Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Thank You, Jay!

Seriously, Jay Powell was once again a maestro in his presser on Wednesday June 15 afternoon. He came in with the entire monetary world waiting to pounce on him for being weak & pathetic if he did not toe the 75 bps line. Being sensible, he did & raised the Federal Funds rate by 75 bps. And then in his presser, he showed his skill in taking the sting out of the FOMC statement. By doing so, he stood up to the elite monetary crazies. If that doesn’t make him the true maestro, what will?

Don’t take our word for it. Read what the truly smart people said:

- Lawrence McDonald@Convertbond – – 75 but Powell opened the door to a softer path. #Dovish relative to expectations – fears. The Fed smells a recession, doesn’t want to make a double dip policy mistake.

Jeffrey Gundlach was much more direct in his terrific interview on CNBC Overtime with Scott Wapner:

- “…. first the 2yr-30yr spread was flat last night ; it was flat when Jay took the podium & then widened to 20 bps as he was talking ; what the market liked is that there is no guaranty of super-sized interest rate hikes baked into the cake; that’s when the stock market rallied & the 2-year rallied; the long bond sort of joined in; I wouldn’t be surprised to see the long bond go down to 3%; we might have a short-term trading opportunity … “

Those who don’t follow Treasury rates on a daily basis should know that during the first two days of last week, Treasury yields absolutely shot up. How bad were those two days?

- 30-yr yield up 23 bps; 20-yr up 26 bps; 10-yr up 32 bps; 7-yr up 36 bps; 5-yr up 35 bps; 3-yr up 39 bps & 2-yr up 44 bps;

The chorus was demanding 100 bps rate hike on FOMC day. Jay Powell could have easily gone along & hinted at another 75 bps hike in July & beyond. But Jay Powell knows this economy better than most talking heads on TV and he saw what many really smart people have been seeing:

- Scott Minerd – “data is moving so fast; can’t remember any time in the past when data moved so fast“;

- Larry McDonald – “financial conditions tightening at the fastest since Lehman“

- Kyle Bass – “Financial conditions are tightening at lightning speed“

- Henry McVey – “never seen it so choppy in my career“

To his enormous credit, Jay Powell (& his FOMC) ignored the crescendo of hawkishness & sent a dovish signal saying that they understand the bigger risk. Kudos to him & his FOMC.

What’s the trade then? Only one stood up after the close to say Buy Treasuries:

- Gundlach to CNBC’s Scott Wapner on Wednesday June 15 – just in the last few days, may be last week, our models for where the real value is for the 10-year Treasury have got really eye-catching – one of the things we use, models we use – weirdly a bunch of them now say the 10-year Treasury yield is too high ; these are good signposts that have worked over time like copper-gold ratio says 10-yr yield is too high; blend of nominal GDP with German 10-year – strange indicator but works really well – says the 10-year is too high ; kinda strange; don’t know if it is a short term blip but it kinda suggests that there is a counter-trend rally coming at the long end of the treasury market which I have been advocating as a hedge but if you haven’t done it, ytd the 10-year is up 189 bps; so a counter-trend rally in the bond market which may have started today & the long end even stared to participate in today’s rally

What a smart call? Treasuries rallied hard on Wednesday, Thursday & Friday with TLT up 2.8% from Tuesday’s close to Friday’s close. But the Treasury curve still looks strange with 20-yr & 3-yr as the maturities with the highest yields:

- 20-yr at 3.338%; 3-yr at 3.341%; 5-yr at 3.338%; 7-yr at 3.331%; 30-yr at 3.28%; 10-yr at 3.23%; 2-yr at 3.164%;

It is rare to find a public figure, a business school professor actually, who can publicly admit to changing his view in the classic Keynes fashion . Prof. Jeremy Siegel wanted a 100 bps rate hike on earlier this week. But then he saw the retail sales numbers & said the following to Scott Wapner of CNBC Overtime on Thursday:

- This week was brutal, today was brutal; let me tell you we are in a recession – its a mild recession ; its not an official recession; but this first half is negative GDP growth; its ending on a slide; .. the data I found most interesting even more than the Fed was retail sales in the morning; wow, that was shocking, shockingly low with momentum downward … every single indicator we have got since then has surprised pretty dramatically on the downside; so we are cooling off the economy ; hope it is not too fast; … looks like they are stopping the economy pretty much in the tracks; we don’t want to go through the windshield here slamming on the brakes … we might be surprised instead of 50-75 bps in July it might be 25 bps if this slowdown really continues… the economic momentum has really sharply turned negative & that’s really something the Fed has to be concerned about going forward ;

Are these words conducive to a Treasury rally? One would think so. And so does Tom McClellan from his own & different perspective in his Friday’s article Corporate Bonds Show Oversold Condition For T-Bonds:

- “This week’s chart looks at a Ratio-Adjusted McClellan Oscillator for the investment grade bond A-D data. On June 14, 2022, it reached its lowest reading since the Covid Crash in March 2020 (not shown). Extreme readings like this are pretty uniformly exhaustive in their nature, and help to signal washout selloffs in T-Bond prices.”

- “In a concerted downtrend, it is possible for the bond market (or stocks, or anything) to ignore an oversold condition. But when we see the biggest oversold condition in a couple of years, it tends to draw our attention and tell us that something special is happening.”

2. Jay’s luck, Swiss National Bank & the Stock Market

Once again, the US stock market roared with approval during & after Powell’s presser on Wednesday June 15. Dow exploded up by 674 points before giving up half the gains by Wednesday’s close. Perhaps they remembered the harrowing decline in stocks the day after stocks rallied after Powell’s May FOMC presser.

Man, were they right! Because stocks almost collapsed on Thursday June 16, the day after Powell’s presser:

- Dow down 741 points; S&P down 123 points; NDX down 453 points, Russell 2000 down 81 points & Dow Transports down 455 points.

But there was a huge difference between the horrific stock market decline on Thursday after Powell’s May presser & the horrific stock market decline on this Thursday after Powell’s June presser. In May, Treasuries fell hard (rates exploded Up) on that Thursday while on this past Thursday Treasuries Rallied (rates fell hard).

The reality is Powell got unlucky on both these post-FOMC Thursdays. In May, inflation shot up on that Thursday & that caused havoc in both stock & Treasury markets. This Thursday, it was Europe. In the pre-market on this Thursday, the 2-yr Treasury yield had shot up by 17 bps & then it collapsed during the day to to close down 9 bps. So what prompted the horrific decline in US stocks? It felt as if a huge owner was liquidating or the market was front-running the feared liquidation by a huge owner, a FOMO-oriented owner.

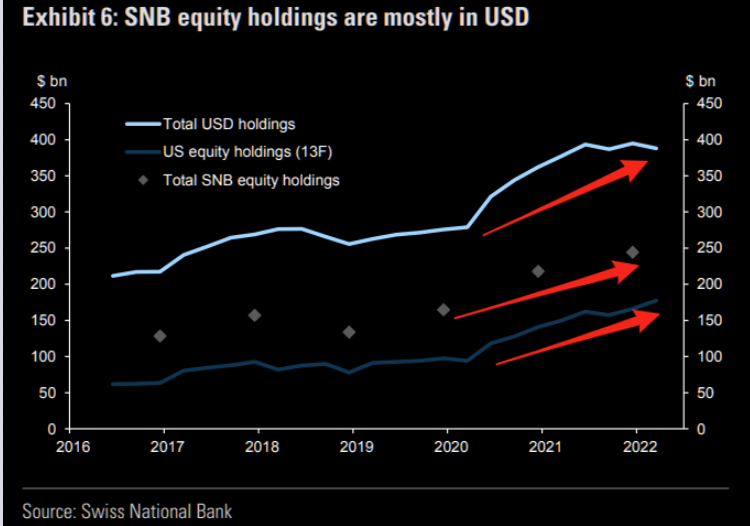

But who could that be? A chart published by The Market Ear might provide a clue:

The external shock on Thursday morning was the rate hike by the Swiss National Bank. The Market Ear added:

- GS wrote earlier this week: “SNB’s balance sheet assets consist largely of overseas investments, there is no “natural” run-off, as is the case for other central banks implementing quantitative tightening (QT). Instead, Swiss QT would require active selling, with implications for both the Franc and foreign assets“.

Is that why the Dollar fell 1% on Thursday, the only day of the week the Dollar was down? But was it mainly fear of SNB selling US Stocks that drove the horrific action on Thursday? We saw little trace of it on Friday. So did some one reach out to SNB & say don’t crash the boat? Or was the ridiculous spectacle of shorts front-running enough to say wait to long-only sellers?

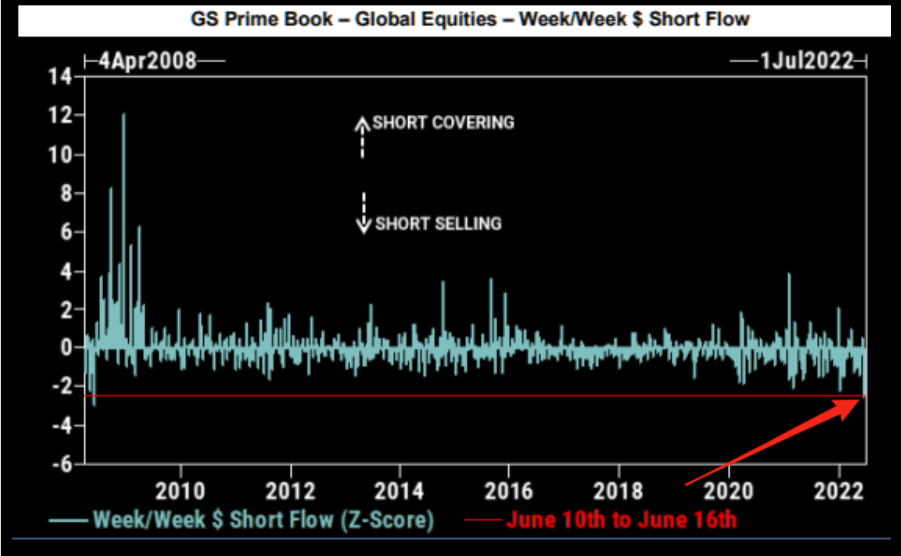

- The Market Ear – Shorting is huge – We have seen some extreme shorting take place lately. As we noted on Friday, the perceived bear is stronger than the actual bear. NASDAQ futs basically closed at the same levels we traded at on Monday lows, after having moved both higher as well as lower. Imagine the short pain should this decide to bounce from here...

Is there anything that can make this past Thursday look even worse than the above?

Given this, have we reached a state of so bad that it might be good?

3. US Stocks

Gundlach was neutral on US stocks on Wednesday after the close:

- “ … I am kinda neutral on stocks right now; we got to 35 on the VIX which is a level at which I start to feel not very negative; I think stocks will put in new lows but I don’t think this is a good time to sell right now ; we have seen a pretty big decline & so I think we will get a better place to sell them … ; So I am sort off neutral … but if you rode it all the way down this far, I don’t think this is the time to sell“

Did that comment about getting “a better place to sell” suggest a short term rally? But that was before Thursday’s wipe out. Somehow that wipeout was enough to get some to come out & call for a rally or short term bounce.

- Carter Worth aka “Chartmaster” on Thursday post-close on CNBC Fast Money – “… sequencing here calls for a bounce … nothing to do with your long term view ; just here & now seems over done … also a chart of the entire 2009-post bull market … we are now precisely to the penny at the mid point of that channel exactly down 24%; At the end of last year the Russell 3000, broadest thing we have was down 1-2% then; yet at that moment in late December half of all stocks in the index had already lost 20%; now we have 35% of the index down 50%; just as there was no worry in the market in December almost every one is hysterical ‘ take the road less travelled … if you were just to continue the sequencing of selloffs & rebounds a 10-12% rebound would be what is in order … “

Next came Mark Newton on CNBC Overtime on Friday, June 17 after the close:

- …. when you look at things like the % of stocks above their 50-day moving average that is now down to 2%, that certainly was present back in 2016 & in 2018 ; we have finally started to see some evidence of a little bit of VIX backwardation though not to levels that are important just yet ; I think it is a great risk reward when I start to see some evidence of equity put-call getting close to 1 which was near what we saw in March 2020; evidence of last week of a little bit of oversized selling; that meaning the trend Arms Index showed 2 readings of over 3.5 ; so some big big selling on the downside; .. and that came specifically from groups that had not been going down recently like energy all of a sudden & utilities; these starting to join technology on the downside is a meaningful change in character for this market that investors should pay attention to … but we need to see markets go from making higher lows to higher highs.. there is no way to catch the bottom of that … it would take a move above 4,200 … I have some cycles that suggest we might bottom towards the end of June towards the Russell rebalance potentially as early as next week; a couple of things are important – we seem to be getting close to a time when yield & also the Dollar should peak out … those are important ; times when the Dollar is rising rapidly , happened in 2000-2001, 2008 also 2014; those could be difficult for the markets ; if growth starts to slow meaningfully & we see evidence of copper breaking down substantially this week, if the Dollar starts to roll over, I think that might be a few weeks away & the 30-year has really peaked out around 2018 highs, I saw evidence today of technology outperforming as yields dropped; so that’s the key for investors – watch when yields & the Dollar start to roll over, growth should start to act better; you look at FANG stocks this week – stocks like Apple, Amazon Netflix they are only down about 3-5%, much better than the overall average .. seeing that outperformance in some of these high growth technology names should be very important for the indices ; so tough to say we are at the bottom; still think we are going to 3,500-3600 over the next couple of weeks; but I am much more willing to take a stand & say I will buy here & think the indices are higher in the next 3-4 months …

Then Larry McDonald suggested on Saturday that “S&P could bounce 15-20% in a couple of weeks” because of a Fed walk back or politicians doing something about oil.

But his view is that the market ends up in the 3,200-3,400 range given his expectations of S&P earnings of $200-$190. And his big view as expressed below is:

If the Democrat leadership & the Fed start to see even a small probability of that, how fast do you think the Fed will pivot & how fast will the White House & Democrats in Congress throw Powell under the bus if he doesn’t react dovishly?

In that vein, what do the market signals suggest?

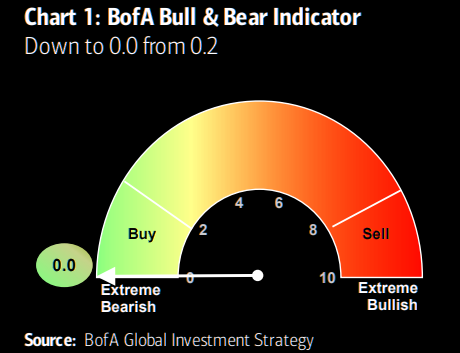

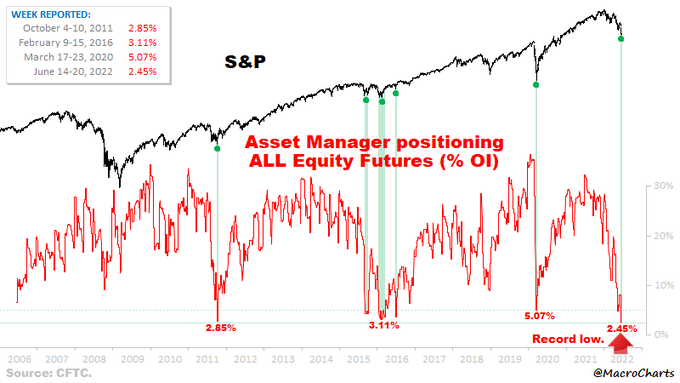

- The Market Ear – THE buy signal? BofA’s bull and bear indicator is currently at 0. This is probably the slowest of all indicators among investment banks. Track record when this hits zero is rather strong (unless double dip recession or systemic event). Last time we hit zero was in Aug’02, Jul’08, Sep’11, Sep’15, Jan’16, Mar’20 according to BofA.

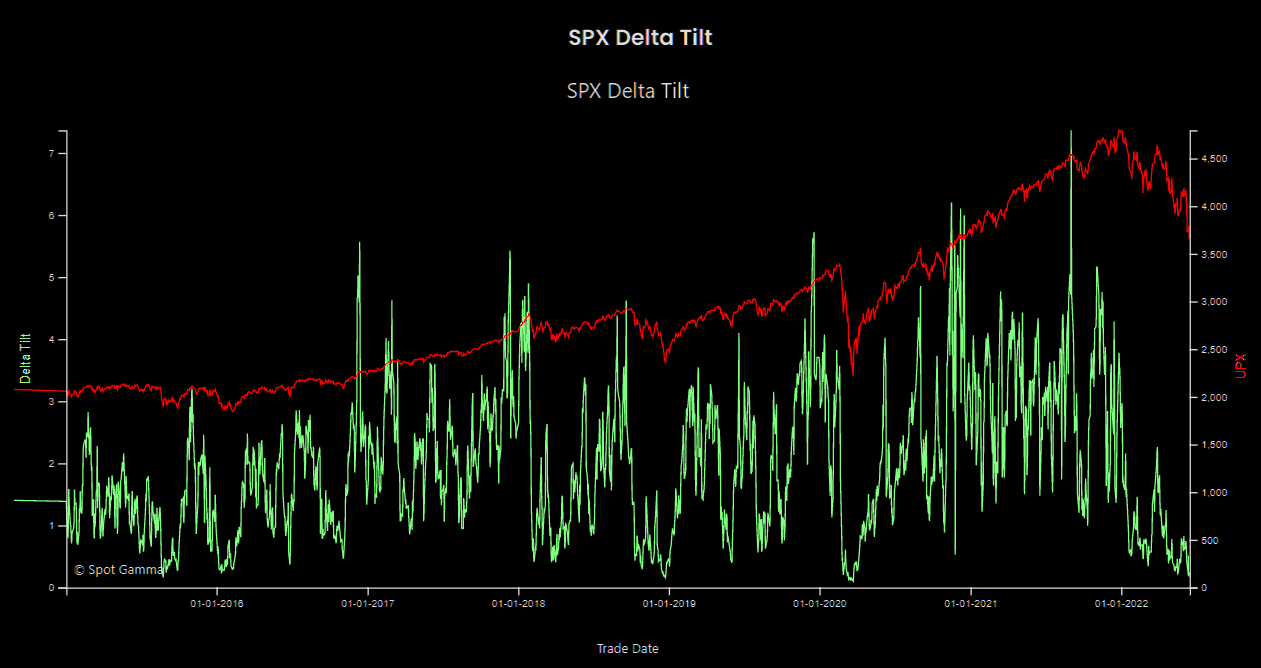

From a simple indicator like the above to call-delta vs. put-delta from Spotgamma via The Market Ear :

- Spotgamma’s delta tilt indicator measures the total call delta to put delta for all expirations. They write: “You can see that we are at March of ’20/Dec ’18 levels as a result of these large puts. Expiration will force this metric higher. This has been associated with rallies in the past, and we still anticipate an OPEX rally today into Tuesday afternoon (Monday is a holiday)”. Obviously the macro set up is very different from March 20 and Dec 18, but the above indicator doesn’t care about macro…

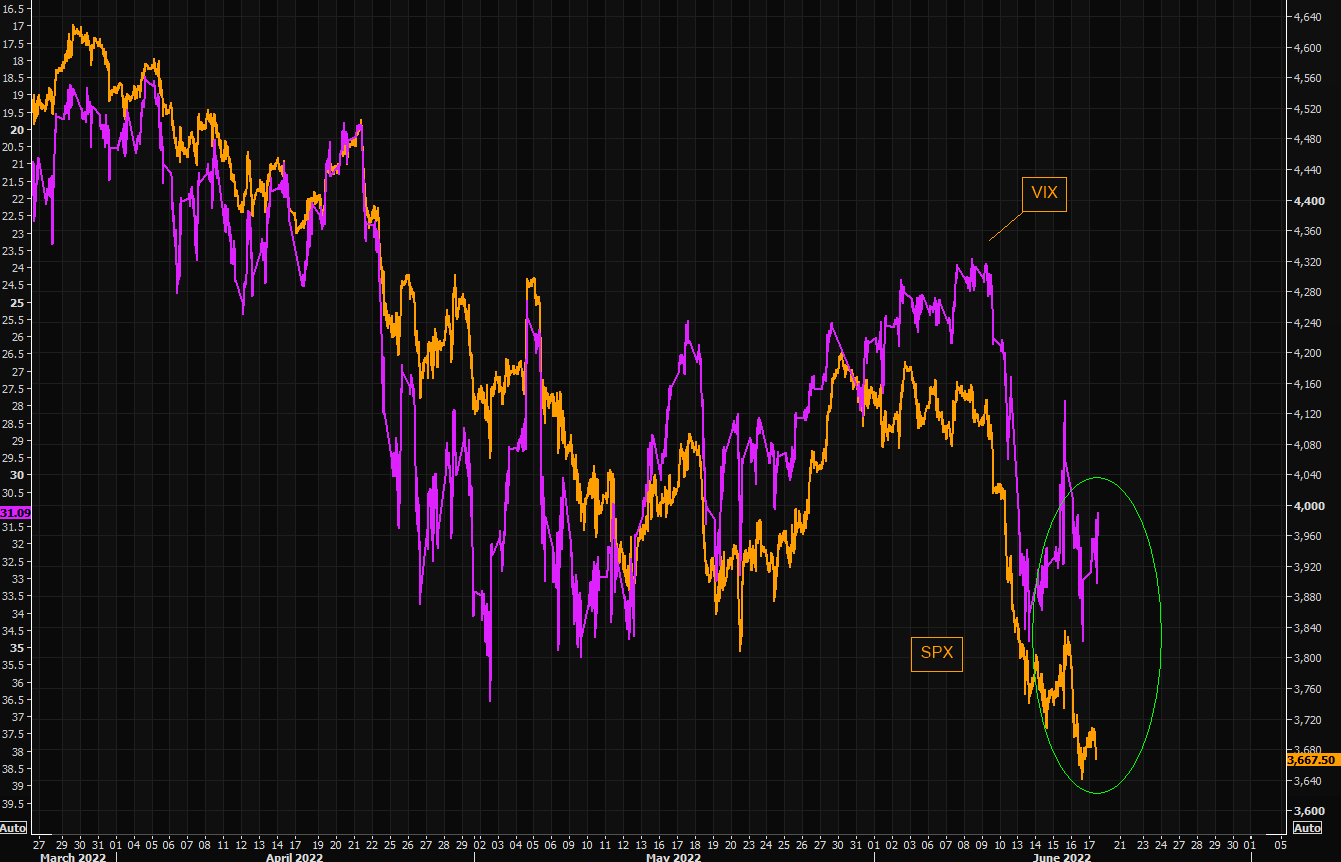

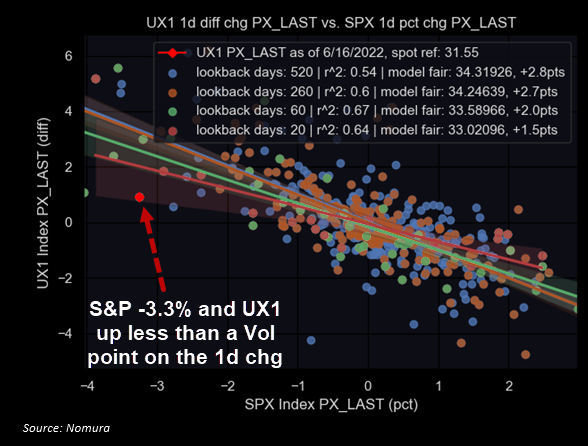

What about the VIX getting to a big high figure? One view suggests that may not be necessary:

- The Market Ear – Over hedged in a pic – The “muted” VIX narrative goes on. The VIX vs SPX gap remains rather wide here. Second chart shows just how “depressed” VIX remains vs the underlying px action. Most people have been stopped out/de-grossed risk, so there isn’t much demand to hedge exposure. The latest risky reading is indicating that a possible upside squeeze remains the “top risk” (here).

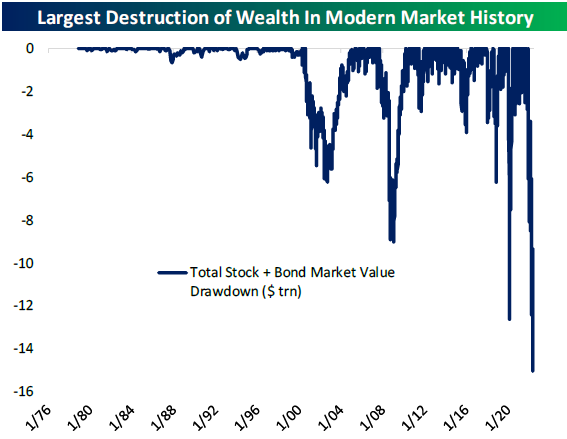

After the above, how about looking at “worst in history” type observations?

What has been the net impact on American households?

Our bottom line remains what it was last week:

- “If buying TLT starts working, then other assets will. If TLT keeps getting clobbered, then the Inferno will get hotter. That we think will be the bottom line for the next few weeks”.

That is why Gundlach’s Treasuries rally call might end up being the most important call of this year if it comes true.

4. Two Weaponizations put the World on Edge

Since early this year, we have been worried about repeat of mistakes of 2007 when overly aggressive rate hikes eventually pushed the U.S. economy into the 2007-2008 disaster. Now we see Larry McDonald tweet about “2022 is looking more like 2008 every day“. And in this case it will be another colossal failure of common sense, as he put it.

Just look around. Europe & Japan have currencies at near lows. But U.S. Dollar & Russian Ruble are going up every week, it seems. It is the story of two weaponizations, that of the Dollar & its payment system and that of Russian control of Energy & Food. First Russia was hit hard by seizure of Russian financial assets in USA & Europe & now even the great agricultural giant named USA is facing rising food prices with real prospect of some food shortages inside America.

What about Europe, especially Germany? Ian Bremmer’s gzeromedia reported on June 16:

- The global energy market has been volatile for months, but things got particularly dicey this week after Russia slashed natural gas supplies to Europe via the undersea Nord Stream pipeline. Moscow cut gas supplies to Germany by a whopping 60%, to Slovakia by 30%, and to Italy by 15%.

- Russia’s state energy company Gazprom says the move, which sent Benchmark European gas prices soaring 24% on Wednesday, was a result of “technical issues,” but no one’s buying that excuse.

- Simply put: the Germans are very jittery. In a desperate Twitter appeal, Deputy Chancellor Robert Habeck told Germans that the situation is “serious” and called on them to conserve energy wherever possible. Indeed, as Russia doubles down on its strategy of using energy exports as a weapon of war, there’s growing fear in Brussels that European states will be unable to find natural-gas alternatives to avoid a full-blown energy crisis next winter.

And now Germany, Merkel’s clean-fuel obsessed Germany, is going back to coal.

In contrast, how successful has Russia been in weaponizing its commodities control? Late last week, Russian Rosneft refused to sell oil to large Indian state-owned companies like Hindustan Petroleum & Bharat Petroleum. Why? Because other Asian nations have flooded Russia with demand. Why would Rosneft sell oil to India at 30% discount while other Asian nations are willing to pay close to market prices?

But India is a nation starved for commodities. So Russia offered to sell coal to India at a 30% discount and guess what happened? India’s Russian coal imports jump 6-fold in 20 days. Why pay exploding market prices to Australia when Russia is selling at a 30% discount?

But how does India afford to pay in the sharply rising Russian Ruble? Apparently India has been paying some portion in Indian Rupees a la the 1960s method & offering to sell Russia Indian goods to enable Russia to use its multi-billion Indian Rupee reserves. And just this week,

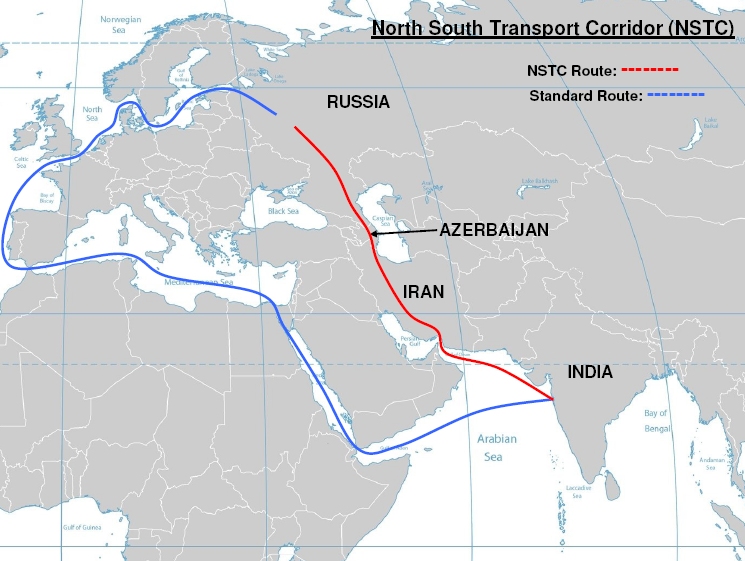

- Russia has started using an alternate route to ship goods to India, through Caspian Sea and Iran, bypassing the Mediterranean Sea – Suez Canal route. Russia dispatched a test cargo to India from St. Petersburg via Iran o Saturday, operationalising the International North-South Transport Corridor (INSTC). According to Russia Briefing, Iran’s state-owned shipping firm has announced the first transit of Russian products to India via the INSTC.

This entire mechanism bypasses both the U.S. Dollar & China. This corridor has been around since before China’s One Belt One Road initiative. It seems to have been revived due to the mess created by the two weaponizations & China’s own ambitions. Already much faster than the old route, this corridor will get faster once Iran constructs the railway across Iran to connect Azerbaijan with Iran’s Bandar Abbas port. And other Eurasian nations can then benefit from this shorter corridor to Russia & then to Europe.

What about Israel & America, you ask? The current I2U2 framework (I2= India, Israel; U2 = USA, UAE) is expected to be upgraded into a QUAD West Asia during President Biden’s upcoming trip to Tel Aviv:

Weird. Managing foreign policy is becoming like simultaneously managing two sets of in-laws with different styles & views.

Notice all of the above seems to be bypassing China. Is that why China seemingly wants to try out its own special military operation across Indian Ladakh to put India in its place? Recall Ladakh was where the two militaries fought a skirmish in 2020.

General Flynn, Commander of the U.S. Indo-Pacific command has called Chinese buildup as “alarming”. And U.S. troops & Indian troops have launched joint exercises both in Himalaya & in extreme cold conditions in U.S.A.

Surely China must be relying on its “taller than Himalaya & deeper than ocean” partnership with NaPakistan! Not really! Two days ago, Chinese companies shut down power plants in Napak for non-payment of Rs. 300 billion of dues:

What about Australia, that Asian commodities power? Bremmer’s gzeromedia reports:

- “Australia, for its part, is also facing a massive pinch due to overlapping factors, including recent floods, planned maintenance at several plants, and global price pressures squeezing coal operators (around 75% of electricity Down Under is coal-powered). Coal prices have been soaring along with other commodities as the Ukraine war rages on, prompting the government of New South Wales to urge its 8 million residents to turn off the lights between 6-8pm.”

Meanwhile, China seems to be drawing the wrong lessons from Russian venture in Ukraine. China has publicly declared the Taiwan Straits as China’s sovereign territory & warned off foreign ships from using the Strait. USA has promptly declared the Straits as international waters. Will China take the momentous step of sending its military across into Taiwan? We don’t even want to think about that!

So much for Eurasia. What is the reaction of Latin America, say of Mexico? AMLO was brutally candid in condemning his norther neighbor for the American “partnership” of Ukraine of “we supply weapons & you supply the dead“. No Latin American nation is as integrated with USA as Mexico & this is what Mexico feels. What then does the rest of the World feel? Are they seeing the “true colors” of Ameurope to use the adjective of CNBC’s Cramer?

Perhaps Cramer might recall a similar decision by Winston Churchill who diverted food ships to Greece from famine-stricken India during World War II saying he would rather feed stout Greeks than starving Indians. Anywhere from 3 million to 6 million people died in North-east India in 1942-43 thanks to Churchill & British colonial Nazism. Below is a photo of Bengali streets from Taste of War (2011) by Lizzie Collingham.

What is happening in Ukraine is horrific & abominable. But, in our opinion, it needs to be solved on the Ukranian battlefield with European soldiers from Germany, France, UK, Poland & other European nations. But they refuse to send their own soldiers while demanding sacrifice from poor nations around the world.

As a result, to seemingly help 40 million White Ukrainians, real misery is being inflicted on 1 billion Africans, 2 billions Asians (ex-China) and hundreds of millions of Latin Americans.

It is now clear that the actual war is secondary & even a decisive victory by either combatant will not stop the two weaponizations. And until the two weaponizations end, the outlook for the global economy will get worse & worse. And that is without a special military venture from China against Taiwan.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter