Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Newton’s Law!

He may have labelled it as “motion” but he really should have labelled it as “trend”. And we see his first law is in full force. Tuesday was a continuation of Treasury rates going up hard in double digits. Then we got a head-fake on Wednesday & Thursday when Treasury rates fell. But, true to form, the dominant trend in Treasuries bounced back with power on Friday.

- 30-yr up 4 bps on the week; 20-yr up 5 bps; 10-yr up 7 bps; 7-yr up 8 bps; 5-yr up 9 bps; 3-yr up 10 bps; 2-yr up 9 bps; 1-yr up 11 bps; TLT down 95 bps; EDV down 1.4%; ZROZ down 1.4%; HYG down 51 bps; JNK down 35 bps;

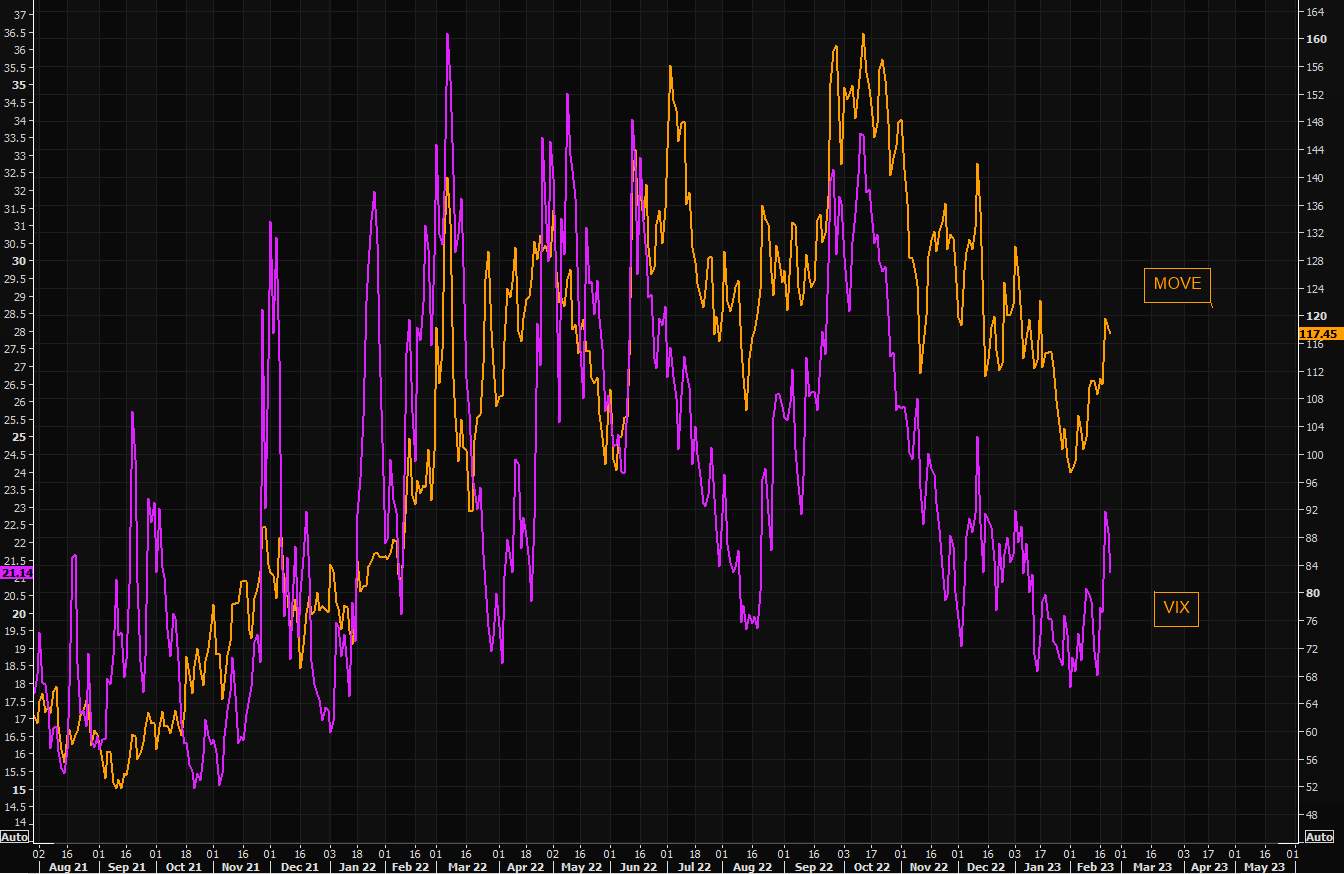

Didn’t some one announce that volatility in rates is passe?

- Via The Market Ear – Thursday – Watching MOVE closely – VIX down from recent “panic” highs, but MOVE refuses giving back any of the gains. Watch bond volatility closely here as it is a big part of the current macro puzzle.

In contrast to Treasury yields, the other dominant trend didn’t waver for even a day. The U.S. Dollar ETFs, UUP & DXY, rallied 1.4% & 1.3% resp. for the week. Naturally, stocks did what?

- Dow down 3%; S&P down 2.7%; RSP down 2.9%; NDX down 3.1%; RUT down 2.9%; IWC (micro-caps) down 4%; DJT down 3.3%; KWEB down 7.4%; FXI down 5.5%; EWZ down 3.5%; EWY down 4%; Indian ETFs down 3%; EWG down 4%

And,

- Gold down 1.8%; GDX down 4.9%; GDXJ down 4.6%; Silver down 4.7%; SLV down 4.6%; Copper down 4.2%; FCX down 2.4%;

What happened on Friday is what can happen to people who guess the dominant trend is changing before it actually does. Read what Mark Newton of Fundstrat said about Treasuries on CNBC Overtime on Thursday:

- “look what just happened in last 24 hours – you see Treasury yields starting to roll over & that is specifically what investors need to be watching to think this market can likely extend; the market meaning both the bond market and also the stock market in my view“;

CNBC host Wapner asked – “so you think rates might have topped again?” Newton replied:

- ” … certainly enough evidence to look at the trend over the few weeks ; 3.87% today earlier week lows 3.84%; that could jump start a pretty good Treasury rally over the next couple of months; …. everybody thinks central banks are so hawkish to continue to hike; well, rates might not do actually what they saying; we are actually seeing evidence they can peak out here & roll over; so that happens, equity markets are going to rally; ….”

And the very next day, the belly of the curve exploded upwards with 2-yr yield up 12 bps on the day; 3-yr up 13 bps & 5-yr yield up 11 bps. And the 10-yr instead of going down to 3.84% rose to 3.94%. It seems Newton was basing his call on the positioning he saw in Treasuries:

- “CFTC data also being quite negative for Treasuries also; highest levels we have seen in shorts for almost 4 years ; that’s interesting to me ; it means people are all betting that rates are going to go higher & stocks should go lower; I would like to take the other side of that; … “

We must stress that we have a high degree of respect for Mr. Newton. And he could prove right as early as next week with the employment data coming up. But we are spending so much space on his views because his clip (produced in full below) raises a critical point. But first his views on the stock market:

- “I think we move higher … & in general weekly momentum & breadth support my view … I think we are going to be fine & really any further pullback causes sentiment to get even more bearish; That’s gonna create an even more bearish; that’s gonna create a really good opportunity ; I don’t think S&P gets below 3,900; today’s move looks important but its really 4060 we need to get above; then we can really start to accelerate higher;;”

Anastasia Amoroso of iQ Capital also said she thinks 3,900 might be the low & that we won’t see a violent correction.

In contrast, Craig Johnson Piper expects a fall to 3,800. He laid out a case on CNBC that “we are seeing this downtrend reversal on all the major averages at this point in time; … we need to see this reset happen; the market can pull back another 5% or so; but what we really need to see is really the uptrend support line off of those October lows remain intact; not to break what was resistance line comes in to be support ;can get a reset all the way down to 3,800 & after that the pop; 4,625 year-end target “

Interestingly, the bearish Marko Kolanovic of JPM sees a similar downside:

- ” … big difference between what equities are pricing and what bonds are pricing ; … equities haven’t pulled back despite the bond market move; .. so we think we could see perhaps another 5% may be downward pressure on equity market; for some of the high beta tech market could be between 5% & 10%; .. with our S&P estimate of $205, we are kinda high, 19ish multiple which is pretty high; when interest rates were around 5%, multiple averaged 15-16; so you could see 2-3 turns lower in the multiple which would translate into a 10% downside; year-end target is 4,200; so we get a selloff here now, perhaps retest the lows of last year; then may be Fed gets the message & signal cutting rates; .. ONLY at that point we can have a sustainable rally so we think Fed will have to cut rates for the market to rally on a sustainable basis; .. “.

The real difference between Mark Newton, Craig Johnson and Marko Kolanovic is that the first two are talking about a rally off of Treasury rates coming down and the latter about a “sustainable rally” that requires the Fed to cut rates.

Notice none of them are talking about what we saw this week – a big sell off in a recent darling (& the acknowledged winner in its space) and a big selloff in a dominant market share leader that has been a long term growth stock. Why did these two fall? A big cut to earnings potential going forward. Look at the first:

Investors had again fallen in love with Netflix after its terrific earnings release just a month ago. The stock jumped to a 25% ytd rally and was re-anointed as the secular leader in its space. Then this week Netflix cut its prices for its consumers in multiple countries. Boom, its market cap fell by 14% in a couple of days.

The second stock has been a darling for years & a classic Peter Lynch stock that almost every American knows. It has been in a downtrend since last summer but, in the best manner of bulls, was described as a victim of Powell & inflation:

The technical condition of this stock is better seen in a 3-year weekly chart:

Remember what Dana Telsey said on BTV last week – “the Dollar Stores & even off-pricers where their average household incomes they were getting was under $40,000 and now consumers with $60,000 household incomes are going there; the trade down is real & that’s what impacts the March-go forward time period”.

Our sense of smell is very basic & stops at Right Guard. Fancy expensive stuff we can’t recognize. But we kinda recognize the smell from the above action in Netflix & Domino’s. It is the smell of a trade down by the American consumer. If we are right, then we can see a semi-violent rally in Treasuries ahead (the moment labor numbers flatten out). That rally can & probably will lead to a snap-back in equities.

But that equity rally may need to be sold IF the common message from companies in April resonates even somewhat with the Netflix & Domino’s message. Unless you think a couple of rate cuts by the Fed will entice Netflix consumers to pay higher fees & Domino’s customers to splurge on takeouts.

Speaking of smell, you really don’t want to be anywhere near the smell of Rosie Rosenberg being proved bigly right again unless you own lots & lots of ZROZ. The last time was in 2007 & who wants that again!

Who must you also mention when the number 2007 comes up?

- Lawrence McDonald@Convertbond – Feb 23 – We often hear ´high yield is termed-out´ (maturity wall pushed out 2024-2025), ´IGs are termed out´, but leveraged loans ($1.5T mkt) have floated up to 10% – back near 2002 extremes, this is NOT termed out, it´s floating – there is NO low fixed coupon to fall back on for now.

- Lawrence McDonald@Convertbond – Feb 23 – Likewise, Mr. and Mrs. Joe Lunchpail with record credit card debt ($1T), and those interest obligations have also floated up to 20% per Bankrate data, that´s a 37-year high vs. 14% in 2007, these guys are gals are NOT termed out either.

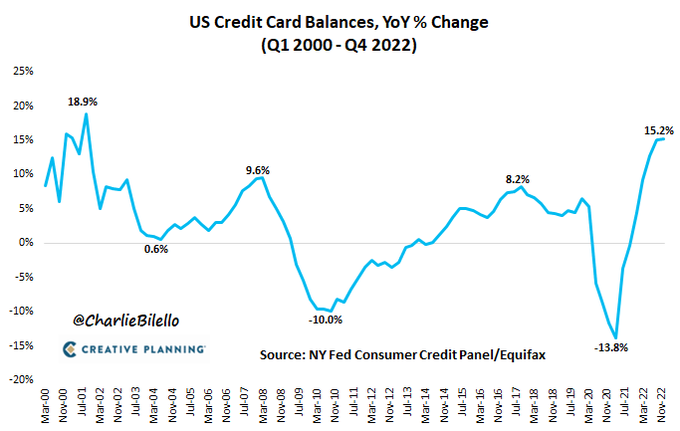

What is another financial figure that now exceeds its 2007-2008 high? Per Charlie Bilello,

Do you think Mr. & Mrs. Joe Lunchpail are likely to gorge on Domino’s Pizza (average $20-$25 price tag wth delivery) or sign up to Netflix? What sector might you consider or not per Mr. Convertbond & who was right the last time around?

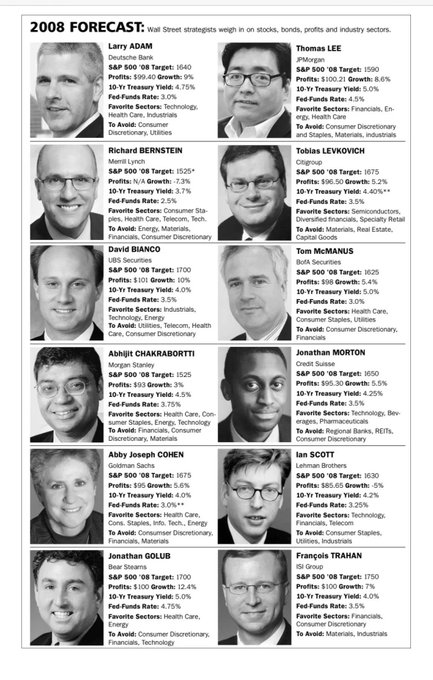

Why the question mark? Because his tweet contained a retweet of the following:

- Kantro@MichaelKantro – Replying to @hcrubin2009 All were thinking soft landing? We can only hope to learn from the past. 2008 was the last time we saw the Fed hike, inflation elevated and banks tightening lending standards. That was the last time we had a recession … and due to subprime, was a very bad one.

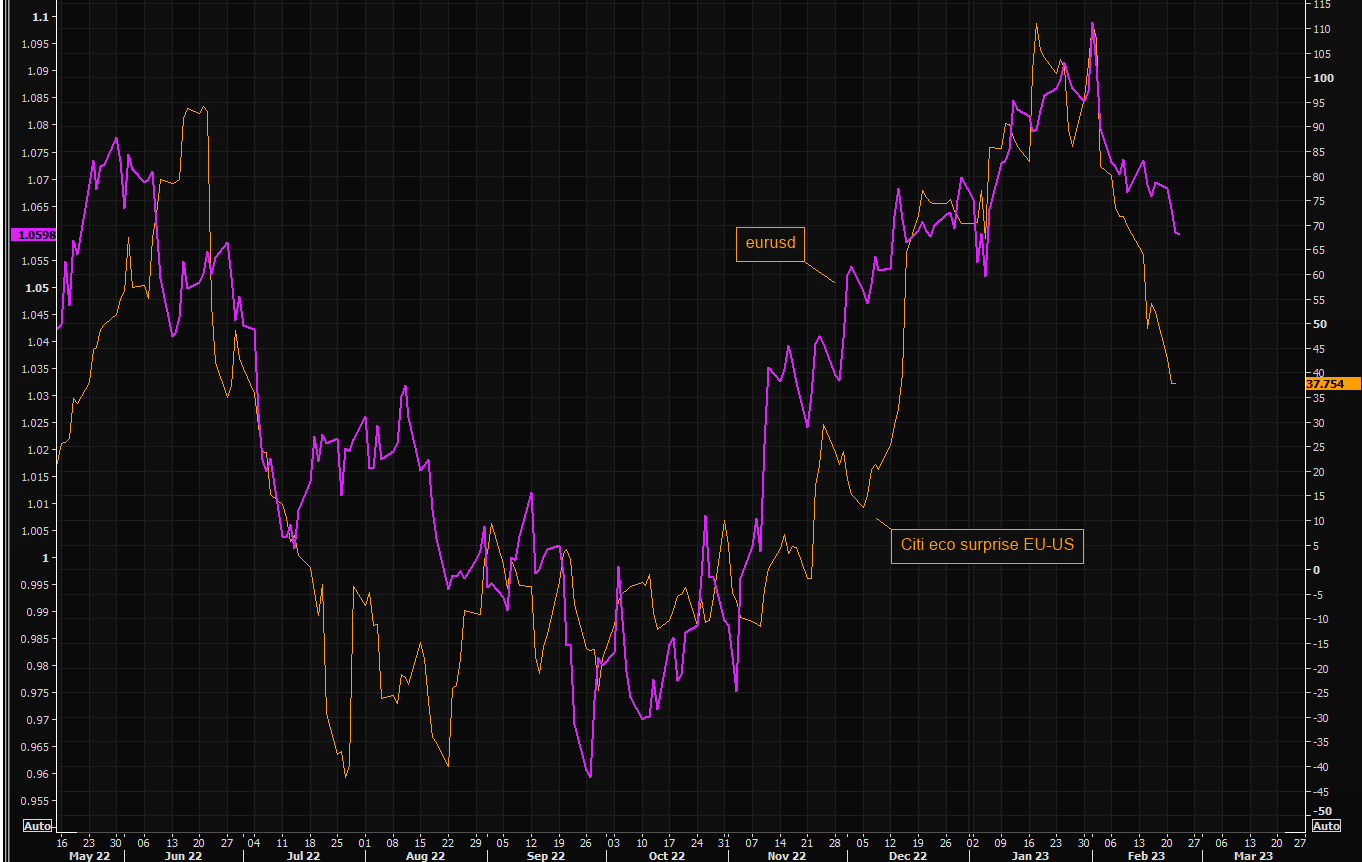

But European stocks are doing well so far. So can European spending save our multinationals? It is possible but then,

- Via The Market Ear – The not so great Euro(pe) – The spread between Citi’s Europe-US economic surprise indexes continues crashing….and the euro is trying to catch up. So many euro longs still trying to figure out why they are long the soggy currency…

When everything fails, there is usually China. Except this time, China seems moving from USA, a 3-letter word, to a 5-letter word beginning with “P”. Does anyone describe that as a positive?

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on Twitter