Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.China – “Lehman moment every 3 years” and/or “a paradigm shift“?

How many times did you hear the “a Lehman moment for China?” phrase on Monday morning? Finally Jim Bianco was asked the question and he simply said “China has had a Lehman moment every 3 years“. By Tuesday morning, it looked likely that the Evergrande mess was something China could handle.

But what is going on inside China? Remember the man who said the following just before the Fourth of July this year?

- “The biggest misconception is the degree to which credit is really being strangled [in China] right now; I know it is consensus to understand there is deleveraging going on in China. But when you look at quarterly results, you are seeing record lows in everything – all the big categories – overall borrowing, borrowing by state firms, by geography; you are seeing numbers crater outside the big 3 – Shanghai, Beijing, Guangdong; its hard for people to understand the degree to which China is really squeezing the credit spigot right now; it is not the deleveraging of the past…”

When you see “credit being strangled” & “record lows in everything“, should you be surprised when a highly leveraged entity gets in trouble?

That man is Leland Miller, CEO of China Beige Book and read what he said on Bloomberg Surveillance on Friday morning. We urge all to listen to the 5:40 minute podcast. In the meantime, a couple of excerpts from Mr. Miller:

- “….some of the numbers we are looking at are not as bad as everyone… mfg is doing OK, services are actually doing a little bit better; so we are not that negative on the actual underlying economy even with these awful deadlines coming from every direction … you have to start with this is not China’s Lehman moment; there is not major contagion risk here;China has the tools to be able to deal with it; “

Of course, the U.S. indices figured this out sometime Tuesday morning and that was the end of fears of Evergrande ruining S&P’s party. But seriously what is going on inside China?

Before we get to Mr. Miller’s comments, we read that China & especially Xi have studied what Gorbachev did to destroy the Soviet Union. And they are absolutely determined to not let than happen in China. What does that mean? Gorbachev got infatuated with America & the West and forgot how & what to say to the Russian people. The Communist Party is determined to not make the same mistake. So Xi is behaving this year like, say a politician running for an election.

What does that signal to Mr. Miller?

- “ … the most important thing for the next year would be signalling a continued pull-away from reliance on the United States & the West … Xi is facing inwards; he is doing a huge rectification campaign in the run-up up to the party congress to show that the social compact has changed between the part & the people …. Now the party is not there for growth for growth’s sake;.. or for creation of wealth; it is there for distributing wealth; making sure everybody is happy; so there is a major domestic focus right now … “

This is not that different than the message of Candidate Biden & the Democrat party before the November 2010 election. But President Biden has not been able to implement much of that because of the Congressional opposition.

President Xi does not have that problem and so he is sending that message to the Chinese society now, way ahead of the Party Congress in Q4 2022. As Mr. Miller said on BTV Surveillance:

- ” … this is a paradigm shift for China, for China’s growth model; … Xi sees an end to this economic growth model right now; there is too much risk, there is too much non-productive usage of capital; good money chasing after bad; … “

What does this mean for foreign investors in China?

- ” … for 2023 & beyond, they are going to have to downshift; have to truly downshift; .. we are going to talk about full percentage points [down] forward in growth; because they are not going to snap a finger & transit from investment to consumption; … China could accept slower growth; it would improve dynamics inside China; stop the debt buildup; all of a sudden capital could go productive uses instead of non-productive uses; … it would be extremely important for China; that’s what the party is doing right now; .. the true risk foreign investors haven’t got the message; but at this point investors should be looking at the medium term trajectory of growth which is going to be much lower ”

Think about this. China can handle the Evergrande mess; Chinese leadership may be getting some horse sense & focusing on their people; the Chinese market has already corrected steeply. And many foreign investors are now rethinking about China.

What might that signal to the brave American investor? But wait a minute, an American investor likes to see the Big corporations coming in after a steep decline & buying their stock, right?

On that note,

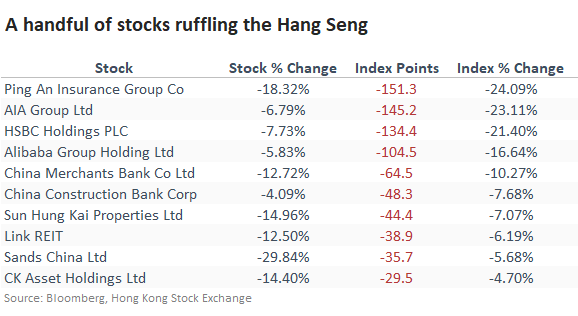

- SentimenTrader@sentimentrader – Selling in Hong Kong Nears Panic Proportions

and more importantly:

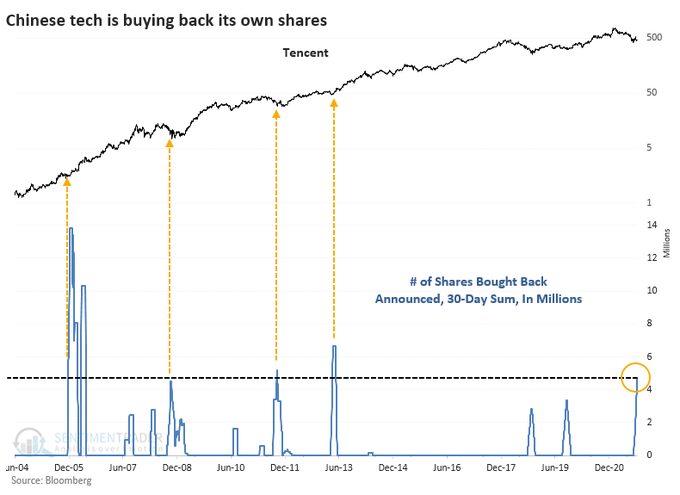

- SentimenTrader@sentimentrader – In the U.S., corporate share buybacks are on a tear. Their timing is often…questionable. Where is it NOT questionable? Chinese tech. And they’ve been buying hand over fist. Share buybacks in Tencent $TCEHY over the past 30 days is the 4th-highest on record.

Intense gloom is sometimes a trigger for some to get in. Look at the NYT article from Q2 that Larry McDonald posted in his tweet on Friday:

That extreme gloom about India made us ask on April 25, 2021 – Indian Stock Market – Is It Time To Get In? We confess we know far less about the Chinese stock market than the small amount we think we know about the Indian stock market. But the Indian stock market has answered our April 25 question with a resounding yes, as Larry McDonald tweeted on Friday:

- Lawrence McDonald@Convertbond – *INDIA’S SENSEX INDEX HITS 60,000 LEVEL FOR THE FIRST TIME – Bloomberg

As the chart below shows, the Indian stock market has not looked back since late April.

We have no clue but we do wonder whether some of the foreign investment capital that fled China went into India. Will the BAML flows-team of Michael Hartnett shed some light on this?

2. Powell melted the “ice” scenario

Mike Wilson of Morgan Stanley came out with a 20% downside case this week. His base case remained the 10% decline but he felt compelled to talk about the potential “ice” scenario that would cause the 20% decline in the S&P.

This Fire vs. Ice discussion was a favorite of Barton Biggs, the well known Morgan Stanley strategist of the 1980-1990s. It is good to see that tradition is maintained to this day. Will Mike Wilson have better success in seeing the Ice scenario in the U.S. market than Barton Biggs did?

No, said Jay Powell on Wednesday and the markets cheered. In our opinion, he is getting close to the “maestro” mantle. By speaking of a near-term “taper”, Chairman Powell wiped out the “ice” fear that the markets dreaded but at the same time his discussion about the economy reduced the fear of an unnecessarily hawkish monetary policy.

The Bloomberg article quoted by BTV’s Lisa Abramowicz highlights the tepid message delivered by Chairman Powell:

- Lisa Abramowicz@lisaabramowicz1 – “I’ve never seen these kind of supply-chain issues, never seen an economy that combines drastic labor shortages with lots of unemployed people and a lot of slack in the labor market:” Fed Chair Jay Powell

Look who was actually pleased with Chairman Powell’s performance:

- David Rosenberg@EconguyRosie – SDefinitely a case of ‘taper talk lite’ out of the Fed statement. But what the hawks couldn’t achieve as a Committee they got in raising their ‘dot plot’ projections — what matters most is the statement; that’s where Powell has his stamp… “if” &“may” when it comes to the taper.

That is why the Treasury curve steepened this week. No, we don’t mean for the whole week. We mean from pre-FOMC 1:50 pm on Wednesday afternoon to Friday’s close:

- 30-yr yield up 14.4 bps from 1.844% to 1.988%; 20-yr yld up 14.4 bps from 1.787% to 1.931%; 10-yr yld up 14.7 bps from 1.113% to 1.458%; 5-yr yld up 12.6 bps from 83.1 bps to 95.7 bps;

In contrast, the Treasury curve flattened a bit on the full week.What about stocks, you ask?

- SentimenTrader@sentimentrader – About 92% of NYSE volume is flowing into advancing stocks. This is the 3rd-highest ever on a FOMC decision day. The others were Sep 18, 2007 (financial crisis) and Aug 9, 2011(debt ceiling crisis). Something about Feds soothing buyers during crises.

What did Chairman Powell deliver? He eliminated the “ice” case; he proposed a gentle “taper” that would be softer than most feared. In other words, he took out the “fear” from the fears of stocks & bonds. If you don’t believe us, believe the 18.4% fall in the VIX from 21.74 pre-FOMC (1:50 pm on Wednesday) to 17.75 at Friday’s close.

Chairman Powell’s lukewarm message may curtail a spike in rates that might alarm the stock market. Look where the 10-year yield stopped rising. That led CNBC’s Carter Worth to suggest Treasury rates could fall a bit from here:

Is it smooth sailing from here? Can’t say that because there is still a risk that the Fed is powerless to prevent!

- Richard Bernstein@RBAdvisors – The #debtceiling isn’t simply a political issue. It’s spooking the #markets. 1-year CDS for the US is now ~50% more expensive than it is for #China and ~7X #Germany.

3. Stocks

Talk about a VIX spike signal. VIX fell nearly 30% from its Monday close of 25.03 to close at 17.75 on Friday. How bad was Monday?

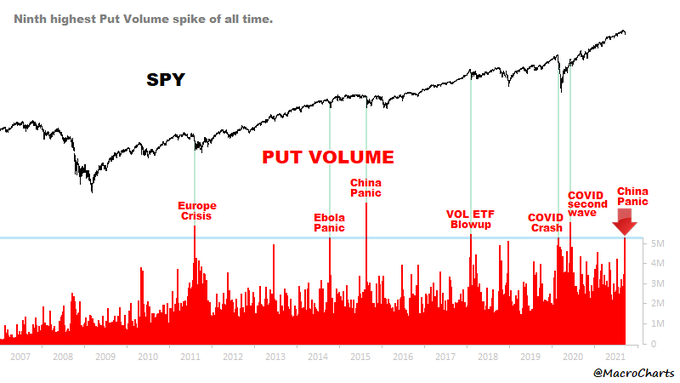

- Macro Charts@MacroCharts – – One of *many* signs of a historic Panic yesterday: SPY Put Volume spiked to the 9th highest of all time. Prior spikes marked capitulation selling – Stocks bottomed within 0-3 days with only one exception (Feb 2020). Is this time different – Or is the bad news mostly priced in?

That was past. What about the future? As far as we know, no one changed their opinion this week with the bearish remaining bearish & the bullish remaining bullish including Lawrence McMillan of Option Strategist:

That was past. What about the future? As far as we know, no one changed their opinion this week with the bearish remaining bearish & the bullish remaining bullish including Lawrence McMillan of Option Strategist:

- “On the recovery rally this week, breadth has improved, and both breadth oscillators have generated buy signals. … In summary, it certainly seems that the bears have lost another chance to take charge. Their last hope seems to lie in the $SPX resistance up to the declining 20-day Moving Average of $SPX, at 4490. But the bulls have new-found strength.”

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on Twitter