This Blog’s Disclaimer: This is an article that expresses our personal opinions about comments about events made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

Two weeks ago, when the panic & hate about the Adani mess was near its high, we wrote our views in Adani Washout – Our Reflections. Today, we update our reflections & discuss what has happened in the past two weeks.

Before we do so, we want to draw attention of readers to our Disclaimer above and re-emphasize our warning to all readers:

- We love markets; we like to think about them & write about them on a weekly basis. That is our pleasure & joy. We know & have said repeatedly in our articles that we are simple folks with simple minds.

- Therefore we deliberately & decidedly warn every reader that our views are merely our views and are not actionable in any way whatsoever. And if, you choose to read further, you will be deemed to have read our disclaimer above & agreed to abide by it.

1. Adani Group – Assets Risk, Financial Risk & Dollar Debt Market Risk

We request readers to read our Adani Washout – Our Reflections article of February 5, 2022. It describes what we view as a mega deal won by Mr. Adani and what it might mean for the I2U2 (India, Israel, UAE, USA) group. We summarized our basic view of two weeks ago in Section 7 – Final Thoughts of our article dated February 5, 2022. We repeat that below for easy reference:

- “From what we hear, the existing portfolio of ports & airports of Adani Group is deemed of high quality.

- “The problems faced by the Adani group are more of financial behavior nature. While wrong & subject to punishment, these seem to be small in comparison to its portfolio of assets. That, in our opinion, increases the possibility of getting adequate funding from Sovereign funds, Infrastructure investors & private equity funds if needed.”

- “All the major banks have stepped up to say that they have mainly lent against assets; that they have no issue with their loans & interest payments.”

The third point above is now beyond doubt. All the Indian banks have confirmed that their loans are against & secured by the assets of the Adani group, meaning the ports, airports & other infrastructure. So they have little exposure, if any, to the finances of the Adani companies themselves, especially the Adani Enterprises flagship.

1.1 Dollar Debt Market Risk:

So the biggest risk faced by the Adani group was the Dollar debt market’s opinion of the cashflow & balance sheet of the Adani Group. These fears were amplified by the sudden (& smart, in our opinion) cancellation of the FPO offering by the Adani Group. As most know, Adani group’s funding had indeed come from foreign sources.

A quick way to see that level of fear in the Debt markets is to view the 4-minute Bloomberg clip dated February 1, 2023 titled Adani Bonds in Distressed Levels. Remember a day later, that brilliant firm named Credit Suisse had torched these bonds by refusing to allow its clients to use them as margin – meaning Credit Suisse judged the Adani debt as virtually worthless as collateral.

Fast forward to one week later to February 7, 2023 and say voila! Why would you say that? Because on that day, Bloomberg reported that Oaktree, probably the world’s largest opportunistic debt firm, had been buying the distressed Dollar debt of Adani Group; not just Oaktree but others like Davidson Kempner as well.

For those who may not be aware, these distressed debt investors are deemed to be the smartest buyers of all because their risks are huge. If they are wrong, then the distressed bonds they are buying can go virtually to zero. That is why they jump in ONLY after extensive research & analysis. That is also why all other investors love to see these distressed debt players (sometimes called vulture investors) buy in before they decide to consider purchases.

As an aside, some might have heard of another brokerage firm named Goldman Sachs. They might not be regarded as smart as Credit Suisse but, in contrast to Credit Suisse, they did say that “Adani Debt offers value“. Weird that some might take the word of Goldman Sachs over a historically venerable firm like Credit Suisse (which was reportedly followed by another brilliant firm named Citigroup in valuing Adani Debt as virtually worthless collateral). Weirder still is the fact that Goldman Sachs proved right while the old, venerable C-named firms proved badly wrong.

Watch the Bloomberg clip yourself:

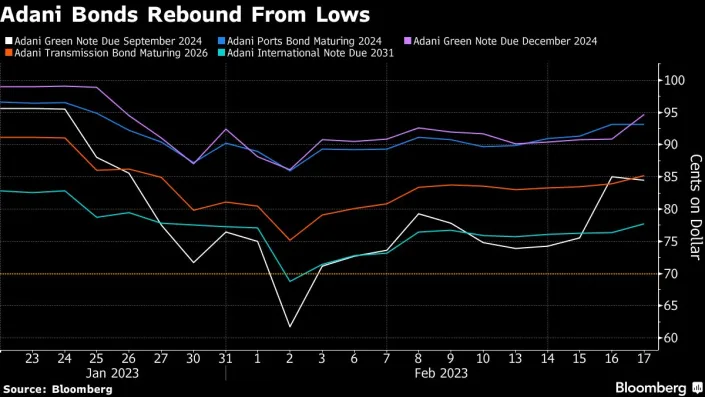

Were Oaktree & their colleagues right in “scooping up Adani dollar debt“, to use a Bloomberg expression? Fast forward to Friday, February 17 to a Bloomberg article titled Most Adani Dollar Bonds Exit Distressed Levels on Debt Promises. Since a picture is worth lots of words, look at the price chart of Adani debt as of Friday, February 17:

- The Bloomberg article is still behind their paywalls. A version of it can be found in the Yahoo article titled most-adani-dollar-bonds-rally.

The rally in Adani Debt, per a Times of India version, was because:

- “Adani executives held a call with fixed-income investors Thursday, as part of efforts to reassure investors about the health of the group’s finances. …. The management said on the call Thursday it is seeking to cut the group’s ratio of net debt to earnings before interest, taxes, depreciation and amortization to below three times next year, from the current 3.2 times, people familiar with the matter said. The group had previously said that its companies faced no material refinancing risk and had no near-term liquidity requirements.”

It is important to stress that debt markets are moving very fast & furious. So the above does not mean that Dollar Debt Market risk is extinguished. But it seems undeniable that the risk has been reduced somewhat as the buying by Oaktree & other distressed debt investors tends to do. That means our term Adani Washout may need to be modified to Adani Turbulence.

1.2 Assets Risk & Financing Risk

We had suggested two weeks ago that Adani assets in infrastructure are of such quality that getting financing against them or even selling some to relieve financial stress is possible. Ours was a view of simple folks with simple minds. So we were relieved to read an article in the Financial Times of London on this very subject titled Ports, pylons, cement: the best assets behind Adani’s debt pile:

- “Gautam Adani made himself one of India’s most powerful moguls by building a vast infrastructure empire — from the country’s busiest container port to power lines that criss-cross the subcontinent. …. As the Adani empire comes under siege following accusations of fraud from US short seller Hindenburg, its cash-generating infrastructure assets are providing comfort to some bondholders that group companies can service their debts. They will also be among those most coveted if the billionaire is forced to sell businesses“.

- “Those assets are real. The ports are there, the airports, the power plants, the railway lines, the mines,” said Amit Tandon, founder and managing director of Mumbai-based proxy advisory Institutional Investor Advisory Services.

- “One holder of bonds issued by Adani Ports and Special Economic Zone (Apsez) said the group’s logistics arm had lent “against marquee infrastructure assets that are critical to India’s growth“”

(courtesy image posted on Twitter)

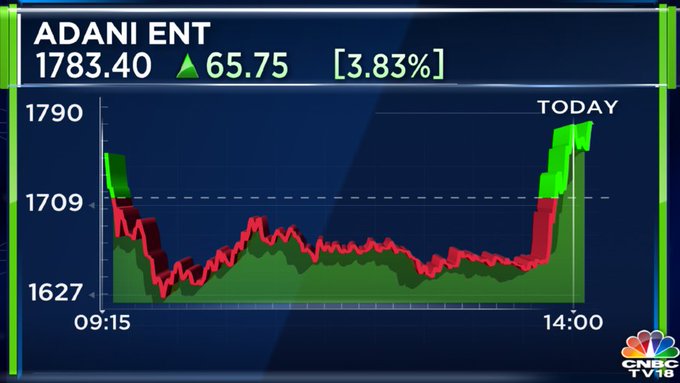

The above, we think, addresses the Asset risks & the Asset financing risks. But the group still has to function profitably to keep up its valuation & profile. That brings us to the tweet below dated February 24:

- CNBC-TV18@CNBCTV18Live – Feb 14 – #3QWithCNBCTV18 | Adani Enterprises reports Q3 earnings. ◼️Net profit at Rs 740 cr Vs Rs 1.8 cr (YoY); ◼️Revenue up 41.9% at Rs 26,612.2 cr Vs Rs 18,757.9 cr (YoY); ◼️EBITDA at Rs 1,629 cr Vs Rs 771 cr (YoY); ◼️Margin at 6.1% Vs 4.1% (YoY)

How did the stock react?

The above further suggests that our two-week old term Adani Washout should be modified to Adani Turbulence.

We are not smart enough to guess how the stock trades from here now that much of the fear seems to have ebbed away. But some seem happy about what they see:

- Volatility Volume and Value@VVVStockAnalyst – Feb 16 – One more time Adani Enterprises setting exactly the way i want – Getting ready like a beast #ADANI ENTERPRISES

**once again to newer readers – inclusion of a tweet like the above is NOT any reflection, positive or negative, on the message of the tweet or the entity that tweeted. It is simply included as an interesting tidbit, that’s all.

Finally, the utter bullcrap we heard from Bloomberg & much of media that the Adani mess may cause turbulence in the Indian stock market & sully its reputation. In our Adani Washout – Our Reflections article dated February 5, 2023, we pointed out the stock markets did not show such concern. In fact, we had wondered whether the media outcry “could actually be a buying opportunity for INDA relative to SPY“?

So far, so good as the chart of INDA (in red) vs. SPY (in yellow) for the last two weeks points out:

Once again, our point was entirely for the short term guided by our fear-reduction belief. That was not & never intended to serve as actionable, as our disclaimer specifically & categorically states.

What about the reputational damage to Mr. Adani & to the Adani Group? Was his growth a “con” as some have described? In our humble opinion, a portfolio of high quality infrastructure assets cannot be built/acquired/grown via a “con”. But we are simply not qualified to discuss & opine on this issue.

That is why we were happy to see the below, an article written by an IMF Director & tweeted in full by a sensible opinionator:

- Minhaz Merchant@MinhazMerchant – Feb 14 – Finally, a forensic examination of

@HindenburgRes’s report which called #AdaniEnterprises “the biggest con in history”. After reading this excellent piece by @SubramanianKri , former #CEA & current

@IMFNews director, (India) the real con is Hindenburg 👇

Who is Mr. Subramanian, you ask? He was the youngest Chief Economic Advisor to the Government of India, serving from 2018 to 2021 and is now India’s Executive Director at the International Monetary Fund. Not a bad resume to make the case he made in the above article.

2. Real Turbulence using Adani

The above & our previous article Adani Washout – Our Reflections have led us to believe that this media tempest was NOT really about either Mr. Adani or about Adani Enterprises. Based on what we have described, there is nothing in the Adani group business or financial dealings to merit the extreme level of hate we all have witnessed. Heck, the Adani mess pales in comparison with FTF, Enron & so many acts in US & European finance. But Adani was elevated into the symbol of war.

The simpler view is that this has been about the vicious hate about PM Modi on the part of a very large & powerful group of what can be sensibly & historically referred to as Brit-Nazis, the British & Anglophile people in Britain, Europe and America. These Brit-Nazis have been the elite of British intellectual society & they occupy high offices in what is referred to as International Media (itself a racist term given they are predominantly white colonial in thinking & background).

Actually it is not even about the person of Shree Narendra Modi. Because the same large hate-filled complex would have made Shree Modi a global hero had he been a Muslim who advocated a return of Muslim rule over the Indian Subcontinent. Remember the Timurid-Mongols were glorified into Mughals by the British elite as a way to convince Hindus that their lot on earth was to be servile & obey.

But, unfortunately for them, Shree Modi is a TRUE Indian, an Indian in the spirit & teachings of the Ved, an Indian in the power of the term the Greeks ascribed to the Sapt-Sindhu people. Shree Modi is a fervent believer in the destiny of the Sindhu Dharma & its principles and he works tirelessly to make the Indian people mentally independent.

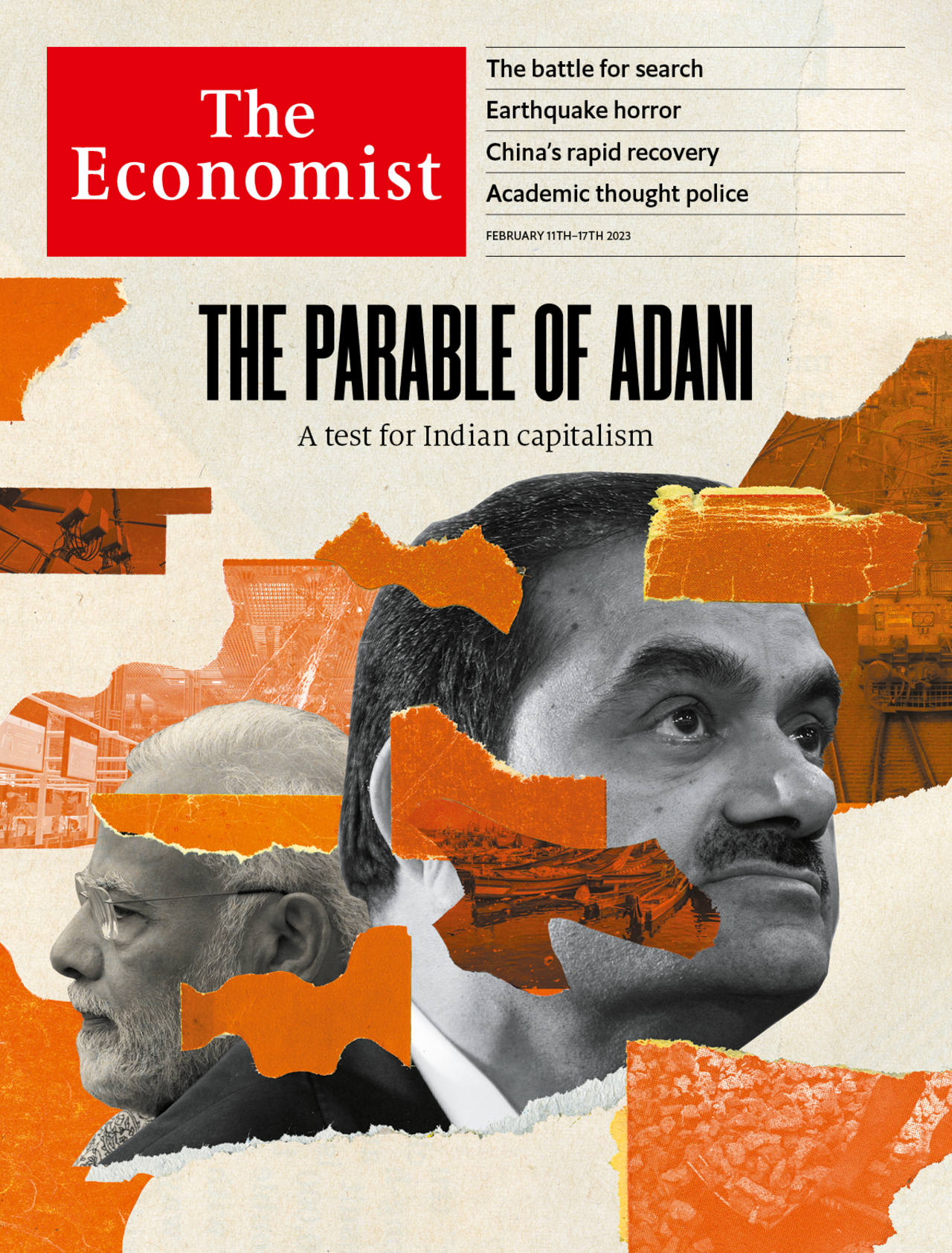

That makes him Enemy No. 1 for the Brit-Nazis and for, what we regard as the group’s standard bearer, The Economist. Look at the cover they unveiled this past week:

The Economist@TheEconomist – Feb 9 – Indian capitalism faces its sternest test in years—but the humbling of the tycoon is also a political embarrassment for Narendra Modi econ.st/3Xj6QBe

The Economist@TheEconomist – Feb 9 – Indian capitalism faces its sternest test in years—but the humbling of the tycoon is also a political embarrassment for Narendra Modi econ.st/3Xj6QBe

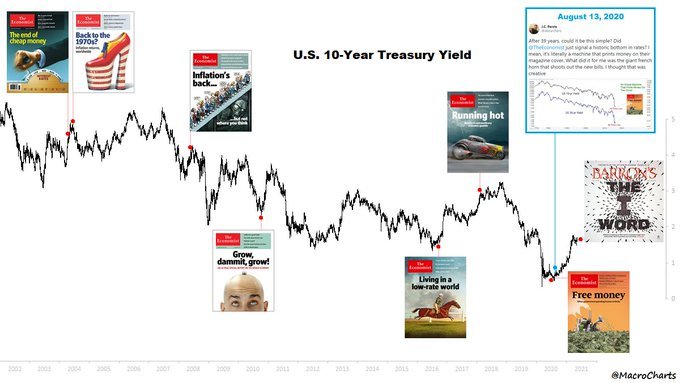

Remember the people the German Nazis fooled the most were themselves. That seems equally true of these Brit-Nazis. They don’t seem to know or recollect what most American investors know that the Economist Covers have a track record of being totally wrong, 180-degree wrong.

But we like to be helpful, perhaps in our hopeful hope that even Brit-Nazis can be taught to learn from their mistakes. So we tweeted to them, a chart we have seen on Twitter from @MacroCharts of series of 180-degree wrong covers of this stupid publication:

- Editor Viewpoint@MacroViewpoints – – @TheEconomist – – would be interesting to see if the near -100% track record of Economist covers is still valid; So BUY Adani Shares per TheEconomist?

That is why it was & remains such a shock to us that Mr. Bloomberg actually chose a guy from The Economist to lead Bloomberg.com. And he seems to have got what he bought. We are now hearing very angry feedback from Indian friends & associates about Bloomberg India, feedback we have NEVER heard about CNBC India.

The Economist might be laughed at by many & worshipped by many. Their reach is long but it is not highly dangerous except in that it enables the truly evil to mask inside The Economist umbrella. Look what happened with a few days of The Economist cover – George Soros broadcast his support for The Economist hate campaign:

If you look at the history of German Nazi media behavior, you notice how often they damaged their own propaganda. That pattern seems to be repeated by the Brit-Nazis. Soros himself has launched an awareness campaign in India & Indo-Diaspora that will undoubtedly help PM Modi. Soros was so stupid & The Economist went so overboard that they have managed to link their own behavior to the recent hate message from BBC. Go to Twitter to see how even major media figures in Indian political opposition have condemned Soros & tried to distance their organizations from him.

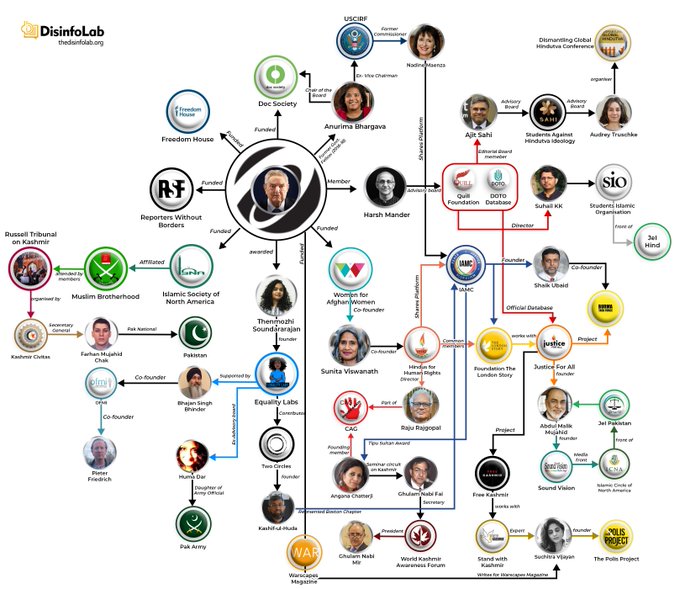

Look at the tweet below as an example of fact finding efforts that have been launched in India:

- DisInfo Lab@DisinfoLab – Feb 18 – Philanthropist’ #GeorgeSoros has been promoting democracy all over the world – just like that. Incidentally, many fronts that target India’s image with fake data & fabricated stories, exploiting India’s fault-lines, found to be linked with #Soros – just like that! A Thread:

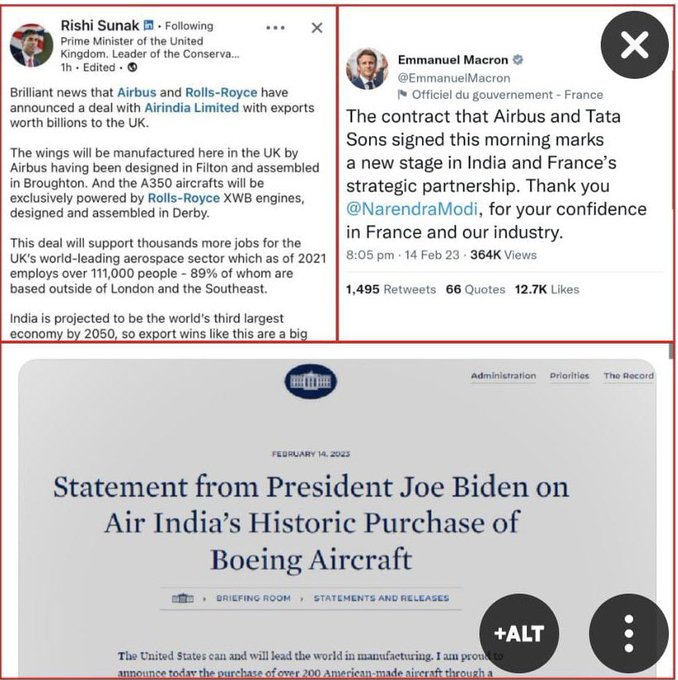

What does PM Modi have to say about all this? Actually look at what some of his supporters are using to contrast his actions with his opposition’s:

Editor’s PS – Back in 2011, we described how Anti-Hindu Nazism pervaded intellectual British Society and many of the people still studied in US Schools & Colleges. Those interested can read the detailed quotes from leading British intellectual figures in our July 16, 2011 article.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter