Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Looking to 2022 – East

We heard a few comments this week about the “strong” speech by President Xi in which he warned about foreigners breaking their heads against the steel wall of 1.4 billion Chinese people. Then we heard the story (broken by Sudhi Ranjan Sen of Bloomberg) about India moving 50,000 additional troops to the three main areas of the India-China Line of Control to engage in “offensive” defense as the military deems necessary.

But we did not hear much about the slowdown in the Chinese economy, a slowdown that we think is being recognized by the US Treasury market. Except from a couple of folks:

- Julien Bittel, CFA@BittelJulien – With Chinese equities down 10% vs. global YTD, it’s clear markets have started to fear a slowing domestic economy again… & rightfully so. The decline in China Real M1 growth suggests auto sales are peaking. This will start to impact US & Euro Zone new export orders in H2 ‘21.

But is this sort of stuff only a tip of the iceberg? That is what we heard from Leland Miller, China Beige Book International CEO, courtesy of Bloomberg Surveillance:

- “The biggest misconception is the degree to which credit is really being strangled [in China] right now; I know it is consensus to understand there is deleveraging going on in China. But when you look at quarterly results, you are seeing record lows in everything – all the big categories – overall borrowing, borrowing by state firms, by geography; you are seeing numbers crater outside the big 3 – Shanghai, Beijing, Guangdong; its hard for people to understand the degree to which China is really squeezing the credit spigot right now; it is not the deleveraging of the past…”

Why? Mr. Miller says,

- “… there is realization, anxiety in Beijing that, while they may not be at the end of the line, they are nearing the end of the line”

This, Mr. Miller says, is a real problem looking into 2022 when you have the twice-a-decade party Congress:

- “ … they are going to have to figure out how much of a slowdown they can stomach, particularly going into a political year like 2022”

What do autocratic leaders do when domestic problems can’t be fixed? Sometimes they create an international situation that can be blamed for the domestic problems. Simple folks like us are not the only ones worried about this. Look what the US & Japan did and more importantly let it leak? As Geopolitical Futures wrote:

- “Japan and the U.S. celebrated the anniversary by leaking news that they’d been conducting secret war games in the South and East China seas simulating a conflict with China. Japan also will hold its first joint air force exercises with the Philippines next week.”

2. Looking to 2022 – West

Are there some who want David Rosenberg to “scream uncle” & admit publicly that he is wrong? There probably are. They might get their chance soon. How do we know? Because David Rosenberg himself promised to do that in his long clip on Real Vision around minute 18:38 of the clip:

- “We are going to have a different economy, different stimulus after July; my view has a life line that takes me past July. I will scream uncle, I am wrong if the economy does not slow down precipitously past July. …. the fiscal drag, fiscal draw we are going to have after July till the end of the year is going to be massive & I don’t really understand why the consensus is so wholly on the other side … “

And what will happen eventually? Rosie said,

- “ … inflation expectations are going to melt and we are going to have a huge rally in the longer-end of the Treasury curve“

Priya Misra of TD Securities had a different viewpoint to explain the current bull flattening in the Treasury curve on pre-NFP Friday morning on Bloomberg Surveillance:

- “… market is telling you that the Fed is going to be forced into hiking for some reason, perhaps inflation and the economy can’t handle it; that is why the hiking cycle would be cut short & it could potentially slow down growth going forward … the market is running with a more hawkish reaction function – I think every data point now is going to be a market event … ”

Now go back a week to Friday, June 25 and recall how long duration Treasury rates spiked up 5 bps + because of the infrastructure deal announcement. Did we hear a pip about that deal this week? We didn’t. Is that why Treasury rates fell by 5-6 bps from Monday to Thursday?

Then came Friday’s Non Farm Payroll number, a number that satisfied most as “goldilocks”. How did the Bond market react to this good news? Treasury rates fell another 4-5 bps on Friday. Why?

- David Rosenberg@EconguyRosie –The most important data point in today’s jobs report was not the headline but rather the contraction in the workweek and the repeated decline in real wages. Look out for a sharp weakening in Q3 GDP growth and likely beyond. Treasuries have sniffed this out ahead of everyone else.

BlackRock’s Rick Rieder had a different answer in the post-NFP show on BTV:

- “Technicals win more than fundamentals; liquidity coursing through the system is extraordinary & this month you are going to get this pay down if Treasury’s general account; the amount of money is almost a trillion dollars that’s come in plus Fed’s putting $120 billion a month … “.

But he added,

- “I think you are going to see that liquidity stay there for a few more weeks; … as you get in the back half of this year, Treasury general account pay down will stop; amount of Treasury issuance is going to be significant in the back of the year … “

With all that, what is the risk to the market according to Mr. Rieder?

- ” … risk to the markets today is that Fed doesn’t taper …. you start to worry they are going to break the economy on the other side; markets would much rather the Fed move now … “

Priya Misra also said pre-NFP on BTV that there is a ton of Treasury supply to take down later in the year. She expects the Fed to announce a taper by year-end leading to her forecast of 2% 10-yr rate. But she says hiking rates is much farther out. Hence she likes Treasury steepeners.

However we keep thinking about November 2022 & expect a massive push to pour money into the economy from November 2021 on wards, the traditional one-year stretch. How will the Fed taper into that political stretch, especially if the Biden team is unable to pour fiscal relief in the pockets of middle class American?

Remember the QQQ + TLT portfolio? This week QQQ was up 2.7% and the TLT was up 2.1% (Zero-coupon EDV was up 2.9%). The 30-year yield fell by 11 bps this week; 20-year yield fell 10 bps and the 10-year & 7-year yields fell 9 bps. Actually everything went up this week including the Dollar, Gold, Silver, Oil and almost all US stock indices. It was almost goldilocks, except for Russell 2000 down 1.2% & Copper down a bit.

And what about FAAMG, you ask? Facebook was up 3.9%; Apple up 5%, Amazon up 3.2%, Microsoft up 4.7% and Google up 2.2%.

3. “Beautiful time to be in the stock market“

So said the usually under-stated “Farmer” Jim Lebenthal on Thursday’s CNBC Half Time Show. As if they were listening to him, the Dow, S&P & Nasdaq rallied to new all-time highs on Friday.

Even the usually sentiment-reversing Sentimentrader.com turned happy like Farmer Lebenthal. They wrote in their article – There Has Never Been a Year Quite Like This:

- This year has marked one of the few times in history that both stocks and commodities have rallied at least 14% through this far into a year. In fact, it’s the best year for both assets, edging out 1976.

- For stocks, in particular, it’s been one of the best, most consistent, and most persistent rallies year-to-date in its history. Through the end of June, the S&P 500 has rallied more than 14%, ranking in the top 85% of all years since 1928.

- It’s also been one of the most consistent years. The S&P has scored 34 record highs for the year already, ranking in the top 88% of all years.

- And it has been a very persistent rally. The S&P has now gone more than 150 sessions since the index was more than 5% off of its peak. That streak ranks in the top 93% of all years since 1928.

- Momentum is a strong force and doesn’t usually roll over easily. If we look at the strongest, most consistent, and most persistent years through June, this year ranks among the best.

- The risk/reward for the last half of the year was decent after the other “best” years. There were almost no large declines in the months ahead, but gains also tended to be limited. That’s a combination of a lot of buying power potentially already used up, along with what has frequently been a summer soft spot.

So is it kinda done? Not so says:

- Ryan Detrick, CMT@RyanDetrick – An object in motion tends to stay in motion… The S&P 500 is up >5% for 5 consecutive quarters for only the second time in history. The other time was 1953/1954. The next four quarters it gained another 26.4%.

But what about next 6 months?

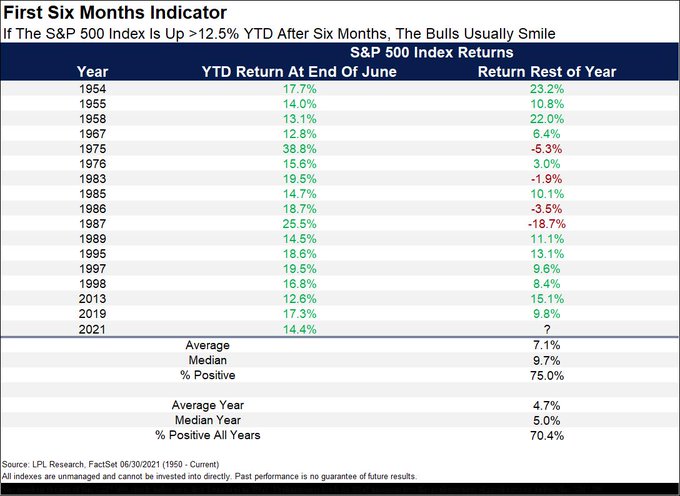

- Ryan Detrick, CMT@RyanDetrick – What a first 6 months, with the S&P 500 up 14.4% YTD. The good news is a strong first 6 mos usually means a strong next 6 mos. When the SPX is up >12.5% YTD at the end of June, the next 6 months are up a median of 9.7%. That is nearly 2x the median final 6 months for all yrs.

Tom Lee raised his S&P target for this year to 4600. His favorite sector remains Energy because of supply-demand dynamics. And he tweeted the graph below of OIH:

Speaking of demand for energy, Bloomberg wrote “India Regains 90% of Pre-Virus Gasoline Sales as Demand Rebounds“.

- “India is expecting fuel demand to get back to pre-virus levels by the end of 2021, according to Oil Minister Dharmendra Pradhan. “There are signs of demand resurgence,” Pradhan said at a Bloomberg summit on Tuesday. “We are confident by the end of the year, we will be in a very robust position to restore our original consumption behavior.””

We will see what OPEC does next week. Previously Saudis & Russians were the players who wanted to drill more. Now it seems to be UAE. But the bigger story about curtailing supply is the obsession about ESG. That seems to be the gist of what Larry McDonald told Maria Bartiromo.

4.On the other hand

What’s the other side of semi-euphoria?

- J.C. Parets@allstarchartsFewer stocks making new highs, and fewer bearish market participants. What comes next?

This seems to be bothering even some who have been correctly bullish:

- The Market Ear – Kolanovic: Buy tech protection for threat of a reversal – Mark-to-Marko swears in the FAANG church and says that maybe it will not grow straight to the sky: “As a hedge, or for tactical downside exposure, we recommend purchasing QQQ October 340/315 put spreads for $5.00, indicatively, ($354.47 reference price), taking advantage of its rich volatility skew (84th %-ile over the last 5-years)“. NASDAQ VIX, VXN, is down to post corona lows practically. …

5. 14th on Fourth

In his wishes for the Fourth, Art Cashin said have a 5th on this fourth. We totally support the underlying message, if not the scale. Frankly, his message reminded us of an evening back in college when we recorded 13 straight, last 5 consumed on the doorstep saying bye to our host. So, in the spirit of new all-time highs in the stock market, we intend to go for 14th on this Fourth. We may have to take the day off on Tuesday but it will be for a good cause.

Have a great Fourth, everybody.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter