Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

0. Interesting Quote

Below is an interesting, or even profound, quote from Milton Friedman about economists giving investment advice:

- Bespoke@bespokeinvest – Quote of the Day: – “Asking economists for investment advice is like asking a physicist to fix a broken toilet. Not their field, though sort of related.” – Milton Friedman

Yet, you hear Fin TV anchors ask economists regularly about what investment advice the economists would give to their viewers.

1. On the cusp of “Macro Stability”?

Below is an opinion that has been borne out in markets during the past 2-3 months:

- Larry Tentarelli, Blue Chip Daily@bluechipdaily – Sat Nov 8 – Get the bond market right and a lot will follow. $TNX is the first chart that I check every morning. $TNX rolling over. $XLK new all-time high. $HYG 20-month weekly closing high. $ITB sharp recovery back over all MAs. Want to see $TNX stay below 4.70 on any rallies.

This proved true last week with ZROZ/EDV/TLT out-performing Dow, SPX, NDX & even SMH. In fact, as Bespoke pointed out, TLT closed above $90 for the first time since late September.

- TLT up 2.4%; EDV up 3.1%; ZROZ up 3.4%; HYG up 96 bps; JNK up 85 bps; DPG (leveraged credit fund) up 7%; UTG (another leveraged utilities credit fund) up 3.8%; EMB up 1.7%;

An interesting message from the Treasury curve last week:

- 30-yr yld down 14 bps; 20-yr yld down 15 bps; 10-yr down 18 bps; 7-yr down 20 bps; 5-yr down 21 bps; 3-yr down 18 bps; 2-yr down 15 bps; 1 -yr down 13 bps;

The above two bullet points fit totally with what veteran Treasuries investor Dr. Lacy Hunt said last week on Bloomberg TV:

- “economy heading into a hard landing; … we have a very serious monetary contraction in real Dollars … the yield curve will normalize; short yields will drop more rapidly than long yields but the greatest capital gains opportunities will be in the longer end of the curve“

As macro strategist Jay Pelosky pointed out on Bloomberg Surveillance on Friday (minute 54:20) that VIX has fallen below 14 & MOVE, the Treasury volatility, has fallen below 20. What did it mean for broad US Stock indices last week?

- Dow up 1.9%; SPX up 2.2%; NDX up 2.4%; SMH up 3.1%; RUT up 5.5%; IWC (micro caps) up 6.1%; DJT up 3.5%; AAPL up 1.9%; AMZN up 1.1%; GOOGL up 2%; META up 1.9%; NFLX up 4.1%; MSFT down 66 bps; NVDA up 1.6%; MU up 2.6%

As we have argued before, TLT & Banks (loaded with large unrealized losses in long maturity bonds) are essentially the same trade & closely linked with Small Caps given the large weighting of financials in small cap indices. So given what RUT & IWC did last week, wouldn’t you expect Banks to outperform?

- BAC up 8.2%; C up 8.2%; GS up 4.2%; KRE up 9.3%;

Carter Worth, resident technician at CNBC Fast Money, suggested going long KRE based on the chart he displayed on air on Friday.

The U.S. Dollar was hit this past week with UUP down 1.7% & DXY down 1.8%. How did emerging markets & commodities do last week?

- EEM up 2.5%; EWZ up 3.3%; EWY up 3.3%; EWG up 6.3%; EPI up 1.9%; FXI up 1.5%; KWEB up 2.6%; Gold up 2.2%; GDX up 4.2%; Silver up 6.9%; SLV up 6.7%; Copper up 3.9%; FCX up 6.9%; Oil down 2%; Brent down 1.3%; XLE up 1.5%; PBR up 5.6%;

Perhaps that is why Jay Pelosky said on Bloomberg Surveillance on Friday that:

- “US is capped by its valuation; its going to be earnings driven; rest of the world has valuation & earnings growth … we really continue to favor the rest of the world, particularly emerging markets. ”

His main point:

- “we believe we are on the cusp of “macro stability“; there is a lot going on that we think is very positive & the market is starting to sniff it out and that makes us constructive not just thru tear-end but into 2024“.

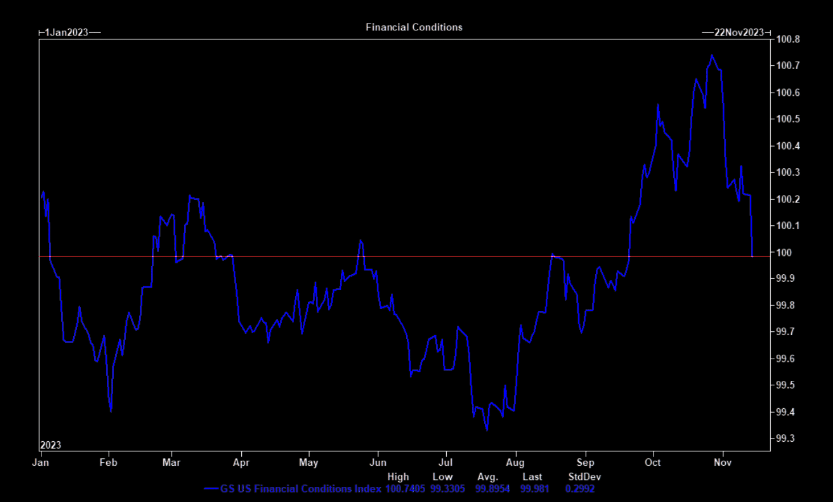

Can you be on the cusp of “macro stability” without financial conditions easing or at least not tightening?

- Via The Market Ear – Thu Nov 16 – Probably the most important chart in the world – Will the Financial Conditions index continue its “positive collapse” and reach summer lows and if so, where will equities then trade...? Source Goldman

2.Treasury Rates & Risk Assets

Treasury rates fell along the curve this week thanks to milder inflation releases & the dreaded “D” word uttered by the people who have more data on the lower income consumer than anyone else in America. In fact, the Wal Mart management warned that “In the U.S., we may be managing through a period of deflation in the months to come and while that would put more unit pressure on us, we welcome it, because it’s better for our customers,”.

Priya Misra of JPM had an investor’s view on this – “adding to duration risk being extremely careful about what credit risks we are taking “

While this is true, it was interesting to see the 10-yr yield drop closer to 4.35% on Friday morning only to reverse to close around 4.43% thanks to some positive economic data. Remember, Peter Tchir of Academy Securities said a few days ago on Bloomberg that he expected the 10-year yield to drop to 4.3% & then reverse back above closer to 4.7%. Sonal Desai, CIO of Franklin Templeton, said on Friday on Bloomberg that:

- “[drop in Treasury rates] has been too fast; don’t think it has been backed by fundamentals; it smacks of FOMO; we are probably going to get a reversal; closer to 5% is lot closer to where the bond needs to be”

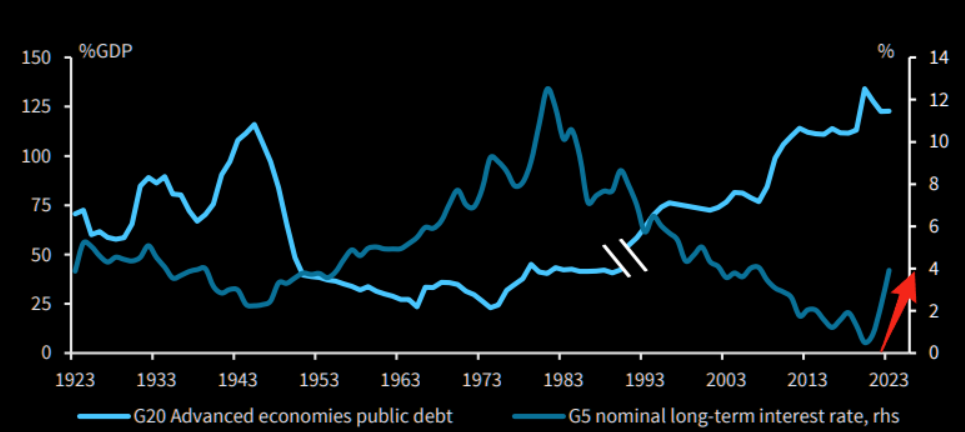

What is a longer term concern of many?

- Via The Market Ear – Thu Nov 6 – Macro theme for years to come – Extremely high public debt in a higher interest environment is going to be with us for years to come…Source Barclays

What that might mean for Treasury borrowing in the next tranche is why Andy Constan (@Damped Spring) said on CNBC Fast Money that he has sold all in his Alpha portfolio & went short risk assets aggressively:

Mr. Constan perfectly shorted Treasuries at the right time a couple of months ago & he covered his short at the perfect time after Treasury Department reduced its refunding via 30-yr Treasuries. So his track record has to be taken seriously. And, as we have pointed above, a number of veteran Fixed Income managers are expecting a reversal in recent fall in Treasury yields.

And the ultimate risk in equities might be in the most beloved of sectors – tech mega-cap stocks and semiconductors. What did Jay Pelosky say about these in his discussion on Bloomberg Surveillance?

- “… yes, very constructive between now and end-of-the-year; tech is definitely the leader and Semis are breaking out; I think this is very very important; … reality of today is that big-cap tech are money making machines & they are printing money on top of money they have already printed … so tech is a leader & will sustain its leadership; … ”

We will all learn more next week when NVDIA reports. Now at the other cap spectrum,

- J.C. Parets@allstarcharts – Sat Nov 18 – The Nasdaq100 just closed at new 52-week highs. The S&P500 is 1.5% from new 52-week highs. German DAX & Japanese Nikkei are each 3% away. Russell2000 is 10% away. Do we see $IWM at new highs by Christmas? Or sooner?

Final – Asinine suicidal action + a personal admission:

Chacha Ke Liye 2 Shabd Pleaase !!

Was it his skill or Luck 😂?#VandeBharatExpress #VandeBharat pic.twitter.com/FkTrlhnSDJ— Trains of India 🇮🇳 (@trainwalebhaiya) November 12, 2023

Unbelievably asinine, right? This brought up a personal memory. I had an even closer escape as a young boy. At that age, I hardly ever used the overpass in a nearby railway station to cross over. I used to do precisely what the old man above did to get over to the other side.

One day, I didn’t even notice the train coming at me and at the last moment, in a momentary burst of strength from sheer panic, I jumped over to the platform & rolled over without standing up until the train passed. I never shared this with my parents or anybody else. But I NEVER crossed the tracks again without checking out an incoming train. Yes to smart readers – I kept crossing the tracks, with serious caution of course, because climbing up the overpass & then climbing down on the other side took too much effort & time. Talk about youthful asinine stupidity!

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on Twitter