Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Beginning of a divergence?

This was a bad week in just about every way. Dow was down 2%, S&P down 2.9% & NDX down 3.9%. But RUT was only down 1% and IWC, microcaps ETF, was only down 17 bps on the week. Emerging markets got hit very hard with EEM down 4.6% after being down 5.7% the week before. Interest rates were up big with the entire 30-2 yr yield curve up 21-30 bps in yield, the 30-yr being the least up by 21 bps & the belly up 30 bps. Even commodities were down with Oil down 5.7% & Copper down 6%.

One divergence was VIX. The week before the S&P was down 1.3% and VIX was up 16%. This past week, the S&P was down 2.9% and the VIX was also down 3.8%. Will this prove to be the beginning of a real divergence?

- Jason@3PeaksTrading – – Market still squishy but can feel that selling is less extreme each day this week.. need to close back over 4300 first which is the largest gamma strike on the board but if $NYSI index can cross positive here into next week.. Nasdaq version also making higher low $QQQ $SPY

But there is negative news every where you look:

- Charlie Bilello@charliebilello – – In the last 70 years, the only time US Consumer Sentiment was this low without the US being in a recession was a brief period during the 2011 bear market (Aug-Sep ’11). Charting via @ycharts

So earnings estimates have to come down hard, right? And that is not positive for the S&P as Mike Wilson of Morgan Stanley said on CNBC Fast Money:

We also saw Eric Johnston of Cantor Fitzgerald change his view from bullish to bearish after becoming bullish a week & half ago after becoming bearish in January. Kudos & thanks to him for his candor & courage. He says the fundamental backdrop has gotten materially worse because a) the Fed’s job now looks “nearly impossible” & b) growth is simultaneously slowing & that’s before the big up move in commodities; multiples will fall. He says you will get rallied, sharp rallies but these are very good selling opportunities.

But all this negativity suggests a reversal to some:

- Jason@3PeaksTrading – – >30% of total S&P delta expiring on 3/18 for quad witch March expiration next week. Lots of fuel for upside if the market wants to have some fun.. the kindling is dry, just need a spark

Technician Mark Newton of FundStrat said on March 10 that the rally could just be getting started although momentum is in downtrend, per the paraphrase by CNBC’s Scott Wapner. Katie Stockton of Fairleigh stated that 13,200 was support for the NDX. And if that holds, we should see an intermediate low established here. Her basic thesis is that this decline is not like 2001-2002 secular bear market but is more like the 2018 decline.

Anyone else see the 2018 parallel?

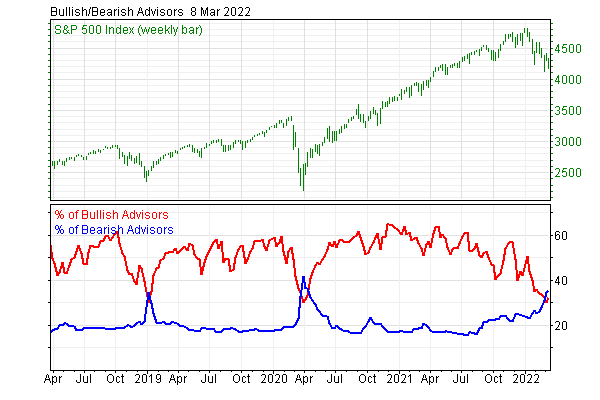

- Jason@3PeaksTrading – – There are so many bearish traders out there its kind of amazing. You gotta be contrarian in times like this. Investors Intelligence poll only has been this lopsided in March 2020 and Dec 2018, and both of those times no one saw a new rally coming.

Oil was down over 5.5% this week. What might be some reasons for smart people to remain bullish?

- ian bremmer@ianbremmer – – russia exports 5 million barrels of crude oil per day. if saudi, iraq, kuwait, and the uae simultaneously produce at their max capacity, they can replace 2 million of those barrels.

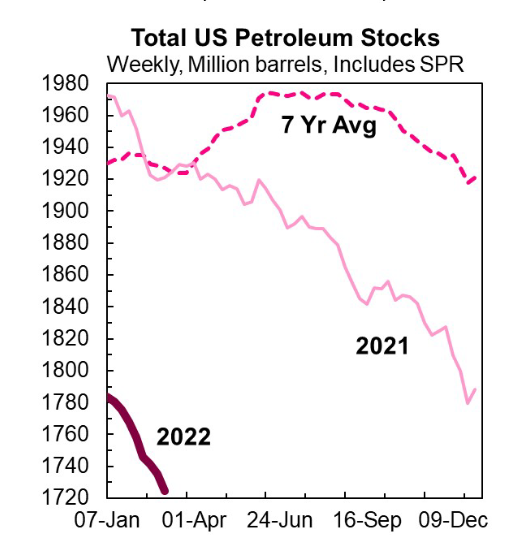

How do Oil inventories look?

- Richard Bernstein@RBAdvisors – – Before you dismiss our claims re #Energy as a growth industry check out this #inventory chart from Mike Rothman at @CornerstoneOil . What’s an antonym for glut?

The R-word & Oil brings us to another divergence, as tiny &/or fleeting as it might be:

2.Ukraine – an emerging divergence?

Two weeks ago, Putin’s Ukraine “operation” was being mocked for its incompetence. Last week we said that Russian army brass was getting back on their game & highlighted (retd.) Gen. Kimmit’s view that it was just the 1st of a 9-inning game . By the end of this past week, the tone seems to have changed – divergence 1 for us.

Witness how CNBC began describing the Russian advance on Friday, March 11, with Shepherd Smith asking “we are seeing a bit of a turning point in the battle for the capital, are we? And he is asking a retired U.S. Army infantry officer & not a journalist.

Listen again and you might hear a “its just a matter of time” kinda feeling in the explanation above. Having watched the above, take a look at the map below:

Look south of Dnipro, the town discussed in the clip above. Russian army already has Zaporizhzhya, the town where the nuclear reactor shooting battle took place. To the east on the sea is Mariupol, the town encircled & bombed constantly by Russians. From south of Mariupol to Kherson is now Russian army territory. So the entire area between the Dnieper river & the Sea of Azov from Kherson to Mariupol & Zaporizhzhya is in Russian control. Russians are also circling around Mukolayiv (northwest of Kherson) to open a land road to Odessa.

Frankly, a better way to look at the steady progress of the Russian military is the clip below from a seemingly German mapper. The area in red is the area under Russian military control, as of March 12. Watching this area in red (Russian control area) spread from day to day (days in European DD/MM/YYYY format) suggests an inexorable force. It is really worth watching.

Now look at a provinces map of Ukraine:

Luhansk & Donetsk are already in Russian separatist hands. As we saw Zaporizhia & Kherson are mostly under Russian control. Crimea is already Russian. So once Dnipro is encircled, Russians will have that province too. So the entire central & southern green area east of Dnieper river is virtually Putin’s already.

Now look at what Putin demanded as his terms of peace besides de-militarization of western Ukraine (west of the Dnieper river) – Luhansk & Donetsk independence & Crimea as Russian. This is actually less that what he already controls.

Is that why Israeli Prime Minister advised Zalensky to accept Putin’s terms? After all, no one understands capturing & holding territories and trading captured territories for peace better than Israel. Recall that Israel still holds all the Syrian & West Bank territories it captured in 1967 and Israel gave back Sinai to Egypt for peace.

So what’s the problem? Just let Putin keep what he has captured in exchange for Kiev becoming neutral & western Ukraine becoming de-militarized. And that stops the viciously brutal violence against the Ukrainian people. But this was instantly rejected by Zalensky. Does Zalensky actually think he can win the military battle against Putin or is there a more paramount objective forced on him by his monetary & military backers?

Note that President Biden said that he speaks to Zalensky every day. And President Biden said clearly on Friday that “Ukraine will never never be a victory for Putin“. And accepting the deal offered by Putin via the Israeli Prime Minister would frankly be a victory of sorts for Putin! Is that why that deal was so dismissed out of hand?

But what if Putin’s position becomes more entrenched or even stronger? Then US-Ukraine will keep fighting for ever until Putin is deposed? Is that why Russia has now begun bombing Ukrainian airbases near the Polish border? To send a message that Russia can bring it to Western Ukraine too? We are not strategists or diplomats, but simple common sense suggests that Ukraine needs to get a deal now if only to save its people from unnecessary & destructive violence.

That is unless Zalensky & his backers seriously believe that Putin will soon be replaced one way or another AND his replacement will simply back off from Putin’s so far not so unsuccessful invasion (given the area now under Russia’s control).

That brings us to what (retd.) Gen. Keane told Larry Kudlow of Fox Business last week that the idea Putin will be replaced is far fetched. And this week we see evidence that a majority of Russian people are supporting Putin instead of rising against him, evidence from Ian Bremmer himself:

- ian bremmer@ianbremmer – – some 60% of russians currently support the invasion, while only a quarter oppose it lev gudkov, director of levada center, last independent pollster in Russia, spoke to @SaoSasha @gzeromedia – https://www.gzeromedia.com/what-do-russians-really-think-of-the-war

A more serious & scholarly opinion came from Mayra Rodriguez Valladres during her conversation with Tom Keene of Bloomberg Surveillance:

- TK – What does our audience need to know right now about the loneliness, the aloneness of Vladimir Putin?

- MRV [about Putin being lonely] – I don’t think so because he has a lot of, lot of, supporters; he has had support for decades among many many Russians at the upper echelons of the Kremlin & he also still has supporters in the former Soviet Union; I know right now he is very focused on Ukraine ; he has a lot of supporters in Central Asia …

PS: Watch this clip in its entirety. Ms. MRV discusses the investment ramifications on Bank portfolios in emerging markets.

This interview & tweets like Bremmer’s are divergence 2 for us. Because it suggests that at least a few serious people are beginning to realize that America’s actions are now actually against all of Russia & not just Putin. And these discussions show an increased awareness that U.S. sanctions & political anger may be based on unsound assumptions and thus might lead to a backlash against America inside Russia & outside Russia.

The 3rd divergence we see is increased media discussion about Ukraine being a “suitably moral” ally for America. It was CNBC’s Shepherd Smith news hour that first focused on the intense racism experienced by Black African & Asian people trying to leave Ukraine for Poland. This was followed by more detailed segments on MSNBC by anchors Mehdi Hassan & Ayman Mohyeldin. One featured a Black African vividly describing how Ukrainian officers made him sleep outside in winter because he was black (as he was told by Ukrainian security) and because warm inside space was reserved for “white” Ukrainians.

Then you see the overseas discomfort about the enormity & depth of pain in US media for plight of “white” Europeans vs. how they covered plight of Syrians, Afghans & other people hurt in US-launched wars. Finally even elite left of center cognoscenti recognized this discomfort & of course promptly pooh-poohed it.

But even committed Biden-supporters like Joy Reid (of MSNBC fame) & other African Americans don’t buy these politely phrased but intensely race-based rationalizations of Ian Bremmer & his cohort. Asking US minorities to sacrifice their financial wellbeing for a truly moral “save democracy” cause is one thing but asking US minorities to do so to keep a color-based racist regime in power is quite another.

And this “is Ukraine a really moral enough ally of America” discomfort is also being seen in right of center media. And that is thanks to one of the main architects of today’s (post 2014) Ukraine. In her Congressional testimony, Under Secretary Victoria Nuland let slip an admission that Ukraine has numerous (26 by one media count) bio-research labs.

First, as an aside, Ms. Nuland is a smart political operator who has managed to rise & succeed in multiple administrations. Her demonstrated talent is to give evasive answers to the simplest of questions. In contrast, we all saw her reveal this potential bomb-like story in response to a soft question by Senator Rubio. We can’t help wondering if Ms. Nuland did so to build a defense against accusations of hiding facts or an offensive ” this biolabs mess is not mine” defense.

Tucker Carlson was the first Fox opinionator to focus on this story. But that wasn’t a divergence in our opinion. Then we saw Laura Ingraham come at Ukraine from a much more explosive & politically serious angle. She focused on how Ukraine colluded with the Democrat machine in the 2016 election to undermine President Trump. And she brought back the famous quotes of Victoria Nuland about the “protests” in Kiev.

Sean Hannity has already said that he knows about corruption in Ukraine but he still supports Ukraine because what Putin is doing must be condemned. But does he also come out now condemning Ukraine for being rabidly anti-Trump & pro-Hillary? If he does, then the Three Foxeteers will again become All for One & One for All. And that would become a Big Divergence indeed.

We think this angle of “Ukrainian leaders being in cahoots with Democrat operatives since 2014” & “Ukraine colluding with DNC in being actively anti-Trump” is not only bad for Ukraine (Ukraine could lose a lot of support) but even worse for President Biden & Democrats. Already people are dismissing Biden’s “gas prices are high because of Putin” claim. Now if President Biden’s motives re Ukraine & the Democrat history with Ukraine start getting questioned at Fox, then it could get tricky for both Ukraine & President Biden.

We do think the turn by Laura Ingraham to questioning Ukraine, Ms. Nuland & Democrats could prove to be a major shift in the wind currently backing Ukraine. As Ms. Valladres told Tom Keene (see clip above), the public could soon get weary of watching the same story of Ukraine slowly being encircled every day. In contrast, the story of “Ukraine colluding with DND in being anti-Trump with Biden’s support” could have long legs, perhaps even stretching into November.

Finally and to add an honest caveat, we have no idea whether divergences mentioned above are of any value or we are being excessively simple-minded, perhaps as a result of some liquid consumption on Sunday evening.

But it does seem that the clean & simple Ukraine story of the previous 2 weeks appears to be diverging a bit. And if that leads to the Ukraine panic lessening in markets, then that would a divergence to laud.

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on Twitter