Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Fed Chair

What a perfect job by Chairman Powell in the presser! The statement again was a bit hawkish but that impact was diluted by Chairman Powell in his presser.

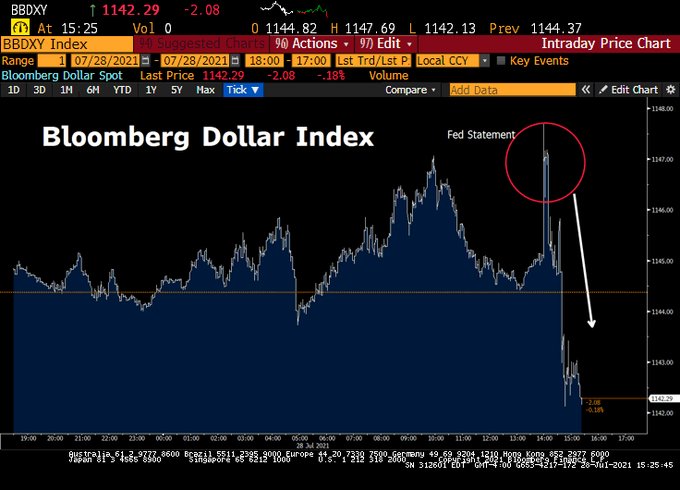

- Lawrence McDonald@Convertbond – By Definition, if the US dollar is off 14bps since the Fed statement, the central bank was NOT hawkish.

- Dow up 18 bps; S&P flat; NDX down 26 points; Russell up 12 points; Transports up 113 pts. Treasury rates fell about 2 bps. Gold & Oil were up 2%. The Dollar was down a little and VIX was down 3%.

- Lawrence McDonald@Convertbond– New permanent foreign repo facility is large for emerging markets,Fed trying to arrest USD, support global recovery. Why? $64T of GDP outside USA vs $20T inside. If you blow up the $64T again (see 2013, 2016, 2020), you just have to offer a lot more accommodation on the backend.

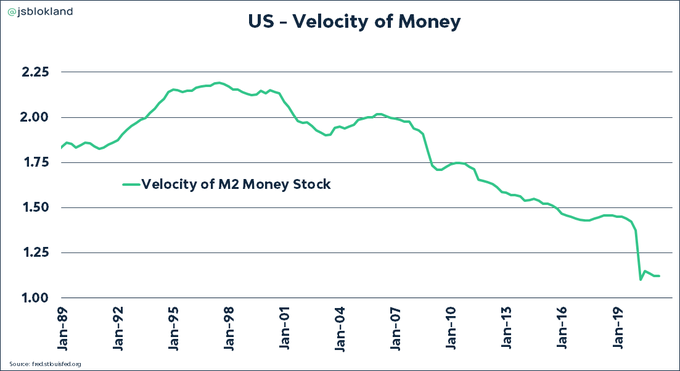

- jeroen blokland@jsblokland –The Velocity of Money in the US remains extremely depressed!

- Lisa Abramowicz@lisaabramowicz1 –JThe Citigroup U.S. economic surprise index is getting close to the most negative it’s been in a year. This just underscores the degree to which analysts have more frequently been too optimistic of late after months of failing to be optimistic enough.

- David Rosenberg@EconguyRosie – This economy is so totally distorted that — get this — we had a 6.5% annualized real GDP growth pace in Q2 in the same quarter that real personal disposable income collapsed at a 30.6% annual rate!

- David Rosenberg@EconguyRosie – Ever heard of Kerplunk from the 60s? That’s the US economy. And why Powell will defer the taper & why Biden is so fiscally desperate. If not for these huge fiscal interventions, GDP would be $1.2T or 5% lower. Like 1934,1935 & 1936, it’s a recovery in an elongated econ depression

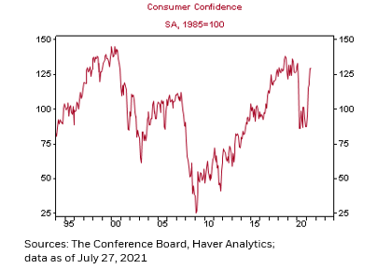

- Rick Rieder@RickRieder – Elevated #confidence by #consumers and CEO’s will continue to buoy growth (and employment). The policy debate, therefore, should center more on accelerating, and potentially sticky, #inflation over the coming months and quarters.

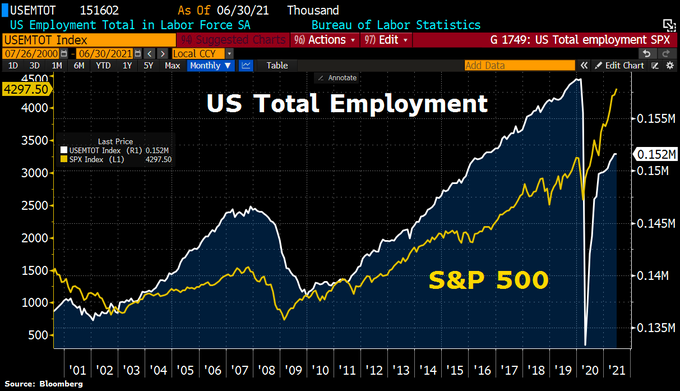

- Holger Zschaepitz@Schuldensuehner – This chart highlights why the Fed will no longer let stocks fall. There is a correlation between US total employment and the stock mkt. In other words, the equity market drops, employment drops. The equity market goes sideways even, employment levels off. (via@JulianMI2 )

3. The Big Factor for the economy

Sadly the brain trust that came to power last November is now proving to be both clueless & pathetic about the Covid mess in America. The viral spread of the Delta virus strain is casting serious doubt on where the country stands & whether the FDA-CDC have any clue. We have been appalled at the apathy & political indecision we see in the people in power.

It has been well documented that the efficacy of the vaccines, especially the Pfizer vaccine, drops to 84% within 6 months of vaccination. As we recall Pfizer announced a third booster shot to those who have taken the first two shots a few months ago. But both the FDA & CDC dismissed that idea, clearly for political convenience of their masters.

- “It’s the C.D.C. versus capitalism,” ; the incoherence of our government is making people very scared. … I haven’t been this frightened since the beginning of the pandemic,; … So thank you C.D.C. for making us feel like if we go outside our house, once again, we are at risk.”

Frankly, Cramer was neither direct enough nor angry enough for us. The most descriptive fact we had heard is that this Delta strain distributes 1,000 times more particles from an affected person’s nose than the original virus did. That should persuade everyone to wear a surgical face shield like the one Doctors wear in hospitals. Such a face shield is the only way to protect your face, nose & mouth from such high frequency emission of particles, at least to our simple way of thinking.

To be honest, we personally have been wearing a face shield AND a mask for the past several months, even during the summer. We got a few looks especially in parks at children’s activities. But New Yorkers being polite, no one has said anything. Now look what we heard after Friday’s close – CDC study shows 74% of people infected in Massachusetts Covid outbreak were fully vaccinated. The article added,

- The new data, published in the U.S. agency’s Morbidity and Mortality Weekly Report, also found that fully vaccinated people who get infected carry as much of the virus in their nose as unvaccinated people, and could spread it to other individuals.

So it seems to support what we had heard earlier that this Delta strain sends virus particles through the air and, as we recall the quote, “they breathe near you & you get it“.

But the particles need to get to your face for you to get it. And what’s the best defense against it? A Face Shield that covers your entire face & a surgical mask underneath the shield that covers your nose & mouth.

Wonder what CNBC’s David Faber thinks now, the same Faber who mocked those who kept wearing masks a few weeks ago? Fortunately, his sometimes colleague, Sara Eisen was smart enough to ask the U.S. Surgeon General about the 3rd booster shot in America, something that Israel has done already. His reply was OK but not as positive as we would have liked:

What has been the experience of other countries that fought the Delta strain?

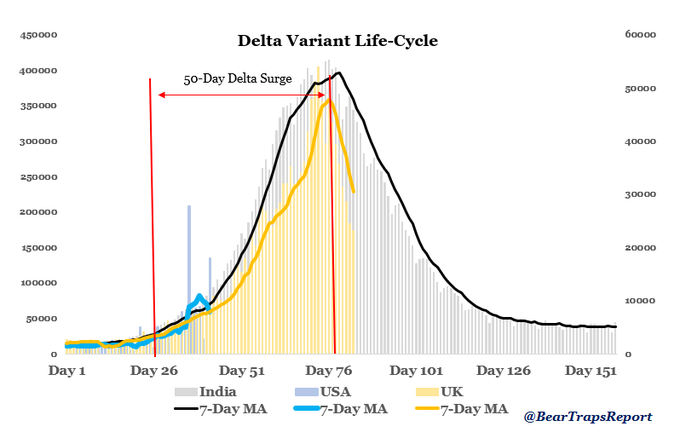

- The Bear Traps Report@BearTrapsReport – Based on data coming out of India and the UK there is a pretty interesting trend in case growth. The lifecycle of delta surges has peaked around 50 days after lift-off. The US is currently approaching 15-20 days into the cycle. Implied target date for a peak is near 8/26 – 8/29.

But there is a caveat, as we recall. The above life-cycle was based on the involved governments panicking near the peak. As of now, all we see in America is a panic to discuss & debate. That is why we can’t wait for the morons in DC to act.

One positive note was sounded by the balanced and sane Dr. Scott Gottlieb despite his scary statement about 1 million Americans getting infected every day:

4. Treasury Rates & Bonds

Below is what we had written two weeks ago on July 17:

- “So think about Fed refusing to taper,inflation cooling down, Manchin backing stimulus and, hopefully, Delta strain proving less alarming than feared. Will that trigger a rise in the 10-year back to 1.70% or even higher?”

This week, the Fed clearly refused to taper. Inflation does seem to be cooling down. May be it is now Sinema & not Manchin but the infrastructure bill seems to be farther ahead now. What if the Delta virus behaves in the US as it did in other countries & starts falling off by August end? And, hoping fervently, President Biden reappoints Powell to another term? Will that finally trigger a rise in the 10-year yield?

We may not need all that because we did get a powerful signal from a “stealth bond king” this week. Look what happens when Apple sells bonds?

It was polite of Larry McDonald to tweet the below:

- Lawrence McDonald@Convertbond – @FerroTV thanks for the shoutout, Maestri is a priceless bond seller ahead of moves in bond yields higher.

It was polite but misplaced. Actually the above-mentioned shoutout was first from Lisa Abramowicz, a co-host of the Bloomberg show. When she spoke on air about the above chart, Jonathan Ferro asked her to forward the chart to him. We get that these three are big-shots while we are simply ordinary viewers of Fin TV. But we do think in our simple manner that credit should be given where credit is due. And the credit for the shoutout of the above chart of Mr. McDonald goes to Ms. Abramowicz & not to Mr. Ferro.

But is there any piece of evidence that might support the above trigger?

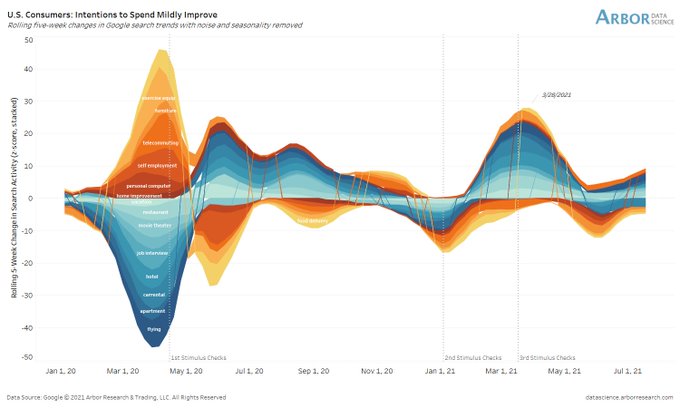

- Ben Breitholtz@benbreitholtz – Fortunately, US consumer search activity has begun to rebound after retreating into early June. Further downside for yields may be limited. (2/2)

- “In summary, the bullish case is still intact, as long as $SPX continues to remain above 4233 and as long as $VIX is trending lower. Having said that, we will trade various sell signals alongside that “core” bullish position when they are confirmed.”

- On Monday, we begin a new month. Normally money flows are bullish as we turn the calendar, but seasonal trends are not. I see a few warning signs flashing. Dip buyers may return, so stay on guard. Pullbacks are ripe for trade opportunities.

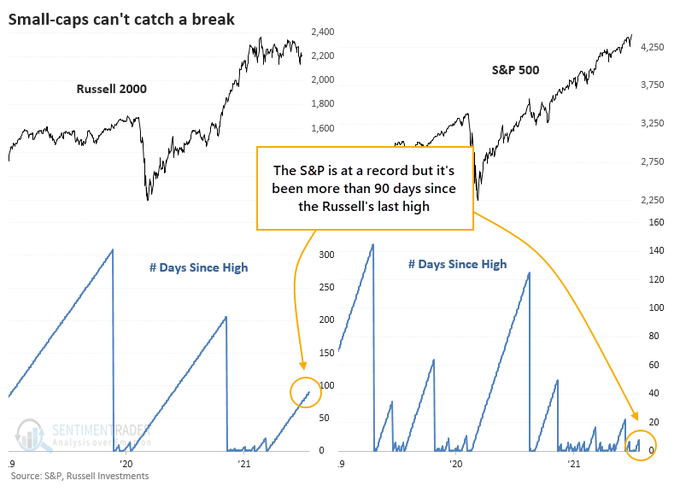

- SentimenTrader@sentimentrader – Jul 27 – It’s Been More Than 90 Days Since Small Cap Stocks Did This

- If we focus on the interplay of the two indexes and look for times when the S&P set a new high with the Russell not having done so for at least 90 days, it wasn’t a bad sign at all.

- Over the next six months, the S&P showed a positive return after 20 out of 21 signals, and the sole loser was erased in subsequent months. Over the next 6-12 months, the risk vs. reward was impressively skewed to the upside.

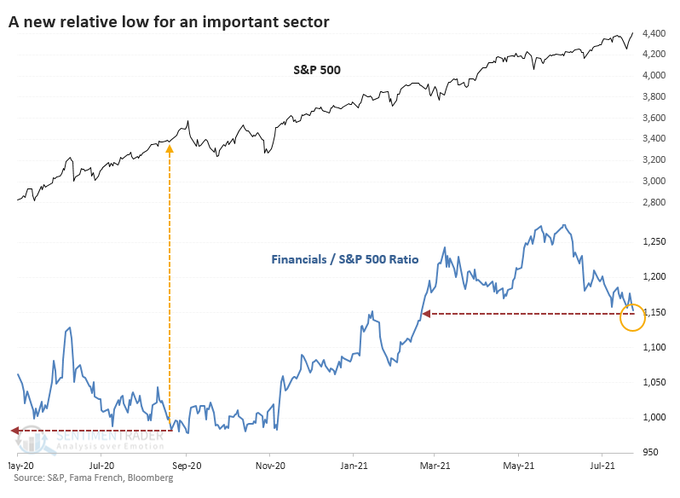

- SentimenTrader@sentimentrader – Jul 28 – A New Relative Low for an Important Sector

- We’ve all been taught to buy the strongest groups and sell the weakest ones, and generally, that’s probably good advice. In this particular situation, though, Financials have tended to rebound quite strongly during the past four decades.

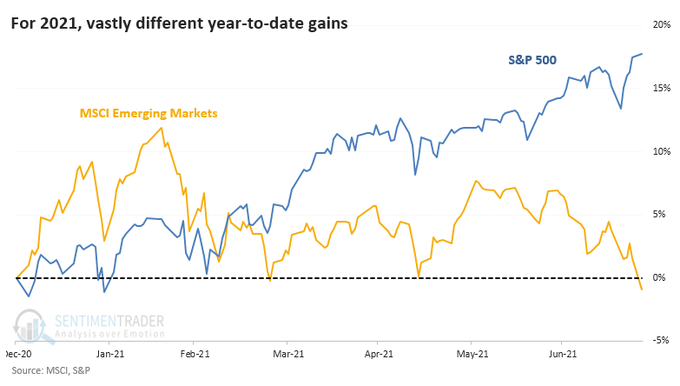

- SentimenTrader@sentimentrader – Emerging Markets Have Only Done This 3 Other Times

- Through the end of July (or close to it, anyway), this is the 4th-widest difference in returns between the S&P and emerging markets.

- There is a tendency to think that we should see some mean reversion through the end of the year. Bulls outside of the U.S. would want to think that impressive returns in the S&P would prompt investors to re-allocate to lagging markets. It wasn’t to be.

- Since 1988, there have been 3 other times when the S&P 500 was up by double digits through late July while emerging markets were in negative territory for the year. Each time, emerging markets fell further in the month(s) ahead.

- With July now in the books, that’s now 4 consecutive months where the CRB Commodities Index outperforms the S&P500. ….. for me, it’s the relative performance of Commodities over Stocks that has my interest.

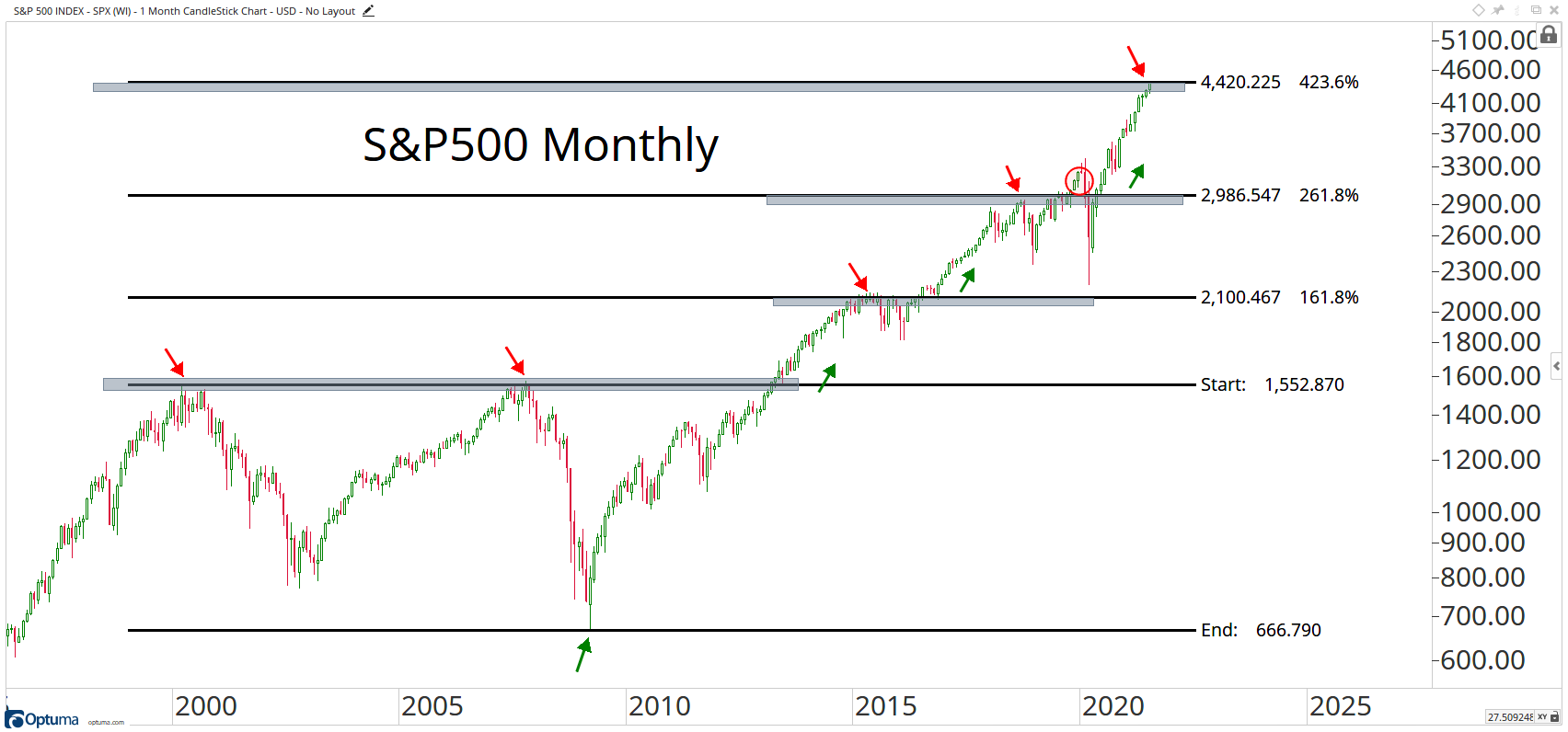

- Look at the S&P500 running into its next Fibonacci extension. Based on the 2000 highs down to the 2009 lows, the next extension level is 4420. Yesterday the S&P500 closed above 4419:

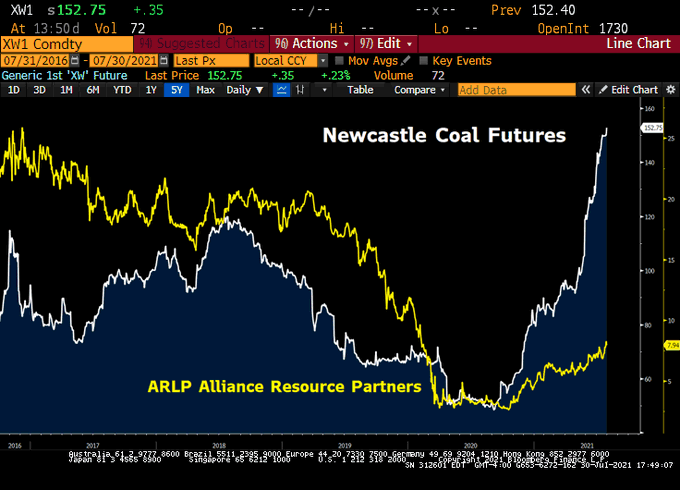

- Lawrence McDonald@Convertbond – Last 30 years, we have exported at least 5 million jobs from the US rustbelt around the planet earth, pulling millions out of poverty. The brain trusts at Davos do NOT have a clue as to how to address the explosion in the global demand for electricity. All fueling coal usage.

- Thomas Thornton@TommyThornton – Doubling my 1% sized $GLD long position to 2% and adding $SLV as a 2% long on the open today to the Hedge Fund Telemetry Trade Ideas sheet. Potential breakout for Gold

Also Carter Worth, resident technician at CNBC Options Action, put a buy on GLD on Friday afternoon.

7. Elitist Food vs. Commoner Food?

Starbucks is a heavy favorite with CNBC Anchors & their shows. They can’t stop talking about it as the stock to buy. Guess that is the Peter Lynch phenomenon. All these rich anchors buy Starbucks coffee & adore it, perhaps because it costs over $5 a cup, an elite product that the elites love & can’t stop talking about. And it is popular in China, a country they admire. So its a perfect come together of elitism.

We are simple folks & have never bought a Starbucks coffee. We love coffee but the simple instant kind. That is also true of food & of the food stock we like. The elite-seeking crowd we know despises this simple food offering. But the stock of our non-elite food has wiped out the stock of Starbucks both this year and over several years. Look at the evidence if you don’t believe us:

(DPZ-SBUX – 5 yrs) (DPZ-SBUX – 10 yrs)

This week we found out that Bill Ackman actually swapped his Starbucks holdings to buy Domino’s around $330. The clip below explains why he did so far better than we could.

Allow us to add something Mr. Ackman did not mention. One mega trend we see is the long term secular increase in incomes of ordinary Indians in smaller urban towns all over India in addition to the big metros.

And Domino’s Pizza is the best play on this mega trend. Not only is their delivery system just as good as it is here but you find Indian families stopping in to have dinner at the locations as they pass by. And unlike McDonald’s, Domino’s is purely vegetarian. So their stores can be located anywhere, even near temples.

Finally, how good has DPZ been as a growth stock & not merely a restaurant stock? See the 10-year comparison between DPZ & GOOGL:

While many emerging markets got hit this week, the Indian stock market was flat to up. And Mark Moebius said on BTV that India was their largest allocation. One of our favorite plays on secular rise in Indian incomes has been private Indian banks like ICICI (IBN) & HDFC (HDB).

Now compare the 1-year, 2-year, 5-year & 10-year charts of DPZ (Domino’s) to those of IBN to see why we consider DPZ to be a premier secular play on rising Indian Incomes.

8. Pisani, the name!

We are really interested in the etymology of the name “Pisani”, as we have written before. It is the only non-Sindhi “ani” ending name we know while we know at least 15-20 “ani”-ending names from Sindh (now inside Napakistan).

Look what we found this week while reading some commentary from Harvard about the Great Epic Mahaa-Bhaarat or the first known world war. Factually about 3.1 million soldiers died in that 18-day war and two generations of Kings & Princes died in that war that involved the entire known world of that time (from today’s Iran to today’s Xinjiang to today’s Sichuan (in China) to Southeast Asia & all of the entire northern Indian Subcontinent). There is no epic of this size & greatness anywhere as even the worst Hindu haters have written.

We found a reference to an Italian Professor named Vittore Pisani & his book “Rise of the Mahaa-Bhaarat”. We intend to see if we can contact him and learn some about the Pisani heritage. Who knows, we may find that the world is kinda one after all.