Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.“blow-hot, blow-cold” or a sleeve-gun?

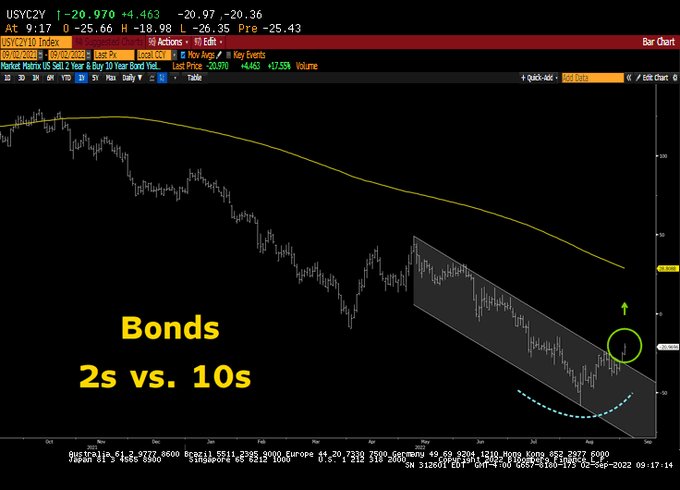

Remember the FinTV storm on Jackson Hole Friday about the Fed’s “renewed” commitment to raise rates higher & longer? In our simple stupidity, we had labeled his talk as “blow hot, blow cold” Fed-speak. Then came the Non Farm Payroll Report this past Friday. Most thought it was strong & even those who demurred didn’t say it was bad enough to change the Fed’s mind about their highly publicized determination to raise rates hard & long. So the 2-year Treasury rate should have gone way up, right?

Guess that’s why they open the markets every weekday! Because, as CNBC’s Mike Santoli told viewers on Friday after the close, the 2-year yield is now below what it was pre-Jay Powell speech. What gives?

Was Chairman Powell just mouthing off his hot & hawkish belligerence without bullets in his gun? Or was he hiding his sleeve gun while the entire world was focusing on the shiny colt in his holster? We think the latter. And remember, as fans of Louis L’Amour westerns know, the hidden sleeve gun is what ends up killing the other guy.

It was a sleeve gun that Chair Powell held during his soft Avataar during the post-FOMC presser in July, the gun he promised to fire in September. And it was the same sleeve gun he held during his torrid talk at Jackson Hole. And, true to form, Powell’s sleeve gun killed the bad guy.

The bad guy, as the previous super-dove Kashkari made it clear, was the steep & intense stock rally that followed Powell’s FOMC presser. It was that rally in stocks that both enraged & frightened the Fed because a) it made them look like impotent fools & b) it loosened financial conditions & spread cheer when they are desperately trying to slow down the economy. So they killed it this week. The stock market fell 1,000 points on Jackson Hole Friday & fell 4 out of 5 days this week.

So why did the sleeve gun or QT kill off the rally so quickly? Because, as Peter Tchir said on BTV Surveillance on Monday, QT goes directly to asset prices:

- ” … QT is starting to ramp up & QT behaves very very differently than rate hikes; .. why long end Treasury yields are behaving poorly this morning is people are starting to realize QT is coming & that behaves differently than rate hikes & goes directly to asset prices .. you are going to see everyone move down the risk curve; that’s going to be tough for stocks to overcome … and how liquid are these markets? Friday was ugly but Friday was a very thin market; & what I find most difficult to talk about … market liquidity in Treasuries is way worse than it was last summer… I am actually much more bearish than that [jackson hole consensus that recession is next year’s business] ; I think we have already turned the corner in the economy in a negative way … we are seeing things roll over & I am going to bet that by December we are complaining about deflation & real problems in the economy rather than inflation .. I think we have got too far too quickly … things are turning, things are rolling over … I don’t like what I am seeing in housing .. people have gotten far too complacent …”

Fast forward to this past Friday and read what SocGen’s Subadra Rajappa said on BTV Real Yield on Friday afternoon (minute 8:20 of the clip):

- “… what I am really concerned about with QT is the fact that a lot of the reason why the Fed purchased the assets in the first place was to provide liquidity in the Treasury market; my concern is that, as they kind of step away from the market & start tightening liquidity in the system that you might see some disruptions in the Treasury market & secondary market trading and the liquidity in the Treasury market might deteriorate further; that’s what I am watching closely right now; liquidity conditions have worsened to the point where we were back in March 2020; that’s something the Fed has to be tracking closely as they are unwinding their balance sheet … “

Then Robert Tipp of PGIM pointed out a couple of liquidity impacts he is seeing:

- ” … the spread between the cheapest securities in the market that are less liquid & the most liquid richer securities in the market – that spread has widened; bid-offers on off-the-run Treasuries have widened and the fragility in the non-Treasury market has really increased … “

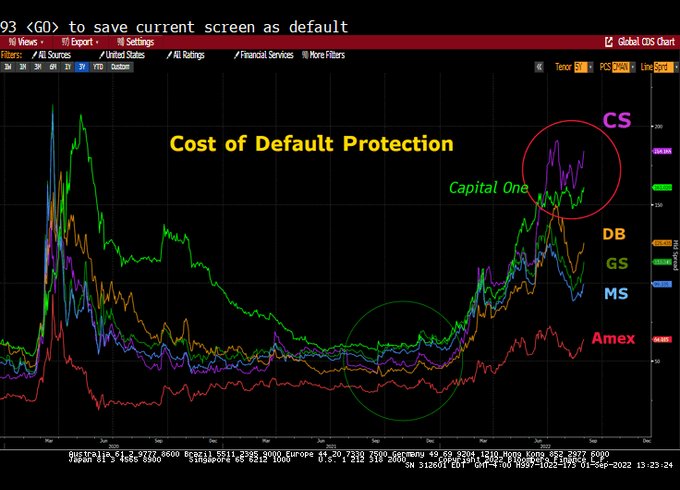

When you read about fragility in the non-Treasury market, liquidity down to Covid panic lows & you notice we are in September, do you feel like singing Come September or do you recoil in fear & start buying protection on bank credit? Look what one man who went through a previous mega-bad credit September tweeted on Friday:

- Lawrence McDonald@Convertbond – – Last 15 years – economic data does NOT drive major Federal Reserve policy path decisions – credit risk does – STOP the delusions.

But why did the market blow up on Friday after the Gazprom decision to stop gas into Nord Stream? When markets blow up, you look for money illiquidity & when you think that, spell “banking”.

- Lawrence McDonald@Convertbond – – Why did equities stage such a stark reversal today? Putin knows a hard Russia (Nord Stream) line blows up the European banking system. He has all the cards. How do we stop this lunatic?

And, in the face of this, the ECB wants to raise interest rates in Europe by 75 bps next week?

- Robin Brooks@RobinBrooksIIF – – This week’s price action illustrates what’s driving Euro lower. EUR/$ goes above parity early in the week on excitement over a 75 bps ECB hike. Then Putin turns off Nordstream & EUR/$ falls back below parity. The lesson: look “through” the ECB and focus on the coming recession…

On the other hand, what happens to the balance sheets of European Banks if the Euro falls fast & hard? On that topic, is China about to devalue the Yuan?

- Otavio (Tavi) Costa@TaviCosta – – Chinese yuan devaluing again but this time feels different than 2015. No one cares and only very few investors are positioned for it. China’s banking crisis will make Lehman Brother’s collapse look like a walk in the park.

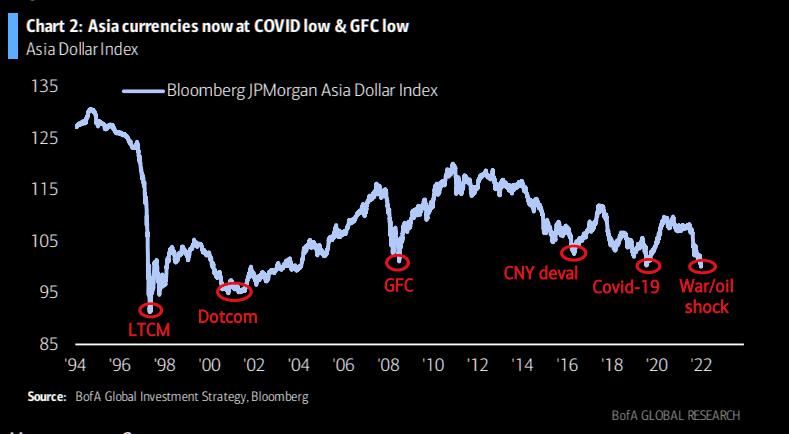

We wouldn’t know because we prefer cabs to walking in the park or anywhere else. Things can’t be so bad when Emerging Market currencies are doing fine, right? At least the “safer” Asian currencies?

- Via The Market Ear – Remember ADXY? – Hartnett reminds us that Asian currencies, ADXY, now trade at COVID low & GFC low….he adds “if oil drop unable to ignite bid for Asia oil importers (yen, won, rupee) = global recession signal“.

Coming back to our safe & strong currency land, our companies are doing fine both in sales & earnings right? Why should we worry about what is going on Europe, let alone all those other countries? Frankly, we are sick of that mess & even more sick of Mike Wilson & Eric Johnston scaring us about earnings destined to fall? It is so much nicer to hear the really smart money-managers in Wapner’s CNBC “investment committee” scoff at all the above type of worries. We wish to agree with them but then we see something like below:

- Endless Capital@endless_frank – I don’t think most Americans realize how dire the situation is in Europe. If your utility bill went from $250/month to $2500, discretionary spending would get obliterated. The EU makes up 25% of $SPX earnings. Corporate earnings will fall off a cliff as the weather cools.

So what do we need? First & foremost, we need the U.S. Dollar to fall fast & hard. Is that likely? Not according to Ebrahim Rahbari, Citi’s global head of FX analysis, who said the “Dollar still goes meaningfully higher” on Thursday evening on Bloomberg China Open. He expects the Dollar (DXY) to get to 115 (it closed at 109.61 on Friday).

As a final note in this section, does it say anything material when a classically long term investor sells & sell big?

- Otavio (Tavi) Costa@TaviCosta – – The Swiss National Bank just sold its largest amount of assets in the history of the data. $55B in the last 12 months. Let’s be clear: This is not the backdrop of excessive central bank liquidity that drove markets to today’s insane valuations. Quite the opposite.

Yeah, those Swiss! What do they know about safe money, right?

PS: Is there a more iconic sleeve-gun scene that the one beginning with Cuchilio – count to three

2. A big reversal?

This was a bad week for bonds:

- TLT down 3% on the week; EDV down 3.9%; HYG down 2%; JNK down 2.1%; and EMB down 1.7%; 30-yr up 15 bps on the week; 20-yr up 19 bps; 10-yr up 16.5 bps; 7-yr up 14 bps; 5-yr up 11 bps; 3-yr up 5.5 bps;

Thursday was especially bad, so bad that:

- David Rosenberg@EconguyRosie – – “This all smacks of the Fall of ’87. As was the case back then, stay the course on Treasuries and try to be patient.” #RosenbergResearch

Then came Friday and what Steve Weiss of CNBC Half Time called a “major reversal in 10-year yield“. He was not alone with Emily Roland of John Hancock saying

- ” … then we see this big backup in the 10-year Treasury yield & we think that is about right; … we think embracing bonds right now does make a lot of sense .. ”

A day before, Ian Lyngen of BMO had made a peak for this cycle call:

- ” .. I still think that we have seen the 10-yr yield peaks for the cycle but it would have been a lot more of a compelling argument is we were at 2.51 as recently; it is certainly going to be an interesting next 2-3 weeks in the run up to the Fed .. if we break 3.50%, it will be between now & 21st of September & that would be a massive buying opportunity for a lot of investors… “

Next two weeks could indeed end up being critical for the direction of interest rates. In the meantime, the question remains:

3. What might a Fed pivot mean?

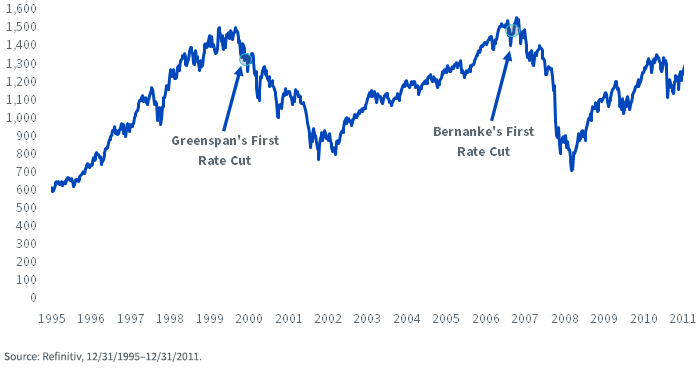

Since Powell’s July FOMC presser, the question of a Fed pivot has been raised. The media consensus seems to be that at the sign of a Fed pivot, there would be a big rally. Is that valid & even if we get a rally is that rally sustainable?

That brings us to what David Rosenberg said in his appearance on BTV Surveillance on Tuesday August 30. The best place to hear the entire discussion by David Rosenberg is the Bloomberg Podcast. Some excerpts are below:

- “… what happens historically is that Fed pauses, then you get a relief rally; then once again recessionary pressures take hold – so when they pause, you want to be very wary about the relief rally; you can rent it, not own it; even after the first rate cut in a recessionary bear market; the market does not bottom after the first rate cut ; you know when the market bottoms? after the last rate cut when the market sees whites of the eyes of the recovery , that’s the fundamental low; that might be 12 months from now … history rhymes … “

Interestingly, Wisdom Tree published an article on this topic titled It’s Beginning to Look a Lot Like 2001.

- The futures market anticipates the Fed’s most likely path will be a tightening of policy from the current 2.25%–2.50% range clear to the 3.50%–3.75% area, perhaps around the December meeting. The futures market then sees the Fed on pause to mid-2023, maybe beyond. The rate cuts would then begin sometime thereafter, in an “out” month.

- That rate-cutting program, should it come to pass, could also take some time. It might go on for a year, or two, or three.

- Even so, that may not be enough for the stock market, if the 2001 and 2007 rate cut experiences are anything to go by. …………. “Greenspan pivot,” along with Bernanke’s September 2007 pivot. Both came nearly two years prior to the stock market’s ultimate bottom.

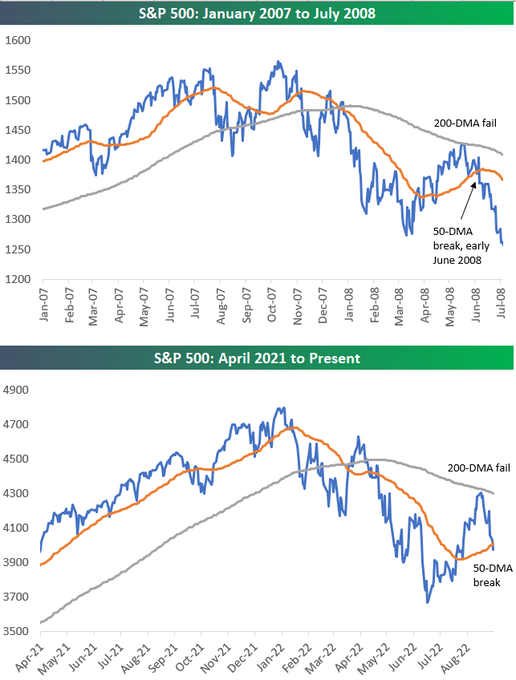

Double interestingly, Bespoke published excellent charts that compare this year to the 2007-2009 period:

- Bespoke@bespokeinvest -Aug 30- After a 20%+ drop from highs in January, the S&P saw a big rally off its mid-June lows but stalled at its 200-DMA and is now breaking back below its 50-DMA.

Bespoke points out that the pattern emerged in June 2008 as well:

Does this mean much? We don’t know but it is indeed interesting to see how many different entities are discussing chart similarities with 2008.

The lesson we draw is simple – the longer the Fed waits to pause & cut, the more recessionary impulses get entrenched into the economy. Then it takes a long time & a long rate-cuts campaign to emerge out of it, not to mention big big QE.

4. Year-end 2023

We just can’t end on the above negative notes. So we go back to the W.C. pair that has been a winner this year. On Monday, August 29, Jim Cramer published the views he heard from Larry Williams about the parallels Williams with 2022. Specifically, the clip below discusses 2014, 1962 & 1891 as years that looked like 2022 so far & they featured terrific rallies in November-December. Watch the clip below to at least end your reading experience on a positive note:

And not all markets are down this year.

- J.C. Parets@allstarcharts – – India is wondering what bear market you’re talking about as the NIFTY 50 closes the month at new all-time highs

In fact, all India ETFs we follow were up 50 bps to 1.7% this week in a sea of negative EM ETFs . To be frank, that was because the 2.5% ramp on Wednesday ahead of Thursday’s holiday for the annual Ganesh festival. Ganesh is celebrated as Vigna-Harta, the removal of all obstacles. There is no one loved more or celebrated more. Each area celebrates Ganesh according to what they do best as Indian stock bulls did on Wednesday.

Surat may have done it best this year. This city of diamonds celebrated Bhagvaan Ganesh with a huge Murti (representation) with reportedly 150,000 diamonds installed in a beautiful pavilion accompanied by 108 smaller murti. Watch the clip below to see how many diamonds are on the large Murti:

What we found astonishing is the visible lack of security in the pavilion with pure gold ornaments & diamonds in the open! Guess no thief or atheist would dare to violate a Ganesh Murti or its pavilion!

Finally having mentioned Subadra Rajappa above, we must ask whether there is another elopement/abduction that is celebrated in multiple countries for multiple centuries as that of Subhadra of the Mahaa-Bhaarat? Several years ago, the WSJ had published an article (on page A1) how Indonesian brides wait by their windows the night before their marriage to run away with the bridegroom. We also saw, during the evils of ISIS, images of how Yazidi brides do the same in Syria & Iraq. That is the famous Subhadra-Haran, the consensual abduction of Subhadra by Arjun in the Mahaa-Bhaarat.

By the way, the term “Bhadra” stands for a noble good of the highest order and Su is the prefix signifying positive good like Su-svar (lovely voice), Su-muhurta (auspicious occasion) etc. An embodiment of Bhadra is now the new ensign of the Indian Navy as discussed in our adjacent article Mental Independence & Strategic Expansion – INS Vikrant.

May Bhagvaan Ganesh remove all your obstacles

Send your feedback to [email protected] Or @MacroViewpoints on Twitter