The phrase “on the cusp of a take-off” was used by Prime Minister Narendra Modi when speaking with the Financial Times. At first, that phrase may seem strange given what India has already achieved so far The strength of India’s economy, the stature Indian foreign policy has achieved and the stunning success of India becoming the first country to land a lunar vehicle on the south pole of he Moon – all these already suggest a country well on its path to big success.

No wonder Trinh Nguyen, Senior Economist at Natixis told Bloomberg Asia that “India is our key conviction call – a structural bull trend“. And her point below is consistent with the “on the cusp of take-off” phrase on PM Modi:

- “if you look at the cap-ex (capital expenditure) cycle, we are only at the beginning; if you look at the fundamentals of India, you will see that it is only at the beginning of the investment cycle“.

Ridham Desai, Strategist at Morgan Stanley Asia, made the same point :

- “we are starting at a low point of credit; corporate credit to GDP ratio is about 50%; household credit is in high teens; together they are under 70; that number is probably going to 100 in the next ten years“.

Both make the natural comparison with China pointing to China’s demographics & the resultant deflation. In fact, demographics is a great positive about India. But not just demographics in numbers. India’s neighbors, NaPakistan & BanglaDesh actually have better demographics but that is sensibly viewed as a risk for those regimes. Why is India different? Ridham Desai explained it well:

- “we have a young population that is highly aspirant; that wants to win; its a force that is very difficult to counter; people should not, even for a moment. under-appreciate how much the rising lower middle income group wants to succeed; that’s our driving force; that is NOT an advantage almost any other country has“.

This shows up in the raw energy in India that investment visitor after visitor have mentioned on Fin TV. Much of the progress is due to smart policies introduced by PM Modi in 2015 & then again in 2019. As Ridham Desai explains:

- “GST has eradicated inter-state borders; Oil intensity of the economy has gone down; Reserve Bank has focused on inflation; corporate taxes have been cut; Retirement funds were allowed to invest in the stock market, like President Reagan allowed US 401-K plans to do so in 1980; India is no longer dependent on global factors for growth“.

This flame to grow, to get richer has now driven politicians to promise growth in the near future. Maharashtra, capital of which is Mumbai, had a GDP of $425 billion in 2022-23. This past month, Deputy Chief Minister Fadanvis announced that Maharashtra is aiming to become a $1-trillion economy by 2028. Uttar Pradesh, India’s largest but less developed state, has also used the $1-trillion target though not by 2028.

Frankly, all the above is fine. But where is the big step, the really transformational project that can change the trajectory of a large part of India’s economy? Yes, we all have heard of the IMEC corridor announced with fanfare at the G-20 in Delhi. But, as we have seen, its trajectory depends on Israeli-Saudi Arabia relationship. And, as we showed at that time, India will be only one of the beneficiaries of that corridor whenever it becomes a reality.

That brings us to the truly massive project already launched by the Indian Government, a project that can be a true rival to Singapore & Dubai without depending on any external factor.

Great Nicobar

What led Dubai-UAE to their current status in world trade? Their far-sighted development of the Jebel Ali port & the JAFZA free trade zone? That was just about 45 years ago. Across the Arabian Sea & the Bay of Bengal & at the other end of the Malacca Straits sits Singapore, the city of lions as its Indian-Malay founders named it centuries ago. Today the Port of Singapore is the 2nd largest port in the World contributing mightily to Singapore’s economy.

(Port of Singapore) (UAE-Dubai Jebel Ali Port)

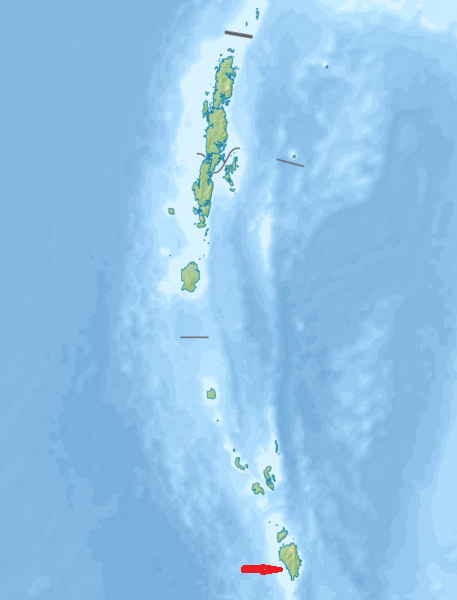

What sits on the other end of the Malacca Straits? The orange arrow in the map on the left below points to island named Great Nicobar. Think about it, wouldn’t it be great to build a big trans-shipment port on that island to supplement or compete with Singapore? Just like Singapore is also a major Naval Base, wouldn’t a big Naval & Air based on Great Nicobar make sense to control the entry & exit between Indian Ocean & Malacca Straits?

Now look at the map on the right above. The islands near the top of that map are the Andaman & Nicobar islands that not only sport exquisite tourist facilities but also India’s only Tri-services theater command. The red arrow in this right hand above map points to the Great Nicobar island.

Now look at the horizontal short black lines in the map on the right that are global channels of navigation. These channels of navigation run across India’s Economic Free Zone between the Andaman islands & the Nicobar islands. But how important are these channels to global shipment traffic?

As Wikipedia informs,

- The Ten Degree Channel (also called Great or Grand Channel) within India’s EEZ is world’s busiest shipping trade route which also connects to very narrow and contiguous Malacca and Singapore straits. This route is considered world’s biggest strategic chokepoint in military terminology, e.g. India and allies could potentially impose a blockade in case of dispute with China whose economy significantly depends on the export trade through this route. …. This area is part of the much larger Indian Ocean region through which 90% of the world’s trade passes, which in turn is part of the larger Indo-Pacific region which hosts most of the global maritime trading activity.

- Six Degree Channel safety and freedom of navigation of power projection of not only India but also other nations of South Asia and Southeast Asia as well as $3 trillion international trade which passes through south Andaman Sea. ANC [India’s Andaman Nicobar command] influence over the gateway of Far East includes Six Degree Channel and Ten Degree Channel in Indian EEZ in Bay of Bengal, which is connected to the Strait of Malacca. These are crossed by over 94,000 merchant ships every year carrying world’s 40% freight trade to and from China, South Korea and Japan.

Where would the planned trans-shipment be located in Great Nicobar? In the area labeled Galathea Bay in the map below on the right:

Don’t be fooled by the small size suggested by the maps above. You may not realize that Great Nicobar is larger in size than Singapore & Dubai City combined. And there has hardly been any local population or local development on Great Nicobar. That makes construction of the massive port, building of air plane runways & power plants both easy & relatively inexpensive to build. By the way, as we understand, the entire project has already been approved by the Indian Government.

Look at the maps above and ask how much the planned Galathea Bay International Container Transhipment Terminal on Great Nicobar could undercut the prices charged by the Port of Singapore? Think back to the glee in the remarks of the Haifa Port manager while discussing how much he could undercut the prices charged by the Suez Canal.

Those who are interested should view the clip below that highlights both the geopolitical & economic implications of the Great Nicobar project. It also highlights the interconnectivity between the Indonesian & Australian naval bases in the Indian Ocean & between Diego Garcia, the US Naval base south-east of India.

By the way, India has already opened its first international trans-shipment port in the deeply southern city of Thiru-Anantha-Puram, a port that is close to (see map below) & might compete with the large, established Colombo port in Sri Lanka

This Vizhinjam International Seaport is being managed by the Adani Group & has opened partially in October 2023.

India in Ten Years

Today, India does not rank in international shipments trade despite sitting virtually on top of the channel which accounts for 40% of global traffic. With projects such as the above, India could well win a substantial portion of this naval commercial trade.

Today India is entering the international armaments trade via Indian-manufactured aircraft, missiles & other weapons. These long-term projects are just on the cusp of taking off.

India is also on the cusp of a healthy inter-state competition for inviting Indian & International companies to invest in India. That is one immediate result of a young population that is deeply committed to succeed economically. The politicians understand it & are responding to it with promises of rising incomes.

Based on all the above, Ridham Desai argues that India’s GDP will grow at 10%-11% annually. That, with a new earnings cycle, the broad markets in India should outperform.

This is perhaps why very smart & very successful investment luminaries like Jeffrey Gundlach have a simple message – Invest in India for the next 20 years & your grandchildren will be very happy.

From Expansive history to a Global Future

Look what India was to the Indian Ocean before foreign invasions & internecine wars bled it dry & made it captive.

First came the land-based invaders from Afghanistan & Central Asia. They were being defeated & routed by India’s resurgence until the disastrous battle in 1761, the largest battle of the 18th century in the World. That defeat opened the Indian ports of Bengal, Myanmar & the Malacca straits to the British.

With control of the Arabian Sea & the Straits of Hormuz on the left & control of the Malacca Straits & Indian-Asian coastline in the Bay of Bengal, mediocre Britain soon became “Britannia that ruled the waves“. Every British Admiral & Viceroy knew what Curzon, the famed British Viceroy of then India, publicly admitted at the beginning of the 20th-century:

- “As long as we rule India, we are the greatest Power in the world. If we lose it, we shall drop straight away to a third-rate Power“.

With projects like Great Nicobar & a continuous rapid build-up of military & economic capability, it may not be inaccurate to wonder if India could actually “rule the eastern Indo-Pacific waves” in future. That is indeed far away but today’s India, with projects like Great Nicobar, could possibly be on the cusp of take-off to the future that rivals or exceeds the glorious past.

*Editor’s PS – Our only caveat is that Prime Minister Modi remain India’s Prime Minister for the next 5 years at least.

Send your feedback to [email protected] Or @MacroViewpoints on X