Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

0.Above all – A Sincere Apology

We wrote the following in Section 2 of our Interesting TACs article last week in a discussion about a family that was finding it very hard to afford diapers for twin boys:

- “This type of inflation is not cured by the Fed raising interest rates to appease fat & happily retired sales-traders now at CNBC.”

At the time of writing that line, we were thinking about a remark made by a veteran CNBC anchor (now retired) a few years ago about the size of salaries in Television. That recollection was the basis of our comment about CNBC people who talk blithely about inflation in America and criticize the Fed for not hurting the people further by making food, diaper & gasoline more costly.

Our sincere & deep regret is about our use the term “fat” as an adjective for the people we were describing. We sincerely apologize to any CNBC person who might have been offended or hurt by that term. It was neither a personal nor a physically descriptive use of that synonym for rotund.

It was actually used in a historically social, cartoon-based framework to contrast the affluent from the afflicted, financially speaking. For example,

More on inflation today & Chairman Powell a bit later below.

1.Back to where it began

Last week, we wondered if China’s lowering of the RRR-ratio was a “panicky reversal“. That seems to be the conclusion of John Authers of Bloomberg (after decades at FT). In his Bloomberg article The China Trade May Be Just Starting to Unravel, he argues that Beijing’s monetary easing is a bad sign.

- “The Chinese authorities dislike easing, and even with the MLFs due to expire as an excuse, they can only be doing this because they have good reason to fear an economic slowdown. This is how Wei Yao, China economist for SocGen, summarized it:

- The past history of RRR cuts (of any kind) suggests that this tool is never used when the economy is doing well. So now that the trigger has been pulled, two things are clear. – First, the economy is not doing well, and this will likely be confirmed by next week’s 2Q GDP data….

Second, China’s easing cycle has started… We now expect another RRR cut of 50bp in 4Q. Based on our current economic projection and bearing in mind the PBoC’s dislike of excessive easing, we do not think the economy would warrant an interest rate cut this year yet. Next year looks more likely. However, even without a policy rate cut, the PBoC will probably drive down interbank rates with more generous liquidity injections from here.”

- The past history of RRR cuts (of any kind) suggests that this tool is never used when the economy is doing well. So now that the trigger has been pulled, two things are clear. – First, the economy is not doing well, and this will likely be confirmed by next week’s 2Q GDP data….

Mr. Authers adds:

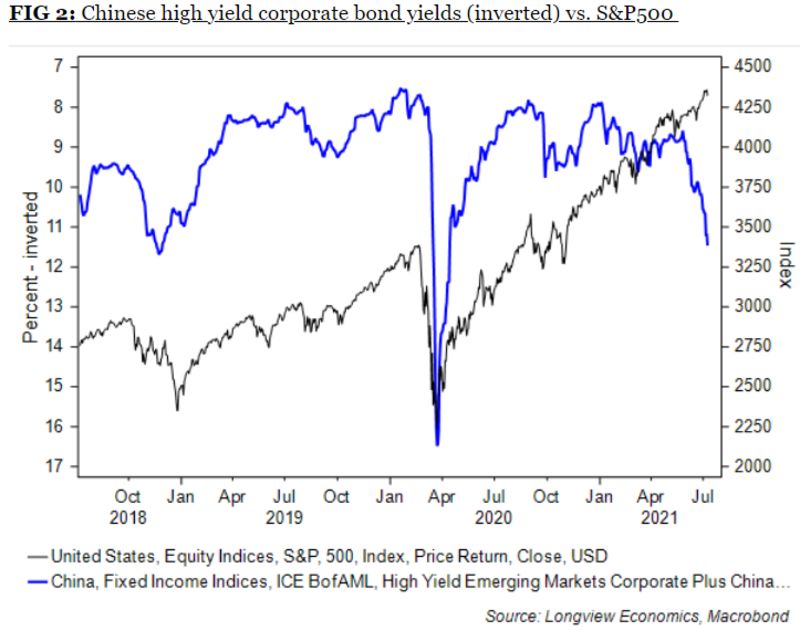

- “Meanwhile, there are growing concerns about Chinese corporate credit. Not coincidentally, yields on China’s high-yield indexes spiked higher just as U.S. equities sold off last year, and the two had roughly recovered together. Now, as this Longview Economics Ltd. chart demonstrates, Chinese credit investors appear to be losing their nerve again, even though there are no such concerns in the West. This suggests deeper concern about the health of the corporate sector:”

We have enough trouble trying to understand even the basics of US Credit. So we claim zero clue about Chinese corporate credit except the simplistic understanding that problems in Chinese credit are not good for global reflation.

What we can understand, at least superficially, is what Barry Knapp of Ironsides Macroeconomics said about Chinese leadership on BTV Open on Friday morning:

- “The policy response to the pandemic really significantly lowered the probability of them escaping the middle income trap. They favored production over consumption, heavy industry investment in state-owned enterprises over private sector; they are clamping down on the most dynamic sectors of their economy”

OK, but what is his investment conclusion? Barry Knapp was clear:

- “I am a big bear on China; I was a a bear before the pandemic; More bearish afterward; productivity growth is going to be even more tepid there & lag the rest of the world. I would not be long anything in China.”

Two weeks ago, we had written:

- “What do autocratic leaders do when domestic problems can’t be fixed? Sometimes they create an international situation that can be blamed for the domestic problems. Simple folks like us are not the only ones worried about this.”

Then we were talking about the deliberate leak about USA & Japan “conducting secret war games in the South and East China seas simulating a conflict with China.”

This time, allow us to quote something more serious:

- Tuvia Gering 陶文亚 – @GeringTuvia – Jul 14 – “What does the decline of American hegemony mean to the world?” – Prof. Huang Renwei, executive president of the Fudan Institute of Belt and Road & Global Governance and former vice president of SASS, sees a future in which US hegemony declines and China’s overall power grows 1/7

Instead of commenting ourselves, we quote the response to the above by Michael Schuman, Bloomberg Opinionist, Contributor to Atlantic & an author of THE CHINESE HISTORY OF THE WORLD?

- Michael Schuman@MichaelSchuman – Jul 14 – The assumption in Chinese policy circles that US decline is inevitable will lead to a lot of bad foreign policy choices & dangerous miscalculations.

Especially when 2022 features the 5-year Congress in China.

And, by the way, John Authers writes that “…the country [China] remains relatively unvaccinated“.

2. U.S. Inflation, the Fed & Treasury Market

Look what Josh Brown said on CNBC Closing Bell on Wednesday:

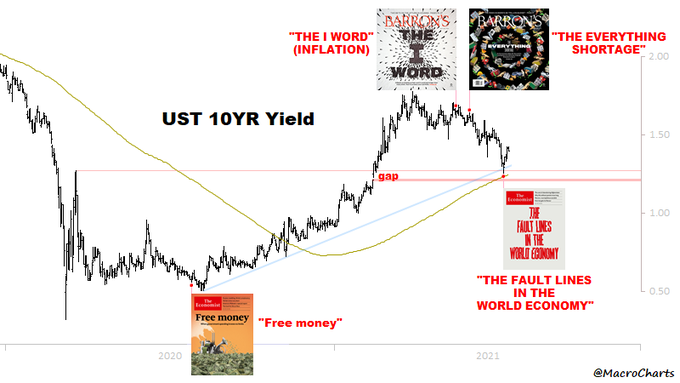

- “You know, The View led with their opening segment today; It was about inflation. The View! . This is no longer a story confined to the Wall Street Journal.“

Media excesses have often marked a top of financial stories or conditions. Neither The View nor Josh Brown are even near the level of The Economist in being spectacularly & consistently capable of creating a top or bottom. But we do feel The View featuring inflation in their opening segment is kinda the beginning of the end of the “inflation” crisis in America.

On the same day, David Rosenberg tweeted:

- David Rosenberg@EconguyRosie – Jul 14 – The lopsided US inflation story: about 90% of the core CPI was +0.2% in June (+2% YoY) and 10% of it jumped over 5% (+20% YoY). Autos (used, new, rentals), airlines, movies, hotels — there’s your inflation. The skew is unprecedented.

-

David Rosenberg@EconguyRosie – Jul 14 – Headline inflation is at 5.4% and the Cleveland Fed median rate is 2.2% YoY. Let’s just say that in the past, when there was such an extreme divergence, the headline converged on the median a year out and not the other way around. Obviously, Jay Powell is seeing the same dynamic.

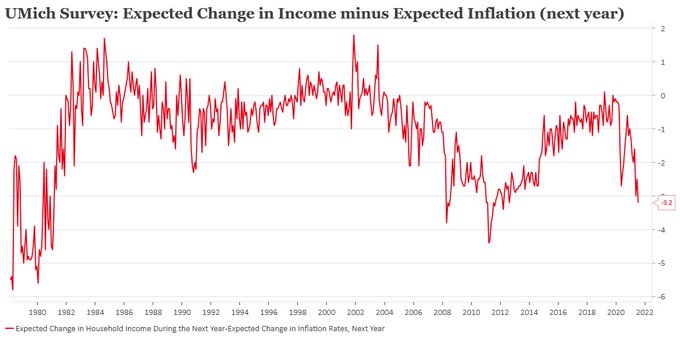

Can there be inflation without demand & can demand stay persistent without rising above-inflation incomes?

- Mark Louis@NoBServations – Michigan Survey: expected change in real income worst since the aftermath of GFC…

And is this already getting reflected in retail sales, real retail sales?

- David Rosenberg@EconguyRosie – Real retail sales down 0.4% in June after a 2.4% slide in May and auto and home buying plans hit four-decade lows apiece in July. In case you’re wondering why Treasuries have been rallying — recession clouds are rolling in.

A little “tell” about Rosenberg that we have noticed. He is usually way early in making his case and his views don’t match reality for some time. At some point, he gets testy about those who dismiss his points. And when Rosenberg gets really testy, that is when he begins to be proven right. That’s our experience. And readers can decide whether his explanatory tweet below about “Real retail sales” sounds testy.

- David Rosenberg@EconguyRosie – To those who can’t read: I said real retail sales. As in… volumes. And it is volumes that determine if we’ve entered a recession or not.

And what is top of mind for everyone in America right now? It is “Delta [virus strain]“, per CNBC’s Sara Eisen & not inflation. Chinese slowdown will only send us more disinflation via cheap exports and people are seeing their disposable incomes flat to down. In the midst of all this, “experts” are demanding that the Fed taper? We bet they can’t be as un-rotund as we are.

And now someone who has been right for a very long time, Dr. Lacy Hunt of Hoisington Investment Management:

HSBC’s Steven Major has also been right on the bond market for some time. He came on BTV Surveillance this week to say that we have “already seen the peak in yields in this cycle“. His basic case is that US has too much debt & it keeps increasing every year. So America simply cannot afford higher rates. We recall Bill Gross used to make the same case. Gross was right then and we think Major is right now. He also argues that, since nominal yields are being controlled, real yields have become the shock absorbers and they have been falling.

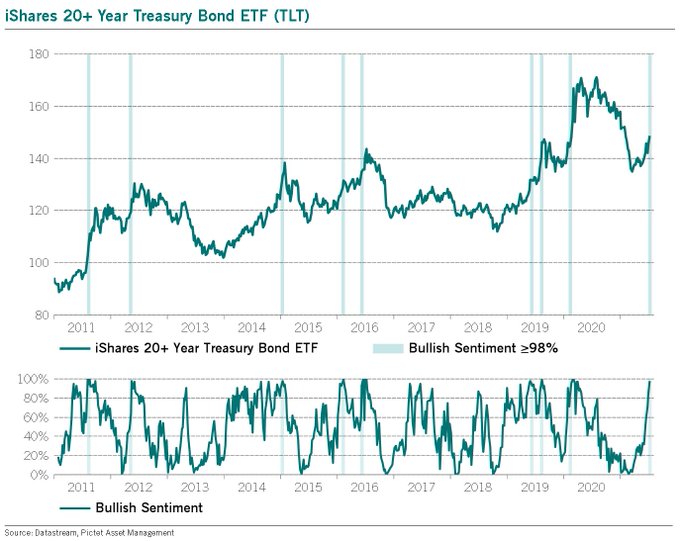

Now someone who has been correctly bullish on TLT & Treasuries for weeks. What is he thinking now?

- Julien Bittel, CFA@BittelJulien – Jul 9 – TLT sentiment on some of my measures is definitely stretched. Night & day from mid-March. From 1% bulls to 98% today. Something to watch.

Electioneering is a simple game. Simply put, it requires the salespeople (candidates) to deliver free or semi-free goods to the customers (voters). That is why we have expected manna to be thrown at voters beginning soon. This week they got the first installment, the child care credit. And Senator Manchin says he is behind the next big spending bill.

So should we start worrying about the end or at least an interruption of the “Manchin rally” in Treasuries? Yes, said Barry Knapp on BTV Open on Friday morning. And he pointed out something we had forgotten:

- “we have had 5 significant lows in bond yields in the summer consecutively; … I think this is going to be the 6th; … you could get a pretty perfect storm in the bond market; move rates up significantly higher in the fall for the 6th consecutive year … “

Yes that could happen without changing the secular long term dynamics of Steven Major & Lacy Hunt.

Wouldn’t that be a contrarian trade around the FOMC meeting on July 28? And it might actually begin if Powell convinces the Treasury market that he will NOT taper any time soon. That might trigger a steepening of the Treasury curve just as a hawkish FOMC triggered the flattening of the Treasury curve since the June FOMC meeting.

And what if inflation threatens to cool down with Lumber already down, Oil following down fast & Copper-Iron Ore falling courtesy of China slowdown? Look CLF is down 11% on the week and FCX down 10%. Even Mosaic is down 7%.

So think about Fed refusing to taper, inflation cooling down, Manchin backing stimulus and, hopefully, Delta strain proving less alarming than feared. Will that trigger a rise in the 10-year back to 1.70% or even higher?

We don’t have a clue, of course. But it is an intriguing thought, we think.

3. Stocks

Some one who was right about NDX & Treasuries back in March-April is humming a different tune now. A tune consistent with our “intriguing thought” above.

- Macro Charts@MacroCharts – Jul 14 – Have been focused on next steps for Equities.. Was constructive Tech/Growth/Bonds since March – but outperformance may be ending. Meanwhile – some Cyclicals at *great* Buy levels AND mood is down sharply. Looks like a great setup to be contrarian (again). Back with more soon.

The one factor that seemed firm & constant over the past couple of months was VIX. Yes, it spiked a few times and then fell hard quickly. For example VIX closed on Friday, June 18 at 20.70, up 32% for that week. But a week later, it on Friday June 25, closed at 15.62, down 25%. It fell again the following week to close at 15.07 on Friday, July 2.

That behavior has changed somewhat. VIX closed this Friday at 18.45, up 22% over the past two weeks since the 15.07 low on July 2. Last week, VIX rose 7.4% while Dow, S&P and Nasdaq closed up on the week. This is not the type of behavior vol guys like to see. And Tom McClellan addressed it on this past Wednesday, July 14, in his article A Useful Misuse of Correlation Coefficient with VIX Index. McClellan gives credit to the well-known Jesse Felder for coming up with a rolling 10-day correlation coefficient comparing the VIX to the SP500. The bottom line is:

- “The VIX Index is making higher lows which is not in keeping with the higher price highs of the SP500. Normally the two move in opposition, and it is a warning of trouble when higher price highs are accompanied by higher VIX readings.”

- “Higher prices with a higher VIX is not how things normally work, and when it happens it is a warning of trouble. The market can sometimes take a while before such warnings come around to finally matter, but they are worth paying attention to anyway.”

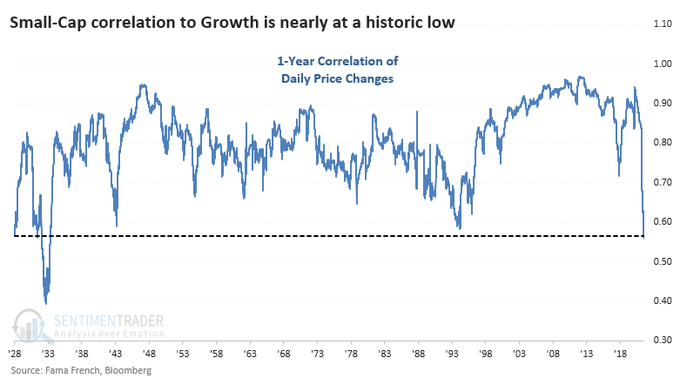

Small Caps have been hit hard:

- SentimenTrader@sentimentrader – Small Cap Stocks Haven’t Done This Since 1933

Russell 2000 was down 5% this week and so were Micro Caps. Dow was down 52 bps; S&P down 1% and Nasdaq down 1.9%. FAAMG was mediocre – FB down 2.7%; AAPL up 70 bps; AMZN down 4%; MSFT up 1% and GOOGL up 1.2%.

The smart & simple Art Cashin said this week – If the big techs like Apple & Amazon continue their breakouts, then the market would be fine. If they don’t, then negative seasonality will affect the stock market.

On that topic:

Thoughts on possible tech $NDX $QQQ selling from @TommyThornton pic.twitter.com/VIFlDMgfFQ

— Abigail Doolittle (@TheChartress) July 16, 2021

4. Commodities

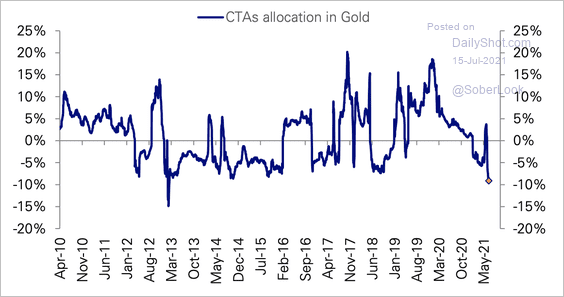

Large speculators tend to govern action in commodities. On one side, we have:

- Jesse Felder@jessefelder – ‘CTA short positioning in gold is near an extreme, largely due to the precious metal’s downtrend since August 2020.’ thedailyshot.com/2021/07/15/hou via @SoberLook

On the other hand, you have Large Speculators in Oil and a negative view of that from Caroline Boroden via Jim Cramer:

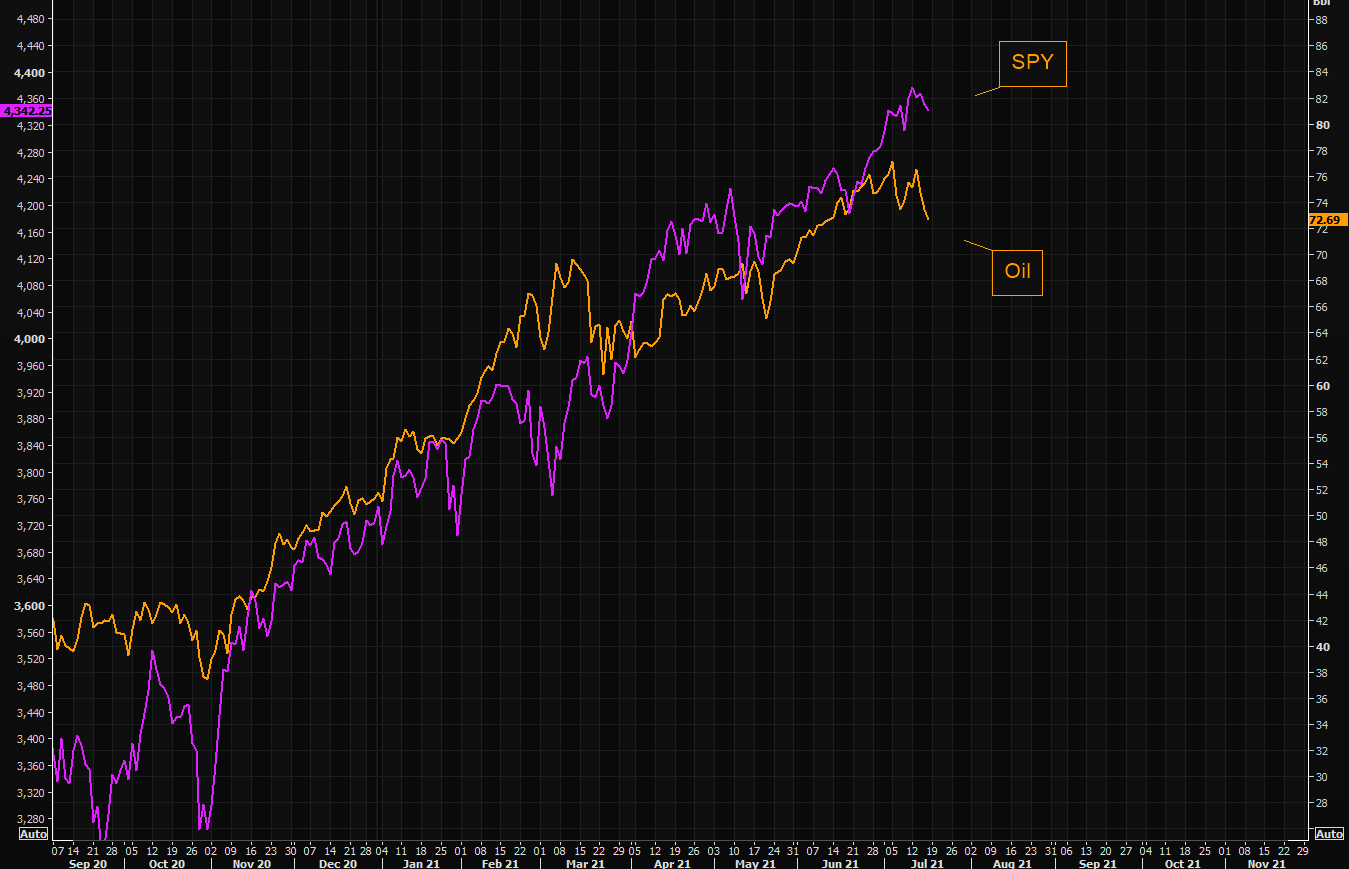

On the third hand, do we have a case of jaws?

- The Market Ear – Oil matters? Oil hasn’t closed here since mid June. The asset that refused to give in to the fading reflation narrative is down big over the past three days. The gap between oil and SPY is becoming rather big here…

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on Twitter