Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Markets last week

And it was the best week for the S&P this year. Not only were stocks up on a big bounce that began the week before, but the Dollar was down on the week with long duration Treasury yields down as well. Given all that, the below should not surprise many:

US Indices:

- VIX down 27%; Dow up 2.9%; SPX up 3.9%; RSP up 2.4%; NDX up 5.4%; SMH up 9.6%; RUT up 2.9%; MDY up 2.7%; XLU up 1.4%;

Key Stocks & Sectors:

- AAPL up 4.6%; AMZN up 6.1%; GOOGL down 27 bps; META up 1.7%; MSFT up 3%; NFLX up 6.4%; NVDA up 18.8%; MU up 16%; BAC up 2.9%; C up 33 bps; GS up 2.9%; JPM up 4%; KRE up 3.9%; EUFN up 4.8%; SCHW up 5.2%;

Dollar was down 59 bps UUP & down 68 bps on DXY:

- Gold up 3.1%; GDX up 7.2%; Silver up 5.5%; Copper up 4.2%; CLF down 4.3%; FCX up 5.8%; MOS up 3%; Oil down 67 bps; Brent down 25 bps; OIH up 1.4%; XLE up 1.3%;

International Stocks:

- EEM up 3.8%; FXI up 3.4%; KWEB up 2.4%; EWZ up 3.2%; EWY up 5%; EWG up 3.8%; INDA up 1.1%; INDY up 1.1%; EPI up 1.1%; SMIN up 1.6%;

The Treasury Curve was mixed however with long duration rates down & short duration yields up.

- 30-year Treasury yield down 7.2 bps on the week; 20-yr yield down 5.4 bps; 10-yr down 5 bps; 7-yr down 3.7 bps; 5-yr down 2.9 bps; 3-yr flat; 2-yr up 1.1 bps; 1-yr up 1.1 bps;

- TLT up 1.3%; EDV up 2%; ZROZ up 2.2%; HYG up 1.2%; JNK up 1.7%; EMB up 1.3% ;

Kudos to the bullish people we highlighted last week. Their calls proved spectacular this week. But what comes next? One short term & one long-term comment below:

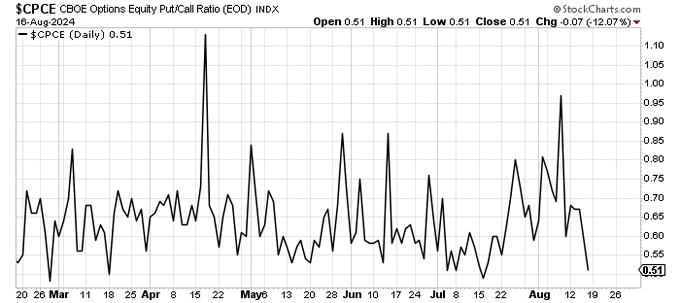

- Helene Meisler@hmeisler – Friday’s equity put/call ratio was .51, lowest since mid July

and,

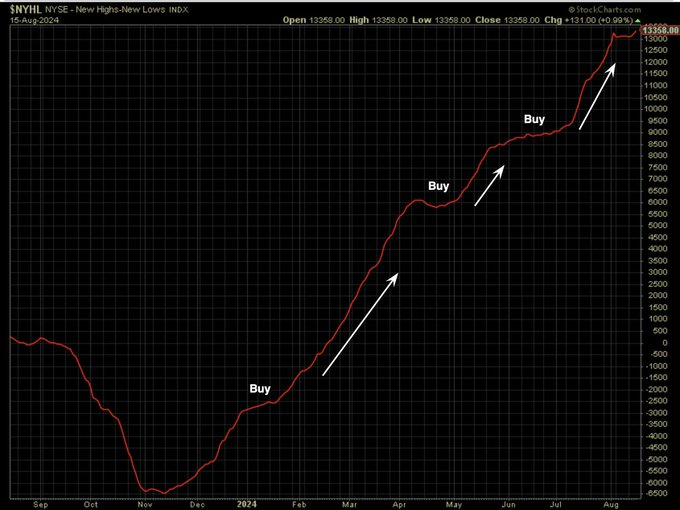

- Seth Golden@SethCL – The stock market regime has not changed, i.e. the trend is your friend. NYSE Cumulative Net New Highs informs it is unlikely to change through year-end, without exogenous event i.e. buy market dips. $SPX $NYA $SPY $QQQ $IWM

2. Rates, Treasury Bonds & Powell at Jackson Hole

Look what trends are saying to Katy Kaminski of Alpha Simplex on Bloomberg:

- “we are seeing very very strong technical signals in fixed income; its one asset class that made kind of a seismic shift in the summer; it went from a Short to a Long & now it seems to be a steady view that rates are going down … “

The nice aspect to Ms. Kaminsky’s comments is that we actually understand her in marked contrast to the talks we used to hear from Prof. Andrew Lo of MIT. Actually he was so articulate that we thought we understood him as we heard him only to realize afterwards that we really didn’t understand much. Worse were discussions about Poisson Jumps (usually called Volatility spikes) in market surfaces from Quant Researchers at Columbia that said no one has been able to model Poisson Jumps. Based on Ms. Kaminsky’s comments, that seems to be true today.

If they can’t predict the occurrence of a Poisson Jump with a strong degree of accuracy, why bother? Just as the wonderful discussions of Complexity Theory have remained nothing but discussions without someone actually creating the Mathematics for it. That’s why we prefer to look at comments like the one below:

- Jay Kaeppel@jaykaeppel – Aug 15 – Are LT treasuries (#TLT) regrouping for another run? Or just flat out blowing a chance to “flip the script?” I don’t have a prediction (would it matter if I did?) but am watching closely. @sentimentrader

If this is the best fixed income folks can do, then why not listen to Equity gurus who have been more right than wrong this year? Listen to what Ed Yardeni said on Bloomberg on Friday afternoon:

- “employment numbers we get … will reverse some of the weakness we saw in July that I think was, to a large extent, weather-related; if that’s the case, then that would be one more reason for the Fed to not do 50 bps but do a 25-bps rate cut; in addition we will get couple more inflation numbers & those should confirm inflation has moderated; Fed has normalized where rates are currently; economy seems fine; there are pockets of weakness but overall Q2 grew yr/yr by 3% which is the normal growth rate for the economy; … so why mess with success?”

On the other side is John Mowrey who was clear about the need for the Fed to reduce the 140 bps inversion between the 2-year Treasury yields & the Federal Funds rate. On that basis, he thinks Regional Banks & Utilities are the play.

Needless to say, all the above could be either supported or ridiculed based on the speech of Fed Chair Powell on Friday.

3. China – India

Last week news broke that $15 Billion were taken out of China in the second quarter. That prompted a call to well-known EM guru David Riedel from CNBC Fast Money. It is a balanced discussion that compares & contrasts market gains in China vs market gains in India. Below is a summary of what is included in the clip & what was specifically excluded by CNBC from the clip:

- “India is always expensive; they have a strong domestic market; they like to buy their domestic stocks; so there is a lot of demand for Indian stocks, domestic & foreign;”

- “China stocks are cheaper for a reason; they are facing a demographic crisis that other countries around the world simply are not facing; facing a demographic crisis takes away one of the pillars of why you invest in an emerging market; you are looking for that good long term tailwind story; there is a near term trade here in China;… I worry about 2025 & 2026” “;

- in India people are willing to pay little bit more for it; I think it could surprise to the upside even from where the pricing is today;”

The live CNBC Fast Money show then featured Tim Seymour, the show’s founding member & a hedge fund manager who spoke quite positively about the opportunity in India. And he specifically mentioned $IBN or the Indian private bank ICICI that he & many others refer to as India’s JPM. Seymour also highlighted his fund’s position in this $IBN and pointed out that it is also acting defensively.

You can see that CNBC edited out all this positive India content. Why? We don’t have a clue. It could be because the show’s host Melissa Lee is of Chinese origin & so the show won’t allow positive content about India while she can mention BABA & other Chinese stocks. We doubt it because Melissa Lee is too smart to be dumb enough to do so. So as we say often, the ways of CNBC are beyond simple folks like us.

We do think there might be a short term trade in Chinese tech stocks & we point out that $KWEB has outperformed S&P for the past 3 weeks. And we see interesting parallels like the one below:

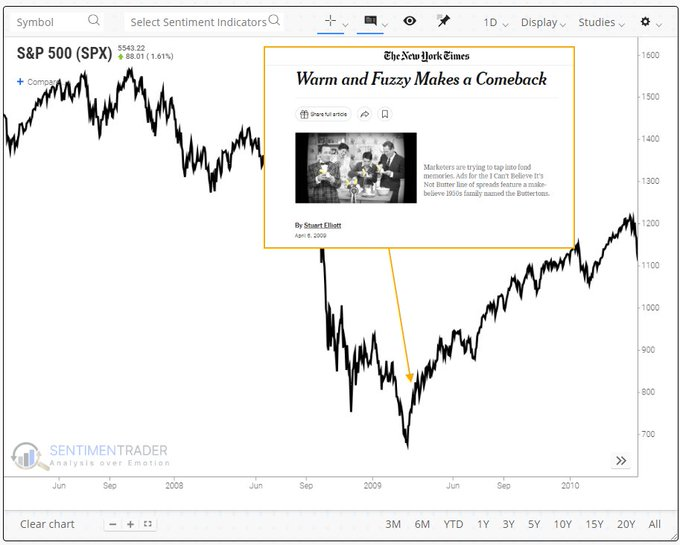

- Jason Goepfert@jasongoepfert – Aug 16 – When economic duress is at its peak, consumers and investors give up and yearn for better times. Life always seemed better in the past. Seeing more articles like this now about China, same as the U.S. in ’09.

Finally allow us to report what we hear that, despite the border dispute & presence of 50-60,000 troops on both sides of the line of control, the economic trade along the Indo-China border is thriving. Cheap Chinese products are being bought in bulk by Indian traders & sold in India. It is a win-win trade for both sides.

4. India – BanglaDesh

Most people who follow emerging markets know of Professor Steve Hanke of Johns Hopkins. The week began with his tweet:

- Steve Hanke@steve_hanke – From Visegrád 24 1:30 pm – Monday 8-12 – Attacks against Hindus in Bangladesh CONTINUE. Yesterday, Islamists set fire to two Hindu villages, Baruapara and Laxipara, in Panchagarh district. BANGLADESH = VERY UNSTABLE. Stay tuned. (Video clip not used bcuz of the extreme violence depicted)

- Dr. Eli David@DrEliDavid – https://x.com/i/status/1822767128019145157 – 🚨 Breaking: Another two Hindu villages set on fire in Bangladesh 🇧🇩, as the large scale ethnic cleansing of Hindus continues 👇

As we read, the UN has also stepped in with warnings to Bangladesh governing authorities. News broke on Indian channels that US has warned new leader Yunnus to clamp down on Hindu-killers because India is poised to send in army if it gets worse. We have no idea if that is true. There are exhortations of “Hindu Jaggo” (Hindus wake up) literally across the world. Below is a video clip from Zee News in Uttar Pradesh & it is a toned-down one despite how it looks:

It doesn’t have to get to a military intervention. India has already taken steps that could severely affect BanglaDesh. For example, BanglaDesh contracted in 2019 with a new Adani Power plant built inside Indian territory to supply electricity to BanglaDesh. This plant was forbidden to sell its electricity to Indian state governments or consumers.

This past week, the Indian Government changed it stance & allowed the Adani plant to sell its electricity within India. If Adani stops delivering electricity to Bangladesh, areas of that regime could become dark & cost of electricity to B’Desh customers would spike higher.

BanglaDesh imports rice, its staple food, from India & that can be reduced or stopped any time. Water is also supplied to BanglaDesh from India.

Despite of all the evidence of killings of Hindus, some professional foreign policy gurus still live in their own world.

- Derek J. Grossman@DerekJGrossman – Bangladesh now has secular anti-authoritarians as leaders. Sounds promising, actually. “These groups of students are not Islamist, and they’re also definitely not Awami leaders, so they represent a third kind of democratic force in the country.” https://t.co/e0dw3s7qiz

So the people burning houses, killing Hindus, going around & killing political leaders/activists of the Awami League are labelled as Secular & Anti-Authoritarian by Mr. Grossman? Takes us back to the day when American establishment hated Hindus & backed Islamic Terrorist state known as Pakistan.

Those who don’t know, there are about 10 million Muslims (Rohingyas & others) that have entered the West Bengal state within India that borders BanglaDesh. The current state government has welcomed these people & given them Indian Identity cards. It is their numbers & their thuggery that enables seizure of voting centers to keep the current state government in power.

5. The horrible, inhumane Rape of a Doctor in Kolkata

This is now the biggest story in India, even bigger than BanglaDesh but linked to it. Lots of details available on news sites, most very difficult to read. It is a story of massive corruption, linkages between state government & the head of the medical college. This would not have been big had the victim not been a professional middle class Doctor who was reportedly gang-raped & killed inside the hospital in a major city.

Now the story is shifting to rape being a form of punishment & not the reason. Below is one of the latest news clips in English:

Reportedly Doctors all over India have gone on an indefinite strike.

While absolutely horrific, this case is far more important than the actual rape-murder. Indian news reported about 3 other rape-murders more gruesome than this one but those have not generated any interest. This case has aspects that touch every educated Indian family; it occurred in a medical teaching institution in a major metropolis.

While all this is true, the ramifications are much bigger. This issue has gone beyond the purview of the socialist anti-Hindu Chief Minister of West Bengal, the semi-dictatorial leader of the most violent Muslim-led party in India. If the President of India with consultations with Prime Minister Modi & the Chief Justice of the Supreme Court decide the matter is beyond the purview of the Chief Minister, then President’s Rule can be imposed on West Bengal & the state government removed. The state will then be run by Governor of West Bengal with consultations with PM Modi. Look what that means to BanglaDesh especially in today’s environment:

West Bengal is the Indian state adjacent to BanglaDesh & has received over a million illegal Muslim migrants from BanglaDesh. It was Chief Minister Mamta & her crony rule over West Bengal that protected BanglaDesh.

On the other side of West Bengal are the states of Bihar, Jharkhand & Odisha – ALL Staunch BJP states. Now if West Bengal falls in the administrative hands of BJP, who suffers the most – BanglaDesh & its flow of Muslim migrants into India. That flow could now be reversed across the long border between BanglaDesh & West Bengal. AND flow of apparel exports ($60 billion from BanglaDesh) could be impacted any time India wishes & perhaps relocated into West Bengal.

Those who know of the past 2-3 year saga with Maldives & its anti-India PM will know that that anti-India PM of Maldives has now essentially made up with PM Modi & India. That was not done willingly but only after he found out that no country was willing to become its benefactor & supporter against India & PM Modi, not even China. We think the story will repeat between the new anti-India Jammat-i-Islami power in BanglaDesh. Look how far China is & given the enormous anger in India, what will China do & how?

Just look at the map. And then look at the Indian Stock Market to see that they don’t see even the slightest problem for PM Modi & India. In fact, if PM Modi now eliminates the migrant Muslim machine set up by the previous administration, West Bengal will end up being a core Indian state.

Those interested should read our Section I in our post-election article dated June 9, 2024. Begin with Section I4 titled Forget Prometheus – It is PM Modi Unbound & then read backwards to Sections I3, I2 & I1. What we write about is a marathon walk & not a 100-m sprint.

Who could foresee that the rape-murder of a young woman Doctor in Kolkata could prove to be a major political & geostrategic event!

PS: To cause severe distress to some & perhaps joy in others, imagine a world in which President Trump, PM Modi & PM Netanyahu work together! Given current trends, that may conceivably happen. By the way, PM Modi will be in Poland this week for the Voice of Global South Summit with 123 countries. USA-Russia are part of Global North & not invited. Strangely, China is NOT invited either.

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on Twitter