Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

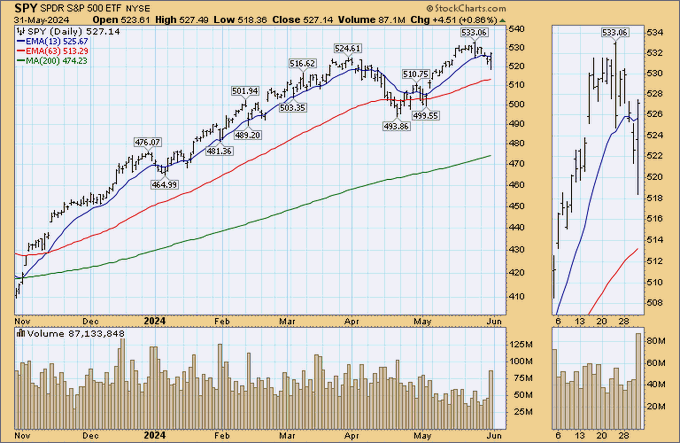

1.Friday afternoon’s outside reversal in stocks

- Walter Deemer@WalterDeemer – May 31 – Second big outside reversal day in six days — this one to the upside.

Another description:

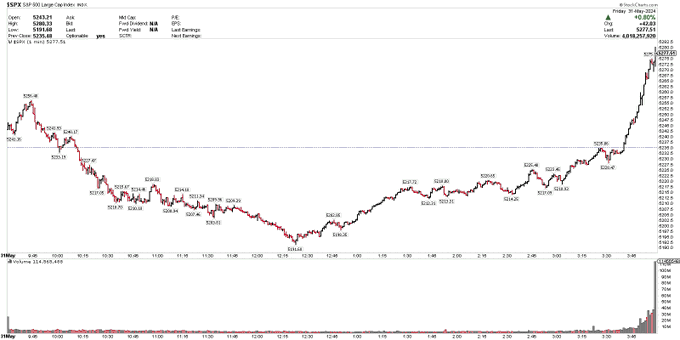

- Larry Tentarelli, Blue Chip Daily@bluechipdaily – May 31 – $SPX one of the best reversal closes I’ve seen in a while. +86 pts off the low and 85% of stocks higher on the day. End of month/PCE volatility not unexpected.

A reason for the reversal that even simple folks like us can understand:

- Jason@3PeaksTrading – May 31 – Seems like there was a large seller in Europe and when London traders closed for the week and went to the pub.. SPY ripped lol

Ok, but any opinion re what follows?

- Jason@3PeaksTrading – June 1 – $SPX rallied 89 points off the lows. EIGHTY NINE. Never fight market breadth and the VIX as implied vol’s and internals always know whats coming. The past two days showed a very big bullish divergence, too many were sucked into the bear trap. Really would not be surprised if that was the low for summer

The above adds on to the below:

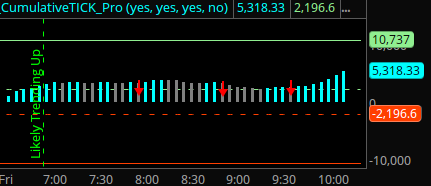

- Jason@3PeaksTrading – May 31 – Cumulative TICK at highs of day and stayed positive all day, either this is dead wrong or the market is going to rip higher next few days, again timeframe is important, not loading the boat long but see the risk to upside here

All this is fine but was there a turn two days prior that might have set up the big bullish divergence & the above upside reversal?

2. Treasuries

How bad was Wednesday’s 20-year Treasury auction? As ugly as Santelli described it! But was it so ugly that it seemed somewhat attractive to some people?

Look at the drop right at 1 pm & then the immediate up candle afterwards. That immediate drop turned out to be the low in TLT for the week. Did the long end moving up from Wednesday & a milder PCE had something to do with violence of the stock reversal on Friday?

Michael Hartnett of BofA-Merrill did write about a reversal in the “ABB” trade in the second half of 2024:

- Seth Golden@SethCL – BofA’s Michael Hartnett drumming up R.E.M. “It’s the end of the world and we know it…” 2H2024 reversal of the ABB, Anything But Bonds trade. $SPX $TLT $SPY $QQQ $DIA $NYA

All this is fine but shouldn’t the economy cooperate at least a bit? Barry Knapp said on BTV Surveillance that the “base of the economy is beginning to crack“. He said what is happening to smaller regional banks is similar to what happened to S&Ls and Thrifts in 1980s; he also pointed out that small business unemployment is much weaker & its likely to begin cracking some time in the summer. He thinks that will lead to the Fed cutting rates before the election.

Then on Friday we heard Bob Michele of JPM say on BTV Surveillance (from minute 1:31:05 to 1;38:13″) “... listen to Brian Moynihan who was out yesterday saying “Oh, goodness me! look at the slowdown that is occurring here“. He then pointed out how the Fed cut rates by 25 bps & 50 bps in 1995 & that was “enough to ensure a soft landing“. Then he said:

- “… that’s what Fed Chair Powell is playing for; he wants to ensure that they take the edge of the businesses & households, not reignite stuff; his concern is if they don’t do something soon, then the long & variable lag will start to catch up in a much bigger way & the pressure you are seeing on lower half of businesses & households can continue to spread above the line into the top half“

Then he was asked about the “who is going to buy Treasuries” consensus. Michelle said:

- “I love that everyone talks about – ugh! you can’t touch the bond market here; look at all the supply .”

Then he answered:

- “.. we are trading 100 bps above the Federal Funds rate; a lot of buying is going on; …. we see 3 vast pools of money out there that are waiting for the yield curve to disinvert because right now, they are comfortable in cash …. First Wealth Management Platforms – they are comfortable in getting 5.5%; … But when you look at the $6 trillion sitting in cash; .. second is Banks – they are better off keeping money in O/N Reverse Repos at 5.40-5.50%; 3rd are foreign buyers – big Japanese historic investor – when the yield curve starts to disinvert, they come into the market ,,,,, from September on” …

We also saw Paul Ciana of BofA come on CNBC Exchange and say that they see yields peaking in Q2 & turning down in second half of 2014. When pushed for a target yield, he said, current move is an Elliott wave B which will be followed by a Wave C that usually reverses the move in Wave B by 38.2% – that would lead to a low in 10-year yield of 3.25% in second half of 2024.

3. Commodities

Who better to speak positively about commodities than Jeff Currie, ex-GS & now Carlyle? Longer term, he says Copper is the best because it has 3 trades wrapped into it – Energy, AI & Defense. His simple point – “if you are going to electrify the world, you need a lot of copper to do it“

4. Indian Market

According to the report released this past week, Indian economy grew by 8% in the fiscal year ended March 31, 2024, vs. the expected rate of 7.8%. This coming week, we expect, the biggest impediment to future growth will be removed with the election results to be announced on Tuesday, June 4. That would confirm our short-term & long-term bullish view of the Indian Defense sector that we had begun enunciating in March & April.

We had focused back in April on Hindustan Aeronautics Limited (HAL) as the lead for the defense sector. Crazy isn’t it? An old stodgy public sector company that had done little of note for decades as the lead for the future? That began with PM Modi’s Aatma-Nirbhar (Self-reliance) drive after his 2019 election. The first evidence of it was the successful landing on the South Pole of the Moon last year. After all, how does one look at a Defense stock? By its backlog of orders & deliveries and by its ability to deliver earnings, kinda like $NVDA, right?

And we all saw NVDA’s amazing move up both before & after its earnings. Now take a look at the chart below of HAL vs NVDA from October 1, 2023 to May 31, 2024. HAL’s big move up in May came after they blew away earnings. Again, who had ever heard of a stodgy public sector company in India blowing away earnings?

What lies ahead in terms of backlog? An order of about 87 Tejas Mk1 fighters with an option for 93 more. And a recent order for 156 HAL Pra-chand, India’s new Light Combat Helicopter (LCH) designed & built for India’s unique needs for a fast, agile & powerful chopper that can operate over 21,000 ft in the Himalayan peaks. By the way, India still uses the classic US Apache Helicopters. But those were developed for much lower altitudes.

The clip below describes 5 key factors of HAL Prachand as well as a comparison with Apache helicopter. Prachand was designed & built after the 1999 war over Kargil & Himalayan terrain based on specific needs revealed by that war:

The next big project for HAL is the AMCA (5th generation fighter) in which GE is a partner with its top engine in a major US-India joint venture.

PM Modi has also stressed the importance of & need for India’s private sector & even its startup sector to focus on defense. And this week saw a first of its kind in the world announcement from an Indian start up in Bengaluru launching – Agni-Baan (Fire Arrow), world’s first rocket with 3D-printed engine called Agnibaan launched by Agnikul, backed by IIT-Madras.

Recall the “angriest speech” of PM Modi in which he condemned the intensely colorist language by the opposition Congress Party – South-Indians are African, West Indians are Arab, North-East Indians are Chinese & only North Indians are white). It was simply the most disgusting statement we had ever heard & it seems the Indian market agreed. Look at the double bottom formed by INDY, India’s Nifty 50 ETF on May 9, the day after PM Modi’s “angriest speech”.

The larger ETF, INDA, made a higher low that day as well:

Kudos to Stephanie Link, a CNBC Half Time contributor, who has been buying INDA on dips ahead of the election results. That took courage for which we think her investors & she will be rewarded.

And now something we didn’t know about today’s India. Chess, the game that originated in India, is coming back to India with intensity. Today, yes today on June 2, 2024, Praggna-nandhaa, an 18-19 year old Indian defeated the world’s No. 2 Fabiano Caruana after defeating the world’s no. 1 player Magnus Carlson. And D. Gukesh, just turned 18, is set to challenge World Champion Ding Liren for the title later in 2024 in a 14-game event after having recently defeated world’s No. 1 Magnus Carlson.

These are not isolated events the way they used to be in India. Today’s chess is exploding in India with India now claiming 3rd rank in number of Chess grandmasters only behind USA & Russia.

This does, in our opinion, have relevance to the trajectory of the Indian stock market. We recall how outsourcing or software built in India for US companies was ridiculed around 2000 as mainly menial work. Today that is a major sector in the Indian stock market. Chess may not be a direct contributor but success of young Indians in this highly competitive intellectual sport may be a sign of the progress India can make in the next 20 years in Science & Technology.

That is why, assuming PM Modi wins this election with a dominating majority, we are long-term confident about the Indian stock market.

5. Indian election 2024 & its coverage in USA

Somehow US media, especially CNBC, does tend to get the most anti-Indian of guests to opine on India. Generally they are desperate to be seen on CNBC & even willing to debase Sacrosanct names given to them by their parents.

But as we realized this week, even sensible sounding ex-Indians, even people who travel to India & have Indian colleagues, tend to show an appalling level of ignorance about India. Take for example, a favorite guest of late morning CNBC shows, Ruchir Sharma. He is the head of Rockefeller Foundation & an ex-MD of Morgan Stanley. CNBC anchors bring him on & listen to him with devotion. And he does work hard travelling with a group of 20 people or so in India before each election to analyze & share his predictions.

But has CNBC or other networks checked out his predictions in the past or even read the contempt in which his predictions are regarded in India? We don’t think so.

By the way, below is the poll of exit polls released this weekend:

And Ruchir Sharma described this election as “competitive”?

- Dr Vijay Chauthaiwale (Modi ka Parivar)@vijai63 – – Mr Ruchir Sharma, any regrets for making premature guess work? It might have pleased @FT , but your credibility is at stake. #RuchirSharma

Another was negative using a face of CNBC:

- Sandeep Pravin Parekh@SandeepParekh – Jun 1 – Ruchir Sharma is the Jim Cramer of Indian politics internationally: PS: Great consistency.

What did Ruchir Sharma predict in 2019, the last election wave which propelled PM Modi to a 2/3rds majority in the Parliament?

Yet, he was neither fazed nor was he in any doubt about his “expert knowledge” about Indian elections. Look what he said about this election:

- “you don’t see a wave, you only see a heat wave …. I think there is a risk to the downside based on the travels I have done & what I have heard ; seen elections in India over the last 25 years”

To be fair, it is not pathetic to be wrong about elections. It is possible that Ruchir Sharma, the Head of Rockefeller Foundation, doesn’t understand either India or the Indian people anymore. What bothers us is the continuous reliance on him by CNBC Anchors who we have come to believe are anti-Hindu.

We ourselves are neither professionally sound about elections nor do we profess to be. So we choose to listen to experts, people whose job it is to be correct like Stephanie Holtze-Jen of Deutsche Bank APAC CIO. We did quote her back on March 31, 2024 as below:

- “(minute 1;23) we looked at the last 5 elections & how the market reacted back then; you look at the 6 months after the election, the market on average made 21%; you look at the 6-months before, the market made about 12% on average; and only on election day there were actually 2 occasions where we had a sell-off happening; we made 2% on average; so it looks like a lot gets priced in before; once the uncertainty is out, may be on election day, you get sell the news effect & afterwards we go back to be able to perform; … the outcome we expect is more stability & more of the same policies to benefit India; & I fully believe that you can draw into the future from history“

By the way, we are not surprised about the Financial Times. In our opinion, they are anti-Hindu to the penultimate if not to the ultimate. We had hoped that Ruchir Sharma would bring some degree of common sense to them but we were wrong. Our fault & we own it.

6. Happy Beginning for USA

We have been bullish about Team America making its mark on World Cricket. Part of our confidence comes from the West Indian players playing in America. So far, we have been right. Look below especially from minute 9:16 when the US team starts batting and double especially from minute 11:06 when Aaron Jones came in to bat for USA. To give it away, he hit 10 sixers (home runs) and destroyed the Canadian bowling. Seriously watch this 3-minute highlight display. By the way, Aaron Jones also plays for Barbados.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter/X.