Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Mirror Mirror who is the best trading house of them all?

Ask & the mirror will simply show you the following chart:

The most consequential Fed pronouncement was the April 5 threat by Brainard to launch QT at financial markets. Look what the stock market did from that day to mid-June. Then, at the height of a 100 bps rate hike fear, Waller came in & took that fear away just as the Fed’s sound-out began. (Who doesn’t think terms that suggest Black is bad like blackout are core racist?)

Watch the beautiful rally begin with Waller’s comment & catapulted by Powell’s presser. It was just too much. So Powell attacked it at Jackson Hole. To what extent did his attack succeed?

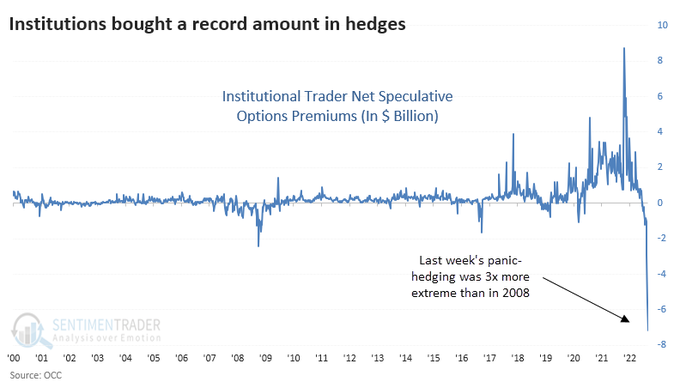

- SentimenTrader@sentimentrader – – Sometimes, there’s a chart that just blows your hair back. In 22 years of doing this, none stand out like this one. Last week, institutional traders bought $8.1 billion worth of put options. They bought less than $1 billion in calls. This is 3x more extreme than 2008.

So what would you do if you were Powellard Trading (or Brainell Trading)? They launched 2.5 Days of Brainell*:

Wow! The 2.5 days of Brainell took the S&P up 4.7% rally from this week’s lows. All with just by 1-2 sentences interspersed in several sentences of hawkish rhetoric. The rally in QQQ was even more fierce.

The Brainell buy signal was so obvious that CNBC’s Scott Wapner saw it in real time on his Half Time show. Watch & hear him say that to Steve Liesman, Fed’s MOS, to use the traditional British salutation (Didn’t most British letters end with “I have to remain, Sir, your Most Obedient Servant?” Pathetically many BrIndians take pride in using that phrase even today).

Seriously folks, which trading house has a more perfect track record than this Brainell/Powellard Trading LLC? (perhaps ZLC is the better structural term because they literally have zero liability for their actions or inactions)

Double seriously, we have developed significant respect for this trading outfit. Look at their timing and recognize their sure & super-DeMarkian hand at reversing a trend at its peak, whether it is killing rallies or ending sell offs.

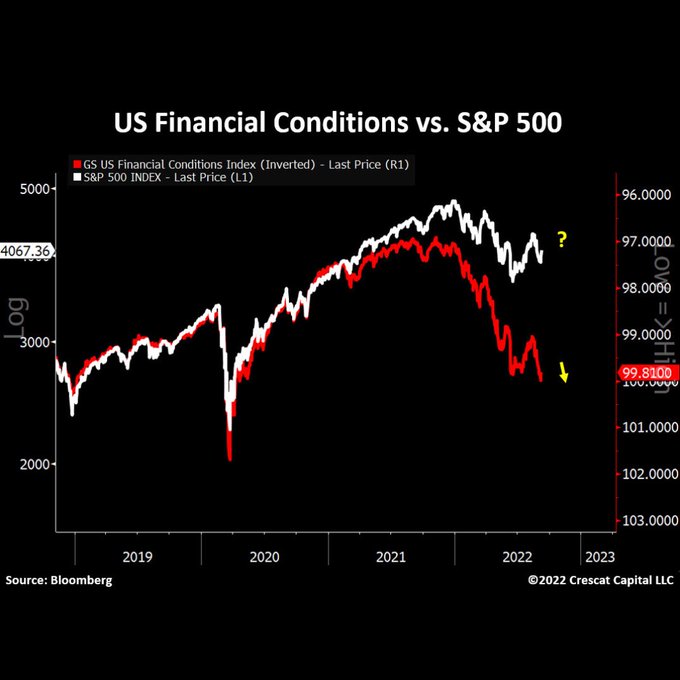

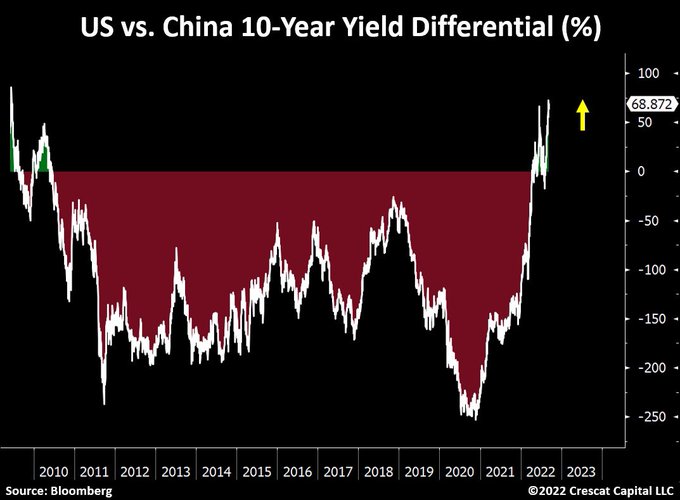

We believe that they know they & hence the entire world is caught in a bind. A bind between the need to tighten global financial conditions (driven by Dollar & US rates) and the simultaneous need to keep the stock markets from falling hard, because the stock markets still represent the best way of protecting the global economy. And the gap is already wide enough:

And what is the force driving this tightening? The unrelenting rally in the Dollar. Now look again at the timing & power of the Brainell signal:

Unlike us, some give credit to their favorite JPM guy. But a loss in Dollar momentum is a must for the world:

- Via The Market Ear – Mighty dollar losing steam – The DXY index didn’t even reach the upper part of the trend channel. This is definitely a loss of momentum. 50 day moving is at 107.5, the lower part of the trend channel. Let’s see how this plays out from here, but credit where credit is due. Recall what JPM’s Nikos wrote last week (here): “Our momentum signals suggests bullish dollar momentum approaching extreme levels“.

And while the Euro is in media focus, the real danger is where most are not looking:

*far more effective than 3 Days of Condor, wouldn’t you say?

2. What next?

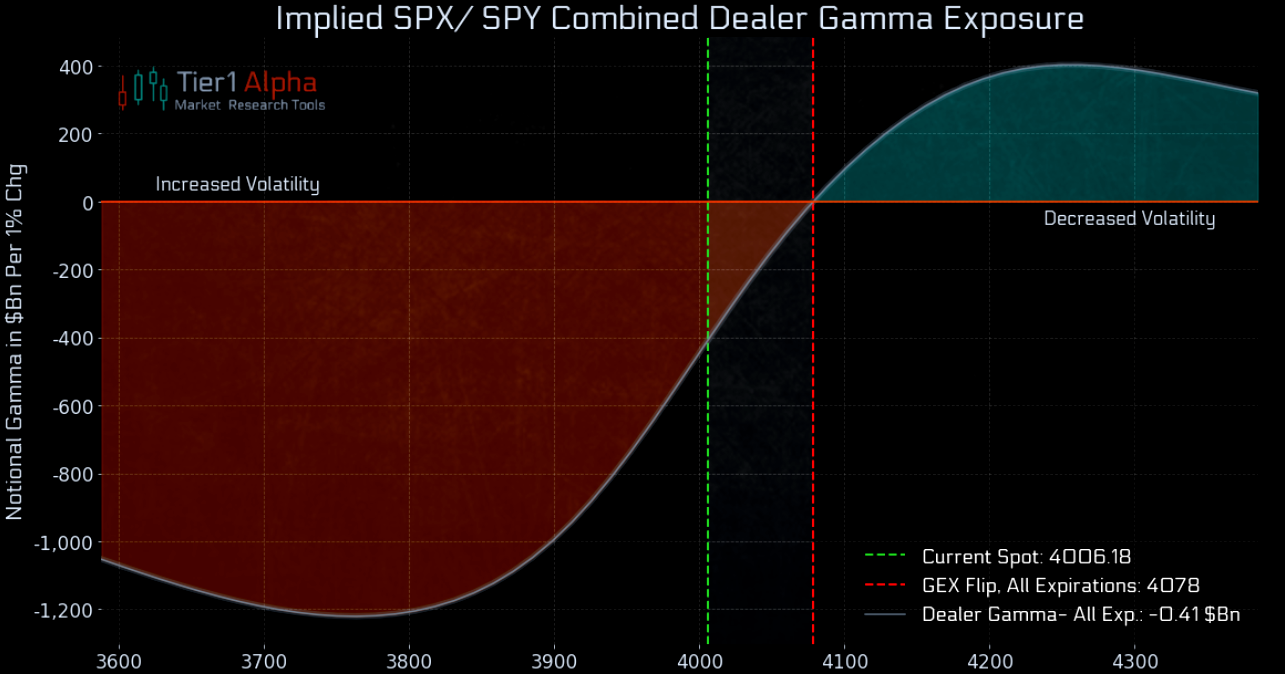

- Via The Market Ear – Pay attention to the gamma flip – Believe it or not, but SPX is up 4.7% from lows we saw on Wed. The move higher has been violent. One of the squeeze ingredients has been the deep short gamma environment that we have been pointing out on a daily basis. Dealers have become shorter and shorter deltas the higher we have moved. Chasing deltas in an illiquid market is one of the short term “pillars” of this latest squeeze. Note the SPX/SPY flip level is approaching quickly. The “furious” chase of deltas will fade soon, at least when it comes to short gamma dealers. They turn into sellers of deltas slightly higher, although absolute levels of positive gamma isn’t large,

Mark Newton of FundStrat put it differently but delivered a similar message:

- “… some of the composites I use actually trend lower starting next week into early October … my thinking is it [the pullback] is likely to be 10%; it is very difficult to put a real number on the extent of what the pullback should be … it is ultimately end up being a buying opportunity in October … in a midterm election year … best time for gains is between October and end of year …”

Despite all of the above, we still feel that Europe, specifically the utter misery of Europeans, represents the biggest danger enhanced by the utter tone-deaf arrogant stupidity of the EU & ECB. As we recall, the currency moves in Germany plus the widening spread between US interest rates going up and US stocks going up triggered the 1987 crash.

That brings us to this past week:

- Dow up 2.7%; S&P up 3.6%; NDX up 4.1%; RUT up 3.1%; TLT down 1.7%; EDV down 2.4%; 30-yr yield up 12 bps; 20-yr up 10 bps; 10-yr up 13 bps; 7-yr up 12 bps; 5-yr up 14 bps; 3-yr up 17 bps; 2-yr up 17 bps; 1yr up 22 bps;

Finally ChartMaster loves oil, as we heard on Friday:

Energy may be having a down week, but @CarterBWorth and @Michael_Khouw say they're in it for the long haul.

The Chartmaster has the charts, the Professor lays out the $XLE trade and @Bonawyn gives his take. pic.twitter.com/FFTLytmwPg

— Options Action (@OptionsAction) September 9, 2022

You also have Mark Fisher speaking as plainly as he does:

- “… in anticipation of the winter, as a trader, you couldn’t ask for a better setup because now the risk-reward of entering into the energy patch has gotten 10 time better, right? Instead of buying nat gas at $9, you might be able to buy nat gas at sub-8, or in middle 7s … “

3. One Loyalty Above All?

While we understand the emotion behind the passing away of Britain’s Elizabeth, we sincerely feel that 9/11 is & must be the prime focus when the two have to be discussed the same morning. In that spirit, we thank & congratulate CNBC’s Squawk on the Street for their focus on 9/11 in stark contrast to Bloomberg Open.

We must never forget 9/11!

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on Twitter