Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”… clearly a transition taking place … “

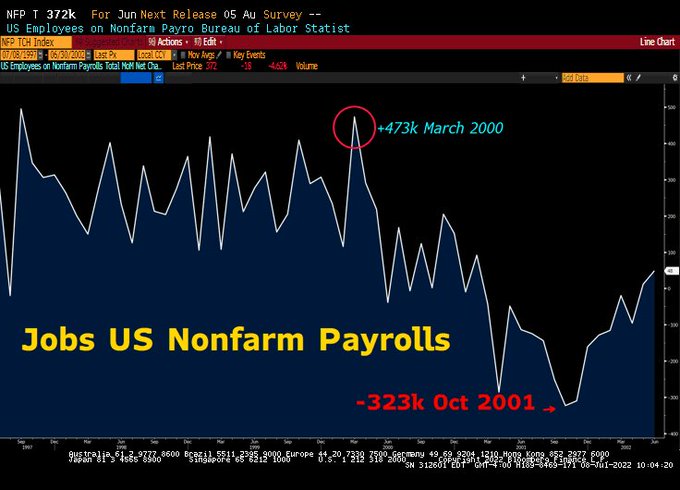

Is the Non Farm Payroll report even relevant to leading economic indicators, leading being the operative term here?

The reality is that the Non Farm Payrolls report is deemed to be of major importance to financial markets. So there is a lot to be said about Friday’s stronger than expected + 372,000 jobs report. As BlackRock’s Rick Rieder said on BTV Open on Friday morning,

- “This is a solid report, it keeps the Fed moving; there is no ambiguity around that; its strong enough; …. they will go 75 bps; they will get 50 bps done in September … “

Then he added “there is something strange going on here … something funky going around … “. He clarified:

- “I would modify a little bit of how strong this report is; look at household survey down over 300,000 jobs; … this divergence between the payroll numbers & household survey … last 3 months, household survey has been pretty soft; … jolts report we got this week – professional & business services was down over 300,000 job openings, manufacturing down 200,000 job openings … there is clearly a transition taking place; 1st thing you do is start freezing hiring, cutting those openings; .. in cyclical places you saw that in pretty profound ways … look at 3-month average to 6-month & 9-months … no question it is slowing … we will see [by September] number of characterizations of a significantly slowing economy …. “

Fast forward to Friday after the close to hear what Professor Jeremy Siegel said on CNBC Overtime:

- “… Jobs report weaker than it looks … if you look at the households survey , a tremendous drop in the number of hours worked per week, .. a 0.1 drop & they revised the previous month by 0.1, is a lot but 1/10th drop in the work week is like 450,000 person loss in payrolls. … & we haver seen one of the biggest downdrafts in hours worked over the last 15 years since going back to the financial crisis back in 2008 … what I saw underneath there I think showed a lot of weakness … I think we are in a recession ,,, I think the Fed will go 75 bps .. everyone is talking about Wednesday’s inflation number and inflation is important but it is very backward looking … it’s going to be for the middle of June when gas prices were at an all-time high; they have already gone down 25-30 cents; wholesale prices have gone down 60 cents …data we have been getting for the past 2-3 weeks has been on the downside ….”

Remember the terrific call by Jeffrey Gundlach on June 15 for a rally in the 30-year Treasury rate from 3.43% to 3%? If memory serves us well, the 30-year yield did actually break below 3% in the morning of Wednesday July 6. Hopefully most had seen the tweet below from Gundlach on July 5, the day before:

- Jeffrey Gundlach@TruthGundlach – – The 30 year UST action today is the mirror image of the throwover mid June which presaged a 75 bp drop in yields. Mirror image.

Guess what? Once again Gundlach was right. Treasury yields reversed hard on Wednesday July 6 & closed up 3 straight days into Friday’s close. The rise in the 30-year yield in these 3 days = 25 bps. The 2-year was actually more robust reversing from sub 2.8% to close the week at 3.10%.

On the week,

- 30-yr yield up 14 bps; 20-yr yield up 16 bps; 10-yr up 20 bps; 7-yr up 22 bps; 5-yr up 25 bps; 3-yr up 27 bps; 2-yr up 26 bps; 1-yr up 21 bps; TLT down 2.8% and EDV down 3.8%.

Finally a look back to turn of the century for what Non Farm Payrolls mean in a falling economy:

- The Bear Traps Report@BearTrapsReport – – +473k on the perch of recession, best print in years – Is there a more useless, backward-looking piece of economic data than US jobs?#LaborMarket

2. Fixed Income vs. Equities

The old dictum says the Fed will keep raising rates until something breaks. That something is usual something big. But the absence of something big blowing up does not mean smaller things are not breaking as Rick Rieder pointed out in his comments on BTV Open on Friday morning:

- “… we are watching things break along the way whether it is the very levered structures that are coming under pressure whether it is refinancings of parts or real estate risk, commercials that are starting to crack; … “

That prompted BTV’s Ferro to ask whether Rieder was more risk-averse now or less? Rieder was clear:

- “… less by a good amount … equities are just OK but credit markets are starting to let the line out a little bit ; … if you can buy high yield at 9%, 9.5%; if you can buy investment grade quality at the front-medium part of the yield curve at 5ish, that’s a pretty good real rate … “

This is similar to what Citi’s Kristine Bitterly said last week on BTV Surveillance except she specifically mentioned Muni Bonds.

We urge all to read the article by Rick Rieder on the Blackrock website titled Getting to the Other Side of this Economic Shoulder Season. A couple of excerpts are below:

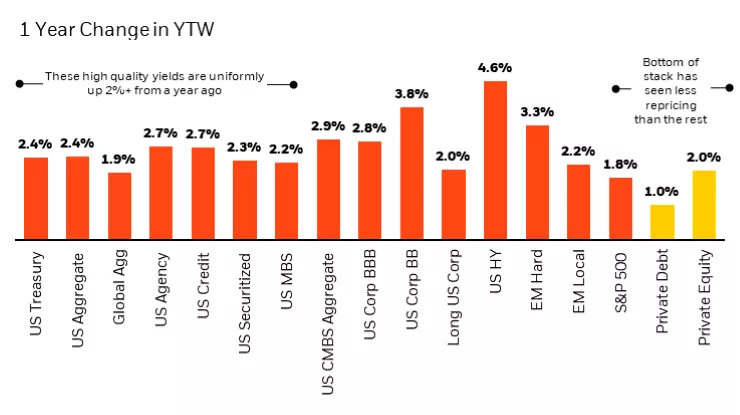

- “Today, after having gone through a balance sheet cleansing over the last few years of depressed energy prices, energy is “under-levered” relative to cash flow, and the high yield index consequently is a healthier asset class. The correlation of high yield to the risk-free rate is also much lower than the rest of fixed income, which gives it some tangible value as a portfolio complement today, given the risk of higher term premium (see Figure 10).”

That Figure 10 below is titled – The biggest re-pricing has been in high yield, followed by high quality

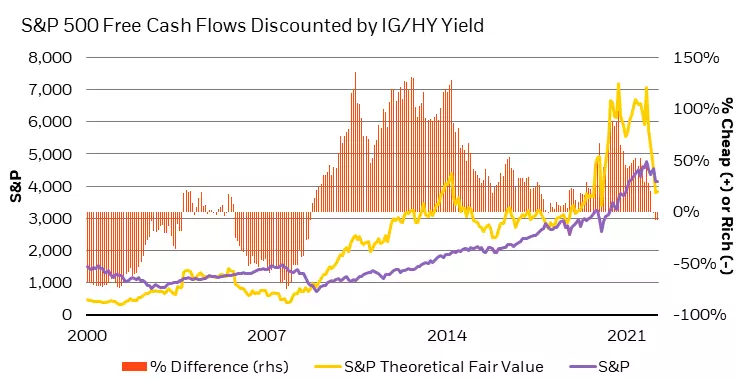

- “With credit spreads having widened much more than equity risk premiums, the relative value between the two suggests that equities have not been less attractive relative to credit in almost 15 years ”

What is Rieder’s basic message to investors in his article?

- “Investors are best served by letting asset prices “come to them” this shoulder season, patiently adding those that reprice the most, as the economy and policy come to a head – a moment that we think will signal the all-clear for markets.”

3. Stocks

Unlike MOVE, the index of Bond volatility, the VIX is almost flat lining. Perhaps it simply suggests that most leveraged players are under-positioned in the S&P. Despite that stocks had a good week finally:

- Dow up 77 bps; S&P up 1.9%; NDX up 4.6%, RUT up 2.4% & Dow Transports up 81 bps. Commodity stocks kept getting hit hard with both precious & industrial metals stocks down 3%-4% on the week. MMANAA did well again with Microsoft up 3%, Meta up 5.8%; Apple up 7.3%; Alphabet up 6.7% & Amazon up 5.2%. VIX was down 7.3% on the week & broke below 25 to close on Friday.

The Bull & Bear from BofA remains at Zero. Can’t get any lower on greed, can it? Despite that, BofA’s Hartnett is reportedly neutral on the summer because, as we understand it, a bounce in stocks would first require a bigger outflow from stocks.

That should mean a lower low in stocks before the summer is out. The only one we heard outright on this was Tom DeMark via Jim Cramer on Wednesday July 7: The operative statement in the clip is:

- “DeMark’s QQQ forecast looks a lot like the 1973 run of the Dow. Specifically Demark sees an upcoming near term low followed by a rally into the end of July, then a decline into the end of August to a newer low... after that however he is expecting that sharp rally into late October that would recover 55%-60% of the entire 2022 decline “

This is a detailed clip that we urge all to watch:

In fact, waiting for a newer low seems to be the consensus this past week both in macro & technically. The macro story from many has been focused on earnings. But as Cantor’s Eric Johnston pointed out on CNBC Overtime on Thursday, “the bulk of the earnings that matter are going to start in the week of the 25th“. So in his words, “there is a little bit of time & we could have more of a squeezy market “. That seems consistent with DeMark’s call for a rally into end of July and might enable the S&P to fill the gap around 4038 as suggested by CNBC’s Carter Braxton Worth.

But the basic message of Erik Johnston is that “buying the S&P right now at 3,900 when you have peak earnings, a tightening Fed is just not a good risk-reward to be long“. Speaking of earnings, he points out that “when a company cuts earnings, there is usually a second or 3rd cut to come“. How much of a slowdown does he see?

- “… there are all sorts of tail risks out there that could suggest a much lower market; credit markets are showing that not only in US but also in Europe; credit markets are suggesting that the risks right now are extremely high “

He then makes a distinction between copper and wheat-oil.

- “copper has sold off 25% in the last month & half; it has big secular tail winds & yet it sold off 25% ; that’s the commodities market telling you that the economic slowdown is real & its going to last for a significant period of time …; if you look at wheat or oil, that is much more of a supply issue that is causing a concern; copper has never been a supply issue… copper was trading at a high because people had a bullish view of the global economy … “

Thursday July 7 was a terrific up day with Dow up 347 points, S&P up 58 & NDX up 256. But that action did not impress Mark Newton of FundStrat. Instead he went the other way on CNBC Overtime:

- “… structurally at 3946, the rally would have gone further than we anticipated; .. it also lines up with downtrend since late March highs … a lot of that comes up between 3946 & 4000; I don’t think 4,000 is exceeded in the month of July; I think we are going to stall potentially as early as tomorrow & turn down towards the lows … I think that’s gonna give us some opportunity to buy in the weeks to come … “

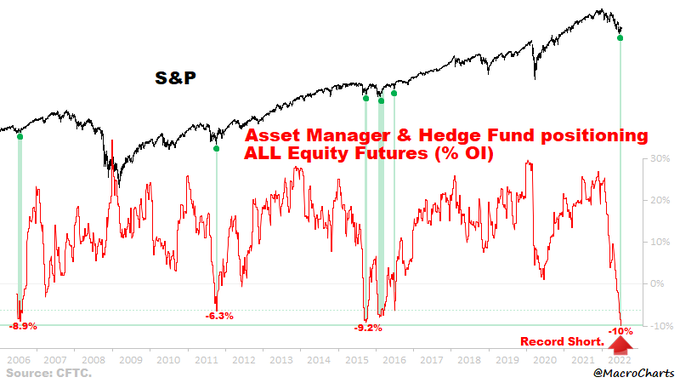

The question is whether sentiment & positioning matter at this stage? Because these two are sending a diametrically opposite message to the above messages:

- Macro Charts@MacroCharts – July 9 – Record Shorts, heading into next week’s CPI/Econ releases.

4. The Real Problem

The biggest market in the world is the Currency market. And it is screaming in panic about the U.S. Dollar which was up 1.9% this week on UUP and up 1.8% on DXY.

- The Bear Traps Report@BearTrapsReport – – A Federal Reserve induced Time Bomb – Using a Strong US Dollar in an attempt to arrest inflation – comes with a price. Economists are focused on jobs, while ignoring tectonic stresses underneath the surface. The US is on earth – NOT Mars, policy actions have serious consequences.

One such consequence might come from a bubble:

But the above is about total Debt. What about distressed debt?

We know that Sri Lanka is now re-submerging. How many others are on the way? But let us not forget that the FED is a U.S. institution with an America Only mandate.

But there is one currency that has risen even more than the Dollar. Who would have thunk it back in March?

That seems to be a big difference between smart investors who look at reality and blowhards on FinTV who can’t see reality. Like Jim Cramer who tried to explain to David Faber that India is a democracy & so the assumption was that India would support the West re Ukraine. Guess Cramer doesn’t understand the American dictum that Democracy is a government of the people, by the people & for the people. And that for India means protecting the financial wellbeing of its 1.3 billion people instead of sacrificing its people for 40 million White Ukrainians. And somehow Cramer can only scapegoat India. He hasn’t uttered a syllable against AMLO of Mexico who is using extremely angry terms against American role in Ukraine, not anything against Brazil either.

The reality is that the entire world is now seeing that many in America like Cramer consider Africans, Asians & Latin Americans as second-rate people who must sacrifice their own economic well being for Ukraine. Asians in particular are reminded that America’s so-called Asian Pivot is just words while China is a reality. And yes, Cramer cannot find a single syllable to blame China for buying Russian oil & openly backing Russia’s invasion despite relying on America to maintain its exports. After all Cramer has been a huge backer of China since China’s entry into the WTO.

But in all fairness, we must state that Cramer is a peaceful rational analyst when compared to the built-in simultaneously pro-Britain & anti-American brainwashing of BrIndians.

5. Br-prefix

Some readers might recall that we often use the prefix Br to describe a large number of Hindus or Indians who remain utterly loyal to the British. Very very few in America understand how many people in India, especially English-educated India, utterly despise America. No, it is not because they are defending their own India. No, they don’t care much about insults heaped on India, Indian Culture or Religion.

Nothing inflames this large group in India as when Britain or British heritage is put down in comparison to America. We saw an extreme example this week on Twitter. The official name of India is Bhaarat with the middle vowel pronounced as “aa”. That name is derived from the dominant Bharat community who won a major war way way back. So the country’s name Bhaarat means the land of the Bharat.

But the British didn’t care about the meaning or heritage of Indian names. They simply used whatever spelling they found convenient and used it. We pointed this out to a tweet-sender named @VertigoWarrior who posts exquisite photos of ancient temples in India. That brought out a follower of VertigoWarrior who tweeted

- @mustang_6454- – Replying to @MacroViewpoints and @VertigoWarrior – Brit imposed spelling? The language itself is theirs. We can not decide the spelling. If you really wanna claim the heritage you can use ‘भारत’

This is what we encounter all the time. Unlike the Chinese &, frankly, every independent people, many in English-educated India have given the British the right to butcher Indian names at will. That is why this one said clearly “we can not decide the spelling” meaning the Brits can spell or pronounce any Indian name any way they like.

The exchange between us was civil including our belief that India needs to create its own English perhaps called Indlish. The response to that was also civil:

- @mustang_6454 – – Replying to @MacroViewpoints and @VertigoWarrior – So now you will change ENGlish to INDlish? Man you’re unreal!!!!!!! I bow down.

Then we tweeted that we are American & only use American form of English. That opened the floodgates of mustang’s inner rage:

- @mustang_6454 – – Replying to @MacroViewpoints @uvecog and @VertigoWarrior – American? I should’ve checked ur profile, I wouldn’t hv wasted time. Americans aren’t only obese in physique they hv obese brains also And you had to modify English nd use it becoz u didn’t have any language. India has Hindi and 27 others languages as well.

- @mustang_6454- – Replying to @MacroViewpoints and @VertigoWarrior – No wonder you have no knowledge and just barking that English and to that muslim one are India’s official languages. After all, you are American. The most stupidest people out there.

- @mustang_6454 – – Replying to @MacroViewpoints and @VertigoWarrior – America is a finished superpower now.

- @mustang_6454 – – Replying to @MacroViewpoints and @VertigoWarrior – Go solve your abortion laws issues?

All this vomit just because we, as an American, dared to be negative about British English, or Britlish as we call it! We have experienced this since we started this Blog. We can criticize the British BUT we simply cannot criticize anything British while supporting how America treats the same topic.

What few realize that this is the feeling of a majority of Indians leaving aside the relatively small percentage of Indians who study or work in areas where America & India intersect – technology, finance, venture capital, investments etc. The vast majority of Indians have no experience with or understanding of America. This includes the sectors that actually govern India- the vast Indian Administrative Service, the Indian Judiciary and Indian businesses in India.

This vitriolic contempt of America comes right from the British elite who actually established the Indian textbooks & curriculum of these sectors. And NO ONE in India has bothered to change the textbooks written before the Independence of India or just after. And those British elite had nothing but contempt of America even while FDR’s America was bailing out that Britain.

Don’t take our word for this. Read the words about America of Marquess of Linlithgow, who served as the British Viceroy of India for seven years from 1936 until 1943:

- “What a country,” he derided America, “and what savages who inhabit it! My wonder is that anyone with the money to pay for the fare to somewhere else condescends to stay in the country, even for a moment! What nuisance they will be over this Lease-Lend sham before they have finished with it. I shan’t be a bit surprised if we have to return some of their shells at them, through their own guns! …. I love some clever person’s quip about Americans being the only people in recorded times who have passed from savagery to decadence without experiencing the intervening state of civilization!”*

But Linlithgow was no fool. Look what he said to Earl of Halifax who served as Britain’s Foreign Secretary until 1940.

In fact, in terms of the Indian Army, Linlithgow was “greatly dependent upon the constituents in North America,” he admitted to Halifax, “for heavy gear. So don’t tell them [Americans] what I think of them“, he warned“. *

(Marquess of Linlithgow) (Earl of Halifax)

This brutal opinion of America & its very inferior status to Great Britain was inherited by the vast Indian bureaucracy, political elite & the Indian Judiciary. Also recall that the first Indian Prime Minister who took power in 1947 was Jawaharlal Nehru who was even more of an admirer of Britain & contemptuous of America. And Nehru served as PM from 1947 to 1964.

Many of the textbooks used to educate & train the Indian Judiciary, Indian Administrative Service from late 1930s to late 1950s are still used today. They still train the new entrants to the elite & powerful Civil, Foreign & Finance sectors as they used to under Linlithgow & Nehru. And that training requires them to faithfully & semi-religiously use British English and absolutely reject any thought of Indianizing Britlish even after 75 years of Independence.

If you want to understand why China has exploded past India, look at Deng Xiaoping who turned the Chinese economy towards the American model and away from the traditional British model. India, in contrast, went even more towards the British model at that time & still cannot break away.

This is partly why virtually every young technically smart Indian we know is desperate to leave India for America or failing that to Canada. This has been actually good for India. Frankly, India will not be able to survive without the $85+ billion sent every year as remittances to India by these Indian expats.

Contrast that with the Indian Judiciary which absolutely insists on being addressed as Your Lordship and addressed in Court as Mi’Lord. Yes not even my Lord but the British Mi’Lord. And double yes, a woman Judge is also called Mi’Lord.

Narendra Modi is the first pure Indian Prime Minister of India and he has identified America as India’s absolute 1st preference as a partner. But he was elected in 2014 & has been busy running the country. As a result, the textbooks teaching antipathy to America are still brainwashing Indian minds as we see in the explosion of Anti-American hatred from the above mustang tweet-sender.

You can see the all-encompassing servility to Britain prevalent even within the Indian community in America. Just look at the number of educated affluent Indian-origin guests on Fin TV who keep using Amrita for Amruta, Kriti for Kruti & Rishi for Rushi and above all mispronouncing Modi with a hard “d” instead of soft “d”. Can you ever find a Chinese-origin guest who mispronounces Xi?

Is this why India, the Indian economy, the Indian system always play below their weight? What about Cricket, you ask? Yes India is now the unquestioned economic power in Cricket, sort of America in Basketball. But what is the difference you ask? America does & will always beat the world in Basketball while India almost always loses in cricket to Britain, Australia & even tiny New Zealand. Because the Indian fans only care about entertainment & hardly ever about winning, or more accurately about preparing to win.

Hopefully now you will understand why, in our opinion, terms like BrIndian or BrHindu are accurate terms of reality!

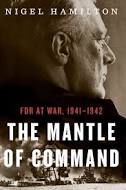

*the two quotes above of Linlithgow are from page 246 of The Mantle of Command – FDR 1942-1942, by Nigel Hamilton.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter