Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we clude important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Two ways of looking at markets

The week was dominated by credit news, the final one on Friday about AT1 bonds in Europe. Despite all this heavy news, much of it non-positive to health of US financial institutions, the broad indices closed up again with VIX almost collapsing on the week:

- VIX down 14.8%; Dow up 1.2%; SPX up 1.4%; NDX up 2%; RUT up 52 bps; GS up 2.8%; BAC down 2.2%; C down 2.9%; UUP down 71 bps; DXY down 71 bps; EWG up 3.4%; EWY up 5.8%; EEM up 2.7%;

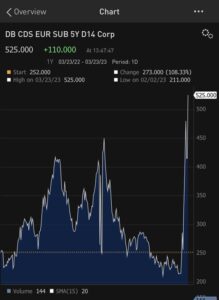

How does EWG, German ETF, close up 3.4% the same week in which Deutsche Bank is going through a credit spasm (courtesy Boaz Weinstein tweet) ?

Interest rates fell hard at least at the short end:

- 30-yr yield up 1 bps; 20-yr yield down 2.8 bps; 10-yr yld down 6.7 bps; 7-yr down 10.6 bps; 5-yr down 10.2 bps; 3-yr down 15.5 bps; 2-yr down 7.3 bps; 1-yr up 1.7 bps;

This led to:

- Jeffrey Gundlach@TruthGundlach – Mar 24 – UST 2 Year versus 10 Year is now inverted 40 basis points. Was 107 basis points just a few weeks ago. All UST Yields two years and out are well below the Fed Funds rate. Red alert recession signals.

The more scary comment came from the obvious source:

- David Rosenberg@EconguyRosie – The crisis is with regulators who are idle while Comerica bonds blow out. The contagion is here. Everyone’s been focusing on an equity market driven by six stocks. This is a liquidity crisis of epic proportions. It’s incredible that policymakers are still sitting on their hands.

But aren’t these 6 stocks great beneficiaries of the credit issues? Where else could you go to get into stocks that may protect you, at least somewhat, from the liquidity crisis that is now entering previously stable areas:

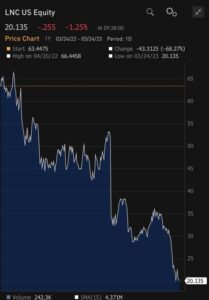

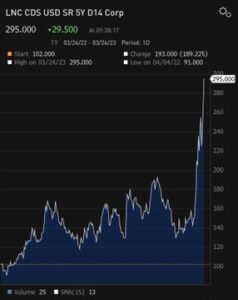

- boaz weinstein@boazweinstein – 3-24 – A new front in the battle opened up this week – life insurers. The fundamental rationale is CRE and financials exposure even if they don’t have the HTM issues of the banks.

If you think this makes sense, you might concur with Jonathan Krinsky who says Nasdaq et al will fall to join others:

On the other hand, April is deemed to the most bullish months of the year. That & other signs make Mark Newton bullish:

The WC duo (Larry Williams + Cramer) has had success in suggesting money making ideas to viewers of Mad Money. This past Wednesday, Jim Cramer discussed the bullish views of Larry Williams in his Off the Charts segment. Strangely, we cannot find even a trace of this clip on CNBC.com. We realize that you can’t get more controversial than Cramer but, in our opinion, his Off the Charts series has been an excellent source of technical commentary. A couple of weeks ago, Cramer relayed the positive technical view of Carley Garner on Treasuries. We wanted to feature it but couldn’t find it on CNBC.com. Weird!

Those who like to get a quant-technico view prior to the open might want to read the Sit Rep published by Tier 1 Alpha in the morning. For example, look at the Sit Rep from Friday morning:

“The bigger issue to keep in the back of your minds are threefold:

- Tax season is upon us and last year’s dispersion and active trading means many will likely still have tax bills despite overall losses. This tends to lead to seasonal selling into the end of March/early April. We’re seeing signs of reduced “buy and hold” investor inflows — whether this is seasonal (as we saw in 2022) or structural, as higher yields attract investor attention away from volatile equities, is unclear at this point.

- We are seeing evidence of a rapid deterioration in CREDIT conditions tied to the banking crisis. Credit Default Swaps are blowing out in Europe following the Credit Suisse COCO (AT1) debacle.

- Illiquid and highly credit-sensitive areas of the market, like used cars and commercial real estate, are seeing rapid rises in delinquencies and defaults. We do not see how this can be reversed easily.

The old adage, “If you’re going to panic, panic first” is likely to be tested soon.”

Hopefully, that test will not come until Thursday since we are being dragged off (without even our laptop) for the next 3 days to where the sun shines & the sea beckons.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter