Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TACs is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. “unbelievably strong”

was how David Rosenberg described the “headline and the details in the U.S. nonfarm payroll report” on Friday morning. Once again, the payroll report went against what had been built in. Bonds had been sold & yields had risen ahead of the past two payroll reports. This time, a savvy journalist like Greg Ip spoke of a softer report on Thursday evening. Such expectations had driven bond prices higher & yields lower by Thursday’s close:

- Jason Goepfert @sentimentrader – Optimism on bond prices (pessimism on yields) recently reached an extreme. $TNX $TYX $TLT.

The conditions were ripe for a sell off in TLT & long duration Treasuries. And they did as soon as the stunning 321,000 figure was released. TLT fell by a point and the entire treasury curve shot up in yield. Then something weird happened. Slowly TLT began to move up and by 9:15 am, it turned green. The 30-year yield was down 1 bps at that time. It did then start rising and stayed higher most of the day until it started falling in the afternoon. It closed up by a mere 1 bps despite the stunningly strong payroll report. This is tantamount to “the dog didn’t bark” messsage of Sherlock Holmes

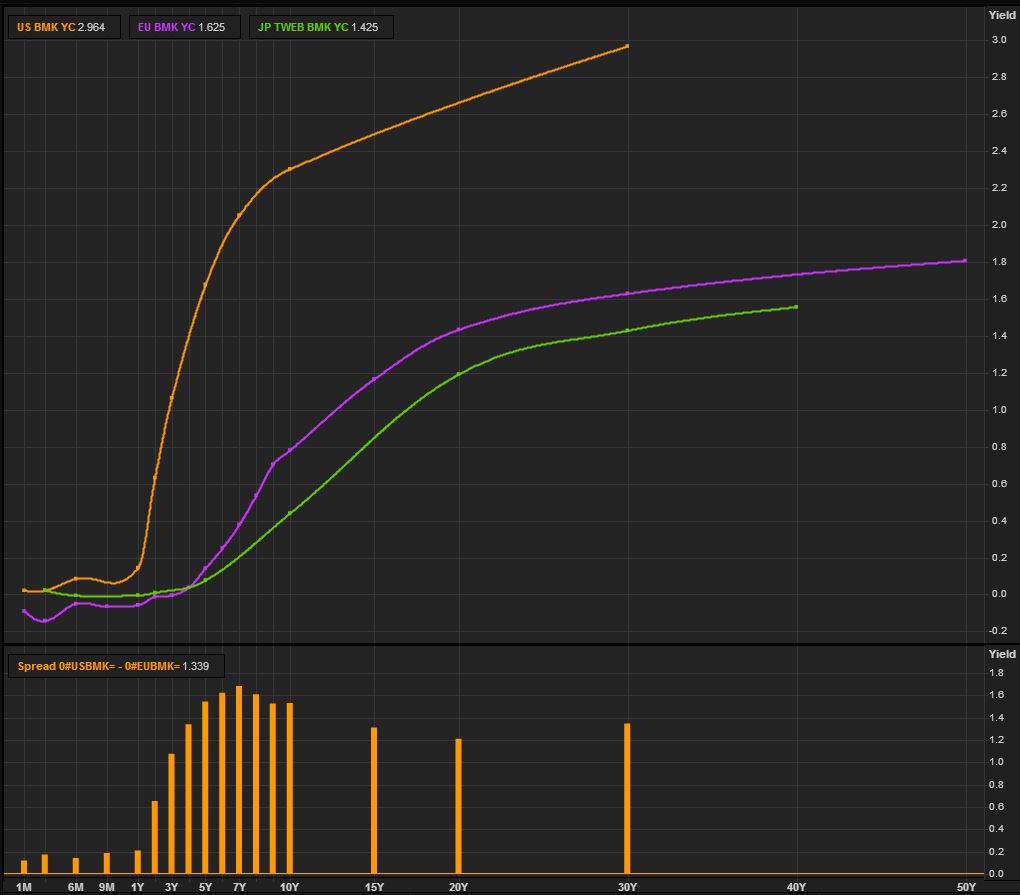

Think back to July 5, 2013 when a stunningly strong 195,000 payroll number caused a 20 bps spike up in 30-year yield to 3.697%. In contrast, a 321,000 number caused a mere 1 bps rise in the 30-year yield of 2.96% this Friday? What’s going on? Of course, this is only true for longer-maturities. The 2-year, 3-year and 5-year yields shot up on Friday by 10, 12 & 9 bps resp. The market is speaking with utter clarity – strong economic data causes a hard flattening of the yield curve. That has been the story of 2014. .

- Matthew B @boes_ Another leg down in the steady march to zero…yield curves already ~ 20 bps flatter than when Fed began hiking in 04.

The reality is that 1-5 year curve is where the distortion is. And that distortion is being slowly removed as the data gets stronger.

- Eric Burroughs @ericbeebo – Simple chart says a lot on growth/inflation views: US, EZ and Japan yield curves

If the distortion in the 1-5 year curve gets removed by the bond market, then the Fed will finally be dragged into raising rates. And that, assuming flattening on strength continues, will end up giving us a flat yield curve “at a level previously thought unthinkable” as Jeffrey Gundlach put it last week. That is because inflation, the main driver of long duration yields, continues to go in one direction.

- FxMacro @fxmacro – 10 year breakevens making new lows

Perhaps the key to the action of the 30-year is the short positioning we described last week. Or perhaps it is due to the liability gap described by Larry Fink this week on CNBC Squawk Box:

- “I actually believe the duration gap of assets & liabilities have gotten wider; most insurance companies were predicting higher rates & they had a portfolio that was going short the liability; & I believe that gap has widened; you have the whole issue of longevity with pensions; I am hearing more and more pension funds are now reassessing their liability and do they have to have extend even longer; you may see between now & year-end, if I right, a bunch of insurance companies needing to cover the gap; you may see bonds tick under 2% again“

Combine the move under 2% on the 10-year because of buying from insurance companies with a hawkish statement from the Fed on December 17 and add a strong payroll report in January – you can get a flat 2-10 curve around 2%. That would be in Gundlach’s category of “who wd have thunk it?“

2. The dominant trend

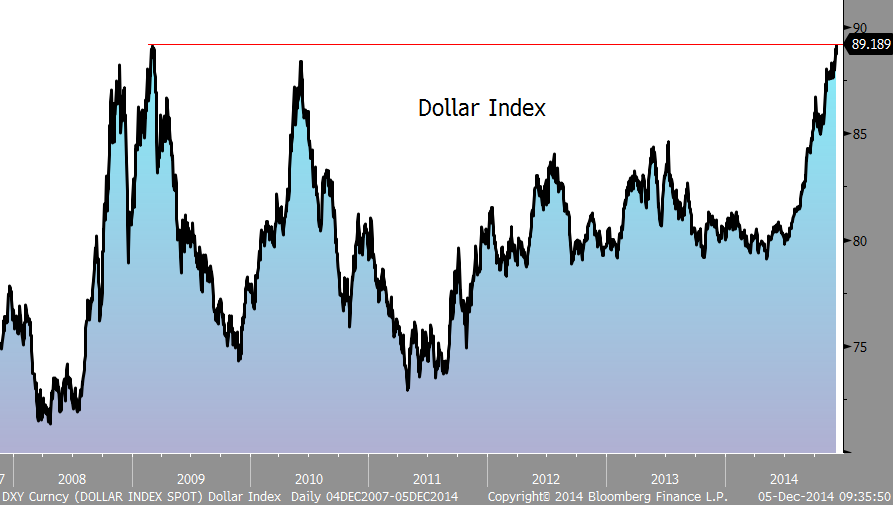

The dominant trend of the second half of 2014 has been the rally in the US Dollar. And the Dollar reacted as it should have to the 321K payroll number:

- Charles Bilello, CMT @MktOutperform – Dollar Index back to March 2009 levels $USD $DXY

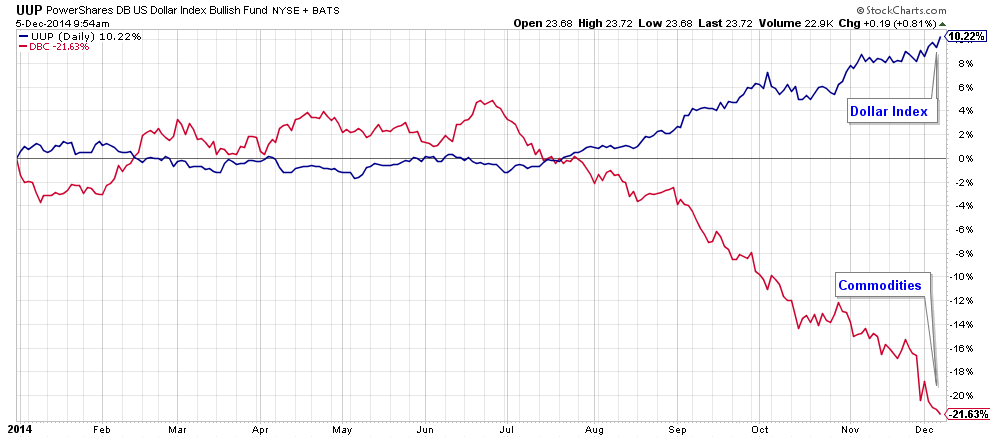

This in itself is disinflationary as far as physical commodities are concerned:

- Charlie Bilello, CMT @MktOutperform – Dollar at new YTD highs, commodities at new YTD lows. $UUP $DBC

We get the drop in physical or commodity inflation. That is why Gundlach expects CPI to get to zero in 2015. But what about service sector inflation? Ian Shepherdson of Pantheon Macroeconomics had argued on Tuesday November 25 that:

- “87% of US economy is in domestic services; most US inflation is from services & rental market vacancies are at 17-year lows”

Where is the inflation in domestic services? If the U.S. economy can grow payroll jobs at 300K a month for the next several months without a pickup in service sector inflation, then why would the Fed raise interest rates in 2015? Chair Yellen is a labor economist and she would like to get higher wages into the hands of US workers even at the cost of a bit higher inflation. Unless the Fed will decide to raise to rates “just to see what happens” as Gundlach said last week.

This environment is just about perfect for the U.S. economy – growth steadily moving to a higher step, low inflation, low interest rates. What’s not to like? Simple – the inexorably flattening of the yield curve.

3. Draghi & QE in Europe

Paul Richards of UBS was clear on Thursday on CNBC FM 1/2:

- “he [Draghi] told us he has a mandate; that mandate is 2% inflation; his latest expectations are 0.7%;so they are going in January“

Nouriel Roubini was more explicit:

- Thursday – Nouriel Roubini @Nouriel – ECB QE is coming in Jan. Markets didn’t get Draghi: he mentioned QE more than ever; the GC discussed the terms of QE; Buba doesn’t matter

On the other hand:

- A Evans-Pritchard @AmbroseEP – Draghi “still very confident” can win consensus from QE naysayers. His tone revealed frustration, implicitly suggested Germans won’t yield

- Holger Zschaepitz @Schuldensuehner – Buba’s Weidmann and 3 other members of ECB Governing Council opposed Draghi’s push to make ECB balance sheet explicit target, FAZ reports.

The European bond markets are in the Roubini/Richards camp. The Spanish 10-yr fell to 1.80% on ECB Sovereign QE hopes. And German growth keeps getting downgraded.

- Holger Zschaepitz @Schuldensuehner – Bundesbank cuts German outlook. Sees 2014 growth at 1.4% vs 1.9% in June, 2015 growth at 0.8% vs 1.8% in Jun, 2016 growth at 1.5% vs 1.7%

Can the Dollar fail to keep rallying in the face of all this?

4. Bonds

We are clear that we prefer doers to talkers. The tweets below from Thursday afternoon show why:

- Scott Redler @RedDogT3 – $tlt met another objective. Filling the gap up to $121.50. I’m still long but less

- Peter Tchir @TFMkts – @RedDogT3 I’ve liked 5s 30s flattener but long treasuries feels like a crowded trade suddenly.

Kudos to these two gentlemen. They called it a day before the sell-off in TLT after the 321K payroll report on Friday morning. We assume if Mr. Tchir liked 5-30 flatteners on Thursday, he loved them on Friday after another 8 bps of flattening.

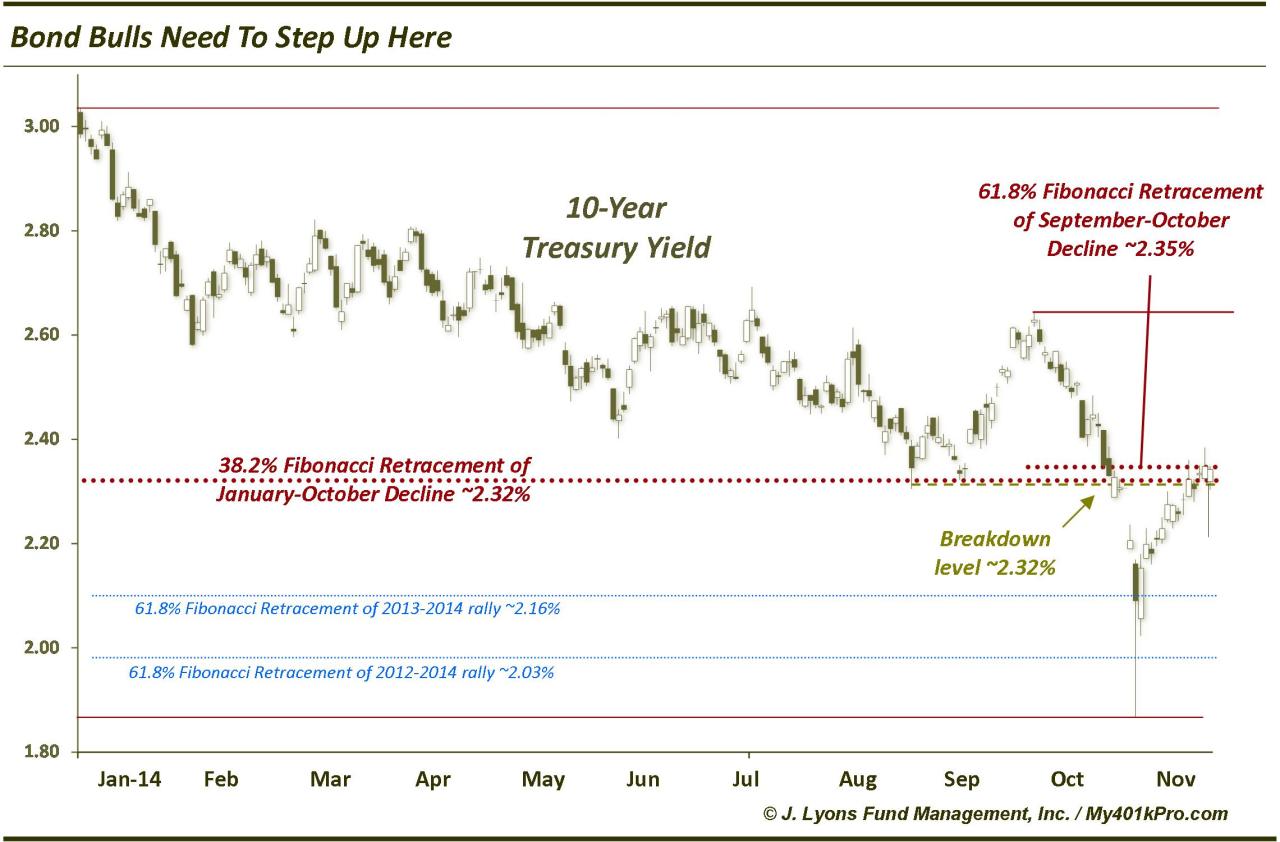

Next two weeks could be important for the direction of the Treasury market. The Fed meeting is on December 17 with a press conference by Chair Yellen.If next week’s data doesn’t surprise on the upside, expectations could build about removal of “considerable period” from the Fed statement. Rick Santelli is focused on next 2 days – if the 10-year yield closes above 2,38%, then it could rise swiftly to 2.60%. If it doesn’t, then it could fall to 2.14% by year-end. Dana Lyons revisited his November chart in his tweet:

- Dana Lyons @JLyonsFundMgmt – Yields testing key spot again (Bond Bulls Need To Step Up Now: http://jlfmi.tumblr.com/post/101865570270/bond-bulls-need-to-step-up-now-on-october-14-we …

His chart from November is below:

The relationship between stocks & high yield bonds has been discussed for months. The prevailing wisdom is reflected in following tweet:

- Jesse Felder @Jesse Felder – 10x since 2007 the high-yield ETF dropped 5% in 30 days. 9x the S&P 500 fell an average of 9%. http://stks.co/c1K8b $HYG $SPY

On the other hand, we have:

- Dana Lyons @JLyonsFundMgmt – Covering balance of High Yield short…for now (http://disq.us/8l792r ) $HYG $JNK

So what happens to the HYG-SPY relationship if HYG now rallies?

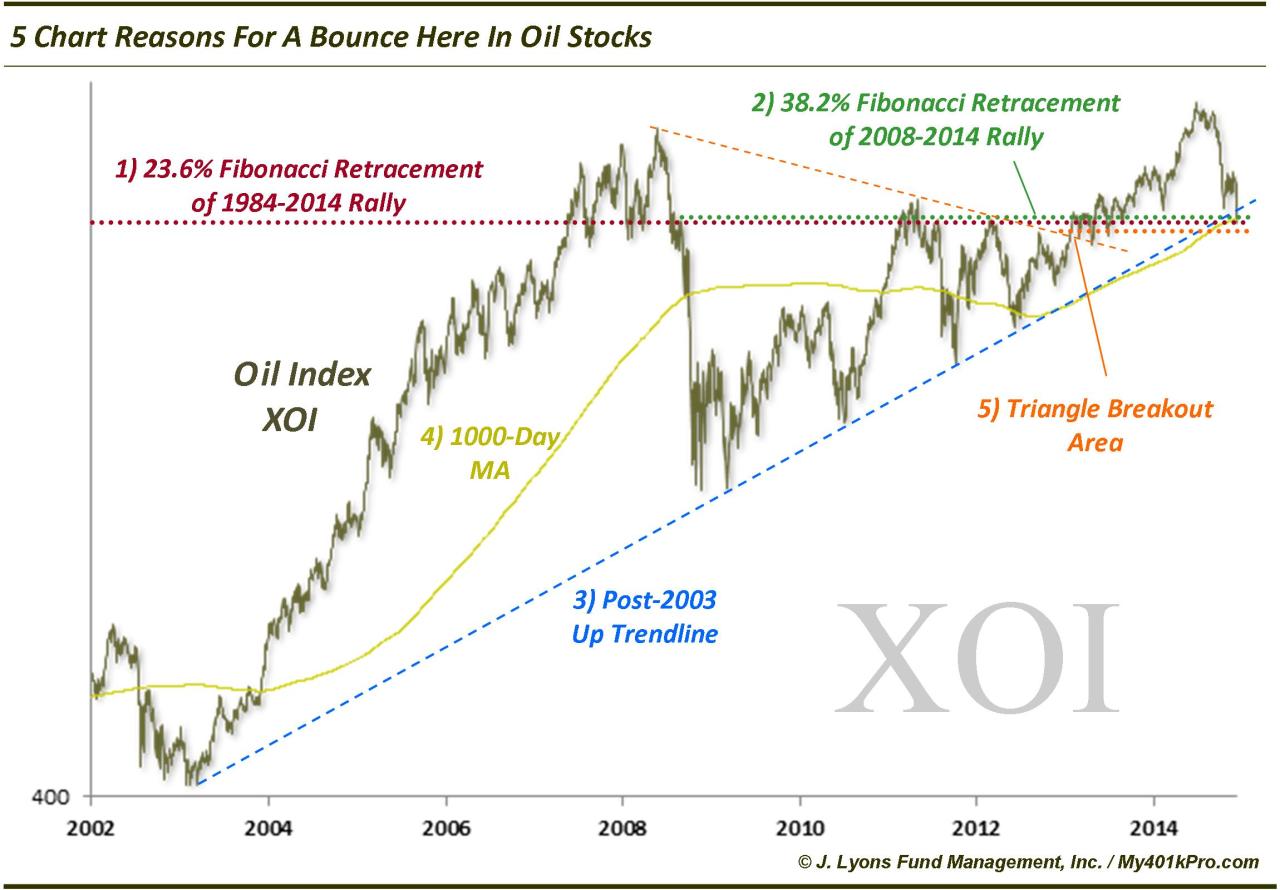

5. Stocks

Can anything derail this 7-week rally? The markets expects Draghi to come in with QE in January. Kuroda now has greater room to add more QE as Larry Fink said this week. Not really seems to be what both Lawrence MvMillan & Tom McClellan wrote on Friday:

- Lawrence McMillan wrote in his Friday summary – “In summary, the trend of the market is up, and as such it must be respected. Hence the intermediate-term outlook remains bullish. However, with sell signals from breadth and equity-only put- call ratios, there is certainly danger of at least a sharp, but perhaps short-lived correction. With seasonality being as bullish as it is, it is much more likely that any such correction would occur very soon or not until after the New Year.”

- Tom McClellan on Friday – “To get a big slide now, the stock market is somehow going to have to fight off the bullish forces of positive seasonality, plentiful liquidity according to the breadth numbers, and more QE coming from other countries’ central banks. Plus we are now in the year following the mid-term elections, which is nearly always an up year”.

The one force that could create a sell-off is Chair Yellen on December 17. But that is a week & half away. The belief in the “certainty” of seasonality and the rally since October seems to have created extremes of both inflows & bullishness as CEO David Santschi of TrimTabs said on CNBC on Thursday:

- “We are definitely seeing a type of king dollar dynamic through out the world; definitely worrisome how much money is flowing into US equity ETfs; we saw an inflow of $28 billion in November, another $6.2 billion on the first 3 days of this month; the trailing 3-month inflow from this September to this November was $64 billion; that’s the highest since late 2008;so certainly doesn’t mean the market is going to crash but the bullish camp is getting very crowded right now; we have analyzed the flows historically and you see extremely heavy inflows like that, the market tends to perform poorly in the short term; ETF flows are one of the best contrary indicators in our data sets“

- “we dont see a recession either; we just think the bullish camp has gotten very crowded & short term we dont think there is a lot of upside based on the big flows we are seeing; by the way the flows also confirm what we are seeing in a lot of major sentiment surveys – Investors Intelligence, American Association of Individual Investors, Charles Schwab’s reader survey, market vane census – all those are showing extremely high levels of bullishness right now“

But what if the perceived certainty of year-end rally is shaken?

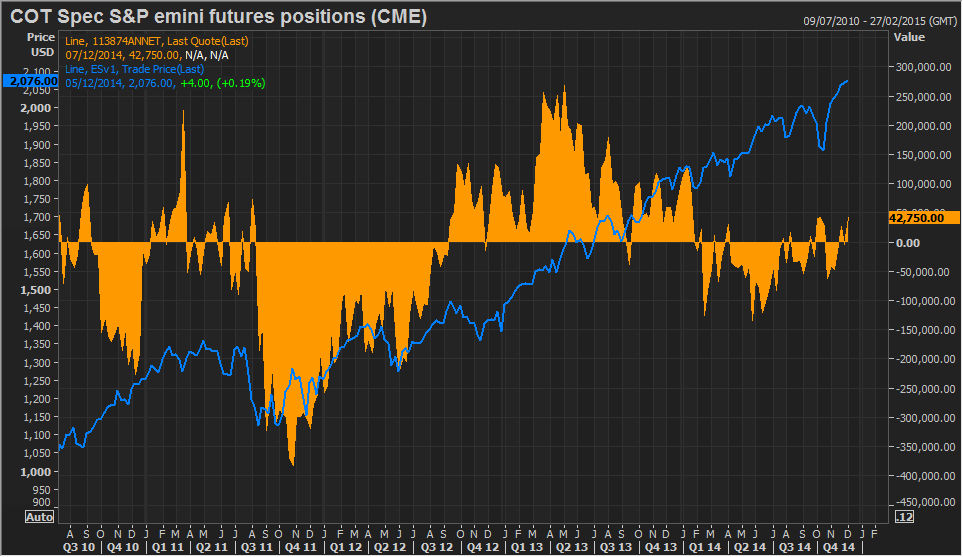

- Eric Burroughs @ericbeebo – Those S&P specs, now as long as they’ve been in a year. Any year-end reversal could be nasty as weak longs bail

The most interesting action on Friday was the breakout in the banking sector mainly due to the big steepening in the 1-7 year curve:

- Mark Dow @mark_dow – RT @msttrader: Weekly bank breakout is a big deal. $BKX

- Todd Harrison @todd_harrison – The Most Interesting Chart in the World $BKX