Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Message from Waller – Stop wailing?

Despite that awful mixing of W’s, we wonder whether his might have been a buy signal.

Mr. Waller said the market is “getting ahead of itself” in pricing in a 100 bps rate hike on Thursday in Idaho, a full two hours behind New York time. We will know this week whether this was more than a 2-day signal. But at least we got a nice up move in stocks Thursday afternoon & Friday.

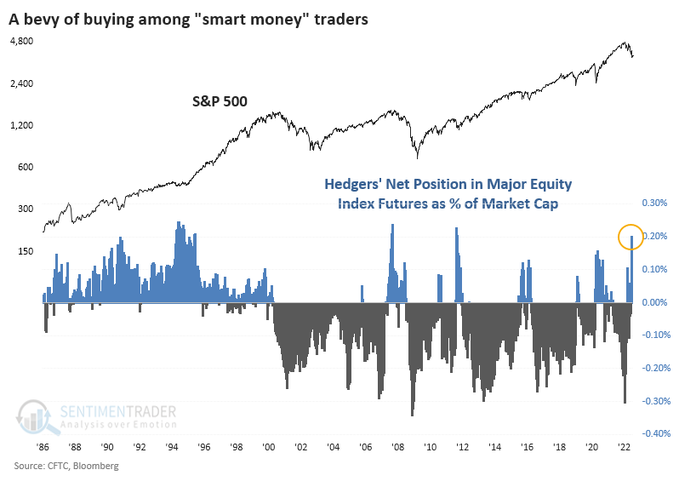

The “this is it, I like it” call came from Larry Williams via Jim Cramer on Monday. as we recall. That call was based on Commercial Hedgers being long S&P while Speculators are short. Williams called this “an incredibly encouraging sign” per Cramer. But we can’t find this clip of Williams-Cramer either on CNBC website or on YouTube. No harm done because the message of Williams is also seen via a picture & a tweet:

- SentimenTrader@sentimentrader – – Smart money is ignoring the pressure to sell. In fact, commercial hedgers are holding a record value of contracts net long. Although not a foolproof metric, this group seems to think the worst of the selling pressure is over, @JasonGoepfert writes.

Those who like to fade parabolic moves, especially secondary moves, might want to follow Commercial Hedgers here:

- Jason Goepfert@jasongoepfert – – Things going parabolic: Rates Rent The dollar And… Bets on a market meltdown Traders have shoved nearly $10 billion into inverse ETFs, about a double from May. The pace is quickening.

Yeah but these reversals do need a big push from money. Where might that come from?

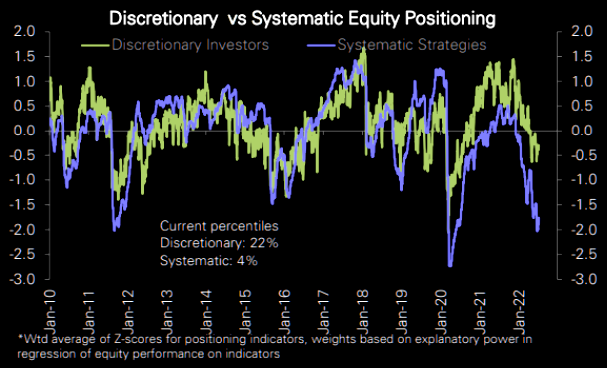

- Via The Market Ear – Before you get too bearish (III) – Just remember that the Systematics maybe do not turn on a dime but they can buy size 10% up from here…

What about pain for the broader community?

- Via The Market Ear – Peak “position proxy” pain – There has been a lot of selling….The “position proxy” for S&P 500 mini futures-longer history from Flow & Liquidity….

Add to all the smart stuff above by thinking simple – Waller gave a nod & that might have been the last until FOMC meeting on July 27. Most of the scary data was already out this week pre-Waller. So we might have a quiet period in a market that is loaded up leveraged inverse ETFs. Didn’t Larry Williams call on July 7 (via Cramer) for a rally into “rally into the end of July” following “upcoming near term low”?

But does the S&P need to break above a certain level for this expected rally to work?

- Jason@3PeaksTrading – – This is definitely something to keep watching into end of July as FOMC nears. Bond market volatility almost always correct and can eventually spill over to stocks if cant exceed $SPX 4000

2.Fed-US recession-Treasury Bull Market ….

What a week for the Treasury market? And not entirely in a good way as the tweet below indicates:

Well-clarified almost instantly:

- Jason@3PeaksTrading – – Also no disrespect to mailmen or delivery people in general. My mom worked in that field. I was just noting that literally every oneeee is talking inflation and yields. This has to be peak inflation if we look back in 3 months.

That’s the kind of week it was in Treasuries:

- 30-yr yield down 16 bps; 20-yr yield down 19 bps; 10-yr yield down 15 bps; 7-yr down 13 bps; 5-yr down 9 bps; but 2-yr yield up 2.3 bps & 1-yr yield up 14 bps; … TLT up 3.3% & EDV up 4.5%

The real big move was in German yields, as pointed out by Rick Santelli, with German 10-yr yield down 21 bps and German 30-yr yield down 25 bps. But more on Germany & Europe later.

While we might be over-bought here, the fundamentals suggest a big bull market ahead for Treasuries at least to a familiar voice, nicknamed Rosie. Before we use his excerpts, a picture might better describe what Rosie spoke about:

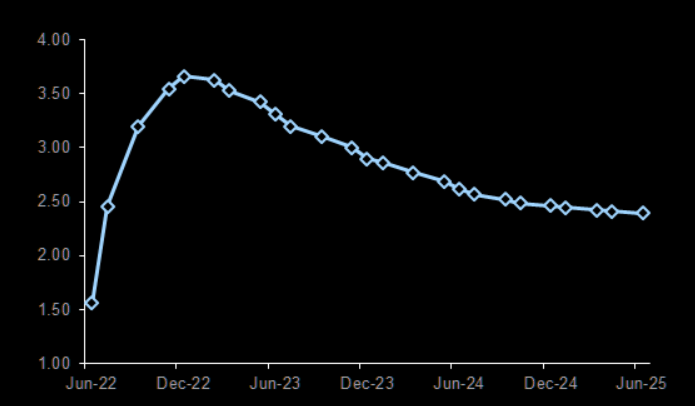

- Via The Market Ear – Peak in December – Investors appear to be pricing significant cuts following a peak in December/early next year. Chart shows FOMC meeting OIS curve; in %

Now read what Rosenberg said in his 5:42 minute clip dated July 13:

- “most important development of the past two weeks – 30 bps inversion of the Fed futures strip between Dec 2022 & December 2023 contracts; Over the past month, this spread has swung from nearly + 50 bps to negative 30 bps; .. so someone out there believes that the Fed cuts rates which is in the end going to be major league bullish for the Treasury market;

- “… kaiboshes US Dollar which would be very positive for gold ….”

- “we have the most acute tightening in fiscal & monetary policy in tandem in any year in the past 6 decades – narrow M1 flat in May after it contracted -0.4% in April & a 3-month trend of M1 is running at minus 2.2%; yr/yr trend has now receded 9 straight months; it was 17% peak last August & now down to 7% in May … same holds true for the broader M2 – that is an epic slowing of money supply ; real kicker is root of monetary creation which is growth in base money which is bank reserves & money in circulation ; the monetary base contracted – 4.8% in May after being down 6% in April ; its down 5 months in a row … last August yr/yr trend was 32%; today it is deeply negative …”

- “recession in second half of this year …the recessionary bear market in equities is in tact; yield curve has inverted again; bond market is saying Fed will be forced to cut interest rates next year … basically at this point, half way done in bear market in equities & corporate credit and only likely 1/3rd of the way through this new cyclical bull market in Treasuries ….”

On the same day, July 13, veteran Gary Shilling was on BTV:

- “You can buy Treasuries; that’s what we are doing; the Fed normally switches to easing once they have done the recessionary dead & markets anticipate that; Treasuries are beginning to see that; then there is the fear factor; the 10-year is already anticipating a 4.5% funds rate .. and I am a devotee of the 30-year bond because that’s where you get the bang for the buck when rates go down… “

Remember how Jeff Gundlach has been using the Copper-Gold ratio as an indicator for Treasury yield? That has not been working as it used to. Tom McClellan discussed this divergence & its implications for the 10-year yield in his article titled Wild Times for the Copper/Gold Ratio:

- “This is creating the type of big spread that has led to big reversals for bond yields in the past. But how can bond yields turn lower if inflation is still so high? That is the conventional thinking question. But the message from the copper/gold ratio is that something else is cooking that the conventional thinkers are not yet contemplating. And what’s cooking typically leads to lower interest rates.”

What is cooking might well be a global recession!

But there is a timing issue or a volatility issue, as Sonal Desai of Franklin Templeton said on BTV on Monday, July 11:

- “I don’t think current levels are cheap; they are still rich; the long-end needs to sell off more; … the big market call is much more volatility coming forward; in 2 weeks time, we had Treasuries, the biggest & most liquid market in the world, rally 60 bps; in 2 days time, we had a sell-off of 20-25 bps; these types of moves are not done; So I am not ready to make that call to jump into risk markets; .. I think it is way too soon … “

Another way of describing that is Madden’s classic “speed kills“. But Larry McDonald of Bear Traps Report chose a quote from a man who actually changed the world:

- Lenin – There are decades when nothing happens; and there are weeks when decades happen

Larry McDonald actually experienced this in Q3 2008 during the decapitation of Lehman. So we take his words seriously, especially in conditions like today’s:

- “This period we are in right now is so amazing; because once-twice a decade, 3 times in 20 years, you get a 2-3-4 week period where asset prices are moving at an accelerated pace, so fast that …. risk assets take on economic data … “

- “its the rate of change of asset prices, leveraged loans, energy markets, bonds, credit default swaps; we are seeing the highest acceleration, rate of change speed, its literally as fast as COVID, as fast as Lehman … credit risk is about to veto Fed’s policy path; … the Dollar is so strong that its the global wrecking ball; the IMF is owed $100 billion from emerging market countries & the Fed is lighting that balance sheet om fire right now …. “

But surely this is not 2008 & Lehman, right? Larry McDonald points to a bigger danger that is staring at all of us right now:

- “in last 2-3-4 weeks, conversation from the buy-side & investors that run billions of Dollars is focused on Sovereign Risk … & Lehman risk has been transferred from balance sheet banks to Sovereigns & now the Fed is accelerating rates up and they are blowing up global bond market & that is what is going to stop them … ”

That brings us to:

3. Dollar-Emerging Markets-Europe-Recession

David Rosenberg called the U.S. Dollar “may be the most over-crowded trade out there“. Gary Shilling disagrees as a long term call as he said on BTV on July 13:

- “The Dollar has a long way to go; if you look back to 1985, we are still well below that; Dollar is a safe haven; Treasury yields are higher than they are in almost any developed country’s sovereign; … so investors pick up a yield spread & also you have got to be in the Dollar to get these … I think the $ has got a long way to go ; … remember Euro was well below par when we started in 1999 & early 2000 and the Euro has virtually collapsed … ”

And, Gary Shilling said:

- “I like Copper on the Short side because there is no cartel to support it; it is not like Oil where you are worried about OPEC & Russia and it goes into everything in manufacturing … & we are short the S&P“

Larry McDonald is focused on EM risk & rightly so. But is EM is a systemic risk as it was back in the days? We don’t think so but until this week we didn’t find any support for that position.

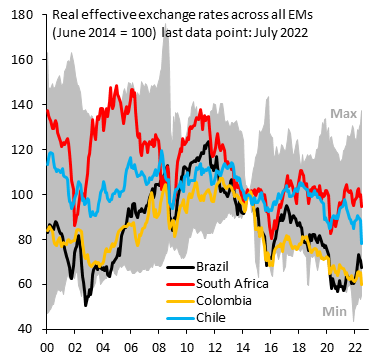

- Robin Brooks@RobinBrooksIIF – – In recent years, EM currencies have been to hell and back again. They fell massively in Q1 2020 amid huge capital flight. Then they recovered and there were no systemic blow-ups. It’ll be the same now. EM will pull through the coming global recession without systemic blow-ups…

That is non-China EM. So what about China?

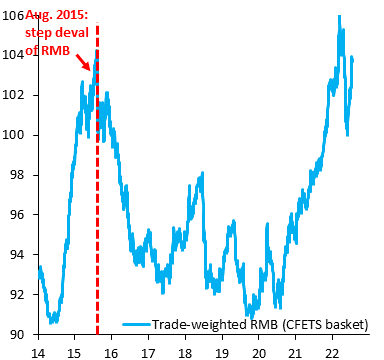

- Robin Brooks@RobinBrooksIIF – – When the US Dollar starts strengthening like crazy – the way it is now – China needs to be on its toes. If China doesn’t weaken the RMB quickly enough versus USD, trade-weighted RMB starts rising, which is undesirable. That happened earlier this year and is happening again now…

But China is probably not a source of systemic risk. So what is? Read what Michael Shaoul , CEO of Marketfield Asset Management, said on BTV Surveillance on Monday, July 11:

- “Europe is a risk; it has poor political leadership; the ECB is not an entirely credible central bank and I would say Euro itself is a major currency that to a lot of people is a voluntary currency; so if we had a region pulling everything else lower, that’s a region you need to watch out “

And Europe is the second largest economic region in the world. Don’t these two make Europe the big systemic risk at this point?

Shaoul added,

- “… Europe was a mess going into this & continues to be a mess and has the additional strain now of sanctions on Russia & the potential for some rationing of energy in the winter … “

How does systemic risk hit? Shaoul says in the beginning of his clip:

- “… dislocation is when markets, as they did in 97,98, august-October 87,is a move in markets that really breaks with fundamentals; you look at it and say it is just liquidity being withdrawn; … there are price levels , speeds of movement at which the Fed would be forced to do something …. “

Where precisely did this dislocation arise out of?

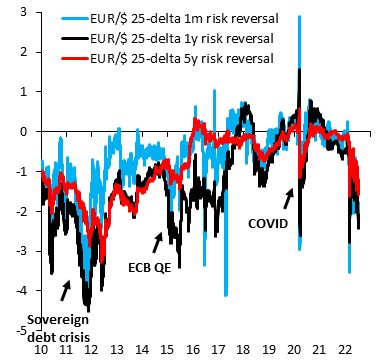

- Robin Brooks@RobinBrooksIIF – – This is “The End of the Beginning” for the Euro fall. Russia’s invasion of Ukraine is a seismic shock for the Euro zone, because so much of the European growth model has been predicated on cheap Russian energy. That’s over & done with. Recession & structural headwinds are coming.

Ok, but there isn’t much downside left for the Euro, right?

- Robin Brooks@RobinBrooksIIF – – Option markets are starting to price Euro downside, but we’re nowhere near the kind of skew priced at the height of the Euro zone debt crisis in 2011/12. Still lots of room for markets to catch up to the seismic shock that has befallen Europe due to Russia’s invasion of Ukraine.

Starting to price Euro downside? If that is not enough, look what Robin Brooks tweeted on Sunday morning?

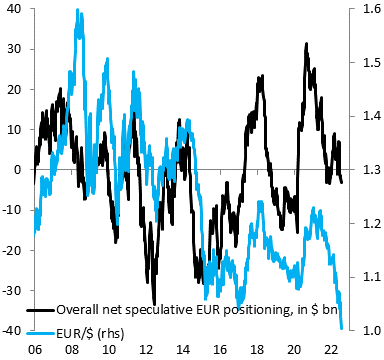

- Robin Brooks@RobinBrooksIIF – – The fall in the Euro has only just begun. Look at where speculative positioning (black) is now versus previous periods of EUR/$ weakness (blue). Markets are playing catch-up to Russia’s invasion of Ukraine, which is bringing recession to the Euro zone…

Notice of course that the blue line can also meet the black line with a rally in the Eur/$. And that might happen if we get a risk assets rally pre-Fed. But if you think Mr. Brooks might be proven right, then do hold on tight to your 30-yr T-Bonds at least until Fed’s November meeting!

Those who want a more global & geopolitical view might wish to read our adjacent article – The First Financial War?

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on Twitter