Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Instability

How was this week? “Eh” if you are a S&P-passive investor or even a QQQ-passive investor:

- Dow down 24 bps on the week; S&P down 22 bps; NDX down 25 bps & Transports up 24 bps. The worst index were RUT (small caps) down 1.3% & IWC (micro caps) down 1.5%. Even EEM (emerging markets ETF) was only down 54 bps. Our MAFAA was mostly unscathed with Microsoft down 1.4%; Apple down 47 bps; Face-Meta up 81 bps; Alphabet up 96 bps & Amazon down 7.8%.

Who do we have to thank for this uneventful weekly performance? Fed Chairman Powell. Look even the interest rates he controls were flat – 2-year yield down 0.4 bps & 1-yr yield down 7.1 bps. Double look, he even took some fear out of the market with VIX down 9.6% on the week. Thank you Jay, if we may fondly call him so.

Frankly the dreadful mix of big wage gains & steep productivity decline reported on Thursday morning were unfortunate for our man Jay. Imagine what might have happened had these numbers been released on Wednesday morning instead of on Thursday morning. Then we would have seen the 1,000 point sell-off on Wednesday AND there is NO WAY Chairman Powell would have been able to take the 75 bps rate hike in his Wednesday afternoon presser. And then, especially with what Bank of England did on Thursday morning, we might have seen another 1,000 point fall on Thursday.

With two 1,000 point down days, the S&P would have fallen to 3,120 or way below Mike Wilson’s 3,400 target. Would that have converted Mr. Wilson into a bull or would he then have gone lower to 3,000 or 2,800 as his new target?

Our point is that Jay Powell was being sensible in saying that the Fed was not considering a 75 bps increase in the next FOMC. That sensible & pragmatic comment was WHAT prevented a Market-Götterdämmerung (twilight of the market gods) this last week.

Unfortunately for him, as Dominic Konstam of Mizuho said on Friday on Bloomberg Surveillance – “it is up to the data to prove that Powell is right; problem is that data is not about to turn“. On the other hand, another economist pointed out that the data is already turning:

- David Rosenberg@EconguyRosie – – The bond market really needs to take a chill pill. These past three months, wages have averaged +0.3% versus +0.5% the prior three and six months. Slowest in a year, in fact. The moderation is becoming more visible. #RosenbergResearch

Visible to Treasury-Rosie but not to the long end of the Treasury market:

- 30-yr yield up 24.5 bps on the week; 20-yr up 27.1 bps to 3.446%; 10-yr up 21.8 bps; 7-yr up 17.5 bps; 5-yr up 11.2 bps; 3-yr up 4.7 bps.

If you look at day-by-day action, you will notice that these long duration Treasury yields hardly moved down on Wednesday but they exploded up on Thursday & followed through on Friday.

So what is the biggest issue as Dominic Konstam asked & answered on Friday morning on BTV (minute 41;39):

- “It is not about the fundamentals as such; its about where are the buyers; buyers of Treasuries & what are they worried about? There are a lot of foreign buyers & they want stability; they will come back when there is stability; they are not going to come back when there is this volatility; that’s a big problem; … that is why we are in this overshoot territory …”

We think he is 100% correct. The foreign buyers are Europeans, Japanese & some Chinese. Don’t we all know that they value stability above all?

The stock market may have reflected stability at the end of the week but the Treasury market trumpeted massive turmoil with TLT down 4.8% on the week & EDC down 6.1%. How does this look historically? To quote Jim Bianco who quoted DB, “The bond market is having its worst sell off in 200+ yrs“.

And after such a massive & unprecedented selloff & with foreign buyers on a buyers-strike waiting for stability in Treasuries, this Fed announced they will sell $30 billion Treasuries & $17.5 billion of Mortgage-backed securities every month from June through August. Then in September they plan to to double those amounts to sell a total of $95 billion every month.

Isn’t that tantamount to launching a financial nuclear war on Treasury investors, the same folks who buy Treasuries to finance the U.S. Treasury? That’s not a joke or even hyperbole!

Isn’t this Wall Street Journal coterie the same one that, per Dominic Konstam, “wants Powell to beat up on the demand by taking down asset prices in all asset classes in order to make sure that inflation comes down“?

And wouldn’t this financial nuclear war against asset prices have a similar economic/financial impact on the American people that the physical nuclear war on Russia will have on the American people?

How perfect was Ian Bremmer to label it as “unhinged”? Glad to see the twain of uber-elite, uber-connected, uber-smart Bremmer and simple folks with simple minds like us actually meet in thought this time. Roll in your grave Rudyard Kipling!

2. A path to reducing instability

This section assumes the Fed is not using the “nuclear war” option on the American people. In that case, there is only one way to arrest this massive buyers strike in long duration Treasuries. The Fed needs to achieve price stability in the Treasury markets and there is usually only one way to do so. Before buyers, domestic & foreign dare to step in, the Fed needs to stop their planned selling of Treasuries & Mortgages.

In other words, postpone QT. Not necessary to actually announce it but simply use Fed-heads like Kashkari et al to suggest that while QT is a major objective, its implementation can be modified or moved back based on market conditions.

We refer you to our Two letters and One Adjective section of our TACs article of last week. We felt quite lonely while writing that section. This week we feel less so thanks to Tom McClellan’s article The Bad Things That QT3 Will Bring:

- Investors have seen this movie enough times before to know how it ends, and now the soon-to-commence sales of the Fed’s bond and MBS assets are also going to have their own predictable effect.

- QT2 in 2017 was mitigated by a cut in income tax rates, which made up for the loss of Fed-supplied liquidity. There does not seem to be the prospect of a tax cut this time to mitigate what the Fed is about to do, even though taxes are already running at above 18% of GDP, which is the threshold for triggering a recession. See the linked article below.

- The result is likely to be a 2008-style destruction of liquidity, at a time when the stock market is not prepared to handle that. Whether we get the same amount of damage that we got in 2008 is something that remains to be seen. But the outcome will not be good.

- If I was put in charge at the Fed (which I thankfully am NOT), I would immediately reverse course on QT plans, since it has never worked out well. Just leave those assets in place, and replace them on the balance sheet as they mature. This would also mitigate the interest rate expense problem of the federal government, since the Fed returns the “profits” from those holdings to the Treasury.

This has nothing to do with raising short term rates. Look the 1-year Treasury is already at 2%. So the next two 50 bps rate hikes are already priced in.

3. Assuming long Treasuries stability

Assuming long duration Treasuries (TLT) stabilize for the next couple of weeks, our view is the same as what Eric Johnston of Cantor Fitzgerald told Scott Wapner on Thursday after the close:

- “today was wholesale liquidation across asset classes; across crowded trades in the market; … you make decisions on what your P&L is telling you that you have to do in terms of de-risking; what volatility is causing you to de-risk; … typically when you see these all-out liquidations across asset classes that are somewhat indiscriminate, that typically comes more towards the end of a sell-off rather than the beginning … today’s move … is why we think it can go the other way very quickly … the magnitude of today’s sell off was surprising but to be clear this doesn’t decrease my conviction at all … “

Then he added,

- “… two times when we have seen bonds/TLT sell off 3% & the S&P sell off more than 3%; one was in March 2020 which was basically at the lows & the other was October 2008 before we got a sharp sharp short term rally; “

He does say that you can’t read too much into this with a sample size of 2 but adds that

- “the event calendar after the CPI next Wednesday is very light; .. that could be a time when you have dullish market, volatility comes down & based on positioning that could allow for a rally that I am speaking about … “

To be clear, Johnston said in his last Monday’s conversation with Wapner that he thinks we are in a bear market & the rally he sees is a fast short term rally.

A similar point about the last two cases was made pictorially:

- Optuma@Optuma – – 2nd time in a week that $SPX has a +2% day followed by -2% day. Previous clusters on the way to lows in 2008/9 and 2020:

And there may be a natural reason for the deluge last week:

Looking a bit longer & if this is a bear market, what level should the S&P go to? 3,800 at the minimum & possibly to 3,400 said Morgan Stanley’s Mike Wilson. He said the “cake is baked” regardless of what the Fed may nor may not do. He also said the “equity market is interpreting this differently than the stock market; that the equity market is seeing a major major slowdown ahead internally …”

More importantly, Mike Wilson added that this is “a cyclical bear market, not a secular bear” & “we will get through this rough ride“. Of course, this critical point was omitted by Morgan Stanley in the clip they posted on YouTube.

4. Inflation

It seems Natural Gas & Oil are at the spark for the inflationary fire that is spreading rapidly across the world.

And,

- Bloomberg Opinion@bopinion – – Diesel is the workhorse of the global economy. It’s used everywhere to keep trucks, tractors, freight trains and factories moving. Its ubiquity means the increase in its price will exacerbate global inflationary pressures trib.al/2RvxVzf

Inflation in prices is often linked to shortage of inventory.

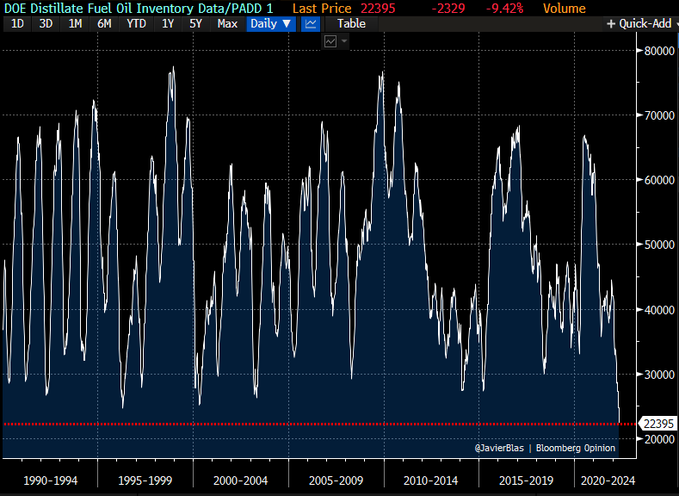

- Javier Blas@JavierBlas – – New York harbor, we have a problem: US East coast diesel inventories are now at the lowest **absolute** level in at least 32 years (not just seasonal), per @EIAgov data just released. The Eastern seaboard is running on diesel fumes: bloomberg.com/opinion/articl via @bopinion #OOTT

What about the other coast?

- Mark Chediak@markchediak – – California warns it may be at risk of blackouts for the next three summers due to power supply shortages and extreme weather bloomberg.com/news/articles/ via @business

What about that basic input of American family survival?

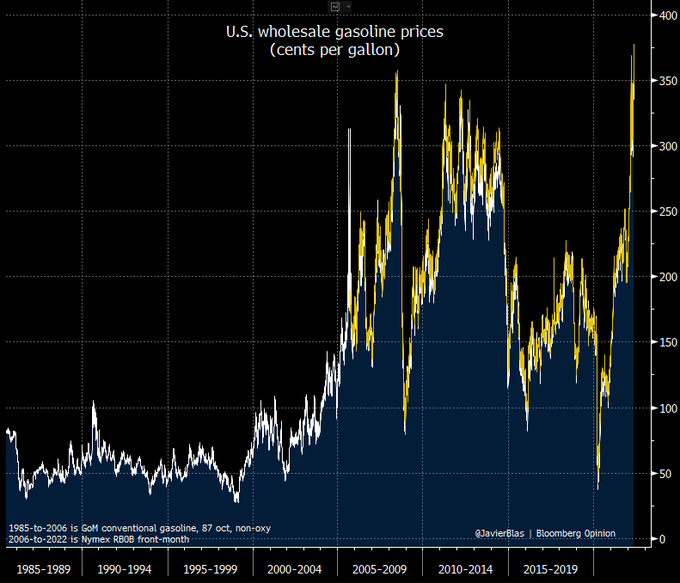

- Javier Blas@JavierBlas – – CHART OF THE DAY: US wholesale gasoline futures close Friday at a **record high settlement** price of 375.9 cents per gallon. More pain at the pump coming. (the chart is a bit messy as the benchmark for gasoline prices changed in the 2000s – see the note at the bottom) #OOTT

If this is in America, how bad is it in other less rich places?

- Javier Blas@JavierBlas – – All Nigerian airlines say they will stop flying their domestic routes indefinitely from Monday after spike in jet-fuel prices — emerging markets are getting priced out as refined oil product prices skyrocket | #OOTT #nigeria “https://guardian.ng/news/local-airlines-to-shut-operations-monday-as-jet-a1-hits-n700-litre/”

How does destroying the prices of U.S. Bonds & Stocks help reduce this inflation? Just like threatening nuclear war against Russia will lead to peace for the world.

How is the world reacting to this? Even leaders who are yet to be elected are calling Putin a victim on par with Zalensky:

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on Twitter