Editor’s Note: This is a journalism article that merely expresses our personal opinions and features comments made on Social Media, Print & Television. It is not an investment article. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

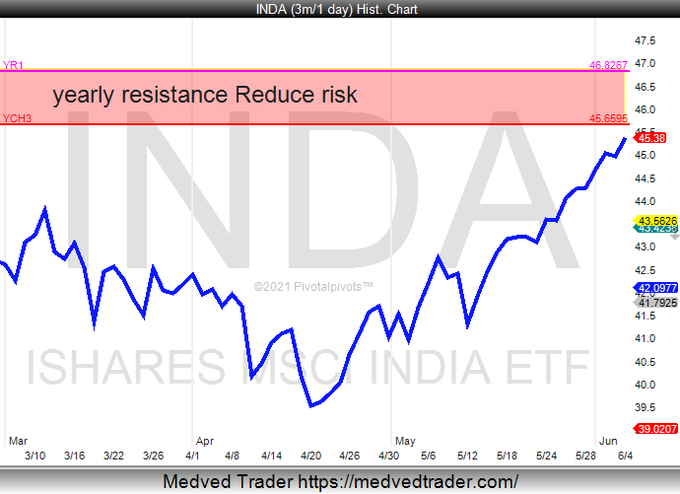

This week the talk was about “the Indian Stock market on fire“. Naturally given that Indian ETFs hit all-time highs 3 days running. What a rally it has been since we asked on April 25 – Indian Stock Market – Is It Time To Get In?

Just look at the performance of India ETFs in both absolute & relative to S&P 500 terms since April 26 – INDA (BlackRock MSCI India); INDY (BlackRock Nifty 50) ; EPI (Wisdom Tree) & SMIN (BlackRock Small Cap):

It has been our adage for a very long time that America & India are very similar countries & people. That is why using American parallels for India has worked quite well & this time it worked phenomenally well.

Another old & proven adage in monetary policy is that when Central Banks start panicking, Investors should stop panicking. The Corona Virus version of this adage is when Heads of State in a democracy start panicking, Investors should stop panicking about the pandemic. Because then the Heads of State marshal all resources & fight back.

President Trump began his fight on Friday, March 13, 2020 & the market gave its first signal on Thursday March 19, 2020. Prime Minister Modi began his fight back in a nationally televised speech on Tuesday, April 20, 2021 and the Indian market gave its first positive signal on Thursday, April 22, 2021 as we outline in our April 25, 2020 article.

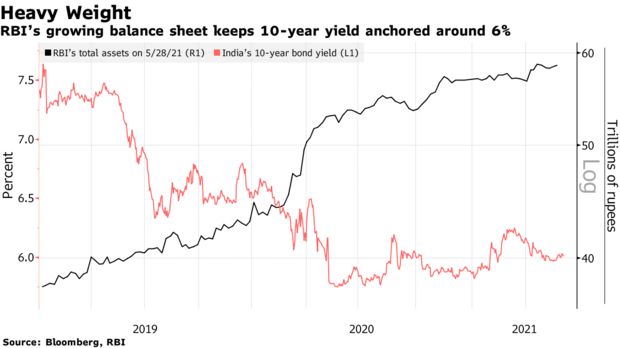

But Heads of State are not enough. After all, stock markets & economies are about money. So what the Central Bank Governors do is critical for a sustained rally. How did the U.S. Federal Reserve (Fed) begin in March-April 2020 and how sustained has it been? Most know but it is helpful to view via a picture that speaks volumes:

- Holger Zschaepitz@Schuldensuehner – Jun 11 – #Fed balance sheet on course to $8tn. Total assets rose by another $16.6bn as Powell keeps the printing press rumbling despite rising inflation. Fed balance sheet now at fresh ATH of $7,952.3bn, equal to 36% of US’s GDP vs ECB’s 77% or BoJ’s 133%.

In contrast, not many know what the Reserve Bank of India is doing except, perhaps those who read Bloomberg.com.

The Bloomberg article, titled RBI Owns More of Its Benchmark Bond Than Yield-Managing BOJ, states:

- The Reserve Bank of India has lifted its holding of the 5.85% 2030 bond to 545 billion rupees ($7.5 billion) or at least 52% of the total outstanding via Operation Twists, two tranches of government securities acquisition program and indirectly via a special auction in February, Bloomberg calculations show. The number is likely even higher if the RBI’s discreet secondary-market purchases are incorporated.

- To be sure, the BOJ hasn’t needed to scoop up as much of the latest issue to maintain its yield target under current market conditions. The BOJ still holds 48.4% of Japan’s government bonds while the RBI owns 15.7% of Indian sovereign debt as of December.

But what about currency debasement of the Rupee as is feared about the U.S. Dollar? But debasement against what is the answer given that every Central Bank is engaged in a similar debasement of its own currency.

But aren’t developed market currencies like Dollar, Euro & Yen fundamentally stronger than the Indian Rupee? Yes indeed. But India has somethings most developed markets don’t – growth (including secular loan growth), inflation & higher rates. That doesn’t mean India won’t see a currency flash crash at any time. How has the RBI hedged against that? This week, India’s FX reserves rose above $600 Billion for the first time.

Speaking about secular loan growth is fine in theory but aren’t Indian Banks hobbled by their notorious bad-loans crisis, especially the mammoth State Bank of India? Yes & No, per a Bloomberg.com article & specifically Bloomberg Intelligence analyst Diksha Gera:

- “State Bank of India’s “earnings will likely maintain pace as balance sheet cleansing is largely over,” said Gautam Duggad, head of research at Motilal Oswal Financial Services Ltd. Retail-asset quality is “impeccable with slippages significantly lower versus peers,” he added.”

- “Return on equity [of State Bank] may rebound by about four percentage points to above 12% in the 2022 fiscal year due to better asset quality, Ms. Gera wrote”

- “Market watchers haven’t been this bullish on State Bank of India in almost two decades, as they bet on the lender’s improving asset quality to help it weather the pandemic.”

Heck, even bearish analysts seem to like Indian Banks as stated in the Bloomberg article:

- “Still, even Societe Generale SA strategists, who downgraded Indian stocks to underweight on Friday, see banking as a bright spot. Banks have been “conservative in lending to retail and small enterprises, the two most-vulnerable segments,” and raised more than $11 billion of equity over the past year that’s helped loan loss provisioning ratios, according to the SocGen note.”

What about fiscal stimulus along the line of America? It seems the scope of US stimulus is getting lowered because of the Biden-GOP divide & a sense of stimulus exhaustion. On the other hand, PM Modi hasn’t even begun a major stimulus drive yet. His base is the poor, lower middle class rural, semi-urban and urban people and he knows them very well. He has already begun with what seems small but what is very important to Covid-hit communities & people – free education for life for their kids.

The big question, of course, is the monsoon and food inflation. If the monsoon is kind, then food inflation will be subdued. If not & even if food inflation is subdued, expect some of the huge $600 Billion FX reserves to be used to import food as necessary.

2. Virus Infrastructure

The above has been mainly financial. But isn’t the real problem the pandemic? Here is where the “When Heads of State start panicking, Investors should stop panicking” dictum paid off. Recall what we wrote in our What’s Next? article on May 9:

- “Based on what we hear from sources we believe to be excellent, the drive being undertaken now is broad, intense & committed. Several have assured us that the Oxygen crisis faced by urban hospitals will be almost over by May-end or early June. A massive vaccination drive is now in full swing as well. So we are told that the “crisis” in Mumbai is nearly over and even Delhi is stabilizing.”

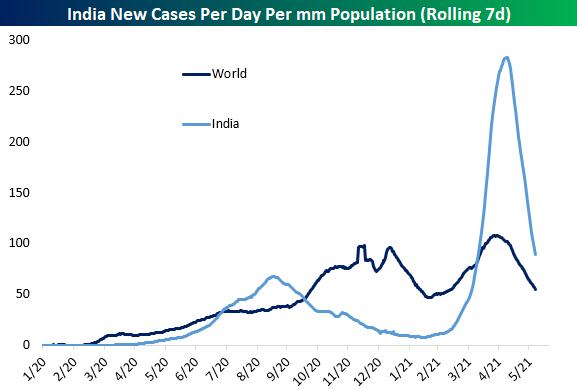

Remember how huge the spike was in Oxygen demand?

- “Medical oxygen consumption in India has shot up more than eight-fold from usual levels to about 7,200 tonnes per day this month, said Moloy Banerjee of Linde Plc (LIN.N), the country’s biggest producer.”

No one in the US media pointed out that there was an Oxygen surplus in other Indian states & so the real bottleneck was transportation infrastructure. Reuters got a informed executive source to predict:

- Reuters@Reuters – April 29 – EXCLUSIVE India’s oxygen crisis to ease by mid-May, output to jump 25% – executive reut.rs/3u4bHsn

But what about the huge upswing in Covid cases, the upswing that was used by all Western Media to attack India, mainly as some have argued, in a transparent attempt to undermine the Modi government. How wrong were these hate-monger regime-change driven media?

- Bespoke@bespokeinvest – June 7 – India’s decline in COVID cases from its early May peak has been just as steep as the spike higher in April.

So the downswing in Covid cases & upswing in Covid treatment & Indian economy had already begun by the time we wrote the following in our What’s Next? article on May 9:

- “There is no doubt that all of India is now on a war footing against this second wave. And this effort has long term positive consequences especially in terms of a new private-public joint action. A robust supply chain infrastructure is being established on a war footing and it will only be upgraded & broadened in the next few years. This 2nd corona wave will end up delivering to India what the country has needed in refrigeration & transportation.”

That seems to be proving true. India is not celebrating success against the 2nd wave in June 2021. They are preparing on a war-like footing against a potential 3rd wave. And the Indian health-care infrastructure buildup is not only critical for India but for all of Asia & even Europe-Africa.

In our optimism, we had made a bold forecast in our May 9 article:

- “This second wave has been like what the disaster at Pearl Harbor was to America in 1941. But that disaster led America to a major restructuring of Naval Strategy & the Navy. What America implemented in the couple of years after 1941 is still operational in US Navy today. We feel strongly confident that what India is building now & what India will build in the next couple of years will show a huge payback in years to come.”

If we are even half right about such a future, should any one really shed tears about missing the huge May rally in the Indian Stock Market?

3. What Now in the Indian Stock Market?

We ourselves are not interested in short term wiggles or corrections. As many like Bond-King Jeffrey Gundlach, we are long term bullish on India. But many are concerned about short term pullbacks & rightly so. So we simply present below two different views without any opinion about either of them:

- See It Market@seeitmarket – – India Stock Market Breakout Signals Bullish Continuation Higher – seeitmarket.com/india-stock-ma blog by @MikeZaccardi $INDA $EEM $SPY

On the other hand,

What about those who want to get in? That was a question asked on this Friday, June 11, to one of the smartest macro thinkers & investors in the world. See what he said (from minute 35;25 to minute 36:45)

A participant asked Raoul Pal:

- “I have been waiting patiently for a pull back in Indian stocks; when would be the right time to buy $INDA?“

A frank & longish answer from Raoul Pal:

- ” I have struggled to buy India for exactly this reason; it never gets cheap; it never corrects enough & then stays down. So I don’t know – I think the only way is to average in; I don’t know how to do it. I have struggled over the last 10 years; I have invested in India on & off; I mean it just goes up; and every time it corrects, it corrects really sharp; you think great – it will stay down for awhile; it doesn’t; it just goes back up again; I guess that happens when you are financializing 1.3 billion people that put money into their pension plans; so the market doesn’t stay down for very long; So the answer is I just don’t know how to do it; … in that case, I just tend to average in .. But I am terrified I am going to look like the idiot for buying the top; … just average in say over 3 months; do it every week – see where it gets you … “

Some will read the above answer & recognize the sagacity in it. Some will read it & scoff saying -“what’s the big deal here; anyone can say that“. In our humble opinion, the latter should stay away because the probability that they will be wrong both going in & coming out is high.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter