Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Good news first

That was the NFP report of 678K new jobs vs. the estimate of 423K jobs. While that was good news to most, David Rosenberg highlighted the bad news therein & brought up the infamous period:

- David Rosenberg@EconguyRosie – March 4 – The story beneath the payroll headline was the break in the upward wage trendline. A goose-egg on average weekly earnings and -0.1% on the median. Real work-based pay has now been down for 5 straight months and in 6 of the past 7. Last time that happened? Sept 2007-Jan 2008. Doh!

And he had used the R-word the day before.

- David Rosenberg@EconguyRosie – – So we have a war. A supply-induced oil price surge. A tighter Fed. Full employment. A flat yield curve. And an asset bubble. Sounds a lot like 1990! What came next? A recession.

But his old colleague pooh-poohed Rosenberg’s R-word after the NFP report:

- Richard Bernstein@RBAdvisors – – #Recession looming?? Uh no. Leading, coincident, and lagging #indicators in today’s #employment report all surprisingly strong.

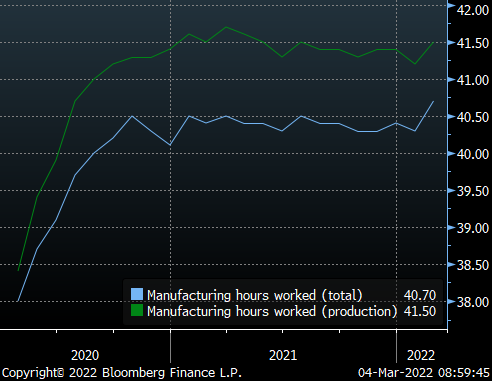

Then Bernstein focused on one leading indicator:

- Richard Bernstein@RBAdvisors – – Not exactly a #recession forecast. Hours worked (LEADING indicator) shows considerable strength across many #sectors.

Unfortunately for all of us, Friday delivered a proven negative indicator that might support the Rosenberg view.

- Lisa Abramowicz@lisaabramowicz1 – March 4 – A benchmark U.S. yield curve grinds ever tighter, with the gap between 2 & 10-year Treasury yields reaching a new post-March 2020 low. I track this every day because it indicates the waning optimism about a soft landing in the U.S. It’s sending a consistent message.

The low shown in the chart above was broken during Friday afternoon. The 10-yr-2-yr spread closed on Friday below 25 bps.

For the week, Treasury yields closed down hard with 30-yr yield down 13 bps, 20-yr down 14 bps, 10-yr down 24 bps, 7-yr down 25 bps, 5-yr down 22 bps, 3-yr down 15 bps & 2-yr down 8.5 bps. But as we will discuss later, the impetus behind this move might have been something else.

2. Stocks

The only good day of this week was Powell Wednesday with Dow up 596 points, S&P up 80 handles, NDX up 238 points & Transports up 395 points. Treasury yields exploded up with yields across the entire 30-2 yr curve up 18-23 bps on the day. And U.S. Dollar was down a touch, the only day the Dollar & VIX was down this week. The charts below show this.

The week was down but not particularly bad for US Indices – Dow was down 1.3%, S&P down 1.3% & NDX down 2.5%. On the other hand, EEM was down 5.7%, FXI was down 6.4% & Indian ETFs were down 5-6%. European stocks were hit hard with EWG, German ETF, down 13.5%. And the U.S. Dollar was up 2% for the week.

The big questions are how far down does this decline go & what indicator might suggest a reversal. For the answer to the first question, we turn to Jonathan Krinsky who has been right so far. He is looking for a break of 4,000 for the S&P.

For an answer to the second question, we turn to Jim Cramer & Mark Sebastian, Cramer’s techni-pal & a volatility expert. According to Cramer, Sebastian expects to see a lot of volatility & weakness in the stock market just like in the run up to the Gulf War. Sebastian predicts more wild days like last week . Sebastian wants to see the market make a new low with the VIX Not making a new high. When the VIX and the S&P diverge, it tells you that the trend is about to change. That, according to Sebastian via Cramer, will the moment to jump in with both feet just like October 1990.

3. Commodities & Inflation

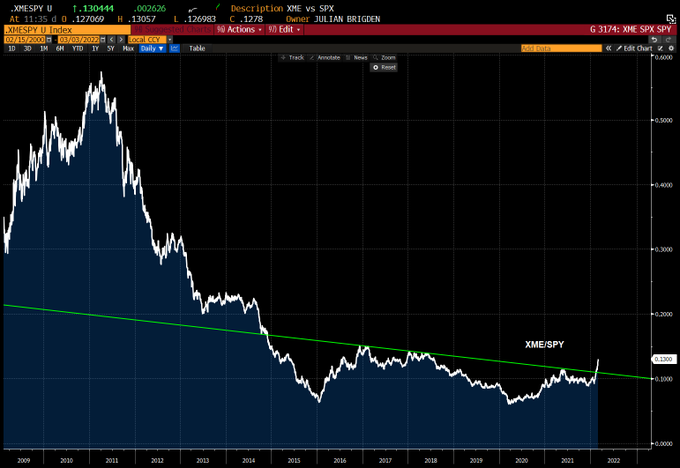

On the other hand commodities & commodities ETFs exploded up to previously unseen levels:

- Oil up 26% on the week, Brent up 21%, Copper up 9%, Gold up 4% and Silver up 6%. MOS, the fertilizer stock, was up 20.5% on the week & CLF, the iron & steel stocks, up 21.5%. Gold miners up 9% & XLE was up 9% as well.

The disaster in Ukraine was the main impetus for this explosion. But the big question is whether this is a short term spike or is it a new big trend?

The big near-term consequences might be human misery:

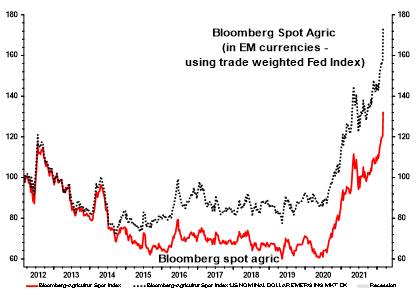

- Albert Edwards@albertedwards99 – – It’s not just energy prices that have rocketed higher in recent weeks, but also agric. Bloomberg Agric Spot Price has risen a third over the last decade, but in EM terms the rise is more like 75%. Even before the latest rises, EM were facing food riots – echoes of the Arab Spring

We did not know the following about Egypt:

- Lisa Abramowicz@lisaabramowicz1 – – Surging food inflation is raising the specter of social instability. For example, Egypt gets 86% of its wheat imports from Russia & Ukraine & is struggling to secure supplies right now. A decade ago rising food costs helped spur Arab spring protests.

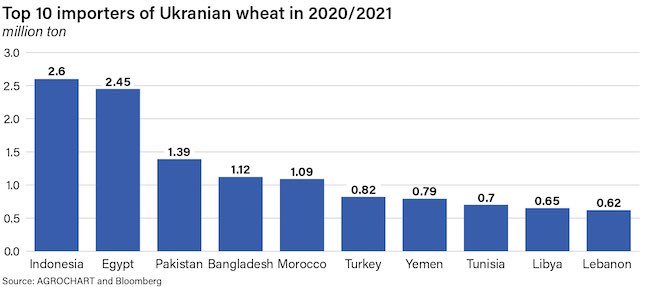

And Egypt is much more stable than some other top importers of Ukraine’s wheat:

- jeroen blokland@jsblokland – – For the record, the top 10 importers of #Ukraine’s #wheat are home to almost 1 billion (!) people. ht @LizAnnSonders

The above sounds bad. But it pales before the real problem that the world might face soon:

4. Still “they know nothing“?

Allow us to quote from our TACs article on January 17, 2022:

- We recall how Bernanke entered 2007 with a hawkish determination and how inflation had been a visibly big problem by the summer. Treasury rates had risen to around 5.5% and, as we recall, CNBC Fast Money was shouting “inflation” even louder than they are now. Hedgies were short Treasuries massively as well.

- we keep wondering whether we are in a reprise of a 2007-like slowdown that is building underneath the economy’s surface as the surface seems hot & inflationary. Frankly, we think that 2007 economy was actually stronger than the one we have in 2022. The data in 2007 began slipping later in Q1 or early Q2. In 2022, it is already slipping.

- Then on the morning of Friday, June 22, 2007, the Treasury market turned. Rates stopped going up & began going down. About 5-6 weeks later on August 3, 2007 came the famous “they know nothing” anti-Fed rant of Cramer.

As we recall, Cramer said then that he was being alerted by his friends in Investment Banks about how awful the situation was. The economy wasn’t in trouble but the big banks were. It was the condition of the Big Banks that made 2007-2008 into what it became. We have been assured that Big Banks in 2022 have fortress balance sheets & so there is no problem.

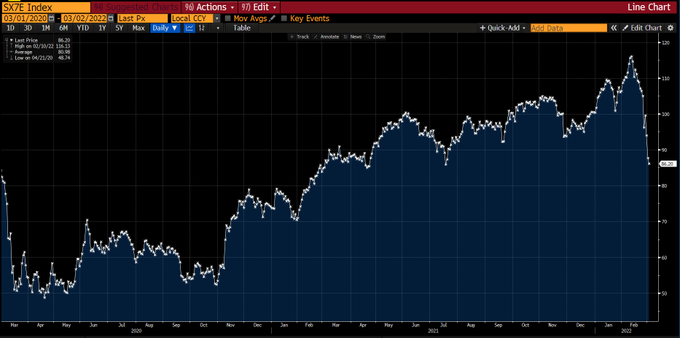

Now look how badly they underperformed this week – Bank of America was down 4.4%, Goldman was down 5.7% and Citi was down 9%. Of course that pales in comparison with Deutsche Bank which fell 10% on Friday alone. Since a picture speaks louder,

Deutsche Bank is down 30% in the last 7 days, from close of Wednesday, February 23 to this Friday’s close. Barclays is down 22% in the same period & Banco Santander is down 19%.

- Lisa Abramowicz@lisaabramowicz1 – – Deutsche Bank’s George Saravelos in a note today: “EUR/USD depreciation on the back of the Ukraine crisis is now starting to inflict damage on the Eurozone. The ECB needs to start thinking about ways to stop this.”

The “this” was not the violence of the artillery war in Ukraine but something far more lethal:

- Lisa Abramowicz@lisaabramowicz1 – – EU banks keep tanking. “Net exposure of European banks to Russian banks stands close to €70bn. This is nearly half the exposure level seen during the Russia-Ukraine crisis in 2014. However the scale of sanctions this time around has exaggerated the scope of impact” TD Securities

And as almost everyone knows after the last decade, what is created in European banks doesn’t stay in Europe. And that’s what caused DB to fall 10.65%, BCS to fall by 8.21%, SAN by 7.21%, BBVA by 6.21% & EUFN by 6.55%, all in one day, Friday.

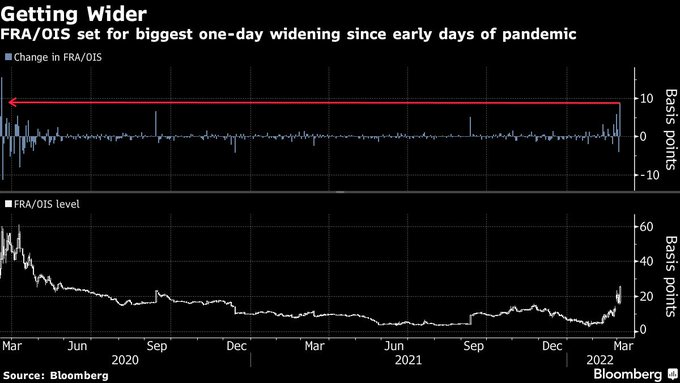

- Lisa Abramowicz@lisaabramowicz1 – – A funding-stress indicator surges to the widest levels since May 2020.

No wonder U.S. Banks, those of “fortress balance sheets“, fell hard on Friday.

Not only is Europe facing far worse energy inflation than America, far worse food inflation and far worse Banks, but Europe is also facing the worst refugee crisis in decades. Plus a non-negligible possibility of a tactical nuclear war.

Isn’t timing a beaut? Just as we come out of the Omicron contagion, we walk into a credit contagion, a contagion created by the most moral of principles. Europe now knows that it is stupid to get rid of coal plants because renewable energy is more morally sound. Will they & we learn that physical wars may actually be safer than morally superior financial sanctions? We all know the risks of physical wars. We hope we all don’t have to learn the unforeseen risks of financial wars, sorry sanctions.

Remember what Gundlach said 30-year Treasury bonds making sense at 2%+ yields?

5. Ukraine – “the 1st inning in a 9-inning ball game”

It looked so bad for President Putin last week that (retd.) Gen. Kellogg said “Putin forgot how to wage war”. On Monday Feb. 28 (retd.) Gen. Jack Keane added relevant color to this feeling to Larry Kudlow on Fox Business:

- (at minute 3:43) – “Putin is on the world stage being humiliated and embarrassed in a way that he never has been in the 22 years he has been serving as the Head of Russia … emotionally I think this Ukrainian thing is so personal for him; he has got such deep feelings, passion about it; he identifies himself with the State of Russia & Ukraine is a part of that; this is about his legacy – I think when you get involved with that degree of emotion & that degree of passion as a head of state; you are prone to make judgemental errors & he has made serious ones here ”

The planning & performance of the Russian military was so clueless, haphazard & pathetic that, we believe, it was humiliating to the entire Russian military brass. So it became an existential crisis for the Russian Military. There was no way they would countenance losing this battle to Ukraine. And that combined humiliation & realization, we feel, made them united despite whatever they might have thought of Putin’s adventure.

So, as the Institute of War reported on February 27, Russian military took “an operational pause on Feb 26-27“. And then they went back to the way Russian Military wages war, the Zhukov way that propelled Russian Army from Stalingrad all the way to seizing Berlin in WWII.

We urge all to read the below & watch what Brigadiar General Mark Kimmitt , a veteran U.S. Field Artillery commander, said on Bloomberg Surveillance on March 1, 2022:

- (minute 0:49) – [urban combat] – its the first inning in a 9-inning ball game … it is tough, brutal combat in a way that we haven’t seen yet … urban combat is the toughest grittiest bloodiest kind of warfare there is … look what happened in Mosul [in Iraq against ISIS] – 100,000 troops were necessary to go against ISIS in Mosul 6,000 inside there; … unfortunately there is a huge toll on the civilian population inside those cities as well …

- (minute 3:58) – “As I said earlier, this is the 1st inning in a 9-inning ball game; & the Russians will just continue to hammer & hammer & hammer away at you in places such as cities & destroy them; its that simple – destroy the buildings, destroy the people, destroy the civilians – they don’t care; they will continue to flow troops, equipment in there; fire artillery missiles & bomb them until they are destroyed – that’s how they see the end-game and in many ways people will say that’s the only end game you can accomplish inside this type of warfare ….”

Near the end of the clip, BTV’s Jonathan Ferro asked Gen. Kimmitt for his assessment of the base case of how this “operation” turns out:

- Ferro – “Eurasia Group is out early this week saying “we continue to see the most likely outcome of this invasion as the combination of regime change & Russian political control over the entirety of the country“; What’s your base case at the moment, General?”

General Kimmitt replied – “I think that’s probably where it will end up“.

Two days later on March 3, Gen. Keane discussed the Russian campaign near Kyiu with Larry Kudlow on Fox Business:

- Kudlow – “From a military standpoint, how does this get resolved? …. in the next few days, what happens?”

- Keane – (minute 3:00) – “They will generate enough forces … Russia has enough military forces despite some of the incompetence that we are seeing; despite the problems their Generals are having in terms of putting together a coherent & effective campaign plan, … they have enough throughput still to accomplish their goal which is to take these cities & also transfer the Government; that I think is a path we are on … ”

General Keane reiterated this opinion again with Larry Kudlow on Friday, March 4:

- (minute 3:45) – “Putin is determined, Larry, to accomplish his objectives & that’s to topple the regime, turn it over & install a friendly government … “

What about the notion of replacing Putin? General Keane warned:

- (minute 7:05) – “listen, those of you who are thinking, who are saying Putin is going to be gone in a short period of time – this is a guy who is in power for 22 years. I think he knows how to protect himself; he is insulated; the service that is close to are his secret service people; that’s the largest entity in his government; what are they there for? to protect him & preserve the regime“

We were flabbergasted when normally sensible people like Ian Bremmer expressed delight at Germany’s decision to arm itself & sanction Russia. Doesn’t that scare the average Russian? Doesn’t this German rearming give at least a bit of credence to Putin’s rants about “Neo-Nazis” attacking Russia via Ukraine? Has any one forgotten Patton’s views and what diplomats like George Keenan said pre-Yalta about using Germans to attack the Soviet Union:

- Patton – “War shouldn’t be over; We should stop p***-footing about the God***mned Russians; we are going to have to fight them sooner or later anyway; why not do it now when we have the army here to do it with; instead of disarming these German troops, we ought to get them to help us fight the damned Bolsheviks …… you leave it to me;. in 10 days I will have us a war with these S*Bs & I will make it look like their fault … “

This brings up another point that is beginning to bother us. Is this already turning into a war against the Russian people & not just Putin? The most interesting comment we heard this week was from CNBC’s Steve Liesman who used to live in Moscow as a journalist. Early this past week when the issue of NATO imposing sanctions on Russia came up, Liesman said about the Russian people’s reaction – “its one thing with Russia vs. Ukraine but it might be another with Russia vs. NATO“. We also heard Nina Khrushcheva, a Putin disliker, sadly telling CNBC’s Kelly Evans that she sees support for Putin increasing in Russia.

Add to the fact that the financial sanctions imposed are really an attack on the financial wellbeing of every Russian man, woman & child. The Fin TV air is full of conviction that Russian economy is collapsing & that Russia will be brought to its knees. On one hand that sounds reasonable but, on the other hand, these sanctions have been in effect against a much weaker Iran for a couple of years. But Iran & the Iranian people have refused to yield. And if Iran has managed to stay solvent, why would Russia not be able to survive & hit back very hard after this Ukraine “operation” ends with Russia controlling Ukraine as Generals Jack Keane & Mark Kimmitt and Eurasia Group predict.

But can any one can really predict what innings 7, 8 & 9 of this crisis might look like? So do we all forget about long-term investing & only worry about the next 2-3 months? Simple minds would like to know!

Send your feedback to [email protected] Or @MacroViewpoints on Twitter