 MT of LMO has been offloaded in Maharashtra, nearly 1680 MT in Uttar Pradesh, 360 MT in Madhya Pradesh, 939 MT in Haryana, 123 MT in Telangana, 40 MT in Rajasthan, 120 MT in Karnataka and more than 2404 MT in Delhi.”

What is being set up now will serve as a foundation for a new transportation infrastructure. The need for refrigeration is leading to a hub-spoke system for transporting perishable items. Walmart-Flipkart is building a massive refrigeration center outside Mumbai with the Adani group for transport of food items across the country. This is why we wrote last week that “This 2nd corona wave will end up delivering to India what the country has needed in refrigeration & transportation.”

The mood of the country is also improving with grief being slowly replaced with humor. And the first topic for Indian humor is always married life:

5. Israel- Gaza

Speaking of sad humor about a dreadful situation, look what our new-found Pragmatic Libertarian. Twitter followee (is that a word?) wrote yesterday:

- Lucio Martelli@LucioMM1 – I don’t understand why Israel is reacting to mostly peaceful rockets

Guess what is the best indicator that CoronaVirus worries are receding in India? WhatsApp messages from India about Corona cases have been replaced by messages about Israel & Hamas. And they reflect the divide between Core Indians and a small but vocal minority of Brit-Indians (BrIndians for short) with the former majority solidly behind Israel & BrIndians condemning Israel. Wonder where our favorite BrIndian, Andrew Ross Sorkin, stands?

However tragic, the situation in Gaza is a relatively localized story compared to what will happen if Hezbollah gets involved from the Lebanon border. The bigger geopolitical issue is the US-Iran negotiations. Assuming that Hamas got its inventory of rockets from Iranian or Iran-backed sources, how does USA keep negotiating with Iran and how might Israel react to that?

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter