Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. Completion of a Phase

Think back to September 20, 2023. Think back to the stern & terror-invoking presser of Fed Chair Powell that afternoon. It launched a river of red across bond, stock & currency markets. This past Friday, Chair Powell uttered other words and look what they signified.

Did the phase from September 20, 23 to December 1, 2023 signify the closing of a loop? Yes, it seems so based on the charts below.

(30-yr yield) (10-yr yield)

(TLT) (SPY)

Higher the leverage, higher the outperformance:

(QQQ) (SMH)

(IWM) (KRE)

Notice the candles (or bars) on Friday in both IWM (up 2.92%) & KRE (up 5.19%).

- Larry Tentarelli, Blue Chip Daily@bluechipdaily – Dec 2 – Regional banks $KRE, breaking out into stage 2. 200-sma reclaim + rising 50-sma + bullish MA crosses. High upside potential vs risk, same for $KBE and many banks. https://schrts.co/VmGcfXER

What about the Bears, you ask!

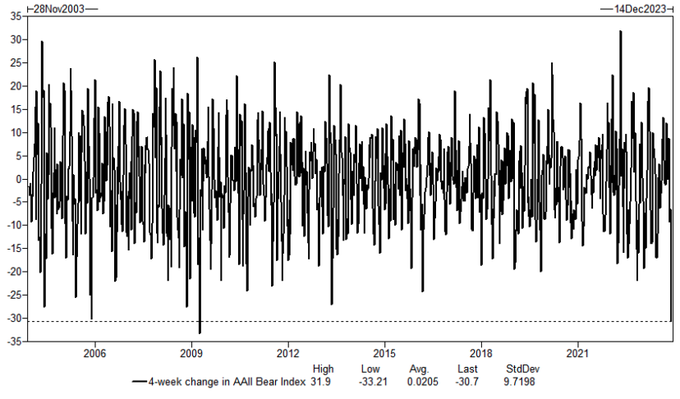

- Daily Chartbook@dailychartbook – Dec 2 – “The 4-week change in AAII Bear Index is one of the largest drops we have seen in the last 20yrs.” – Goldman Sachs

Who needs bears when you have Dumb Money (not our phrase) piling in, right?

- Jay Kaeppel@jaykaeppel – Dec 2 – Counterintuitive at first BUT a burst in bullishness among Dumb Money within an uptrend often provides fuel for a continued rally. A bull market needs buyers – any buyers will do. Chart below highlights Dumb Money Confidence crossing above 80% while SPX > 200dma. @ SentimenTrader

That is essentially what Craig Johnson of Piper Sandler said on CNBC back on Monday, November 27:

- “last Friday we had buy signals on our intermediate term indicators & also on our new highs-lows indicators … just last week … this suggests to us that intermediate term trend is still up; … there is more to go; … this market can get to 4825 by year-end by our perspective ….”

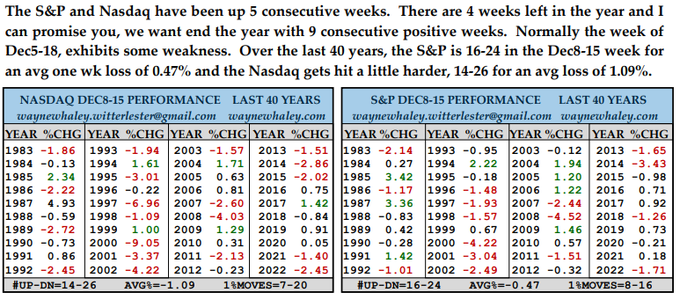

Mr. Johnson has been correct now for a couple of months at least. Kudos to him. But year-end is so far out, right? How about next couple of weeks, Dec 8-15 to be clearer? Below is someone who has also been right on these 1-2 week calls

- Wayne Whaley@WayneWhaley1136 – Sat – WILL THERE BE END OF YEAR TAX SELLING? I can’t call the specific causality but there is a tendency toward a pullback in the market in the 2nd Qtr of Dec which hits the Nasdaq a little harder than the S&P. The Nasdaq 14-26 in Dec8-15, last 40 yrs for an avg 1.09% loss.

2. “Its all about rates“

That is what Michael Shaoul of Marketfield said on BTV Surveillance on Thursday November 30. His basic point was that Either the economy is OK and strengthening in which case 10-yr Treasury yield is NOT staying at 4.25% Or we are in a pre-recession period & we will have a much weaker economy in 6 months & that is not compatible with S&P going to 5,000.

Is the second case consistent with the below?

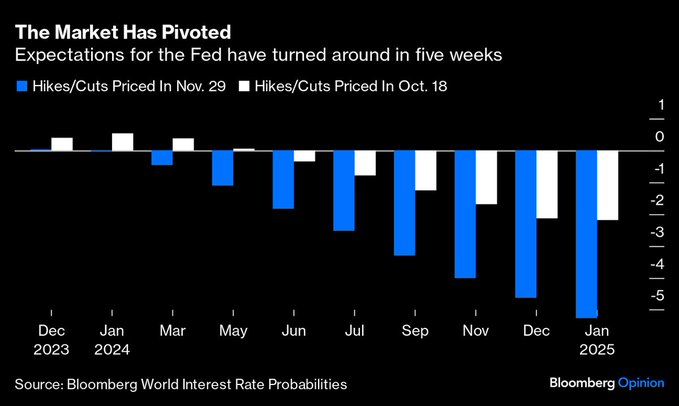

- Daily Chartbook@dailychartbook – Dec 3 – “Only five weeks after the market was discounting two 25-basis point cuts by January 2025, it’s now expecting five.” @johnauthers

We will get a better idea next week with employment numbers followed by Chair Powell presser on Wednesday, December 13. Interesting how this lines up with the Whaley observation above about the Dec 8 – 15 period.

Some are already telling us what is happening with Jobs:

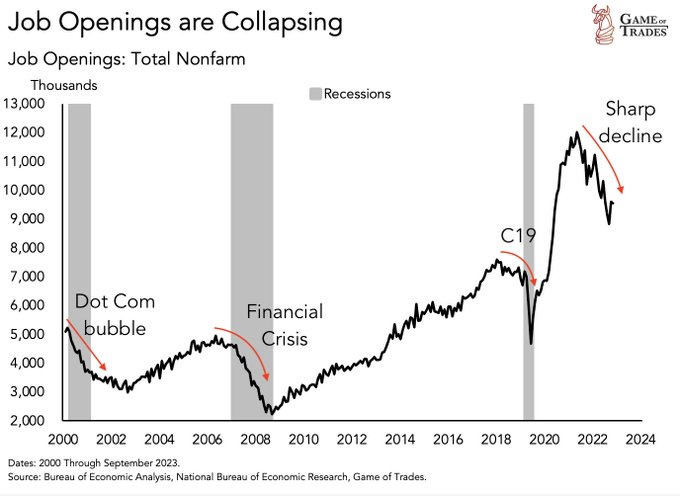

- Game of Trades@GameofTrades_ Nov 30– The labor market has begun weakening; Job openings have been falling off a cliff; Similar declines have happened only 3 times since 2000: 1. Dot Com bubble 2. Financial Crisis 3. Pandemic – Each of them ended with severe economic volatility. The worst part: This is happening at a time when the consumer is running out of excess savings. The consumer’s health is a crucial factor for the economy. This is an indicator we constantly monitor at Game of Trades

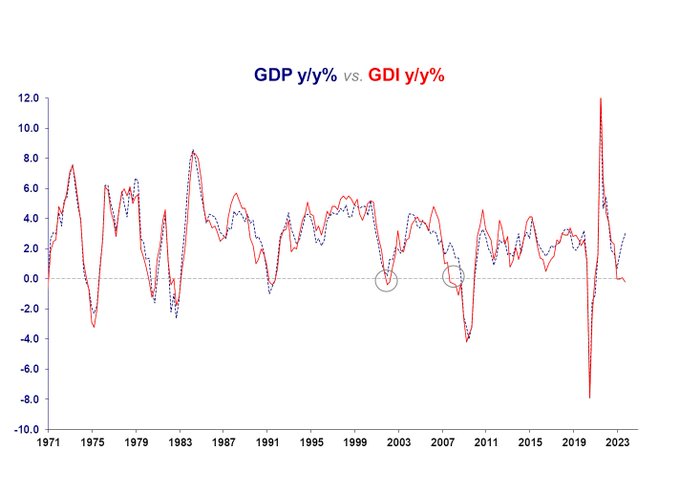

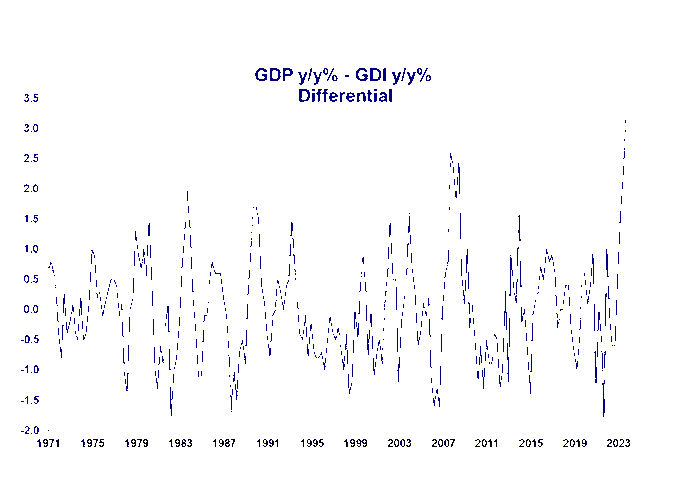

Then you have the dissonance between Gross Domestic Production & Gross Domestic Income:

- steph pomboy@spomboy – Nov 29 – This is probably a better look…and more ominous. It appears that GDI has only been negative y/y while GDP was positive twice before— 2001 and 2007. Buckle up for the hard landing.

And she added that the below is the widest gap between GDP & GDI in history:

Speaking of hard landings, we heard a cute & smart phrase from Lauren Goodwin of NY Life last week. She called this current “soft landing” as a stop on the way to a hard landing. That might be intelligent but not TV-smart. Somebody should tell her that such language is not the way to get back on Scoot Wopner’s Closing Bell show on CNBC.

What might all this lead to?

After all this, how can we leave out the gentle warnings that Roger Altman, founder & Senior Chairman of Evercore delivered on November 28 on CNBC:

- I would remind everybody that the US economy grew at 4.9% this last quarter; it grew about almost exactly at that rate in Q3 of 2007; and corporate earnings have ben tracking at about 5% yr/yr per latest reports; that’s about exactly what it was in early 2008 …. I don’t think it’s time to pop the champagne on soft landing; a little too soon to know if the economy in the fastest economic tightening in 40 years will sail right thru any serious softening – too early to say these many months of an inverted yield curve which historically has been a warning signal of recession won’t mean that this time …. 25% chance we will see a negative quarter or two next year ….

Now look at the TLT chart from November 1, 2007 to December 31, 2007. Even at the onset of that ugly recession, TLT was down about 3% in early & mid-December before the year-end rally. So despite all the above, we could something similar in the next two weeks.

3. The week that was

The major U.S. indices were all up:

- Dow up 2.4%; SPX up 79 bps; NDX up 10 bps; SMH down 38 bps; RUT up 3%; IWC (microcaps) up 3.6%; DJT up 2.5%; VIX up 1.9%;

Mega-cap techs were poor performers:

- AAPL up 70 bps; AMZN up 22 bps; GOOGL down 3.5%; META down 3.8%; MSFT down 89 bps; NFLX down 3%; NVDA down 2.1%;

Banks up big:

- BAC up 4.7%; C up 4.7%; GS up 3.1%; JPM up 2.3%; KRE up 6.7%;

Commodities up except Oil;

- Gold up 4.4%; GDX up 8.6%; Silver up 6.2%; SLV up 4.7%; Copper up 3.2%; CLF up 8.6%; FCX up 6.1%;

International Stocks up;

- EEM up 48 bps; EWZ up 2%; EWY up 1.1%; EWG up 1.8%; INDY up 2.6%; SMIN up 2.4%; FXI down 5.6%; KWEB down 2.9%;

Big rally in Treasuries:

- ZROZ up 5.6%; EDV up 4%; TLT up 3.5%; HYG up 1.3%; JNK up 84 bps; EMB up 2.1%;

- 30-yr down 20 bps to 4.401%; 20-yr down 23 bps to 4.572%; 10-yr down 25 bps to 4.215%; 7-yr down 29 bps to 4.219%; 5-yr down 34 bps to 4.144%; 3-yr down 36 bps to 4.313%; 2-yr down 40 bps to 4.553%;

4. Mark Benioff of Time Magazine vs. Marc Benioff of Salesforce.com

Accused Kha-Terrorist Pannun has been in the news for a variety of reasons this past week. As a follower of financial markets, we are intrigued by one aspect of the story, the story of one CEO-owner who is on both sides of this terrorism story. For those who may not know, Mr. Pannum is given to threats against Hindus worldwide & many have accused him of having a hand in the bombing of an Air India plane.

As a newly revealed aspect of Mr. Pannum, he equates the Panjab state in India with Palestine and says that Panjab will meet the fate of Palestine. We don’t believe he means to praise the involvement of Israeli forces in Palestine to rescue Israeli hostages & clear the region of Hamas associated terrorists. But you decide for yourselves:

Gurpatwant Singh Pannu is again directly threatening India with violence for its “illegal occupation of Punjab” 🤣. “Ballot Or Bullet”. Hard to take him seriously and for this reason I don’t think the Indian government hired anyone to have him killed. pic.twitter.com/2v0ycKpmuO

— Patrick Brauckmann 🕉️ (@vonbrauckmann) November 29, 2023

Earlier this week, Time Magazine published an interview with Mr. Pannum, a soft piece asking him to express to his heart’s content his views. You will notice how gently this accused terrorist is treated by the Time interviewer. That, in itself, is not the issue here. The main issue is Time Magazine itself, specifically the Owner of Time Magazine & his responsibilities in this context.

(Mr. Pannum) (Mr. Benioff)

If you ask “who owns Time Magazine” on Google.com, you get

- “Time Magazine is owned by Time USA, LLC. Time USA, LLC is owned by Marc Benioff, who is the CEO and founder of Salesforce.com. Financing and ownership information last updated February 22, 2021″.

OK, how big is Salesforce.com in India? Ask Google.com and you get,

- Of 9,000 employees the company houses in India, its biggest presence by far is in Hyderabad with over 3,500 employees, Arundhati Bhattacharya, CEO & chairperson, Salesforce India, told TOI

- “Blaze your trail with us in India. We’re building a world-class team in India, bringing together the best talent across our offices in Hyderabad, Bangalore, Mumbai, Jaipur, Pune, and Gurgaon.”

Talk about an interesting double personality. Founder-CEO Benioff of Salesforce gets to profit from the company’s large presence in India with 9,000 dedicated Indian employees who presumably care a great deal about India while Time Owner Benioff gets to white-wash & promote the open anti-Indian hate of an accused terrorist to please the India haters in the UK & in USA.

Got to wonder whether Mr. Benioff has some of the colonial British heritage in him, the heritage that made Britain a global maritime empire using Indian resources & India’s unique maritime assets while treating Indians like a slave force with the determined ferocity that made a young Hitler swear to implement that system in NAZI Germany.

Below are a couple of questions that a Journalist might ask Mr. Benioff about the interview by his employee of an accused terrorist:

- How did Owner of Time Benioff permit a free rein to anti-India hate via a whitewash & celebration of an interview with an anti-Indian accused terrorist? Did he not know of this interview before it ran? If so, isn’t that in itself an indictment of Founder-CEO Benioff for utter neglect of his fiduciary duties to Salesforce.com shareholders? Further did he, after the interview ran in his magazine, take steps against the interviewer & the editor for running such a hate-filled interview?

- Doesn’t that suggest that he might have either known about the interview before it ran and/or he had no problem with the interview as it ran despite the substantial damage it might cause to the image of Salesforce.com in India and globally? Doesn’t that suggest that he agreed with the content of the interview despite the damage it might potentially cause Salesforce.com in India & globally. If so, is it right for the CEO to run Salesforce.com with his unabashed nonchalance about damage to his Salesforce shareholders? Shouldn’t the Board of Salesforce.com step in to ask questions & grill Mr. Benioff about the conflict of interest?

Now come with us to the other big country that is a neighbor of India. Is it even remotely possible that an American company would allow a media company owned by the CEO of the US company publish anything even slightly negative about China? Just watch Ray Dalio of Bridgewater, Larry Fink of BlackRock tread extremely gently about China and you will get the answer.

This shows again that while China is strong & will not tolerant ill-treatment of China & Chinese values, India & Indians remain pathetically weak & cowardly. Indians can get verbose & arrogant when things are going their way but they fall apart quickly & totally. We all saw how the Indian World Cup Cricket team, described as Juggernauts, fell apart pathetically in the final against Australia.

Today, it is fashionable in India to term Mahatma Gandhi as weak. Think how he would have handled this double-dealing of Marc Benioff. Gandhi would have called for his trademark Non-Violent Non-Cooperation against Salesforce.com India and asked for volunteers to peacefully enter all the Salesforce offices in India as protest against Marc Benioff’s support for terrorism against India. A number of Salesforce.com employees would have joined the protestors. They would have demanded the resignation of Mr. Benioff both as a Director & as an Employee.

Neither Mr. Benioff nor the Salesforce Board would have had much choice. The Non-Violent Non-Cooperation of Gandhi would have caused a fall in Salesforce stock & would have prevented any new sales to any company in India or in the Western World for fear of being tainted by a “Benioff stain”.

But as we said this is not Mahatma Gandhi’s India. That man stood against the might of the global British Empire & won his fights. Today’s Indians can’t even think of asking any serious tough questions to Marc Benioff!

Enjoy your success Mr. Benioff, morally decrepit success as it might appear to the majority of Hindus worldwide!

- PS; We would like to acknowledge Mr. Bill Ackman for being the ONLY voice we have heard in USA standing up for Asian Students at Harvard. Every other billionaire only focused on the difficulties faced by Jewish students at Harvard & other Universities. They couldn’t think of broadening their case by including Asian students at these universities who face as bad or possibly worse treatment. Kudos Mr. Ackman! You are a true Mensch, Sir!

While much of India remains pathetic, TV anchors, especially women anchors, in India are not. Below is one example about an Indian TV anchor showing western media white-washing Kha-leaders accused of terrorism.

Finally above are our opinions based on what we see, know & read. We ask here & we will ask, via X, Mr. Benioff, Salesforce.com & Time Magazine to tell us where we might be wrong. We will publish any responses not labelled as PRIVATE.

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on Twitter