Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. Did the stock market just “dis” Powell?

Look back at the market impact of what Powell said on Friday, April 4. The S&P had rallied upon the positive Vietnam news and then Powell spoke. As we wrote two weeks ago:

- “Look at the chart above to see what happened to the S&P after he finished speaking. It went straight downhill & was saved only by the market close.”

Our outrage on that day at the deliberate destruction wrought above by Chair Powell was both honest & direct:

- “We are simple folk & in our simple opinion, this action of Fed Chair Powell was appalling in its contempt not just of President Trump but of all investors whose investments are in the US stock market. What kind of a leader or even a human being, except a Hitler-type, express such scorn for the people of his country? If he hated Tariffs, even if he hated President Trump, double even if he thought Tariffs would lead to rampant inflation, there were other times & podiums to say what he wanted to deliver. But to do it in a one-liner absolute comment laced with contempt for Americans at a critical market juncture of a Friday late-morning?? We simply cannot comprehend it.”

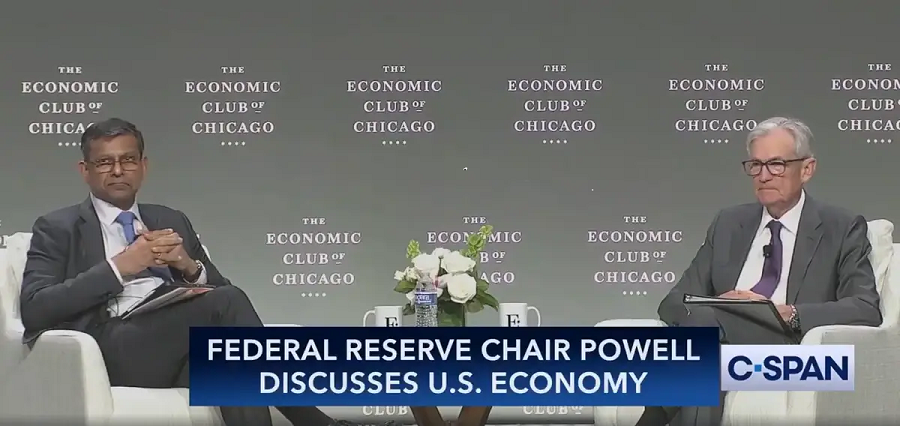

Well, Powell chose another time & podium to deliver a stronger message than he delivered on Friday April 4. In his speech on April 16 at the Chicago Economic Club & in his discussion with Chicago’s Rajan, Powell went “much further“, to quote what Mohammad El-Erian (MEE) said on Bloomberg Surveillance on Thursday April 17, 25 :

- Jonathan Ferro (BTV) – Isn’t the Fed acknowledging that we got to wait for more clarity before we can decide what we need to do?

- MEE – “yes; but he went much further; he said we have to wait for greater clarity but he kept pushing on the challenges to dual mandate; he kept on pushing that inflation may be persistent; he hasn’t said that in the past. Two meetings ago, he re-introduced “transitory”; two meetings ago he re-introduced “transitory” when talking about tariffs. And at the last meeting, he walked it back. Now he has gone one step further and made a very strong statement“.

Ok, Powell not only repeated his message of April 4 but he also made it stronger & more negative. The stock market must have gone down immediately, right? Yes but!

Compare the two charts above. On Friday, April 4, the stock market fell hard & kept falling into the close. In contrast, on Wednesday April 16, the market dropped hard immediately after the Powell comments but mounted a steep comeback from 3:30 pm. As technicians say, look at the up candle at the close. A better contrast between the two reactions can be seen from the two-week chart below:

The red down candle on Friday April 4 is 3 times the size of the one on April 16. Powell got this milder reaction after he made a stronger, nastier statement and used the “transitory” adjective?

We could be wrong but it sure looks like the stock market “dissed” Powell!

2. Track Record of Powell predictions & assurances

In the past we have described Powell to be a backward-looking thinker & speaker. That is neither a put-down nor an insult. Many people are backward-looking thinkers & that, in some professions, is a virtue. That is especially true in professions where most facts are known & rapid major change of circumstances are rare. Unfortunately financial markets are just the reverse.

We think this characteristic of Powell has resulted in proving his prognostications more wrong more often than not.

October – December 2018 – Powell was made Chairman of the Fed in February 2018 by President Trump. After raising interest rates, Powell raised the ante on October 3 saying “we may go past neutral … we’re a long way from neutral at this point, probably” . Look what the stock market did promptly:

What happened in December 2018, you ask? Reaction to Powell’s comments in his FOMC presser as we noted in our articles on December 22, 2018 & December 30, 2018:

- David Zervos said Powell’s “ego got in the way; Powell was too stubborn“

- Jim Cramer was naturally the most explicit saying “I need to the Fed to shut up; I don’t trust the Fed at all; Jay did everything to cause this tremendous sell-off … He did the country a great disservice … Fed is being recklessly imprudent“.

- To her credit, CNBC’s Sara Eisen was honest & direct. She said traders behind her were yelling “make this guy stop talking“. The market virtually puked & kept puking at the sight & sound of Chairman Powell talking about their models & uttering tone-deaf statements like balance sheet contraction will remain on autopilot & that Fed policy doesn’t have to remain accommodative at this stage. It was as if the stock market was running away from that spectacle.

- Our own view was “What we saw of Chairman Powell during his presser is a stubborn attitude with a devotion to lagging indicators.”

Fast forward to post-COVID & recall Powell’s description of inflation as “transitory“. Now fast forward to November 2021 & read our article Jekyll vs. Hyde or a Faustian Bargain? on December 4, 2021:

- “On November 22, President Biden announced the re-nomination of Fed Chairman Powell and, on November 24, Chairman Powell surreptitiously slipped in the Fed’s change to “Whip Inflation Now” policy in the Fed minutes (released late afternoon before Thanksgiving). And then Chairman Powell reiterated this new & revised fight inflation above all policy in his congressional hearings. “

And this anti-inflation fight was emphasized after David Rosenberg wrote that week:

- “… from the recent peaks, iron ore is down 60%, lumber is down 50%, steel prices are down 25%, soybeans are down 25%, Corn is down 20% and all of a sudden oil is down 20% and the base metals in the aggregate are down. 12%.”

The most recent was the Fed presser on September 18 less than 2 months before the November 2024 election in which, as we reported on September 22, 2024:

- ” Chair Powell & the FOMC statement cut the Federal Funds rate by 50 bps on Wednesday, September 18 and said they are likely to cut another 50 bps by year-end”.

If we remember correctly, Stanley Druckenmiller said later that he shorted long Treasuries right after this Fed decision. If so, kudos to him for a great trade as long Treasury rates shot up despite Chair Powell’s easing & promise to ease more on September 18, 2024. Look at the 30-yr yield chart below from September 18, 2024 to January 2025.

Now Chair Powell is making “strong” statements that inflation may be persistent due to the tariffs imposed by President Trump & that, presumably, persuades him to NOT lower rates for the protection of American economy & American people!

We are not sure we believe his convictions after the history above. In fact, some believe that he could be as wrong now as he was in September 2024 but in reverse.

3. Inflation ahead or Recession ahead or, heavens forbid, Deflation ahead?

Just so that we get numbers right, the overnight Federal Funds Rate is sitting at 4.375% while every other maturity in Treasuries from 10-years to 1-year is lower than that. That makes sense if Powell is right in his prophesy of inflation getting unleashed later tariffs imposed by President Trump. Neither Powell nor anybody else can predict what the data will say in the months ahead. What about market indicators that have proved right in the past?

A clip titled Every major crisis started just like this – And its happening again shed some light on a couple of such indicators on Friday, April 17:

- “Copper-Gold ratio has utterly plunged already surpassing 2008 and very nearly undercutting most extreme days of 2020; Gold-Silver ratio – we are talking about deflationary money, liquidations, exceptional degrees of distress and these are only two of too many; Interest Rate Swap Spreads that had plunged to their own obscene lows last week – they are right back to very nearly revisiting them today; … Gold-Silver hasn’t acted like this other than March 2020 & October 2008… when these signals are similar to those case-levels like 2020, 2008, what that says in the probability of something happening is way too high … its not a done deal; its not necessarily 100% but its enough of a chance that significant chunks of the most important parts of the monetary financial world aren’t willing to sit there & do nothing about it …. what everyone is doing is buying increasingly expensive hedges; that’s the key here – price of protection has soared because more & more people see the same thing …. “

Ray Dalio, the man who runs the world’s largest hedge fund, is warning that we might see something that is even potentially worse than 2008. As we all know, 2008 was 2008 because an economic downturn was combined with a monetary event.

But what about the consumers, those patriotic brave souls who have rescued the American economy time & again? The well-known University of Michigan survey (sorry Buckeye fans) showed the 2nd lowest consumer confidence index on record & the expectations index fell to the lowest level in over 4 decades.

And all this is happening without & before any of the inflation from tariff-stricken goods arrives in our ports. So if above is already the state of US consumer, who is going to buy those expensive goods? Is a recession more likely later this year than Powell’s predicted inflation?

As Mike Wilson of Morgan Stanley said on Bloomberg Daybreak on April 15,

- “we did cut our numbers but it wasn’t just because of tariffs; …we think there is a lot more going on than just tariffs ; the overall economy itself is not that healthy in the United States for quite awhile … and of course the Fed not cutting rates anymore – there is a lot going on than just tariffs; …tariffs to me are almost the last piece …. the cherry almost on top of the slowdown that’s going on and the question is whether that tips us over to a recession ; … are our companies now going to take action meaning layoff employees and we have a labor cycle finally; … boy, if we don’t get extensions of the tax cuts …. “

After all that negativity, Wilson strikes a positive note at the end:

- “I am not in the camp that we can’t see something positive by the end of the year; all the growth negatives impact now and the growth positives … start to show up at the end of the year … “

This feeling is beginning to seep into the advisors that work with High Net Worth Americans as Cheryl Young of Rockefeller said on CNBC – ” on a slippery slope” adding “bond market is screaming at us saying recession is coming “. More & more people are beginning to realize what Josh Brown, a CEO in wealth management, said on CNBC – “this is not a 4.5% rate economy“.

If this is the thinking here in America, what must Chinese companies & workers be going thru? The clip below is one of several you can see on YouTube. We don’t know how accurate it is. Wonder if CNBC’s Eunice Yoon can give us some clues from Beijing, if she is allowed to under Chinese policy.

The clip points out that Chinese companies make products upon receiving US orders with their own capital & loans from Chinese Banks. Their eventual profit margins are 10-20% of the sale price. But if the orders are cancelled midstream or after products are manufactured, then Chinese companies are holding the bag with the 80% of price promised already spent. That is why the clip says Chinese companies are facing disaster.

Some quotes seem to make sense:

- “In 2018, export driven employment supported 112 million jobs. If the tariffs continue, trade with China could decrease by 90% affecting 90-100 million people.”

- “The US has 330 million people consuming 30% of the world’s goods while we have 1.4 billion people consuming only 12%.”

The second quote above is the key. China is the world’s greatest supplier while US is the world’s biggest buyer. Correcting this imbalance is the key to solving the tariff problem. Does Xi have to give up his world power ambitions to feed his people?

To us, the above suggests the risks of an economic slowdown, recession or even a short bout of deflation from the dual stubbornness of the Powell-Xi duo! But then we are mere simple folks who think simply.

Just an aside, you might want to get a copy of Tai-Pan, a book by James Clavell, to see get a better understanding how British merchant traders negotiated, fought with the Chinese Emperor & his mandarins to win Hong Kong & generate wealth from themselves. After all Xi is today’s emperor without the formal title & he is behaving just like the “Son of Heaven” did then. This is what Xi refers to when he says he will NOT allow another opium trade disaster on China. He doesn’t realize that he is duplicating the same mistake in a different time & manner.

4. “termination cannot come soon enough”

That phrase from President Trump’s message stunned the US markets as well the rest of the financial world. President Trump had voiced what he believes to be in the best interests of America. At the same time, he had stepped on a semi-sacred monument termed as Fed’s Independence.

The stock market didn’t care a bit (see the 2-day SPX chart in Section 1 above). But while every media outlet waxed eloquently about their views, Bloomberg Surveillance, to their great credit, discussed this by inviting Mohamed El-Erian, a well-known & well-respected figure with a long & stellar career in monetary markets.

The discussion was polite but pointed with BTV’s outspoken Annemarie Hordern & a trying-to-be- diplomatic Jonathan Ferro. A short version of the long discussion is below & it is stellar in quality & content. And we can’t say enough about both the insights & poise of Mr. El-Erian. With our respect, we will simply use “MEE” as his name below.

Ferro – Want your reaction to this headline here from the President in the last hour …

MEE – “I suspect he (President) got very angry when he heard Chair Powell yesterday. Chair Powell really put all the blame on tariffs; gave no possibility to the better outcome, zero, gave it zero possibility. I know conventional wisdom is that this is an attack on the independence of the Fed. There is another way of looking at this which is this Fed has sacrificed people in the past; if you remember the President of the Dallas Fed, President of the Boston Fed, the Vice Chair was sacrificed ahead of the Congress looking into allegations of Insider Trading …. sacrificed to protect the monetary policy side. It wouldn’t surprise me if the President Trump is pushing on this because there is a real question for Chair Powell – should he step down to preserve the independence of the Fed? Because otherwise the Fed will be subject to a lot of attacks going forward“

Ferro – What’s the ultimate outcome here?

MEE – It is a judgement that has to be made & has to be made by Chair Powell. There are credible candidates, Kevin Warsh for example. The markets would be very comfortable with Kevin Warsh as the Fed Chair. He has tremendous experience, he understands markets, he understands economics, he has expertise. So I could see a scenario in which what Secretary Bessent said before the election plays out where they preannounce Kevin Warsh as the next Chair. And then that puts tremendous pressure & Chair Powell has to make a very difficult decision.

Ferro – How do you think the markets would respond to it?

MEE – “I think the markets would look at Kevin Warsh & think he is a very credible Fed Chair. And I think the markets would rather have a credible Fed Chair that is not in continuous conflict with the White House. The Harvard example perhaps is an illustration of what can happen – you can suddenly have all sorts of other things questioned about the Fed, if it is in a direct conflict with the White House“.

Hordern – Isn’t this conversation alone putting into question the independence of the Fed? You are talking about scenarios where we can basically get around the White House to placate the President.

MEE – But we have seen that scenarios where they have gone around the Congress to placate the Congress; we have seen a situation where in the beginning they sacrificed Michael Barr , a Vice-Chair, & he stepped down. So I don’t think this is a much of a structural break but I also think there is a very delicate judgement here, very delicate. And I am glad I don’t have to make it.

Hordern – It almost sounds like you agree with the President …

MEE – “We do know that in a year’s time Chair Powell will step down. We know that. We know that he is not going for a 3rd term. We know he is not going to get a 3rd term. So that issue is out there. We also know that the President is really frustrated about interest rates not being cut. And I go back to yesterday’s comments by Chair Powell; he went well beyond what he has said in the past; were like red rag to the White House.“

Kudos to Bloomberg TV for broadcasting this conversation & to Ferro-Hordern duo for an interesting conversation. What can we say about Mr. MEE’s delicate candor & the deep tactical knowledge about the White House – Fed relationship? Awesome!

5. How about a “TOR” or a Treasury Overnight Rate?

A week ago the Treasury Secretary said the Treasury has a Big Toolkit if it is needed for Bonds. That and this week’s discussion about the Fed made us wonder whether the Treasury should establish & publish its own Treasury Overnight Rate, say TOR for short. This should be separate & distinct from the Federal Funds Rate decided by the Federal Open Markets Committee.

It is the Treasury Department that manages the Treasury Auctions from 1-month all the way to 30-years. Their indicative pricing of the auctions is basically relative the current Treasury market prices for that maturity.

So why doesn’t the Treasury publish its own overnight rate, a rate that is set by the Treasury Secretary on advice of say a committee? And this Treasury Overnight Rate can be changed as necessary due to economic developments, market conditions & feedback from the rest of the Treasury market.

Today, for example, the TOR can be set at 3.75%, 5 bps below the 2-yr Treasury yield. The Treasury could then price shorter auctions using the TOR and not have to pay near 4.375% Federal Funds Rate. Repos can then be priced off the TOR as well. The cost savings to the country can be substantial.

Such a TOR would be an ideal vehicle for the Treasury Market, far more so than the distant Federal Funds Rate that is established according to broader views & perspectives of the Fed. In other words, the TOR could be viewed as another indicative rate, more for the Treasury market than for the broad Economy.

As we have seen in the past & even perhaps now, the Treasury & the Fed can have different views about the economy & its forward direction. With TOR, both the Treasury & the Fed will have their own overnight rates that fit their views. And that flexibility can only help both the economy and the fixed income markets.

Just a thought!

6. “A central bank governor & his ego greater than his country?”

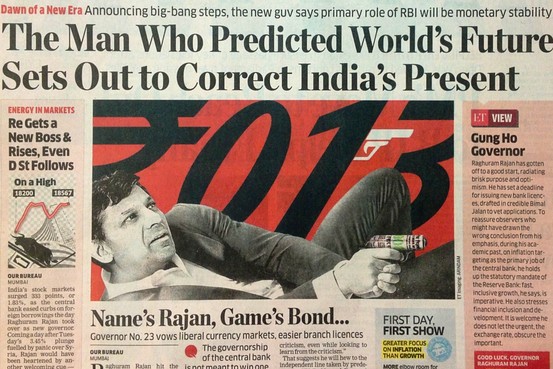

No. We are not speaking of Jay Powell. We are speaking of his interviewer in Chicago, “Raghu” Rajan (see photo below). He was the Governor of India’s Reserve Bank in 2016.

Rajan was welcomed semi-royally in permanently slavish India when he arrived to take over the Reserve Bank of India (RBI). Just look at the title of the article published at that time.

As we wrote on June 22, 2016,

- This crazy “Name’s Rajan, Game’s Bond” stuff seemed to have gone to Rajan’s head. Look what he said in explaining his reasons for a repo rate cut on September 29, 2015: – “My name is Raghuram Rajan and I do what I do.”

Imagine Chair Powell explaining his unwillingness to cut rates by saying “My name is Jay Powell and I do what I do“. Yes, Powell’s actions do suggest the same type of ego but, at least, he was smart enough to not go to Ragu’s public extreme.

When Rajan decided to quit on September 4, 2016, he reportedly sent out a note to his staff. He did not bother to inform the Prime Minister or Finance Minister of India. That was too much for even the usually anti-Modi Huffington Post. They wrote:

- “When Rajan decided to leave, he did so without warning and on his own terms: in a sign of growing tensions he did not inform top members of the government before releasing an open letter to staff on Saturday, a move that took investors and the government by surprise.”

The timing also raised questions. As we wrote on June 22, 2016:

- There is absolutely no excuse at all for this enormous breach of protocol, ethics, & norms of accepted behavior by RBI Governor Rajan. And it looks like a move designed to damage the Indian Rupee & destabilize Indian markets. Rajan knew that the entire world was awash in deep concern about Brexit and its enormous potential to cause havoc in global financial markets. And last Saturday, the day Rajan sent out his note, was the day the Brexit campaign resumed after a two-day suspension.

- Why didn’t Rajan wait for another week & let the Brexit issue be settled before personally creating instability in Indian markets? Was Rajan deliberately trying to create a market convulsion just before Brexit to force the Indian Prime Minister & Finance Minister to beg him to stay on for another term? If not, why did Rajan add “I will, of course, always be available to serve my country when needed” in his note to RBI staff?

The parallels are interesting, aren’t they? Rajan, the man suspected of trying to create a market convulsion in Indian markets, interviewing Jay Powell whose comments did actually create a massive convulsion in US Equity Markets on Friday, April 4 and a smaller one of Thursday April 17! Wowser!

And yes, the man given the incredibly great historic name “Raghu”, allowed CNBC’s Kelly Evans to call him on air as “Ragu”? So Bond in India & Spaghetti Sauce in US? Which ” Ragu” was he, Ms. Evans – Traditional, Light or Organic? Just asking!

Finally a question to Chair Powell’s staff – why did they not get Anil Kashyap of Univ-Chicago to interview Chair Powell rather than “Ragu”?

7. Markets this past week

Fixed Income:

- 30-year Treasury yield down 4.8 bps on the week; 20-yr yield down 4.7 bps; 10-yr down 14.3 bps; 7-yr down 19.8 bps; 5-yr down 21.1 bps; 3-yr down 20.7 bps; 2-yr down 16.4 bps; 1-yr down 6 bps;

- TLT down 84 bps; EDV down 47 bps; ZROZ down 1%; HYG down 1.4%; JNK down 2%; EMB down 1.7%; leveraged DPG down 6%; leveraged UTG down 3.1%;

US Indices:

- VIX down 21.44%; Dow down 2.7%; SPX down 1.5%; RSP down 49 bps; NDX down 2.3%; SMH down 4.1%; RUT down 1.1%; MDY down 87 bps; XLU down 1.8%;

Mega Caps:

- AAPL down 21 bps; AMZN down 6.5%; GOOGL down 3.7%; META down 7.5%; MSFT down 5.2%; NFLX up 8.9%; NVDA down 8.5%; MU down 68 bps;

Financials:

- BAC down 4.5%; C down 2.7%; GS down 3%; JPM down 1.8%; KRE down 4.5%; EUFN down 5.9%; SCHW down 1.2%; HDB up 7%; IBN up 6.9%;

Dollar was down 47 bps on UUP & down 50 bps on DXY:

- Gold up 2.9%; GDX up 2.2%; Silver up 1%; Copper up 3.3%; CLF up 69 bps; FCX down 57 bps; MOS up 5.7%; Oil up 4.4%; Brent up 4.3%; OIH up 4.6%; XLE up 3.7%;

International Stocks:

- EEM down 45 bps; FXI down 85 bps; KWEB down 36 bps; EWZ down 2.5%; EWY down 15 bps; EWG down 5.1%; INDA up 2.7%; INDY up 5.3%; EPI up 3.1%; SMIN up 3.5%;

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on X.