Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.She is backkk!

What tells us that the dovish markets-supporting Yellen is back? This week’s 7 bps bull steepener in the 30-5 year curve & the outperformance of leveraged closed end funds over unleveraged funds of that same class. Look at the 1-week chart of leveraged high yield UTG over unleveraged HYG:

Look at the opening gap on Wednesday, Thursday & Friday morning as well as the big outperformance over the week. QED, we think. We saw a similar outperformance in closed end Muni funds over MUB this week.

What should happen when the Fed surprisingly goes dovish?

- Mark Newton @MarkNewtonCMT – US Dollar index breaking back down to new lows for 2017, lowest since last September– $GBPUSD breaking out

What should happen when Treasury rates fall & the Dollar weakens? Emerging Market Equities should explode and Gold & Commodity stocks should rise. Actually, everything should rise except the VIX, right?

- Urban Carmel @ukarlewitz This wk: Equities at new highs. Vix crushed

$SPX +1.4%$NDX +3.2%$DJIA +1.0%$RUT +0.9%$TLT +0.5%$EEM +5.6%$USD -1.0%$VIX -14%

Gold rallied 1.3%, Silver rallied 2.4%, GDX, GDXJ rallied over 3%; Oil rallied 5% & OIH, XLE rallied by 5% & 2% resp. Base metal stocks exploded with CLF up 9.7% & FCX up 5.9% and Ag stocks like MOS rose 5% on the week.

Thus ended the 3-week consolidation launched by Draghi & amplified by Dudley on Monday, June 19. Once again, assets know how they spell relief – “Yellen”. Actually Yellen had no other sensible choice:

- Jim Rickards @JamesGRickards – Atlanta Fed GDP Q2 estimates: May 1: 4.3% May 25: 3.6% Jun 13: 3.0% Jun 28: 2.7% Jul 11: 2.6% Jul 14: 2.4% You see where this is going.

There is a lot of room between 2.4% & zero for Q2 GDP; so the lower progression in the above tweet is not going anywhere real bad. Not yet, at least. And not until credit starts underperforming.

Kudos to Carter Worth of CNBC Options Action for calling a decline in interest rates last Friday. But his second call Buy XLU Short SPY hasn’t worked out yet. That may because of last week’s terrific call by J. C. Parets that Momentum stocks would breakout relative to S&P. FANGs did devour the S&P in performance this week. Kudos to @allstarcharts J C Parets.

Now what?

2. Equities

Simplicity first:

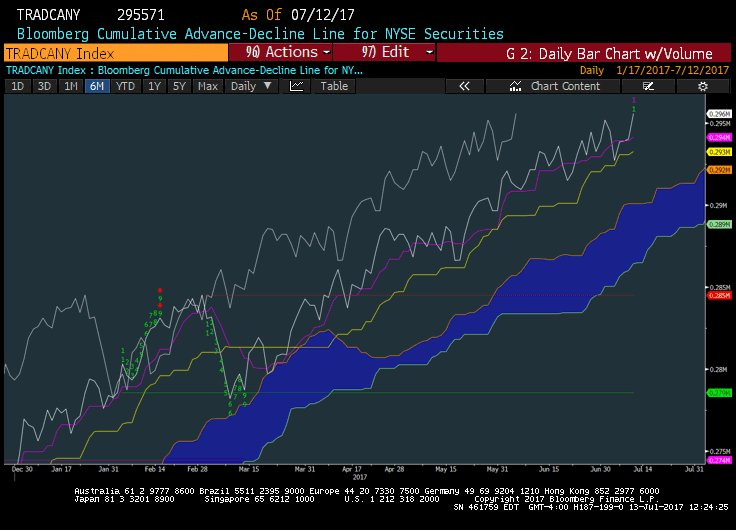

- Peter Brandt @PeterLBrandt – “STOCKS: Bullish short, intermediate, and long term. A-D Line making higher highs is very bullish.” Source: The McClellan Market Report https://twitter.com/McClellanOsc/status/885909378112512000 …

Then breadth:

- Mark Newton @MarkNewtonCMT – NYSE ADVANCE/DECLINE back at New All-time Highs this week– Don’t shoot the messenger Bears

But the breadth picture is not as rosy as the above sounds:

- Urban Carmel @ukarlewitz – Breadth: NYSE-AD (total and common stock only) and SPX-AD at new ATH with indices. Conversely, just 2 of 10 SPX sectors at new ATH today

Then the definitive:

- Lawrence G. McMillan @optstrategist “…there is no doubt that the intermediate-term picture is bullish as long as support at 2400 holds” ” http://www.optionstrategist.com/blog/2017/07/weekly-stock-market-commentary-7142017 …

$SPX

We have not known Tony Dwyer of Canaccord to be a piker in terms of S&P price targets. He kinda proved to be one this week with 2510 as his target for year-end. Heck we could there next week. But to be fair to him, his real target is 2,800 for 2018. His clip below is kinda funny because on Monday July 10, his entire discussion was focused on rates going up and the 10 yr – 6 month curve going from 1% to inversion. But his case for 2800 is based on earnings and that case is only strengthened by a bull-steepening curve & lower Dollar.

Next week brings Options Expiration and that, with the Fed behind the market, could mean another up week.

But,

- Urban Carmel @ukarlewitz – Equity only put/call 0.53 today

$SPX

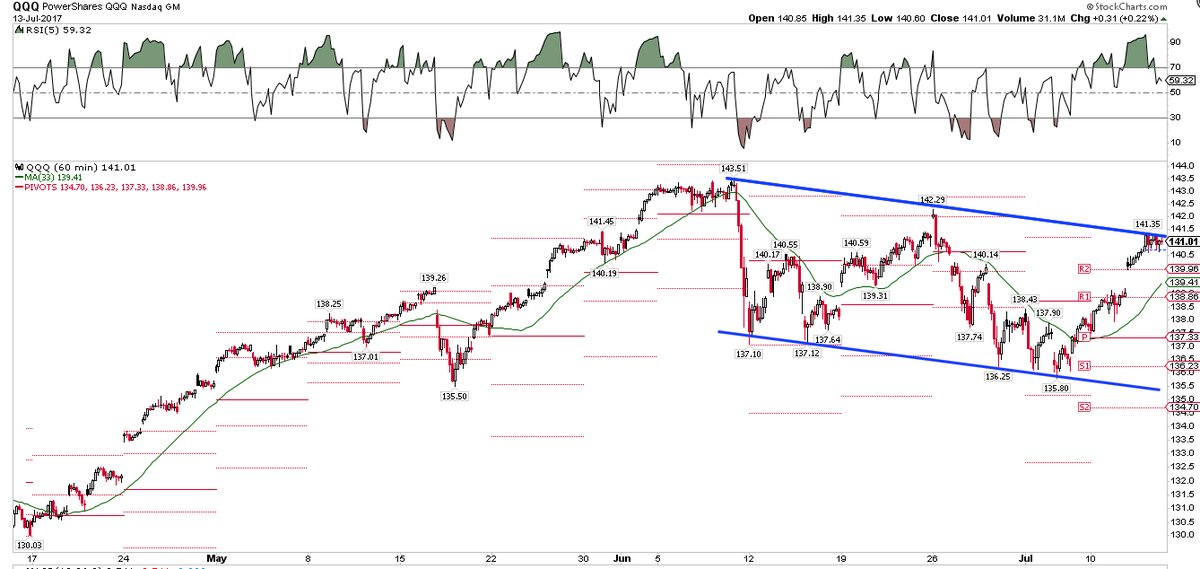

What about the big move in Nasdaq this week?

- Urban Carmel @ukarlewitz – For fans of channels $QQQ $NDX

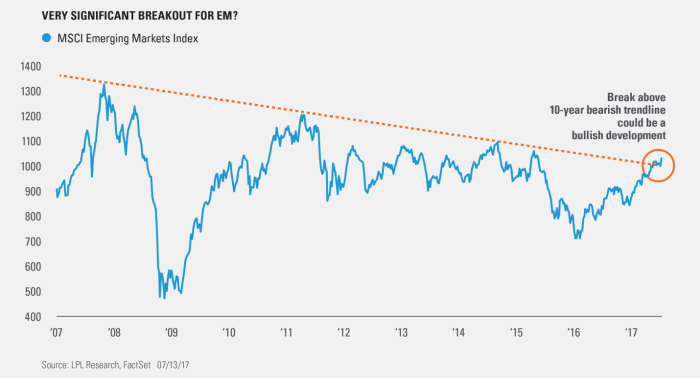

Emerging Market equities went on a tear this week with Brazil up 8.5%, India up 3.5% & EEM up 5.5%. Is this a blow off or is it a break out?

- Ryan Detrick, CMT @RyanDetrick EM has been strong, but looks like there is more in the tank. Check out this breakout from a 10-yr bearish trendline https://lplresearch.com/2017/07/14/emerging-markets-early-innings-or-late-in-the-game/ …

- Emerging markets have benefited year to date from the surprise U.S. Dollar weakness, very strong earnings, and modest valuations. … One major positive suggesting it’s early in the game is that the MSCI Emerging Markets Index is in the process of breaking out of a bearish trendline going back nearly 10 years, suggesting a major change in trend is taking place and EM could score more runs

3. Oil

This week Oil was up 5%; last week Oil was down 4% and the week before that Oil was up 7%. This type of volatility is usually common to tops & bottoms. It is hard to imagine Oil is near a top after its harsh decline this year. It is not at a bottom either. But a technician who has been steadfast in his “don’t care” attitude to oil & oil stocks turned bullish on Friday & suggested buying XLE for a 10% rally. One reason is a bullish divergence he saw in last week’s decline when S&P Energy made a new absolute low but not a relative low to the S&P 500.

4. Gold

Last week J C Parets was so negative on GDXJ that he thought the worst was yet to come. But look what he tweeted on Monday.

- J.C. Parets @allstarcharts – This is a serious candlestick being put in gold miners today. I think this needs to be respected

$GDX

Kudos to him for being open minded & smart. GDX went on to close the week up 3% and NEM was up 4%. It is interesting that the candle in GDX was on Monday, the day before Brainard spoke and a day & half before the text of Yellen’s speech was released.

What now? If the curve keeps bull-steepening & Dollar remains weak, then Gold should have a tail wind. Where does GDX go? We have no idea but one very bullish opinion says:

- Tim Ord @OrdOracle – GDX Wk RSI & Stochastic <50= bearish; Close >50 larger rally may be starting With Head & shoulders target near 52.

$gold,$gld$GDX$gdxj

5. China-India Positive Breakout

On Father’s Day we had featured a terrific film about a father’s dreams for his two daughters, a dream that took them from a rural village in ultra-male oriented Northern state of Haryana to gold medals in International Wrestling. The film is a true story about how the dream was realized. This film called “Dangal”(name of rural wrestling tournaments in Haryana) became a huge success in India. That was not surprising.

What was stunning was the reception Dangal got in China. When it finally ended its run in China last week, it had accomplished something no one could have ever believed let alone predicted. Dangal proved be a greater success in China; it was screened in more theaters AND Dangal got 70% higher ticket sales in China than in India.

[embedyt] http://www.youtube.com/watch?v=65YJPTffyPY[/embedyt]

For readers in America, Dangal is now on Netflix, perhaps an appropriate lead for Netflix earnings on Monday. Netflix is the ONLY way Americans can now watch Dangal. Is that in itself a reason to buy Netflix? Jokes aside folks, if you care about young girls participating in sports or if you care about true breakout of rural low income women, watch Dangal on Netflix.

[embedyt] http://www.youtube.com/watch?v=tNbjVp06neo[/embedyt]

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter