Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Who’s the Boss? Supertanker in a perfect storm?

Wasn’t it Abby Joseph Cohen who said at the turn of the century that the U.S. economy was a supertanker that doesn’t turn swiftly? Well, that was another year & time. This June’s reality suggests that the so-called supertanker U.S. is caught in a rapid storm & tilting swiftly. Heck, it was only a couple of weeks ago, when smart minds began pointing to data moving faster than they had ever seen before.

No one exhibited this speed in his comments as Jeremy Siegel of Wharton. A man who vociferously demanded a 100 bps rate hike by Powell’s FOMC on June 15 turned the very next day to say to CNBC’s Scott Wapner:

- “This week was brutal, today was brutal; let me tell you we are in a recession – its a mild recession ; its not an official recession; but this first half is negative GDP growth; its ending on a slide; .. the data I found most interesting even more than the Fed was retail sales in the morning; wow, that was shocking, shockingly low with momentum downward … every single indicator we have got since then has surprised pretty dramatically on the downside; so we are cooling off the economy ; hope it is not too fast; … looks like they are stopping the economy pretty much in the tracks; … “

Fast forward to Prof. Siegel on June 30, this past Thursday on CNBC:

- “…. I think we are in a recession; the data this morning was very bad; not on the inflation front but on real spending; the indicators that I look at … now saying the 2nd quarter also prints negative GDP growth; … I am not surprised the 10-year dropped below 3%; that’s telling you a really big slowdown with both inflation & 10-yr below 3%, commodity prices falling everywhere … ”

What made the U.S. economy “supertanker” tilt so fast? If you are looking for an immovable iceberg a la Titanic, you might find it in the tweet below:

- Lawrence McDonald@Convertbond – – Listen – this is not another 2008 – but there is 10x plus more leverage on the sovereign (government debts) side — during this rodeo. Don’t forget — the private equity, venture capital space is off 70-80% and the market down 10%. The banks are ok, but everything else is toast.

Wait, the U.S. consumer is a rock right, with a rock-like balance sheet? That rock too tilted downwards in April:

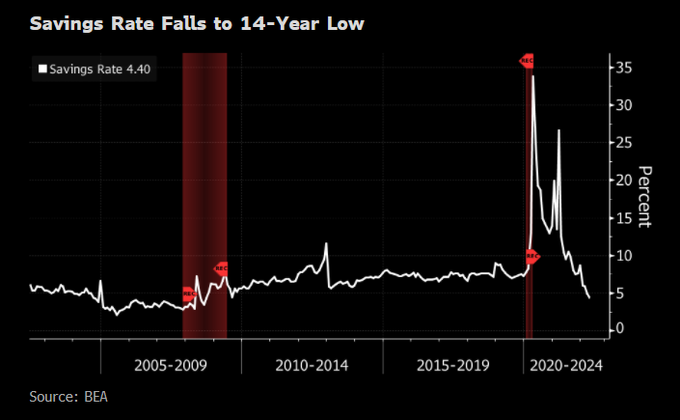

- Lisa Abramowicz@lisaabramowicz1 – – The U.S. savings rate fell to the lowest since 2008 in April, “suggesting growth in spending will decelerate:” @economics

Another chasm between the narrative & reality?

So who is the Boss now? Jim Paulson of Leuthold answered on June 30 on CNBC:

- “… Boss is the economy & the bond market; both are telling you its gotta wind up its tightening program; inflation has rolled over, growth is slowing; bond yields are coming down; it might not be a Fed put but its a bond market put …. the bond market & the economy are going to put more & more pressure on the Fed to stop tightening soon …. ”

But Europe is strong as we keep hearing & ECB has not tightened yet, right?

Since a picture is so much more effective than words:

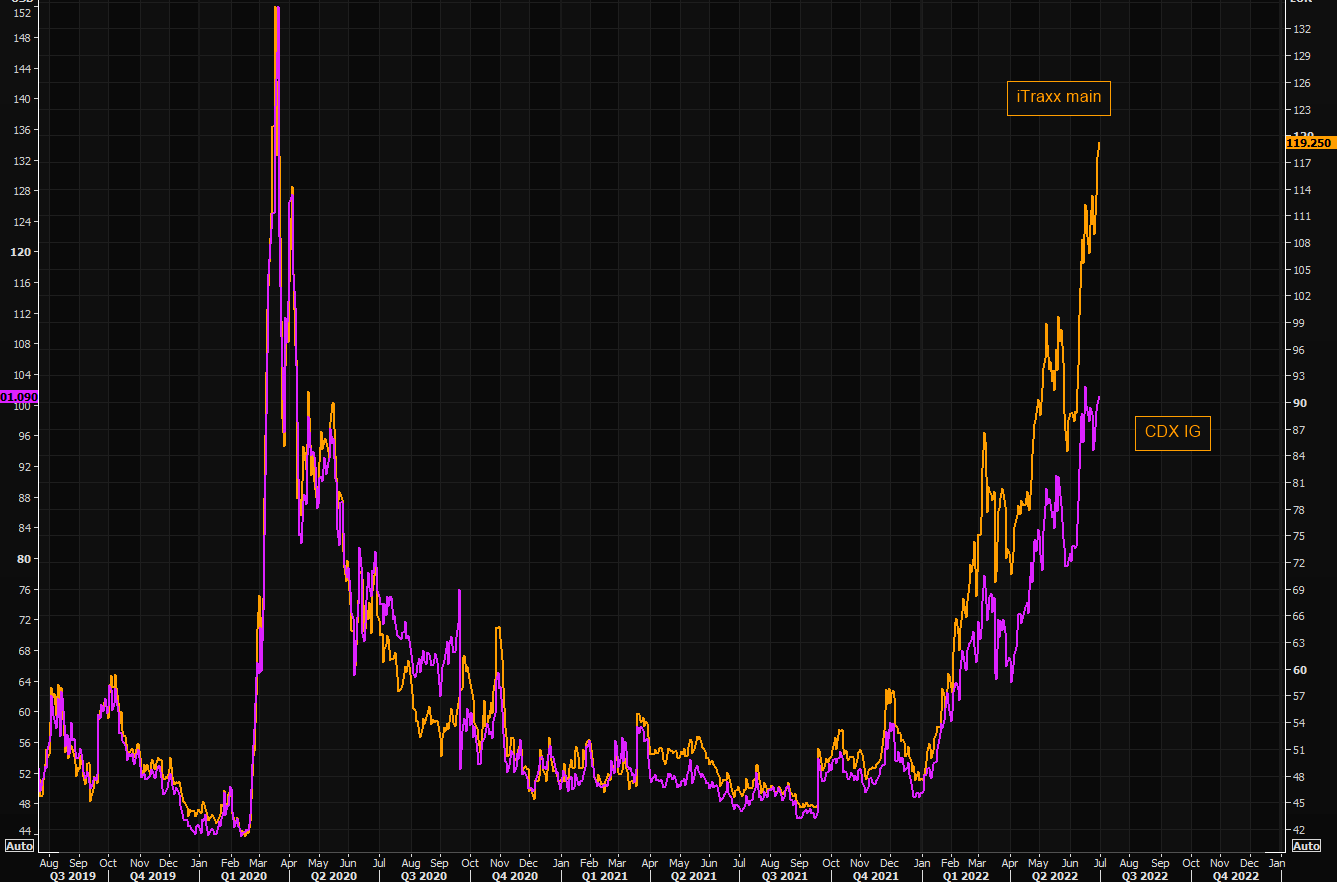

- Via The Market Ear – The unstoppable bid in credit protection – Europe is the leader of all things bearish, credit protection included. Is iTraxx main aiming for the Corona panic highs? CDX IG is elevated, but looks “tiny” compared to the European version.

What is another sign of a mess in Europe?

- Kathy Jones@KathyJones – – The sound of things “breaking”. Euro falls to five year low vs the dollar.

Ok but that raises the obvious question – what sign should we look for to guess when the markets might fully price in the recession?

- Via The Market Ear – King dollar and recessions – According to DB there is no consistent dollar pattern in to a US slowdown. Each cycle has had different paths for the dollar. DB also notes: “In contrast, there is a very consistent pattern when the market has fully priced in the recession: the dollar has historically always weakened when the equity market has troughed, typically around the mid-point of a US recession“. According to the investment bank the dollar has front loaded a lot of risk premium. Conclusion is: “…the next large move is likely to be down, not up.“

2. Fixed Income

We simply have to again recognize what has been the most important timely call of this year. Within half an hour of the end of Powell’s presser on June 15, Gundlach said to CNBC’s Scott Wapner:

- ” … here is a counter-trend rally coming at the long end of the treasury market which I have been advocating as a hedge but if you haven’t done it, ytd the 10-year is up 189 bps; so a counter-trend rally in the bond market which may have started today & the long end even stared to participate in today’s rally … I wouldn’t be surprised to see the long bond go down to 3%; we might have a short-term trading opportunity … “

What have interest rates done since the call (better measured from the close of Tuesday, June 14)?

- 30-yr yld down 32 bps; 20-yr yield down 35 bps; 10-yr yld down 58 bps; 7-yr yld down 65 bps; 5-yr down 45 bps; 3-yr down 48 bps; 2-yr down 33 bps;

Treasury rates simply cascaded down during the last 3 days of this week probably in shock of the economic numbers reported. The Treasury ETFs TLT & EDV were up 2.7% & 3.1% resp. An important line was broken by the 10-year yield:

- Via The Market Ear – US 10 year – crashing below the 50 day – US 10 year broke below the steep trend line recently and is extending the move lower. Note we are “well” below the 50 day moving average. We have not seen the 10 year close this much below the 50 day in a very very long time. First “support” is the 2.7% level … .

The more unpleasant message might be from volatility:

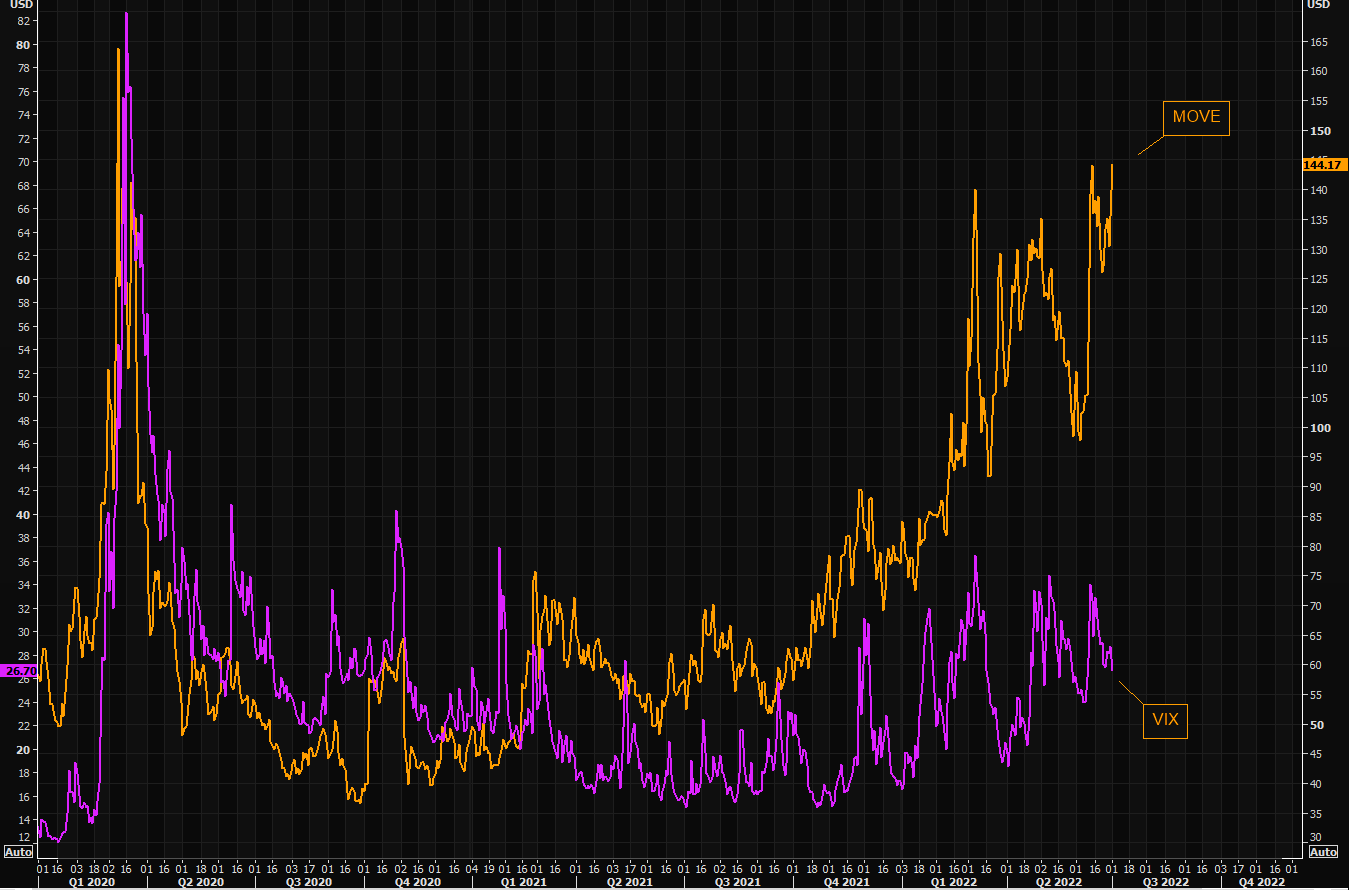

- Via The Market Ear – Unstoppable bond volatility – Bond volatility, MOVE index, prints new recent highs. We are actually not far from Corona panic highs when it comes to bond volatility. VIX on the other hand remains rather dull. Needless to say, the gap between MOVE and VIX is huge.

Does that mean VIX has to explode up to meet MOVE or, preferably, MOVE should move down to meet VIX? Or to put it another way, since both stocks & bonds were torched in the first half of 2022, should investors bet on better second-half 2022 returns from stocks or bonds?

Fortunately for us, Kristen Bitterly answered that on BTV Surveillance this week (min 3:04 to 4:43):

- ” … One of the historic anomalies we have seen is this is the first time in history that we have seen both equities & bonds decline by more than 10% over a six-month period; … we used a threshold of 4.5% & there have been 5 other situations in history where we have seen in tandem declines in equities & bonds of more than 4.5%; in the six months following fixed income was higher in 5 out of 5 of those scenarios with an average total return of around 10.9%; equities were higher in only 3 out of 5 times with an average return of 5.5%; … “

BTV’s Ferro asked – do you have higher confidence in bonds over equities? Bitterly replied:

- “absolutely; bonds have been so out of favor which is why we are talking about bonds more …. we are looking at the muni market, depending on the state you live in, you are getting taxable equivalent return of 7-8%; investment grade fixed income that has in some cases priced in 40% chance of recession; that’s where we are adding exposure. … “

Note that she didn’t mention high yield credit. Sensibly so because high yield credit ETFs, HYG & JNK, were both down 1.4%-1.8% this past week, an underperformance of 4.3% to TLT.

3. Stocks

This week was bad for equities, especially Tuesday which began with a 447 point rally in the morning to close down 491 points. The NDX fell 370 points on Tuesday. The rally on Friday afternoon saved the 3815 level that Katie Stockton is watching as she said on Thursday after the close:

- “… we have downturns in a lot of of our short term indicators that suggest that we might consider getting hedged again here… to be respectful of the next breakdown … a level we continue to watch for the S&P 500 is in jeopardy; it is 3815 – if we see two consecutive weekly closes below that level, that’s another major breakdown for the S&P ; … “

The 3815 level might have been saved on Friday afternoon but the move in a very important sector “sent a downright scary signal“ on Friday. As the Treasury ETF, TLT, was up 2.7% this week, the semiconductor ETF, the epicenter of the world’s supply chain, fell by over 9%. Watch this CNBC Fast Money clip below:

Recall the clip of Jim Paulson we discussed in Section 1 above in which he argued that “the bond market & the economy are going to put more & more pressure on the Fed to stop tightening soon“. His closing point is that “if the stock market picks up that scent, we could have a nice rally“.

That brings us to seasonality:

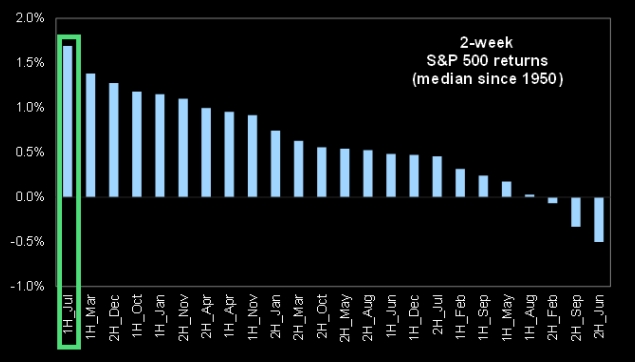

- Via The Market Ear –SPX – it is supposed to bounce here – The re balancing buy everybody front ran did not work. Goldman’s Scott Rubner was out with some seasonality charts last week, but to be precise, seasonality is supposed to kick in now.

4. Commodities

It was a pretty bad week for commodity stocks. Gold & Silver miner ETFs, GDX/GDXJ/SLV, were down 5.1%, 7.3% & 6% resp. Copper was down 4.7% & Freeport was down 5.5%. CNBC’s Carter Worth saw value in going long Gold vs. Copper which, according to Gundlach, is parallel to saying 10-year yield is going down.

Tom McClellan suggested an opportunity in SLV in his article Silver’s Small Speculators Are Giving Up Hope:

- “That message right now is that these small position traders are feeling pretty pessimistic about silver’s prospects. And when they get to feeling that way, that is a pretty good indication of a bottoming condition for silver prices. Then as prices eventually rise, and these traders start wanting to own silver futures again in a big way, they can help show us a topping condition. But that is not what we are seeing now. Right now, they are at their most pessimistic state in years.”

But the most important commodity in the world is energy, at least at this time. And the biggest factor in this commodity is the conflict in Europe.

- Via The Market Ear – The gas tap is turned off – winter is coming – DB’s George Saravelos is very worried when it comes to the energy situation in Germany. Nordstream flows are down on the back of the alleged disruption of parts from Siemens. The planned maintenance during July 11-21 is not helping the situation, but the question is will they restart this at all? Saravelos writes: “If the gas shutoff is not resolved in coming weeks we worry this will lead to a broadening out of energy disruption with material upfront effects on economic growth, and of course much higher inflation…Not only would the energy import bill rise due to even higher prices, but it would raise the risk of an imminent German recession on the back of energy rationing“. The investment bank sees euro range bound this summer, but they worry about the energy situation “providing clear downside risks.”

BofA’s Francisco Blanch is also positive about commodity returns:

- “Commodity returns are going to be quite attractive if indeed curves stay inverted … which is also quite favorable shape of the market for commodity returns …. people will start coming back into gold as well …. “

5. Finally

Fin TV does surprise us now & then. We were astounded on Friday to watch & hear David Woo saying this on BTV Surveillance (at 6.27 minute) on Friday morning.

- “For me, the 1st half of 2022 was scoring goal against yourself; I think the total economic war that the West & America in particular has declared against Russia is hurting the West more than it is hurting Russia. From my point of view, in my career, I have never seen anything like this. Go to War to Win, Not to score against yourself.”

We totally concur that the decision by US & EU to primarily use Finance as the weapon has backfired terribly on both the EU & America. In return Russia weaponized energy & secondarily food exports. We can understand this mistake from Ursula from EU & her colleagues because they are an unelected coterie that derives power from the Euro monetary structure. Sadly, this is the first world fight in which EU is leading America.

As we enter another 4th of July, we think optimistically that this is transitory & will pass soon. Have a Happy 4th everybody.