Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Markets Last Week

US Indices:

- VIX down 5.5%; Dow up 29 bps; SPX up 1.3%; RSP down 84 bps; NDX up 2.5%; SMH up 4.9%; RUT down 2.1%; IWC down 3%; MDY down 2.2%; XLU down 3.9%;

Key Stocks & Sectors:

- AAPL up 2.3%; AMZN up 4.5%; GOOGL up 1.2%; META up 5.5%; MSFT up 2.1%; NFLX down 8 bps; NVDA up 9.5%; MU up 4.4%; BAC minus 55 bps; C down 3.3%; GS down 56 bps; JPM down 1.4%; KRE down 3.2%;

Dollar was up 35 bps on UUP & up 28 on DXY:

- Gold down 1.6%; GDX down 4.8%; Silver down 4.1%; Copper down 3.4%; CLF minus 8.5%; FCX down 7%; MOS down 8.7%; Oil down 2.3%; Brent down 2.7%; Nat Gas up 14.5%; OIH down 6.2%; XLE down 3.4%;

International Stocks:

- ACWX up 18 bps; EEM minus 60 bps; FXI minus 30 bps; KWEB down 1.4%; EWZ down 3.3%; EWY up 2.4%; EWG down 28 bps; INDA up 1.9%; INDY up 1.8%; EPI up 1.4%; SMIN up 1.8%;

And interest rates moved down for the week despite a big jump on Friday post the NFP report;

- 30-year Treasury yield down 9.6 bps on the week; 20-yr yield down 8.4 bps; 10-yr down 7 bps; 7-yr down 6.4 bps; 5-yr down 5 bps; 3-yr down 1.8 bps; 2-yr up 0.6 bps; 1-yr up 0.4 bps;

- TLT up 1.4%; EDV up 2%; ZROZ up 2.2%; HYG down 37 bps; JNK down 45 bps; EMB down 32 bps;

2. What gives? Stocks

The above is weird in many ways. So let’s first look at the consistency in one area:

- Larry Tentarelli, Blue Chip Daily@bluechipdaily – Semis $SMH new highs – pullbacks should continue to be buyable.

Was that strength related to the split in $NVDA, the company that seems to be getting more & more dominant?

- Markets & Mayhem@Mayhem4Markets – Incredible. Nearly 9 out of 10 GPUs globally are $NVDA-made.

To broaden it to QQQ,

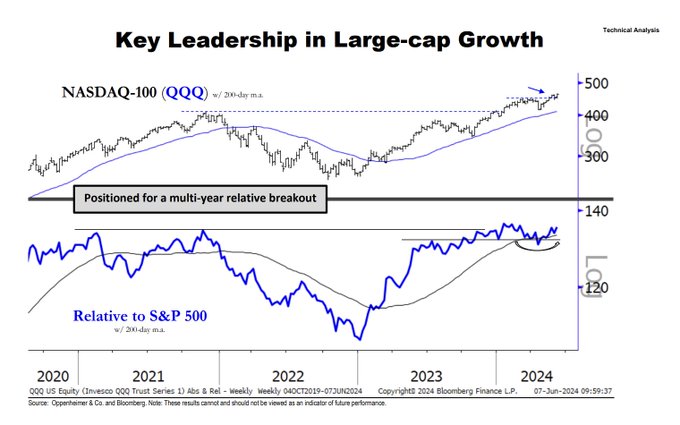

- J.C. Parets@allstarcharts – Jun 8 – From @AriWald this morning, “For the NASDAQ-100 (QQQ), we reiterate this large-cap growth benchmark as a core position in belief 1) its steadiness is underappreciated and 2) it should remain a driver of the market’s secular advance.”

On the other hand,

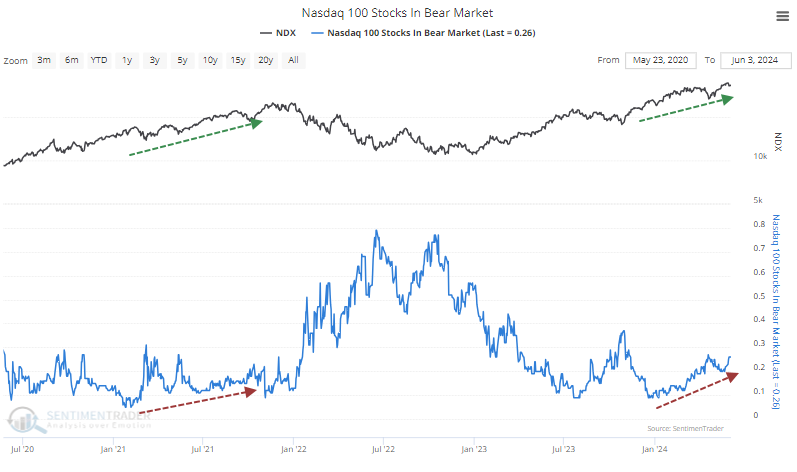

- SentimenTrader@sentimentrader – Bear markets are rising among big tech stocks. Oddly, more and more Nasdaq 100 stocks are falling at least 20% off their highs even while the index rises. This is a change from the initial phase of the rally and is quite similar to the rally in the fall of 2021, when the index rose while more of its stocks fell into bear markets. These divergences didn’t matter for future returns during 1998-99. Outside of that blow-off period, they did.

And,

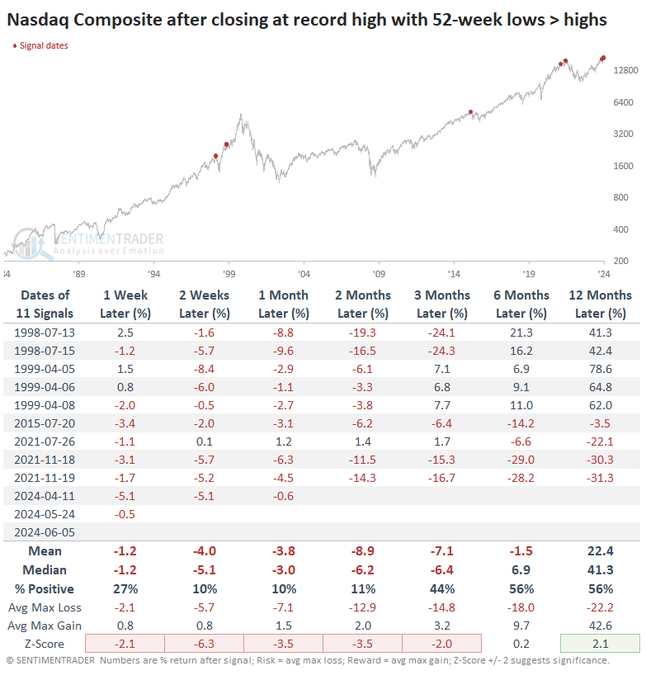

- Jason Goepfert@jasongoepfert – The Nasdaq closed at a record high. But there were fewer stocks on that exchange rising to 52-week highs than falling to 52-week lows. This has not happened many times. The handful of times it did were…well.

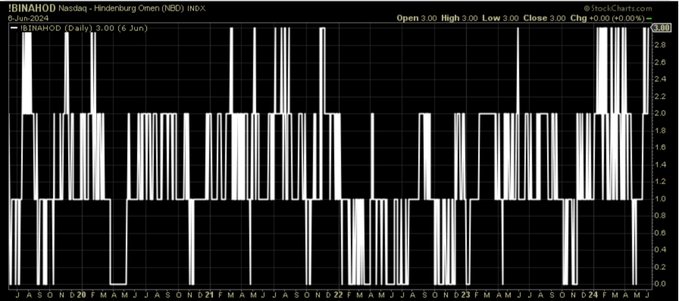

Not an omen but an omen cluster?

- Seth Golden@SethCL – Have not seen Nasdaq Hindenburg Omens in abundance within a 4-month period like this over the last 5 years. Two ways of thinking: 1⃣Some seriously concentrated positioning and bifurcated breadth 2⃣ unique conditions require a flexible approach. $COMPQ $NDX $QQQ $SPX

Moving to the S&P,

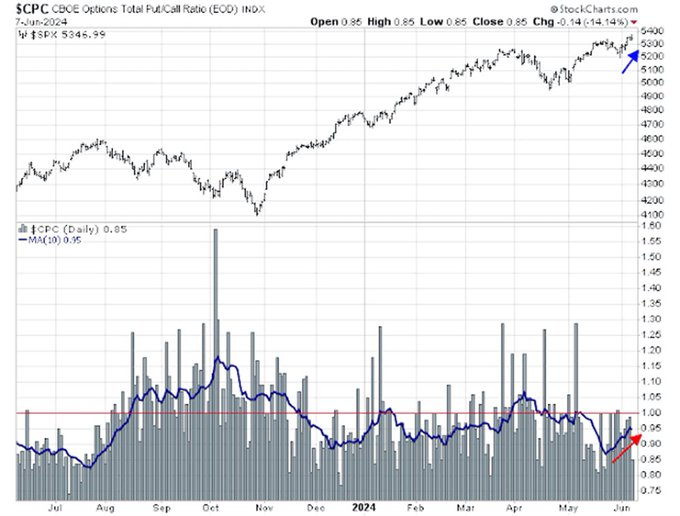

- Ryan Detrick, CMT@RyanDetrick – Stocks bounced back last week, yet we saw put/call ratios move higher. Have to like that for staying power of this June rally. Another nice one from

@HumbleStudent

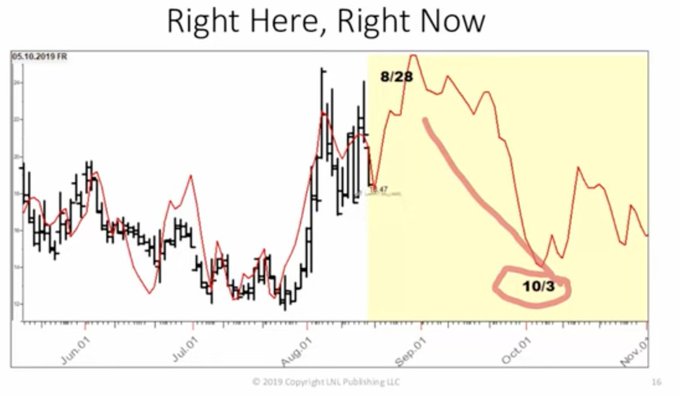

Per Larry Williams,

- Seth Golden@SethCL – LARRY WILLIAMS: CYCLE FORECAST – “Cycles measure for Time, not for Magnitude.” Cycle forecast for the VIX suggests lower until October, then pre-Election spike, before resuming lower again. S&P 500 cycle projects higher prices! $SPX $VIX $SPY $QQQ $ES_F $DIA

2. What Gives? Rates & Commodities

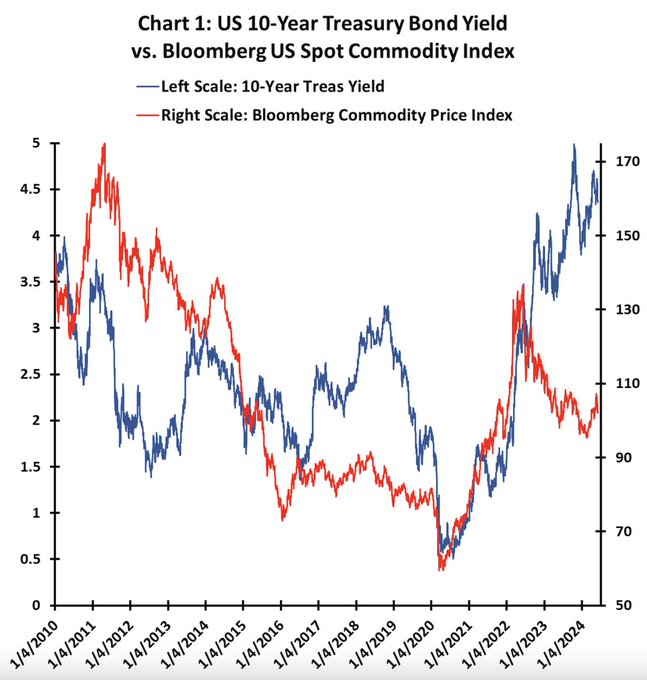

- Seth Golden@SethCL – Something is not right, here 🚨- Commodity price index is down some 35% from highs, but 10-yr Yield remains elevated. Alligator jaws likely to clamp down w/dramatic DECLINE in 10-yr Yield, possibly ending Bond Bear🐻 Market. $SPX $TLT $TNX $SPY $QQQ via @jimwpaulsen

Is there a signal that suggests rates might head lower?

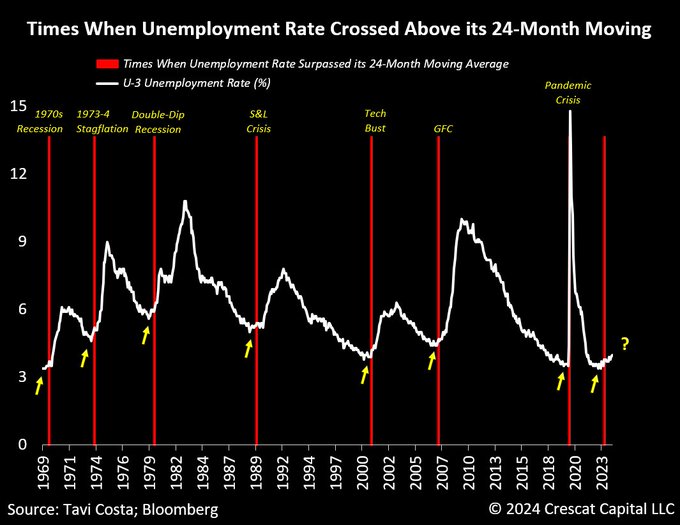

- Otavio (Tavi) Costa@TaviCosta – The rise in unemployment rates yesterday highlights the critical importance of this macro signal, which has consistently predicted severe downturns in labor markets. If history is any guide, this is the beginning of an upward trend in unemployment rates, not the end of one.

The worst chart of the day?

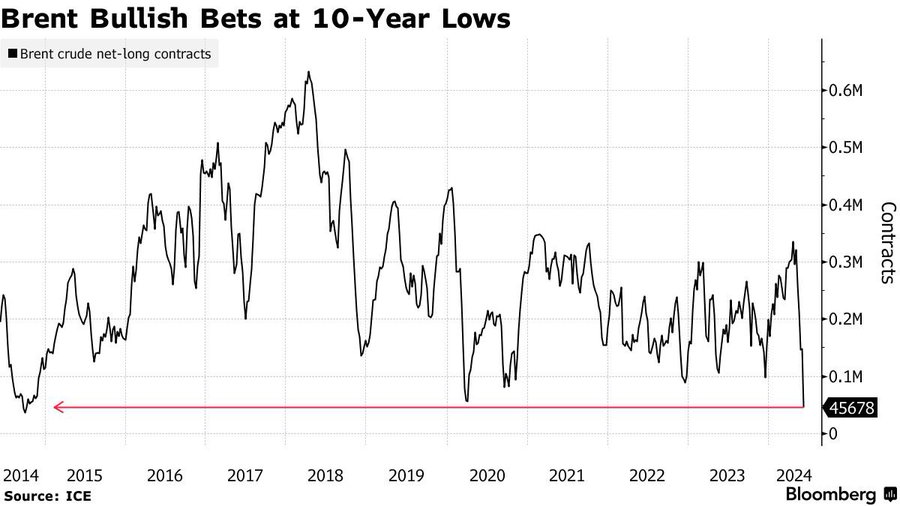

- Otavio (Tavi) Costa@TaviCosta – This is the most important chart of the day. Brent crude oil contract positioning has just plunged to its most bearish levels in a decade. In a world with rising geopolitical risks, where energy commodities are becoming highly strategic macro assets for nations, such low positioning in oil presents one of the most timely opportunities I’ve seen in a while. A key reminder: Overwhelming skepticism almost always morphs into opportunity.

And a carnage:

- Markets & Mayhem@Mayhem4Markets – Jun 7 – Purge carnage in the precious metals today, but it was likely inevitable. Things got a little bit frothy. Let’s see if Powell saves them against next week. He certainly did last FOMC meeting…whether he wanted to have done so or not.

Signor Powell is on deck now. Let’s see what he says & what impact it has.

3. What Gives? The NFP report

- David Rosenberg@EconguyRosie – Jun 7 – This was a tale of two employment reports, NFP +272k and Household survey -408k, but for the Fed and the trading community, nonfarm payrolls will always take precedence.

Rick Rieder said on BTV The Open that “gyrations in the bond market over the last 2 weeks were of the extremes – pretty incredible;.. now (post NFP) repricing to a level that is more realistic … you have a good economy that, at the margin, is moderating & today’s data is reflective of that ...”. .

Then a terse comment:

- Michael Lebowitz, CFA@michaellebowitz – Jun 7 – This is the worst best jobs report I have ever seen. Household survey -408k Establishment +272k; Full time -625k Part Time +286k; Native born -663k Foreigners +414k

We have seen this “foreign-born” category & it confuses us because it spans a huge period & the entire spectrum of jobs. The term “foreign-born” includes the founders & CEOs of hugely successful technology giants like Jensen Hweng of NVDA, Hock Tan of Broadcom. Satya Nadella of Microsoft, Sunder Pichai of Google just to name a few. It also includes a large number of Asian American middle income jobs & businesses because most of them came to America post 1964 which was only 60 years ago. The above term also includes the more recently arrived underemployed who are competing for minimum-wage jobs.

So we are not sure how this all-encompassing term adds much to the NFP discussion.

4. International Markets – China vs. India; Bloomberg TV vs. CNBC

The timing was almost impeccable on Monday June 3 with Monday’s huge rally in India on the way of being followed by the waterfall decline on Tuesday June 4. But the theme of Nomura’s Gareth Nicholson remains unchanged. His basic theme was large international investors are full up in the USA & looking for diversify & his best two choices are Japan & India. BTV’s Yvonne Man asked him about the recent outflows from India. His response – “we lovee the space; to be honest it is a great opportunity; there are so many factors that are supporting the India long term story- stable government, 8-9% growth for 20 years; buying the dip is an interesting opportunity; one of our high conviction plays .... .. “.

When pushed about China by Yvonne Man, he replied “the rally in China has been off a very low base; fundamentals still remain in question; it has been very tactical in nature ; It has been a great rally; we still like China from a tactical perspective but we haven’t seen that shift in economic fundamentals yet — we do feel stickier money remains in India“.

His “stable government” point might have looked dicey on Tuesday but now it looks valid & fine. As we write this, PM Modi has taken his oath of office and has been sworn in for his 3rd term as the Prime Minister of India.

His two points about outflows from foreign investors from India & not being able to find opportunities beneath the common big cap names were answered in the next show & clip Bloomberg Markets; Asia by Feroze Azeez, Deputy CEO of a wealth management firm in India:

- “If you look at flows from 1st of April till yesterday, about $4.5 billion have been sold; .. if you look at index short positions of foreign institutional investors, they have raised shorts to 86%-87% vs. 40% long which is the one of the least I have seen from a long standpoint; … I think they will reverse that position & become net positive over the next 10 trading sessions. So there is going to be a lot of short covering ..”

Gareth Nicholson of Nomura had said above that they like markets where the locals can step up when foreigners leave, suggesting India might be one of those. Feroze Azeez in his clip explicitly tells you why:

- “.. India has 8 trillion rupees of household savings out of which only 4%-5% is equity; so the paradigm shift from debt to equity for the domestic investor will continue … ”

Azeez also spoke about where the next push in the equity market would come:

- “the most important push would come to the PSUs (Public Sector Units) because the PSUs have been undervalued in India & always called value stocks because the way they function is very different than the private sector.” I think that perception is changing to re-rating of the PSUs“.

He spoke about how the mammoth State Bank of India is getting closer to the PE of private bank HDFC. We have been clear in our conviction that PSU sector we love is the Defense Sector which is in an overdrive. Just look at the performance of Hindustan Aeronautics (HAL) & Bhaarat Electronics (BEL) over the past 6 months.

This is all Bloomberg TV. The larger & “first in business worldwide” network has been totally absent in the huge market volatility & opportunity presented this week. This reminds us of February-March 23 when the Hindenburg report about Adani companies created a phenomenal opportunity. Again CNBC was totally absent at that time and the absolute star coverage came from Bloomberg’s Annabelle Droulers.

After the crisis was over & the investor opportunity had passed, an uninformed & clueless Indian-origin on-air talent at CNBC claimed credit. We were afraid we would see a repeat of this during the market turmoil in India this week. But thankfully this time, Tim Seymour a CNBC Fast Money guy came out & spoke.

It seems Bloomberg TV prefers to put an informed person on TV to discuss markets regardless of his/her ethnicity. For example, Bloomberg TV has a smart & talented Indian-origin anchor named Sonali Basak who covers the US financial sector. But they have never asked her to report on Indian markets just because she is of Indian origin. In sharp & disappointing contrast, CNBC always put their solitary Indian-origin person on air to cover major events in Indian markets. The result is disappointing.

Frankly, we consider this practice of CNBC as almost racist. Why does a reporter covering Indian markets have to be of Indian origin? It harms CNBC viewer-investors as it did this week in the Indian market turmoil.

We think it is both lazy & wrong to view India from a Chinese lens. The models & the countries are totally different. We were quite happy to see a star manager of a $16 mutual fund in India tell BTV’s Haslinda Amin this past week that

- “… I think global investors are starting to see there are differences between the China & India models…. I don’t think India is China plus one. I think India is a narrative of its own and it’s a growth model that is perhaps closer to the US of the 1980s; “

We would like to express our thanks to Haslinda Amin & her colleagues at Bloomberg TV for the help they provided this week to simple minds like us. We also wish CNBC would just let Tim Seymour be the voice of CNBC re market events in India.

Last week demonstrated the appalling ignorance of US talkers about India. Fortunately we didn’t read any of the trash that CFR & others produced. We simply took our clue from markets & proved lucky.

So we describe below how we thought about the huge downdraft on Tuesday & how we turned bullish step by step on both the Indian market & PM Modi’s 3rd term. You will see how simple it was as long as you didn’t read what CFR & others wrote!

I. Indian Election up & Down & the Resultant Opportunity

Last week was certainly interesting in the Indian stock market. We were hearing discontent even among BJP loyalists & so we wrote last week:

- “This coming week, we expect, the biggest impediment to future growth will be removed with the election results to be announced on Tuesday, June 4.”

And, if you net out all the drama of last week, our expectation that “biggest impediment to future growth will be removed with election results” has been realized. Of course, we did not expect the intense drama & the violent swings in the Indian market on Monday & Tuesday. But frankly the volatility provided opportunity as long as you kept a cool head & stepped in to buy Tuesday’s waterfall decline. We tried to get our “friends” at CNBC Fast Money to join our starting to buy declaration but, as usual & sadly, they went the other way calling it “the chance to book your losses” opportunity.

Below we describe our reasons to step in when “fast money” was afraid to. First look at the 2-month chart of INDA, the MSCI BlackRock India ETF, and notice that the waterfall decline on Tuesday June 4 did NOT violate the low on April 18 and not the low on May 10. Actually, this is borne out better visibly in the 2-month chart of INDY.

The above was certainly NOT the main reason to step in on Tuesday afternoon. The main reason for the rocket-up move on Monday was the confidence delivered by Exit Polls that PM Modi was again in charge & all systems were go. The waterfall decline followed a cascading down of that confidence & the rise of fear that PM Modi would not remain Prime Minister. So the waterfall decline was amply deserved assuming the fear was valid.

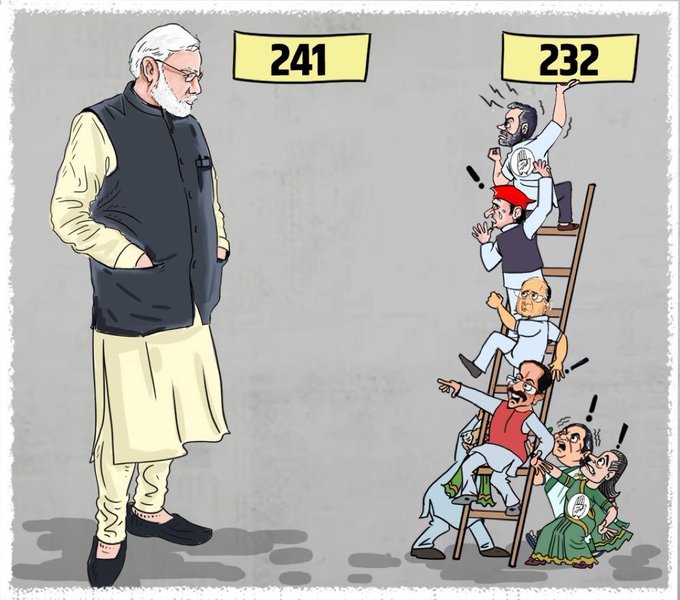

How valid was that fear? Just look at where Modi stood on Tuesday after the announced results & where the opposition stood:

One side or the other had to get to 272 to form the Government. Whom would you have bet on to get to that number? More relevantly on whom did the Indian stock market bet? Let us look the hourly 10-day chart of $INDA:

Notice that low on Tuesday June 4 was at the open. Also notice that from late morning NY time on Tuesday, $INDA began slowly rising. Partly a reflex bounce perhaps or perhaps something the market was sniffing out. The best smell for the sniff was coming from the Partywise Results Status published by the Election Commission of India, the body that announced the results.

Notice that the 6th party in the table (TDP Chandrabhanu Naidu) had 16 seats & the 7th party Janata Dal had 12 seats. Also the 10th ShivSena (SHS) had 7 seats. TDP was already a member of the NDA alliance led by BJP and ShivSena (SHS) was a partner of BJP in the state government of Maharashtra (2nd largest state in India). And Nitish Kumar of Janata Dal was an old ally-cum-opponent of PM Modi.

By Tuesday early afternoon in New York, the news was out that both TDP & Janata Dal had agreed in writing (to the President of India) to support BJP & PM Modi as Prime Minister. That meant PM Modi had the written support of 16 + 12 seats. We also felt that ShivSena (SHS) would also support PM Modi with their 7 seats. With that knowledge, wasn’t it the right move to step in to buy $INDA in the last hour of NY Trading on Tuesday?

Not only did the Indian stock market rally on Wednesday but it had delivered by Wednesday morning, the largest 2-day gain in 2024. So why was Thursday so flattish? Because there was some nervousness about the reliability of Nitish Kumar (Janata 12 seats) and Chandrabhanu Naidu (TDP 16 seats) as allies & whether they would demand too much of a price from PM Modi for their support. After all, both are well-known for joining in & leaving at their whim (Nitish Kumar being known as Paltu-Ram or Mr. Flipper).

So the concern was genuine. But we were not unduly bothered. Because PM Modi & his party boss Amit Shah are neither soft nor amenable to threats. AND we felt that both Nitish Kumar & Chandrabhanu had NO OTHER reliable choice. Those who remember the US dot.com period of 1999-2000 might recall how Bill Gates & other US executives were flying to meet ChandraBhanu Naidu, then chief minister, who wanted to invest big in fiber & internet. The reality is he lost the next election and has been out of politics for the last 20 years. Same with Nitish Kumar who knew that he might be welcomed by Congress now only to be dumped in a short time.

But people who were stupid once can easily act stupid again. So the market was right to be worried. But our faith in Modi-Shah proved correct. Why? Look at the Partywise Results Status again, this time from bottom to up. It shows Independents with 7 seats in total; 16 Parties with 1 seat each; 7 parties with 2 seats each; 3 parties with 3 seats each; 3 parties with 4 seats each & 1 party with 5 seats.

Now ask what these parties, their leaders & elected Members of Parliaments (MPs) must be thinking – they spent monies, fought hard & won a few seats that might mean zilch if TDP & Nitish Kumar remain allies of BJP. All they have earned is political wilderness for another 5 years. And there is no hope from the opposition alliance because it is already a gaggle that has begun to fight among themselves.

Enter the neo-Chanakyian Amit Shah who served as BJP’s Party Head for the two previous elections & the oldest partner of PM Modi since their Gujarat days. What if Amit Shah might be able to persuade some of these small parties to join the BJP with their seats? Isn’t that the real fear of the two TDP & Nitish parties? Because every 3-5 seats these tiny parties add to the BJP total, the less dependent BJP becomes on its two big allies.

And then the news broke about a problem within the star performer of this election – Samajwadi party of Akhlilesh Singh who had gained the most seats in Uttar Pradesh, the largest state & the fortress state of BJP. That party is the product of the late Mulayam Singh, the father of Akhilesh Singh & a 4-time chief minister of Uttar Pradesh.

Enter now Shishupal Yadav, brother of the late Mulayam Singh & uncle of Akhilesh Singh & his cousin Ram Gopal Yadav. These two claimed that the brilliant strategy used in this election was THEIR BRAINCHILD & not that of Akhilesh Singh. Stories started circulating on Friday in India that Shishupal Yadav or Ram Gopal Yadav or both might join BJP with their portion of the 37 seats won in Uttar Pradesh.

Guess what? The Nifty index that had opened with 59 bps gain kept going up slowly & steadily all day Friday in Mumbai and closed up 2+% (we love intrigue & kept waking up every couple of hrs to check the market action & the stories). Look at the 10-day map above to see how $INDA opened on Friday morning.

I2. A Real Wave except in two barriers

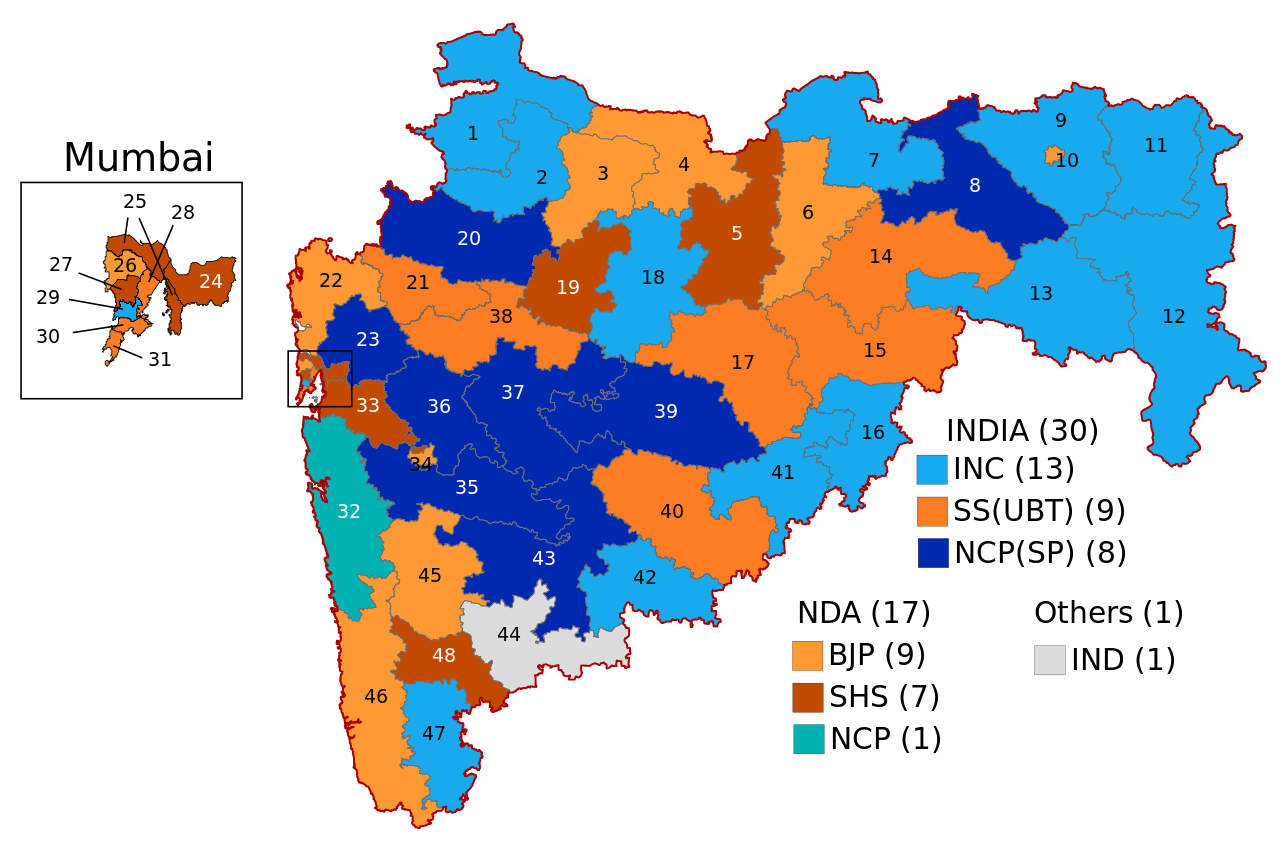

Look at the map of India to understand the real story of this election.

Focus on the light green state named Karnatak on the south-eastern coast of India. This state was won decisively last year by the Congress Party. They celebrated wildly & pronounced the beginning of the end of Modi. But they forgot to govern. BJP won this state resoundingly last week.

East of Karnatak on India’s southwestern coast is Andhra Pradesh. It was won bigly last week by BJP ally TDP. Directly above Andhra Pradesh is the small Telangan & Chattisgad. BJP did well in both. Up the western coast above Andhra Pradesh is Odisha which also BJP won. Above that is Jharkhand which BJP won & above that is Populous Bihar, a BJP win. Next to Bihar is Uttar Pradesh, India’s California size prize. First below that look at the large state of Madhya Pradesh which BJP swept with 29 seats. That was the terrific news.

Now for the bad news. The large state in brownish pink below Madhya Pradesh is Maharashtra, the second largest state with 48 seats and the largest, richest & most industrial state in India. Why did BJP lose Maharashtra? One answer is they had never won Maharashtra. They did well when they chose correct allies. Look at the dark blue region below (numbered from 23 to 39 to 43). This area drove this year’s election. What was the huge issue?

It was an election between the daughter of Sharad Pawar, the old man of Maharashtra Politics, and the wife of his nephew Ajit Pawar. For reasons we did not understand, BJP persuaded Ajit Pawar to join their party with the goal of using him to defeat Sharad Pawar. For BJP it was an election. For Sharad Pawar, it was the future of his daughter & her political inheritance (not to mention the billion-dollar prize the Baramati area represents). Guess who won!

There were no issues in that race of any kind except a family fight about political assets. BJP lost that race & Maharashtra. Fortunately it was a small loss.

That brings us to:

I3. Uttar Pradesh (UP) – the fortress that blew up

BJP had won 62 seats in the 2019 election in UP. Last year in May 23, Yogi Adityanath, the Chief Minister had won a complete sweep of all 17 municipal elections in UP. This was the only state in which Yogi, the Chief Minister, was recognized as the Number 1 factor in the state with Modi as no 2. And RSS, the Hindu-focused Rashtriya Svayansevak Sangh (National Volunteer Organization) or the ground game of BJP. And UP was the state in which the new Ram Temple was built with global coverage. A huge win in UP was a foregone conclusion. So the UP campaign was trusted to a new executive who brought in his own team.

It is a classic case of those whom Gods want to punish, they first make arrogant:

- In the last two elections, the winning seat hit-rate of combined BJP-RSS was 65.9% in 2014 & 69.5% in 2019. The new campaign brains got a different message – the head election guy in Delhi made a public statement saying “party (BJP) has grown from the days when it needed RSS; Now party is strong & can get its own work done; RSS is an intellectual organization & needs to do its work ….“. Of course, the RSS volunteers stayed at home. As we said, Gods make arrogant those Gods want to punish. The hit-rate of BJP-RSS dropped to 54.4% in this election.

- Remember the glorious public celebration of the new Ram Mandir in Ayodhya by PM Modi & BJP. And Ayodhya is reportedly 87% Hindu seat. Yet, BJP LOST its Seat in Ayodhya. This has utterly shocked BJP. They forgot that local Priests in Ayodhya had served the old Ram Temple for generations. Not only did BJP forget, but look what they did:

- Next BJP’s national office did what seems utterly nuts – they sidelined the most popular, most successful election winning Chief Minister in India from running this election & they entrusted the election to their own people run by Delhi. In addition they installed two deputy chief ministers to ensure the Chief Minister doesn’t overstep the bounds they had set.

- And they threw out the list of 30 candidates for the election suggested by CM Yogi Adityanath & chose their own candidates to run in the election. You know what happened.

Given all of the above, we are stunned that the BJP actually won as many seats in UP as they did.

Thankfully all the above is is now in the past tense. From what is seen, Amit Shah is back in his old role of party & election management, RSS & BJP are back as friends & co-warriors for India, Yogi Adityanath is again recognized as the main man in Uttar Pradesh & his two deputy CMs are gone.

And now PM Modi has been sworn in for his 3rd term as Prime Minister of India and we are very optimistic about India’s future, politically, economically & in stature.

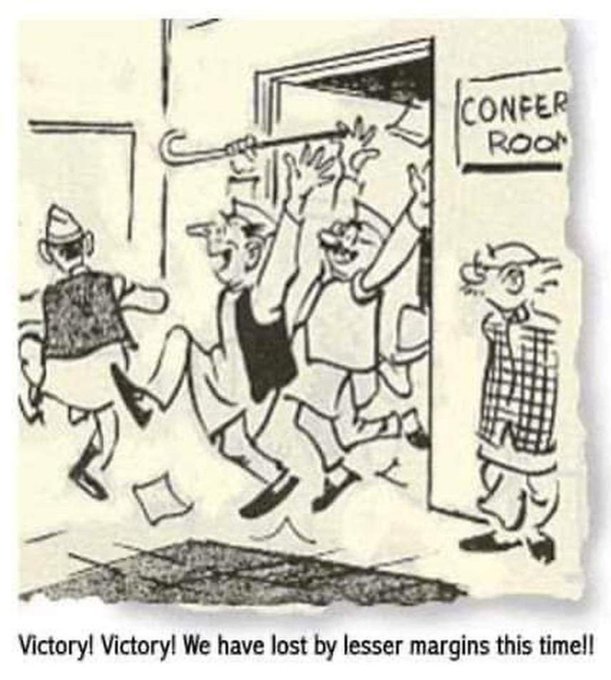

What about the elation expressed by Congress & their proponents?

- The Jaipur Dialogues@JaipurDialogues – RK Laxman predicted 2024 Election decades back!

I4. Forget Prometheus – It is PM Modi Unbound

PM Modi has already declared that the last 10 years were just a preview of what will come during this term. Forgive us for being blunt, but the talkers have to be stupid to think PM Modi will be bound by any alliance issues or fear about being too aggressive. That’s not him.

We expect that the pace of what he wants to achieve will be faster than what we saw in the past 10 years. Had he won a landslide, he might have been more polite & circumspect. Now he doesn’t need to.

We think India will look quite different 5 years from now. And that will be due to Modi Unbound.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter