Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we clude important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. ” .. its all about employment & inflation …“

After a week of steadily weaker data, Friday’s Non Farm Payroll report came in at 236,000 jobs vs. estimated 230,000 jobs. How did the cognoscenti interpret it?

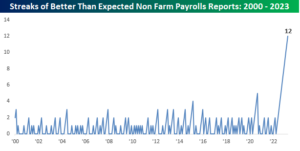

- Bespoke@bespokeinvest – Apr 7 – The streak lives on. It was close, but Non Farm Payrolls have now topped expectations for a record 12 straight months.

- Jim Rickards@JamesGRickards – Apr 7 – Job creation slower but still strong. That makes a 0.25% rate hike on May 3 close to a sure thing. Take it to the bank.

And,

- Justin Wolfers@JustinWolfers – Apr 7 – Yet another brilliantly steady, slightly boring, but relentlessly positive month of jobs growth. Non-farm payrolls +236k. Revisions to Feb (slightly positive) and Jan (slightly negative) subtract only -17k. If the economy is slowing, it’s only a bit, and to a darn good place.

The Treasury market seemed to agree at least on Friday after the NFP number:

- 1-year yld up 13.5 bps to 4.647%; 2-yr yld up 17.2 bps to 3.993%; 3-yr up 17.2 bps to 3.759%; 5-yr up 15.9 bps to 3.5i6%; 7-yr up 14.2 bps to 3.467%; 10-yr up 12.3 bps to 3.413%; 20-yr up 8.4 bps to 3.74%; 30-yr up 8.3 bps to 3.623%;

But there is a side to data that speaks to a different picture:

- Danielle DiMartino Booth@DiMartinoBooth – Apr 7 – A picture that leaves little in the way of interpretation.

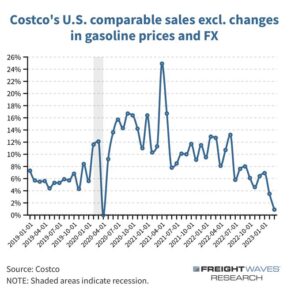

Corporate demand in some sectors suggest a similar message:

- Steve Cortes@CortesSteve – Apr 7 – Economic risks elevate. The latest Chip maker to cite “sharp” downturn in demand…

This was encapsulated by Lawrence McDonald@Convertbond in a couple of tweets with the message:

- Rates, Cyclical Metals, Large-cap Industrials, Transports, Financials, and Consumer Finance all singing the same tune. Recent Drawdowns Lincoln National LNC -43% Schwab SCHW -42% Regional Banks KRE -34% Ally Financial ALLY -30% Alcoa AA -30% United Rentals URI -27% Steel Dynamics STLD -25% Bank of Amer BAC -25% Capital One COF -24% United Airlines UAL -22% ; Caterpillar CAT -21% Huntsman Chemical HUN -21% Retail XRT -19% Ryder R -18% JB Hunt JBHT -15% Off the Q1 highs.

- ” … what we saw in March is an important shift .. US outperformed rest of the world pretty strongly; …. we think 700 bps of the international markets outperformance over the US is largely behind us & we think it is the US that is going to be the leader going forward; .. the slowing inflation scenario that we have in the US gives the US Central Bank the opportunity to slow their rate hikes, possibly pause and that means the US is likely to be be one of the first ones to pause … remember that at the first rate pause there is usually a very big countertrend rally in equities .. you have that in coincidence with very high cash levels in mutual funds & also somewhat depressed sentiment which is a very important push forward for equities rally …

How big of a rally? Ms. Reinhard did not say but someone else did two days later on Thursday:

- Via The Market Ear – What happens after end of Fed rate hikes? This is how equities on average traded past the 4 latest “end of hike” periods: One month later: +3.3%; 3-months later: +8.0%; 1-year later: +17.5% – Conclusion: US equities tend to rally in the month, 3 months and year after the Fed stops raising near-term rates. The only exception was in the year after the Fed’s last rate increase on March 15th, 2000 during the bursting of the dot com bubble. (Data Trek)

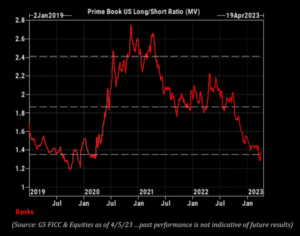

What about Bank earnings that will start getting released this coming week? If you are interested in analysis of the actual earnings, you should be reading some deep research note. If you, like us, are principally interested in how the Bank stocks behave after the release of presumably bad earnings, look at the chart below:

- Via The Market Ear – Hedge funds hate banks – The long/short ratio is at very low levels. Everybody going to be right on banks from here? Source: GS prime book

The story about Regional Banks is not as clear:

- Via The Market Ear – Regional banks exposure – Down, but not out. Hedge funds have reduced the long/short ratio in regional banks, but this actually still remains at higher levels than what we saw back in 2020 (Source GS).

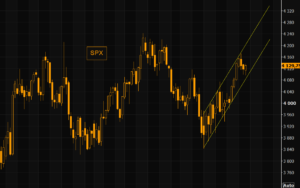

On Tuesday April 4, Cramer relayed the warning of his techni-pal Carolyn Boroden for a short term pullback followed by a potential rally to 4,300 unless the S&P breaks below 3,800. As usual, CNBC webmasters do not even pretend to acknowledge this clip.

But forget April 4. Look what Ms. Boroden tweeted on Friday April 6:

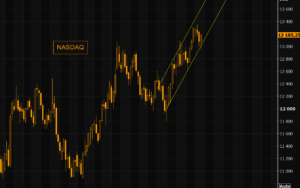

- Carolyn Boroden@QueenOfFibs – – $NQ futures setting up better on the daily chart…. Don’t know if we will make the target for sure but we always shoot for it!

If this were not enough, look

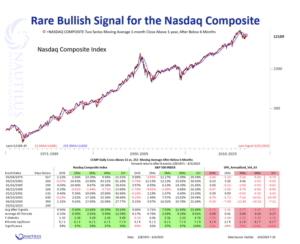

- Nautilus Research@NautilusCap – Apr 4 – #NASDAQ $ccmp — Nasdaq Composite registers a relatively rare signal on 3.31.2023.

If you believe like many do that the market is there to cause maximum pain to maximum number of investors, look at the message below:

- Via The Market Ear – Don’t worry… this is just trend perfection. NASDAQ and SPX trading inside the trend channel that started post the banking crisis. Upside remains a huge pain trade… Source Refinitiv

All of the above would fit the mid-April to late May rally in 2008. That reminds us of what Bob Michele of JPM Asset Management said last week:

- “I actually think the data we are looking at is irrelevant; it is not important; the data that is relevant is the data we are going to see in September… “

Would the recent banking pain & a resultant credit crunch be reflected in the earnings from January 1 to March 31, 2023? Or will we see a true hit to earnings in the upcoming quarter with potential earnings warnings beginning in mid-late June 2023? Will that result in a stock market downturn a la the one from June 2008 to July 2008? If memory serves us, the Bernanke Fed did not become publicly attuned to the 2008 credit crunch and the slowdown until July-August 2008.

Bob Michele believes that data in September could ensure a recession by year-end & virtually compel the Fed to cut rates. Until then, allow us to highlight the last comment of Anastasia Amoroso on BTV after Friday’s NFP number:

- “I would not pre-trade a recession“

We concur. That is why we don’t see a problem in discussing a near term rally in stocks despite the possibility of a severe economic downturn beginning in Q3 2023 or later. Those who disagree or disprove of such short-term vs. long-term distinction should listen to the sensible Kristen Bitterly of Citi Global Wealth explain how she is fully invested in an over weight Fixed Income & Defensive Equities allocation on CNBC Closing Bell.

2. Speaking sensibly about India & Indian Economy from Global Perspective

Usually we have to write criticisms about the unholy bullc*** we hear on Fin TV about India & the Indian economy. FinTV tends to get either stupid guests or those who want to make points about their own political or hate-based interests. The latter category includes Indian-origin professors from name-brand US schools who have either lost their self-confidence or sacrificed it to fit with what their FinTv hosts want from them.

Last week was a major breakthrough and it came from a Fin TV anchor who was a pathbreaker herself in leading women anchors on Fin TV.

- Dr. Krishnamurthy Subramanian@SubramanianKri – – “India provides a ‘wonderful opportunity’ for diversification in trade” was my key msg in the interview @FoxBusiness @MorningsMaria (a very popular business news program in the U.S.) today. Video video.foxbusiness.com/v/6324081415112

Kudos to Maria Bartiromo for being the first to get someone of his stature on her show. Watch the show to hear Maria ask precise questions that show her own preparedness. We are happy to see the “first lady FinTv anchor” act as “first in business” anchor in bringing a true expert on India, IMF & world Trade on Fox Business. Listen to Dr. Subramaniam also explain sensibly why the Dollar will remain as the Global Reserve Currency and why it made sense for India to strike Rupee-based payment arrangements in India’s neighborhood, both physical & economic.

But then comparisons with Maria Bartiromo are futile. There is a reason Maria is a Hall of Fame Anchor. Kudos to her. And she pronounced Krishna-Murthy perfectly.

3. The Choice for India’s PM of US-Europe liberal wing media

It is an open secret that the entire media lobby, at least the “liberal” one, despises Prime Minister Modi and would love to get Rahul Gandhi as the next PM of India. The only qualification of this “pappu”, as he is often termed, is that he is the son of the Italian-born Sonia Gandhi, the “remote-control” of the previous government, and reportedly a leading supporter of anti-Hindu disparagement.

He is termed as “pappu” (kid & a dumb one) because he himself makes that term valid. Look what he tweeted last week:

This sounds serious until you realize that the company PMC Projects is owned by a Taiwanese national & is a Taiwanese company. Who with political aspirations does not know the huge difference between Taiwan & China? Almost every body except the “pappu” who is being hoisted by the global “liberal” media? After all they are the ones who launched the global assault on PM Modi via the Hindenburg report on the Adani Group.

Obviously the “pappu” has been ridiculed for not understanding the difference between Taiwan & China by much of the Indian media. But we mention this here to alert many of the US Fin TV teams, like for example CNBC’s Adani focused team led by their “indian” correspondent Seema Modi.

Why does “pappu”s political-media team persist in making him look like a fool? Below are a few reasons:

- there is a crowd that may still vote for him as a “crown-prince” of the Nehru-Indira Gandhi dynasty;

- he represents the zealous anti-Hindu factions in India;

- they think that a sizable number of people might believe their “Chinese” point above without looking at the commonly known adversarial relationship between Taiwan & China;

- he is reportedly the recipient of large foreign monies entering India against PM Modi & Hindus in general. And you cannot take donor monies without at least showing what you are doing for the donor’s cause.

- Finally, it was his father, Rajiv Gandhi, who legally signed the memorandum giving away Tibet to China.

4. A Georgia landmark legislation that Fin TV should note

It was 16+ years ago when we began focusing on deep-seated & sometimes virulent anti-Hindu bigotry in FinTv, specifically on CNBC at that time. When we wrote about this malignancy, we received private support but not a public one. In fact, the big support we received was from some CEOs of large public American companies who called CNBC management with their protests.

This week shows that the American Hindu community has come of age, political age. Look at the landmark resolution passed by the State of Georgia this past week:

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on Twitter