Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Strong Productivity launches … ?

Last week we quoted Mary Ann Bartels using a 7,200-7,400 target for next year using AI & Block Chain as triggers. We also quoted a soft-spoken guy speaking about Roaring 20s. Signor Yardeni did not use that phrase this week with CNBC’s Becky Quick; instead he laid out his case using a specific term that most understand:

- “… we are in the early stages of a productivity boom; it was extremely low in 2015; it was almost down to zero; we have seen it go from 0.5% to 2%; its quadrupling of productivity since 2015; it can go up to 3%-4%; sounds delusional but reality is we have had productivity booms in the 60s; in the 90s & they also showed productivity going to 3%-4%; & this productivity lends itself to being used by many more business applications than we ever had in 1990s; …. it wasn’t just based on AI; it was based on cloud computing; based on automation; robotics – there are a lot of moving parts in the technology revolution; … the key driver is shortage of skilled labor and technology is able to augment the productivity of workers; … that allows wages to rise faster than prices which is what has been happening for the past year & half; so productivity is really the story; … deregulation helps; tax cuts help; we will see where the tariffs go; there will be speed bumps along the way; we are heading to 7,000 on S&P 500 by the end of next year; 8,000 by the year after ; … 10,000 by the end of the decade; …. that’s my thanksgiving gift to you all; ”

Then he gave an interesting bit of advice to all:

- “look at every company in your portfolio as a technology company… they either make it or use it or they are going to be at a competitive disadvantage … there is tremendous amount of pressure to use technology; … so I think there is still opportunity in technology believe it or not; in communication services ; in the rest of the market in financials still have opportunities; industrials, consumer discretionary; … there are some clunkers like health care; … materials & energy will be challenged by by fundamentally weak outlook for Chinese economy as well as European economy …. “

Even after a day like this Friday? Looking at it another way is a veteran:

Another way of saying it is – “Friday Bull market is setting up a December chase“. That was proclaimed on Friday by an “expert” who has been staunchly & correctly bullish all year:

- “we know December is likely to be up than any other month like 74% of the time; its most likely to be up in an election year; … when you are up so much in the 11 months of the year, December has been up 9 out of 10; up 2.4% on average; its a bull market; its going to be a chase in to the end of the year;… others have taken up the baton – small caps, mid caps, industrials, financials …. what is happening right now is that we have really strong productivity in our country since when – since the mid-late 90s; you have strong productivity; you tend to have higher GDP, earnings growth & better stock returns ….we gained 20% 5 years in a row in the late 90s; not saying that’s going to happen again but when you have the higher productivity …. reasons to think this bull market is alive & well …. “

2. Most interesting story in markets – Not Stocks?

Sounds nuts, right? Guess what has been the consensus since the November 5 election? Deficits will rise fast & rates will shoot up with the Dollar!!

Guess what happened this week? Dollar fell 1.6% both on UUP & DXY. And you wouldn’t believe what Treasury rates did this week? After falling small last week, this week seemed like a waterfall:

- 30-yr yield down 23 bps; 20-yr down 22 bps; 10-yr down 23 bps; 7-yr down 23 bps; 5-yr down 25 bps; 3-yr down 11 bps; 2-yr down 22 bps– 1-yr down 11 bps;

So how did the Treasury ETFs perform this week?

- TLT up 4% on the week; EDV up 5.5%; ZROZ up 6.5% and our favorite TMF up 11.8%.

Kudos to Jeff DeGraff of RenMac & his model we quoted last week. Did he double his position to 30% or did he remain at 15%? But people like DeGraff, like almost all people who claim to like Treasuries, are sedate & un-excitable. This week we found an excitable strategist who proclaimed “Long-end of Treasuries are the most interesting story of the last few weeks“. That was David Zervos of Jeffries. How long will Jeffries tolerate this level of sacrilege?

And that exuberance is not merely for a short-covering bull move? Zervos sounds so nuts that the Judge in My Cousin Vinny would ask him “are you on drugs” as he asked Vinny in the film.

The clip actually quotes a paragraph from a report that might make the bond-hating CNBC Fast Money to move to ban Zervos from CNBC:

- “I have no doubt that deregulation will be a central macro driver for the financial markets over the next four years … it lowers the cost of production, and allows both capital & labor to share in the savings via lower goods prices, higher wages and higher prices.”

Watch & listen to him explain his case on:

- ” … I really am focused on this long-end of the Treasury; that’s the most story of the last 3-4 weeks; its telling us something; its telling us people are getting excited about the de-regulation trade and the lower cost of production that is coming and possibly the less significant government sector; … could we see some slowing in the beginning of this administration as contract payments are ceased, consultants are cut, some job losses in the government sector start to come in; it totally changes the Jan to March to June Fed sequence if we start to see very different jobs data coming more from the public sector than the private sector …. there is this initial trade and there is the long-term trade … are you opening up the economy to better use those resources more efficiently in the private sector, … I think that’s the idea …. the market is starting to sense that a little bit …. short term data is going to be really interesting to watch; … Jan 20th we are going to see a lot of changes really fast – you know there are close to 300 executive orders that the AFPI have put together to put in front of President Trump on his desk; a lot of de-regulation; …. I think a lot of industry’s shackles are going to come off; but a lot changes in Washington are going to happen with Dept. of Agriculture, Dept. of Education, Dept. of Energy … big big changes in the way we have done business as a government for decades … … I think wall Street is giving him benefit of dobut in the art of the deal style. … I love it; I love the way we are lining up.. :

But are waves lining up too?

- J.C. Parets@allstarcharts – 11-29 – how do you like my wave count?

3. Sectors, Views & Tweets

Ankur Crawford of Alger was correctly & firmly bullish on $NVDA when it was close to 120. What about now?

- “If you look at NVDA from here on out, I think NVDA becomes a star performer again as we move forward; because everyone would want to own it for the Blackwell ramp; I mean it trades at a sub-market multiple on 2026; that is not an appropriate valuation for a company like NVDIA; can it rest for a little while? sure; but just be patient;”

But she began her clip on financials:

- “as the economy starts to hum again, reaches escape velocity especially with this new administration, … financials is really interesting; … they touch on the life blood of the consumer of our economy; so companies like Square, PayPal, Blackstone, they are really touching on some of the vectors of growth in the economy from here; (speaking of Blackstone) once this engine starts to hum for Blackstone, it will have a powerful velocity for the next few years; there are a lot of unrealized assets that are going to come to fruition for Blackstone & will drive the earnings power for the next few years;… it spreads even further; you think about M&A; .. I feel CEOs have been handcuffed; … now you can get deals done; the engine starts over again; you will see lot more M&A; you will see lot more IPOs coming to market; that’s very good for the alts; … ”

But she is not sure about healthcare with the uncertainties; but her holdings like NTRA are based on prudent, product cycle stories, she said.

Which way will the below go?

- Seth Golden@SethCL – M.O.A.T. (Mother of All Trends) in question – Semiconductor Index is on verge of testing it’s 2+ year year uptrend. Keep in mind, support is not concrete and can prove reflexive, but and in the spirit of Thanksgiving… Good-Gravy! $SOXX $SMH $SPX $XLK $NVDA $MU $AMD $QQQ

On the other hand & via Goldman,

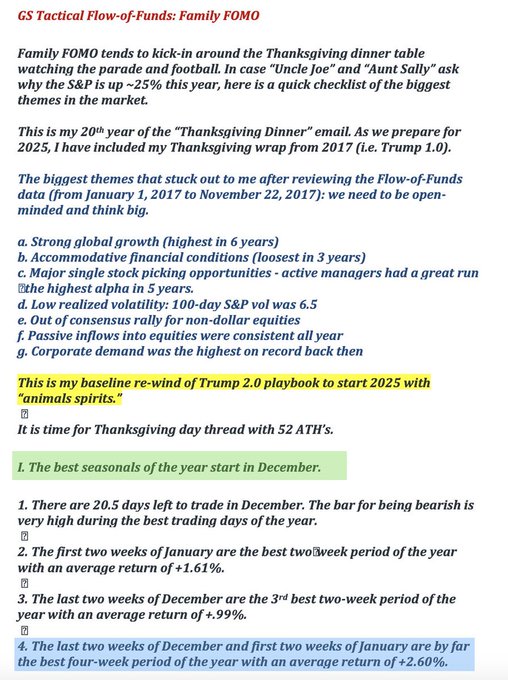

- Seth Golden@SethCL Nov 29 – Goldman Sachs Scott Rubner – 📢 Hold on tight, she’s about to rip⤴️📢Greatest flow and returns of year are ahead 📢6,200+ remains a target for $SPX $SPY $ES_F $IWM $NYA $QQQ

And,

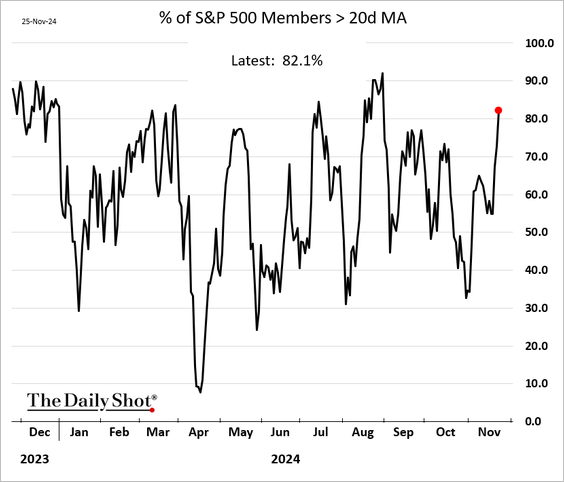

- Mike Zaccardi, CFA, CMT @MikeZaccardi – Market breadth has improved sharply in recent days. Here is the percentage of S&P 500 members trading above their 20-day moving average. @soberlook https://dailyshotbrief.com

4. Indian Elections, Modi-RSS, Adani revisited

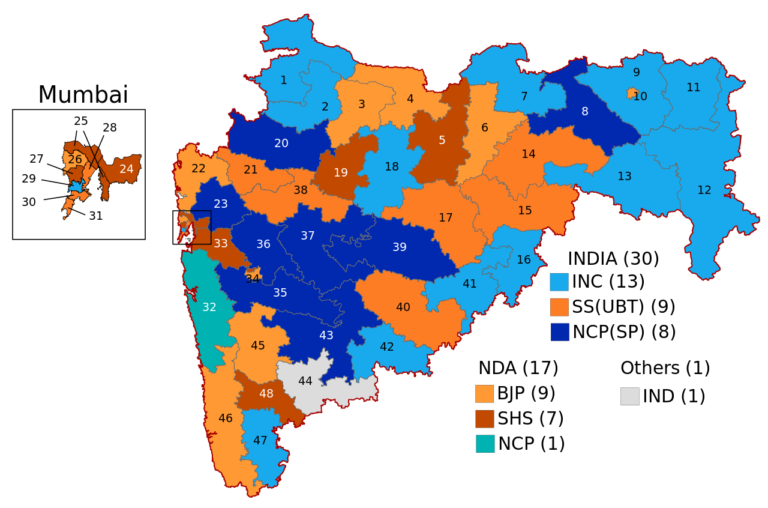

Recall that when the US-EU media was gloating in June 2024 about PM Modi suffering a defeat of sorts, we argued that the disappointing performance was based on two states – Uttar Pradesh (Largest state) & Maharashtra (richest, most industrialized & most educated state). The losses in these two states, we felt, were due to the non-cooperation between Modi’s BJP party & RSS, the all-Indian volunteer organization. Below is the graphic of Maharashtra voting in June 2024 that we used in our June 9, 2024 article

Modi’s handpicked BJP president announced publicly at that time that they had become strong enough to not require the help of RSS. The RSS volunteers in return did not give their usual support. We had argued in our June 9, 2024 article that both sides had realized that they both need each other & they will get back to their cooperation soon.

PM Modi had announced before last week’s election in Maharashtra that BJP & RSS are one. And they fought the election on Be Together & Be Safe type invocation. The opposition was led by Rahul Gandhi, the son & grandson of past Indian prime ministers. He was also supported by what they call in India as the Soros cabal & US left-of-center media. They were sure they would win & shame PM Modi. Coincidentally or otherwise, the US Brooklyn Office issued an indictment of Mr. Adani & his Adani Green company, the man deemed close to PM Modi.

Guess what the voters did – the BJP & its allies won 233 out of 288 seats, a “massive” victory, a “landslide” victory to use the words of MoneyControl, the CNBC affiliate in India as we understand. But CNBC did NOT even report this stunning election victory for Modi. And frankly, neither did Bloomberg. And, by the way, there was a by-election in Uttar Pradesh (electorally California++ in India) in which BJP won 7 out of 9 seats.

- India’s equity markets are likely to react positively to the BJP-led Mahayuti alliance’s landslide victory in Maharashtra, which exceeded exit poll predictions and ended years of political instability in one of the country’s most industrialized states. The decisive mandate, which aligns the state with the central government, is expected to expedite infrastructure development and tackle long-pending governance issues. …..

- After a strong 2000-point rebound on the Sensex on Friday, the markets are expected to continue the rally with a feel-good around the Maharashtra election win, and hopes of a revival in capex in the second half. The GIFT Nifty, which indicates how the Indian equity market opens in trade also signals a robust start for November 25 with a premium of over 400 points, suggesting a significant gap-up opening for the Sensex and Nifty 50 indices.

Can’t blame CNBC too much though! What else can you expect from an MSNBC affiliate? By the way, the TV meltdown in Mumbai was so similar to the MSNBC & CNN meltdown in US after the decisive Trump victory:

The above is actually a more staid version of similar clips across Mumbai’s TV universe.

Getting back to Adani indictment, is it any surprise that it came just before people went to vote in Maharashtra? In addition, as Haslinda Amin of Bloomberg hinted in her first episode, the US indictment might have been due to Adani Energy shutting off electricity supply to BanglaDesh for non-payment. As we all saw Muhammed Yunus, the advisor thrusted on the BanglaDesh coup leaders was joyfully embraced by ex-Presidents Clinton & Obama as well as by President Biden for his work in & after the coup in BanglaDesh. So the Dems have a reason to punish Adani for demanding payment of unpaid bills!

Look at the rally in Adani Enterprises coincident with the election in Maharashtra:

Now listen to a major US Institutional shareholder in Adani Enterprises:

For completeness, below is a response from a spokesman of BJP to a tweet of the opposition about the indictment:

- Amit Malviya@amitmalviya – It is always good to read before one reacts. The document you quote says, “The charges in the indictment are allegations and the defendants are presumed innocent unless and until proven guilty.”

- But be as it may, the essence of the charge is that US and Indian companies agreed to supply 12 GW of power to the Solar Energy Corporation of India (SECI). This was subject to SECI entering into PPA with State electricity distribution companies (SDCs). There was a collaboration between Adani Green Energy with a US renewable energy, Azure Power, under which Azure was allotted 4 GW and Adani Green Energy 8 MW.

- Since the power was costly, the SDCs were not willing to buy. Therefore, the Adanis (in collusion with Azure Power; a US firm) paid the equivalent of US $265 million to SDCs based in Odisha (BJD ruled), Tamilnadu (DMK), Chattisgarh (Congress) and Andhra Pradesh (YSRCP) between Jul 21 and Feb 22 (by far the largest to AP).

- All the States mentioned here were Opposition ruled during that time. So, before you pontificate, answer on the bribes the Congress and its allies accepted.

- Besides, an Indian Court can similarly, on legitimate grounds, accuse American firms of bribing US government officials, to deny access to Indian markets. Should we then allow law to take its course and the concerned corporate to defend or plant ourselves in domestic politics of a foreign country?

- Don’t get needlessly excited. The timing of the report, just before the Parliament session and Donal Trump’s impending Presidency raises several questions. That the Congress is willing to be a prop in the hands of George Soros and his cabal speaks volumes.

Also note that PM Netanyahu was threatened with arrest last week based on the warrant issued by the ICJ. And this week, out of the blue, anti-Syrian rebels attacked Syrian city of Aleppo & reportedly occupied half of it leading to Russia sending its fighter-bombers to bomb them.

And, in a weirdly funny & sad tale, we heard on US TV that CNN is preparing to attack President-elect Trump using the role played by Elon Musk in his transition planning. So now Musk is Adani for President Trump?

By the way, the “first in business worldwide” CNBC network that refused to mention PM Modi’s landslide victor did find the space & time to air the childish actions of Indian opposition screaming in the Parliament about Adani. Having been wiped out in this week’s election, what else could they do? Is that a precursor to MSNBC & CNN promoting a loud & raucous shutdown of the US Congress after the inauguration of President Trump?

Frankly, CNBC should learn from or perhaps hire Bloomberg’s Haslinda Amin. She has been a fervent Malaysian Muslim & anti-BJP as long as we have heard her. But she will cover positive stories about PM Modi as she has recently. And that gives her journalistic cover to discuss the Adani case by inviting pro-NaPakistani Michael Kugelman & the most appalling bender-to-wind, Kishore Mahbubhani on her show to discuss PM Modi.

By the way, one reason for the recent correction in the Indian market & the slowdown in India’s growth rate has been a determined cutdown in government spending in India. Was that a protective act to defend the Rupee against a furious Dollar rally? So is it possible that the rally in Indian markets this past week was also due to 1.6% fall in the Dollar based on UUP & DXY?

Having been a bull on Indian growth, we must admit that, while Indian growth will continue on a secular trajectory, the exciting growth market in the world in the next couple of years will be Trumpian USA.

And that leads us to say Happy Thanksgiving to all.

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on X.