Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Thank you Robinhood

Bespoke had defined the week before this as a “perfect week”. This week was similar in quality but not so much in quantity. By quality we mean everything supposed to rally did rally and the ones not supposed to rally did not. But the rallies were about a 1/3rd in scale to the really perfect rally the week before:

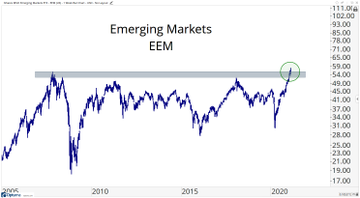

- Dow up 1%; S&P up 1.2%; NDX up 1.5%; Russell up 2.5%; Transports up 3%; EEM up 2.7%; Gold up a bit; Silver up 1.4%; Copper up 4.3%; Oil up 5%; TLT down 69 bps; Dollar down 60 bps; VIX down 4.3% & closed with a 1-handle at 19.97.

VIX is down 40% in the last two weeks, from 33.09 on January 29 to below the big 20-level in the final buying mini-stampede in the last 30 minutes on Friday. So, as Lawrence McMillan wrote on Friday in his summary:

- “Volatility is remaining bullish as well. The $VIX “spike peak” buy signal of January 28th is still in effect. Also, the trend of $VIX is down, as it is below its declining 20-day and 200-day moving averages. Thus, those are positives for the stock market.”

- “In any case, the sum of the evidence is still bullish at this time. The $SPX chart is trending higher and will be in a bullish state unless some of the support levels are broken. Thus we maintain bullish short- term positions, rolling up call strikes as the underlyings advance and raising trailing stops.”

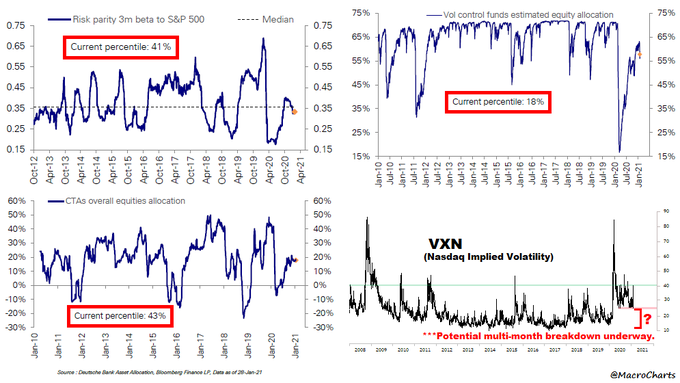

That doesn’t mean there aren’t any indicators suggesting a big overbought condition. No shortage of those actually. But there might be room for some more upside in those indicators too. And didn’t Tom Lee say VIX could go to 15? And what about VXN? Can it go lower?

But do Vol Control Funds have any ammunition left? What about CTAs?

- Macro Charts@MacroCharts – Feb 6 – Everyone is NOT long Equities: Systematic funds are *significantly* underinvested (source: DB). Critically, Volatility is close to breaking Major support. A gradual, steady decline in Implied & Realized Vol would turn these funds into massive buyers of Stocks. Be prepared.

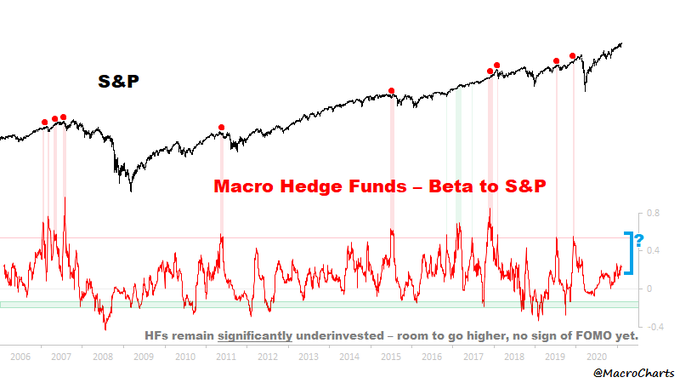

But that was a week ago. Any recent update & about another big class of funds?

- Macro Charts@MacroCharts – Feb 9 – Everyone is NOT long Equities (continued): Macro Hedge Funds are significantly underinvested. They’re usually “all-in” near Major tops – but right now, they have little interest in Stocks. If this rally keep going, it’s only a matter of time until FOMO kicks in.

If the above is correct, then will the statement below also prove correct?

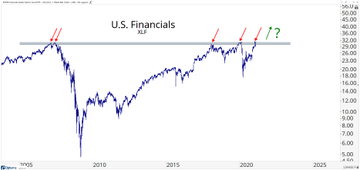

- J.C. Parets@allstarcharts – they keep telling me that stocks are in a bubble. I keep telling them that we haven’t even broken out yet. boy does that piss them off

See why we say Thank you Robinhood? They enabled a large scale de-grossing of portfolios of big speculators and took VIX vertically up. Then Robinhood shut them off. That made VIX fall hard & created pressure for re-grossing.

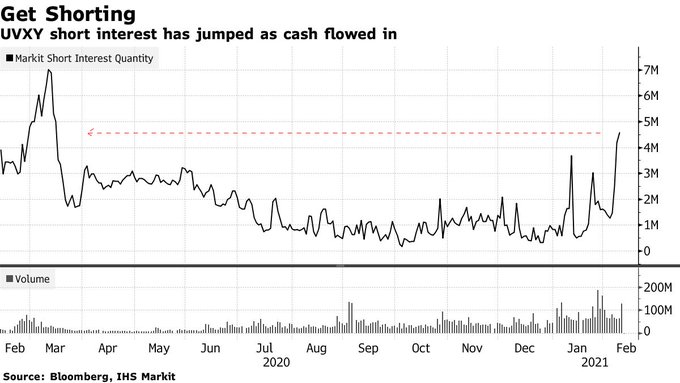

But volatility has to break this major support and keep the support broken to drive the under-invested players in. But what if those smart disruptors choose to do to VIX/VXN what they did to GME? What if they launch a similar campaign to buy VIX /UVXY calls? And what if they do so during next week’s Option Expiration?

- Holger Zschaepitz@Schuldensuehner – Feb 11 – OOPS! The world’s biggest #Volatility ETF grows 40% in just 4 days. ProShares Ultra VIX Short-Term Futures ETF, that profits from U.S. stock volatility has added more than $600mln of new money in less than a week. bloomberg.com/news/articles/

Is that fear keeping the big aggressive funds on the sidelines? What might assuage this fear? A “gradual, steady decline in Implied & Realized Vol”, as the above tweet said, might do the trick?

What if none of this happens next week? Than we take out 4,000 on S&P?

2. A 25% increase in cash level leading 66% increase in cash level?

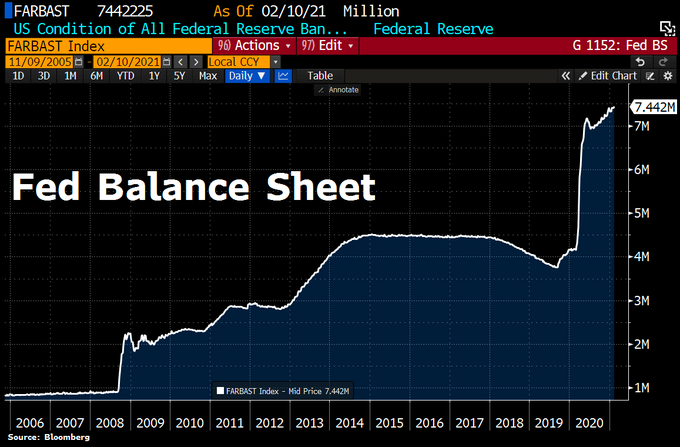

The Fed is of course doing its thing.

- Holger Zschaepitz@Schuldensuehner – #Fedbalance sheet has hit a fresh ATH of $7.44tn last week, equivalent to 34.7% of US GDP. Fed’s balance sheet is smaller than #ECB’s, at 70.7% of GDP, and much smaller than those of SNB or BoJ where total assets are >100% of GDP.

But that is not what we mean by talking about a 25% increase in cash in the US banking system. No indeed. We are pointing to a really interesting micro story relayed by Mark Cabana, BAML Head of Rates Strategy on BTV Surveillance on Thursday (minute 27:40 to 34:10):

- “… the US Treasury’s cash balance is going to be reduced meaningfully over the next couple of months; .. when the Treasury cash balance comes down, that means cash in the banking system increases; “

OK, how much cash is coming in?

- … when you add it all up (QE+Treasury cash), you are looking at the potential for $1 trillion of additional reserves hitting the US banking system in the next 2 months & almost $2 trillion reserves hitting by the end of June …

Big numbers but how big are these compared to the US banking system?

- ” … for context, there is about $3 trillion in the banking system; so we are talking about a 25% increase in the total banking system reserves in the next 2 months & almost 66% increase over the next 4-5 months … “

The 2-year yield closed at 11.1 bps on Friday and the 1-year yield closed at 6.6 bps. What happens to these rates?

- …. you are going to have more cash chasing not all that much additional Treasury debt; more cash, less collateral (assets) that means downward pressure on rates and that could well put Treasury rates into negative;

Negative Treasury rates in America? Cabana added,

- … the Fed doesn’t really like that; US Treasury doesn’t think it is good; they can’t issue Treasury Bills at negative offerings …

So what will the Fed do? Cabana said:

- … The Fed is likely to raise interest rates slightly & try to pull Treasury rates out of the negative territory; … they are going to to do so via IOER (Interest On Excess Reserves) …. we think the Fed needs to do this on or before the March FOMC meeting …

What might this do to Treasury rates?

- … you could see Treasuries richening not just at the 2-year level but up to the 5-year level …

And obviously the Treasury curve will steepen more. As Cabana said, the fixed income managers have already increased the weighted average maturity of their mutual funds.

The big question is what does this cash hoard coming in do to stocks? The Keene-Ferro-Abramowitz gang didn’t ask Cabana. And we feel somewhat sure that Cabana would have ducked the question saying he is a Rates guy not a stock guy. The bigger question is whether the equity gurus like Hartnett et al have spoken with Cabana & come to some answer.

After all, 25% increase in the US banking system reserves in the next two months has to have some impact on US stocks, right?

3. Hi ho Corn

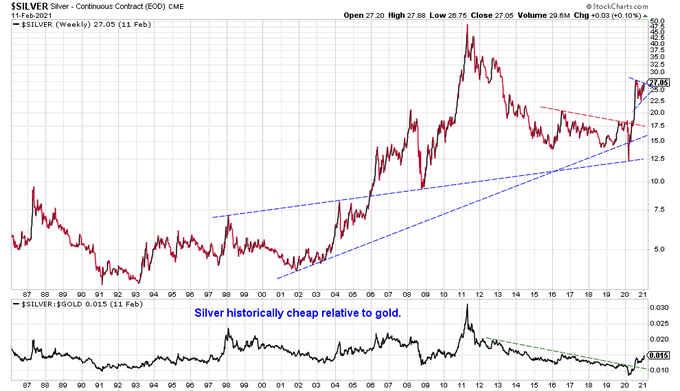

- Ryan Detrick, CMT@RyanDetrick – Silver continues to look great. Still cheap relative to gold and starting to outperform the yellow metal. Remember, silver has many industrial qualities and as the global economy comes back, it should find demand.

This fits with what Jim Cramer said on Wednesday about the predictions about Silver from his colleague Carley Garner:

- ... He showed Carley’s bullish chart on silver and said she thinks it can go to $31; that might be likely be a double top formation and Silver could fall hard from that level … this call, Cramer said, was based on the Dollar not rallying …

The above is based on our recollection and a few scribbles we made as we listened to Cramer. You could do without silver in your life. But could you do without food?

- Jesse Felder@jessefelder – ‘Rampant demand from the world’s second-biggest economy has driven a fierce rally in grain prices in recent months.’ ft.com/content/94b04a

Send your feedback to editor@macroviewpoints.com Or @Macroviewpoints on Twitter